Justin Sullivan/Getty Images News

Nvidia (NASDAQ:NVDA) is largely known for its market leadership in gaming and data center GPUs, empowering the development of core emerging technologies that span from cloud-computing/AI to next-generation graphics rendering capabilities like real-time ray tracing. Yet, its role in enabling the burgeoning crypto sector has also expanded in recent years.

The combination of performance and energy efficiency delivered by Nvidia’s chips has made them an attractive option among crypto miners, who have been eager to scoop up the products at lucrative resale prices during the pandemic-era crypto boom. While management has repeatedly reiterated that demand stemming from cryptocurrency mining remains immaterial to Nvidia’s business, the company has had to implement strategic measures in the past to ensure sufficient supply to meet its core gaming market’s needs.

The recent turmoil in crypto performance though is now drawing questions on whether the situation will add additional pressure on Nvidia’s fundamental performance going forward, as it risks compounding pains from waning consumer demand on PC/gaming ahead of a potential recession. Although Nvidia’s exposure to impacts from the crypto sector’s performance is much more limited compared to stocks that are more synonymous to the risk asset class like MicroStrategy (MSTR), Riot Blockchain (RIOT) and Coinbase (COIN), its crypto-linked business is still prominent enough to warrant existing/potential investors’ attention.

The following will further explore Nvidia’s foray in the crypto sector, as well as related near-term headwinds it faces. Despite the current macro backdrop weighing on the Nvidia stock’s performance this year, we view it as a primary semiconductor holding still, given compensating long-term momentum across its core operating segments.

Nvidia’s Foray in Crypto Mining

Nvidia’s foray in crypto-related opportunities was largely a form of adaptation. Thanks to the combination of performance and power efficiency, Nvidia’s gaming chips (namely, the GeForce RTX 30 series) have become an attractive cost-benefit choice among cryptocurrency miners.

The prominence of Nvidia’s gaming GPUs in cryptocurrency mining became so prominent during the last crypto boom in 2017 that it caught the attention of the U.S. SEC. Following the recent completion of an SEC probe on Nvidia’s fiscal 2018 results, the U.S. securities regulator found the chipmaker had “failed to disclose that crypto mining was a significant element of its material revenue growth from the sale of its GPUs designed and marketed for gaming”. The SEC cited Nvidia’s lack of related disclosures in fiscal 2018 had misled investors that the results, which were heavily influenced by a volatile business, may have been “indicative of future performance”. As a result, Nvidia was fined $5.5 million in settlement of the dispute in early May.

The combined surge in gaming and cryptocurrency mining demand during the pandemic when most were subject to restrictive lockdowns had again forced a surge in the resale value of Nvidia’s gaming GPUs to multiples of their respective MSRPs. The lucrative increase in crypto-driven demand had also cannibalized supply for core gaming applications, forcing Nvidia to introduce mitigating solutions including “LHR” and “CMP” in early 2021.

What is LHR?

LHR refers to “Lite Hash Rate”, a software built into Nvidia’s GeForce RTX 30 series GPUs shipped after May 2021 that limits the Ethereum (ETH-USD) hash rate. Hash rate is the gauge for computing power required in cryptocurrency mining – the higher the hash rate, the more calculations performed per second to enhance the chances of successfully solving the complex math problems required to add blocks of transactions to the blockchain, and consequently reaping (mining) the cryptocurrency reward.

When a LHR GPU “detects specific attributes of the Ethereum cryptocurrency mining algorithm”, it will automatically slash the hash rate or “cryptocurrency mining efficiency” by half. LHR is meant to be a deterrence factor that makes Nvidia’s GeForce RTX 30 series GPUs less attractive to cryptocurrency miners, given the reduced Ethereum hash rate would make mining more expensive.

What is CMP?

In addition to LHR technology, Nvidia has introduced a chip specifically designed for cryptocurrency mining, the “Cryptocurrency Mining Processor”. The “NVIDIA CMP” series offers four chips, each with different hash rates. The design of the CMPs essentially strips out the gaming specifications (e.g., real-time ray tracing) in the GeForce RTX 30 series GPUs, while optimizing cryptocurrency mining performance by “improving airflow while mining so they can be more densely packed” and bolstering power efficiency.

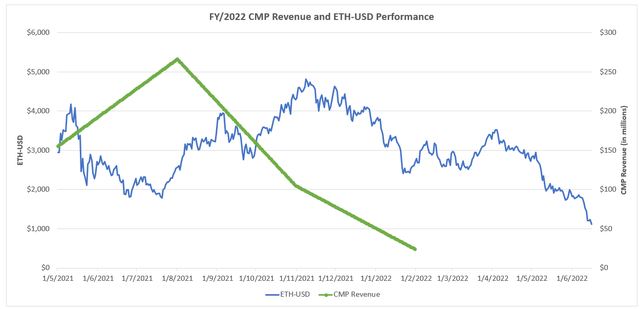

While Nvidia’s gaming GPU price surge in 2021 was largely influenced by additional demand from cryptocurrency miners, the take rate for its CMPs has been lustre-lacking on a comparative basis. Since the launch of CMPs in 2021, demand for the product line has been in a consistent decline, as its production and sales ramp up coincided with a steep plummet in prices across the crypto sector. In Nvidia’s latest earnings call, management noted they were expecting a “diminishing contribution” from CMPs going forward due to the recent reduction in cryptocurrency mining.

Nvidia CMP Sales vs. ETH-USD (Author, with data from Seeking Alpha)

The Merge Curse

The biggest headwind currently facing Nvidia’s foray in crypto mining opportunities remains on the “reduced pace of increase in Ethereum network hash rate”, which has weighed on mining-related chip demand. Specifically, the Ethereum network’s upcoming transition from a proof-of-work to proof-of-stake system, known as the “Merge”, will eliminate Ether mining altogether.

