LoveTheWind/iStock via Getty Images

Investment Thesis

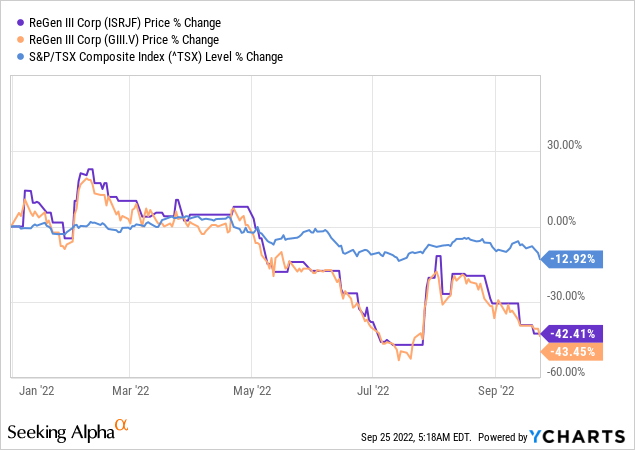

ReGen III Corp. (GIII.CA), a small-cap Canadian company, trades on the TSX Venture Exchange, the Frankfurt Exchange, and OTCQX in the US. It’s had a tough 2022, with the stock losing over 40% of its share value, largely due to the macroeconomic downturn and a risk-off market sentiment. The stock price plummeted because of the high volatility associated with its low market cap and trading volume.

The rising demand, solid yield, high prices, and all the positive signals toward the Group III base oils market make me bullish on the sector, especially with a competitively advantaged re-refiner in play. The industry-disruptive technology makes the company a prime acquisition target for the industry behemoths in the future, adding another layer of upside potential to the stock.

The company offers a great opportunity for green and risk-tolerant investors to buy into a market-disrupting stock that is still in its infancy.

The Company

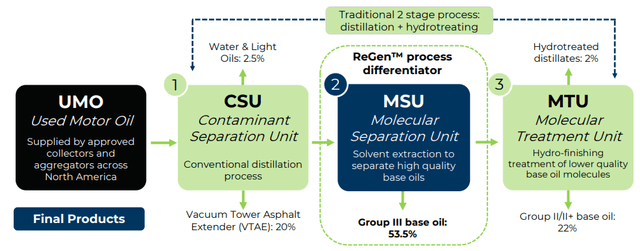

ReGen III is a Canadian clean-tech company that recycles Used Motor Oil (“UMO”) into high-value Group III base oils, also known as synthetic motor oil, through its patented process. These Group III oils are mostly used as high-performance engine oils and industrial lubricants, commonly found in the lubricant, construction, and chemical industries.

The company holds 9 North American patents and 5 other patents issued in India, Malaysia, and Singapore, with 18 other pending patent applications across the globe for processing UMO into competitively advantaged Group III base oil.

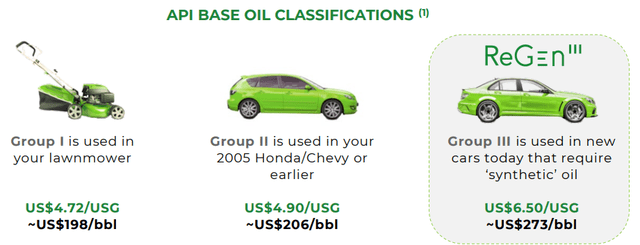

The Product

Even though the company does not have a definitive supply agreement yet, it has signed letters of intent (“LOIs”) with multiple vendors to secure 50-95% of its annual UMO feedstock supply.

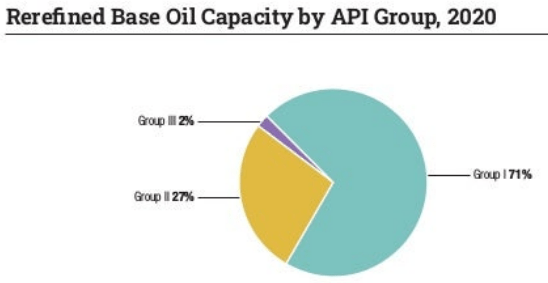

The company aims to leverage its patented technology to convert this input into a higher-value product than traditional re-refiners, mainly Group III base oils. Despite Group III oils trading at around a 50% premium over Group II oils over the last 10 years, only 2% of global re-refined base oils meet Group III specifications, meaning that very few re-refiners can produce Group III oils economically.

Lubes’N’Greases 2021-2022 Factbook

According to management, ReGen III’s technology allows it to produce 50 to 55% Group III oils economically, with a longer uptime run rate (i.e., fewer maintenance down days), granting it a competitive advantage over its peers.

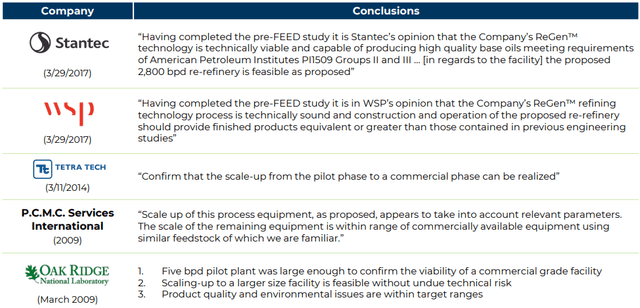

Based on the 5 bpd prototype facility, 5 major engineering firms have technically validated ReGen’s industry-disruptive process for feasibility and scalability.