Historically, proof-of-work requires contributing computing power to solve complex algorithms on the blockchain, in exchange for a token reward. However, the transition to proof-of-stake means Ether holders can now “stake” their tokens as a form of collateral until transaction blocks are verified, and receive a token reward in exchange. The Ethereum blockchain’s transition to proof-of-stake is expected to reduce power consumption on its network by more than 99%, addressing concerns about the environmental impacts of crypto mining.

The transition will eliminate the need for mining Ether altogether. This will significantly reduce the requirement for Nvidia’s CMPs going forward, which were specifically designed to optimize Ether mining (although it can still be used for mining other crypto currencies). While gaming and other revenues attributable to Nvidia’s GPUs and CMPs used in crypto mining are likely immaterial, the company has recently disclosed a year-on-year decline of 52% in related sales.

This is a stark contrast to demand from a year ago that has exacerbated the shortage in gaming GPUs alongside record price surges – according to Bitpro Consulting, Ether miners “have spent approximately $15 billion on GPUs” prior to the recent slowdown. Resale prices on GPUs have “dropped by more than half since the start of the year”, and the cost of Nvidia’s gaming GPUs for users has also normalized, narrowing the gap from its MSRP.

The recent reduction in equipment costs has actually spurred an expansion of operations amongst miners though – sort of like a “last hurrah” before the Merge. This is further corroborated by Nvidia’s recent CMP sales. Although CMP sales slowed 52% from the prior year, which translates to about $74 million during 1Q23, down from $155 million in 1Q22, it still represents a twofold sequential increase from $24 million reported in 4Q22. Although Ethereum’s hash rate growth has decelerated, it has still almost doubled from the same period in the prior year. Mining Ether is still regarded as more economical and profitable than other coins such as Bitcoin (BTC-USD), and recent trends indicate miners may be “trying to get as much as possible before it ends”.

But over the longer term, as mentioned earlier, CMP sales will wane as demand from Ether miners disappear. Nvidia’s gaming GPU sales related to crypto mining, though difficult to quantify, will likely take a hit as well. In addition to the reduction in crypto-mining driven demand, there will likely be an overwhelming supply from Ether miners who are rushing to sell their equipment after the Merge is complete. This may cause Nvidia’s gaming segment revenue growth to moderate further in the second quarter, which is consistent with management’s guidance for a sequential decline in the high teens as the year-long shortage alleviates with inventories “nearly normalized”.

The Crypto Plunge

In addition to headwinds from the upcoming Ethereum blockchain Merge, the recent decline in Nvidia’s CMP sales is also consistent with the worsening slump in crypto assets’ price performance. Bitcoin’s record-high correlation to the tech-heavy Nasdaq 100 index, alongside adverse headlines in recent weeks pertaining to the Terra/Luna collapse (UST-USD / LUNC-USD / LUNA-USD) and Celsius Network (CEL-USD) withdrawal halt have battered the performance of the world’s largest cryptocurrency, as well as other cryptocurrencies / altcoins. This has compounded the deceleration in crypto mining activity, as corroborated by the slowed increase in hash rates, and inadvertently, demand for related GPUs.

Although Nvidia’s gaming segment revenues fell below data center sales for the first time during 1Q23, the role that ongoing volatility in the crypto sector had played in the change of sales mix is likely nominal. Since the introduction of LHR-enabled gaming GPUs and crypto-mining CMPs in fiscal 2021, Nvidia’s gaming segment revenue growth has continued to accelerate, increasing by 61% year-on-year in fiscal 2022.

The gaming segment’s growth deceleration observed in recent quarters is likely primarily driven by a broad-based PC market slowdown, COVID disruptions in China, as well as war sanctions against Russia instead. Acceleration in data center sales is also well within expectations, given the robust demand environment for GPUs across hyperscalers to satisfy growing cloud-computing/AI needs.

But Nvidia’s core gaming business remains strong, nonetheless. A deeper examination of Nvidia’s recent developments in gaming products would reveal that it seeks to garner greater appeal from the larger enterprise sector. For instance, Nvidia’s newest suite of Ampere-based RTX GPUs incorporates “Max-Q” technology, an AI-based system that enables thinner and lighter laptops without compromising on performance. The upgraded Ampere-based RTX GPUs will be deployed through a new series of “NVIDIA Studio Laptops“, which will be capable of “handling the most challenging 3D and video workloads, with up to double the rendering performance” of its predecessors. This accordingly bolsters its appeal to commercial demand stemming from creative professionals like developers and video creators looking for computing power that can handle demanding workloads without compromising performance. Paired with a suite of complementing Studio software, including “Studio Driver“, “Omniverse“, “Canvas“, and “Broadcast“, Nvidia’s latest development in PC-based GPUs is expected to further propel the current upgrade cycle driving its core gaming segment sales for years to come.

Final Thoughts

Despite the steep declines observed across crypto assets in recent weeks, the situation’s actual impact on Nvidia’s fundamental and valuation prospects remains nominal. From a bigger picture perspective, Nvidia’s offerings remain the backbone of critical emerging technologies spanning cloud-computing, AI, robotics, virtual reality (“Omniverse”), and autonomous mobility, which are all high-growth opportunities that underpin our PT of $360 for the stock.

The dire market sentiment stemming from heightening macroeconomic uncertainties, as well as spillage from the broad-based risk-off environment for duration and speculative assets like cryptocurrencies has weighed on the Nvidia stock’s performance this year. However, we remain confident that Nvidia’s fundamental strengths will come through as the core driver of its valuation prospects, making it a core long-term technology investment pick at current levels.

Be the first to comment