The Facility

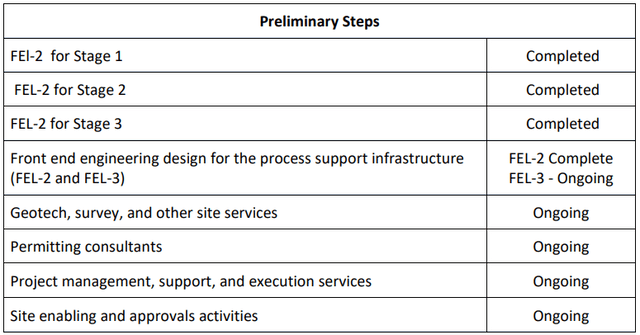

ReGen III Corp. recently completed its pre-project planning for initiating its operations in the United States through a subsidiary, RG3 Texas LLC, with a design capacity of 5,600 bpd of UMO and an output design capacity of 4,200 bpd to 4,400 bpd of base oils.

Koch Project Solutions (“KPS”) is leading the project execution management services and is working with sister organization Koch Modular Process Systems (“KMPS”), which will design and fabricate ReGen’s second stage. Market-leading KMPS has backed this project by calling it “a game changer for the way future used motor oils are cleaned and re-processed.”

ReGen has a multi-year 100% offtake agreement with BP Products North America in relation to the Texas facility. The company is currently negotiating equity financing with a US-based Private Equity firm, expecting to raise between $75 and $150 million in project-level equity.

Management expects conditional financing terms to be concluded between Q4 2022 and Q1 2023 (subject to the provision of additional project deliverables) and final funding to be approved in Q1 2023. Upon the conclusion of the FID and financing, construction is expected to take 18 to 24 months, making the project potentially ramped up for 2025.

The Market

The base oil market is sensitive to downstream demand for automobiles and fuel, with crude prices as a secondary price driver. Accordingly, the growing industrialization and the automotive industry are driving the global Group II and III base oils market. According to Research & Markets, the market for group II & III base oil is expected to reach $29.8 billion by 2027 with a CAGR of 6.7%, driven by the market trends of reducing carbon footprint and improving fuel economy.

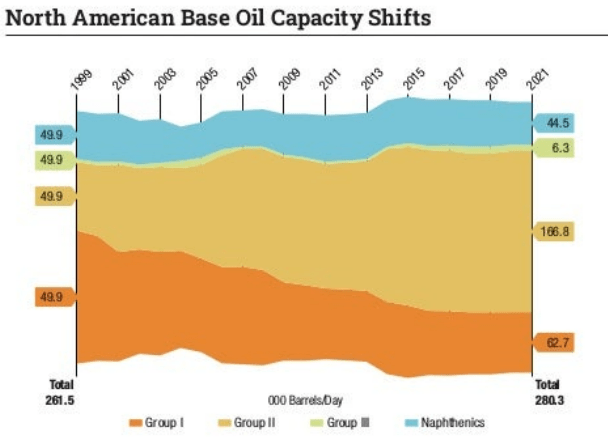

Concurrently, according to Report Linker, the US market for these base oils is expected to grow at a CAGR of 6.94% for the same period, driven by the rising demand for biolubricants and premium base oils, especially for the automotive industry. The significant growth drivers in the market are the production shifts from group I to group II and III base oils, with Group I capacity over halved and Group II more than doubled in the past 2 decades in North America.

Lubes n Greases Factbook

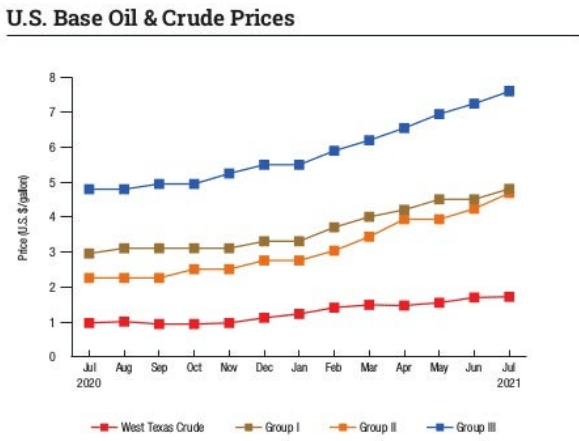

Consequent to the increasing supply, Group I and II base oil prices have mildly softened through the previous few months due to the surplus of light and mid-viscosity grade oils. In contrast, Group III re-refiners have sustained firm rates and higher base oil margins despite increased output because of the tight market supply.

Governments imposing strict regulations in relation to the rising environmental concerns and the pandemic-related supply chain issues resulted in a fivefold price increase of base oils in the UK by 2021. Similarly, prices in North America have taken an upward trajectory in response to rising demand for greener base oils. As aforementioned, synthetic base oils are especially leading these rising prices.

Lubes n Greases Factbook

Lubes n Greases expects about 60% of the North American engine oil market to be captured by SAE 0W-XX oils by 2030, an end product of the Group III base oils. Similarly, the future demand for other Group III base oil products seems to be high enough to cause major M&A transactions in the oil industry despite an upsurge in the EV market. Overall, I believe that the shift toward higher grade, greener base oils should offset the near-term impact of a growing EV fleet.

ESG Considerations

In June 2022, ReGen III released results from a Lifecycle Assessment Study conducted by GHD Services Inc. (“GHD”). The results showed that the ReGen™ re-refining process is expected to have a significant, positive environmental impact, resulting in an 82% CO2 equivalent emission reduction relative to the burning UMO.

Based on ReGen’s Texas facility, this is equivalent to removing 903,000 tonnes of CO2 per year or 195,000 cars from the road each year. ReGen’s process is also estimated to be 99.7% less eco-toxic than UMO entering the environment. This is important given that, according to the U.S. EPA and DOE, for every gallon of UMO re-refined, 1.8 gallons are burned as fuel or dumped – totaling almost 900 million gallons per year in 2018.

In addition to contributing to the circular economy, ReGen III has also committed to adhering to several United Nations Sustainable Development Goals.

These ESG considerations should be seriously monitored by investors because, as I have previously mentioned in one of my articles,

Studies have found a strong correlation between companies’ ESG initiatives and share price. According to a study conducted by Rockefeller Asset Management which drew conclusions from over 1,000 individual studies, ESG integration leads to improved financial performance over the long-term, protection against downside (especially during a social or economic crisis), and drives better financial performance due to mediating factors such as improved risk management and innovation.

Despite having a tough 2022, the company’s solution provision is long-term oriented rather than short-term and that is where the real investor return value lies.

The Path Forward

The company currently expects to close project-level debt and equity financing in Q1 2023. According to the Value Engineering review process led by Koch Project Solutions, the capital costs for the Texas recycling facility will be about $293 million (+/-30%). However, this figure will be refined during FEL3. While some capital cost components such as steel could decline, other project expenses – such as financing costs and premiums for project/process guarantees – will need to be factored in as well.

The company is currently expecting to raise $75 to $150 million in project level equity and the rest through debt financing. Additionally, it has received a $108 million LOI and indicative terms from Export Development Canada and is working with other financial institutions. Since the draft agreements have already been received from the PE firm, I expect the financing approvals to act as catalysts, resulting in short-term price gains.

After financing, it will start the facility’s construction in 2023, which needs to be concluded within 2 years of financing to keep the BP offtake agreement in force. However, given the company’s strong relationship with BP and the rising interest of oil giants in expanding Group III base oil production, the contract is a win-win scenario for both entities and is unlikely to be affected by any minor hindrances. The contract also has a 5-year renewal option and the right of the first look at future facilities’ offtakes.

The FID and the construction milestones are share price catalysts that are likely to result in price gains but may also result in a loss in case of delays and missed deadlines.

The company is negotiating with various suppliers to secure up to 165% of its feedstock supply requirements and has LOIs for 41 to 78 million gallons (50% to 95% of Texas facility requirements) of UMO. Following the project activation in 2025, based on contractual base oil prices with BP and the feedstock LOIs, the company is forecasting a first full year EBITDA of about $230 million from this facility on revenue of over $350 million, which appears to be an ambitious target for a small cap company.

However, the company’s 100% offtake agreement, high expected feedstock supply, and prospective ability to produce high volumes of Group III base oils at a low cost are major contributors to these revenues and margins of about 60-65%. This high-yielding high-margin production is the crux of investing in this stock.

Associated Risks

Despite the potential upside embedded in the stock through the upcoming milestones and catalysts, investing in a non-revenue generating small-cap company comes with significant risks. The security is a speculative buy and, as such, offers a high-risk, high-return scenario to investors with a larger risk appetite.

Since the company’s revenue generation is not expected until at least 2025, any price gains are significantly dependent on the market sentiment dictated by the news, updates, and, unfortunately, even rumors about the stock.

The stock is currently exhibiting a beta of over 2x, meaning the recessionary market conditions are doubly depressing the stock, and in case of further economic downturns, the systemic risks might overshadow any idiosyncratic rewards.

Additionally, suppose the company fails to achieve its milestones or targets. In that case, the stock might significantly suffer as it has a low trading volume, and any material sell-off can result in extreme price setbacks.

Conclusion

The low supply, high demand, and consequently, the high margins of synthetic oils are the makings of a forward-looking investment. Risk-tolerant investors looking for a green investment can leverage the opportunity of speculatively buying into a market disruptive stock in its infancy to cash in the gains in the long term.

The company still has a lot of hurdles to overcome in its path to revenue generation. Still, given its technological superiority endorsed by industry veterans like Koch and backed by the offtake agreement from BP, I expect the stock to be market-winning security in a growing industry.

I rate the stock as a buy because of its high short and long-term potential, currently smothered by the depressed macroeconomic conditions. However, caution is advised to investors as per this article’s “associated risks” section.

Be the first to comment