Makhbubakhon Ismatova

Written by Nick Ackerman. A version of this article was published to members of Cash Builder Opportunities on October 4th, 2022.

Dividend growth stocks aren’t always the most exciting investments out there. They often aren’t grabbing the headlines; they aren’t the stocks running up hundreds of percentages in a year. In fact, they are often some of the least exciting stocks. And that is precisely their strongest selling point. With such a vast world of dividend growth stocks available out there, it is important to screen through to see if there are any worthwhile investments to explore.

They are stocks that provide growing wealth over time to income investors. Dividend growers are often larger (not always), more financially stable companies that can pay out reliable cash flows to investors. Some are slower growers than others. Some are going to be cyclical that require a strong economy. Some are going to be secular, which doesn’t generally rely on a more robust economy.

Dividend growth can promote share price appreciation. Of course, that is if these companies are growing their earnings to support such dividend growth in the first place. Trust me. There are yield-traps out there – I’ve owned a few that I’m not particularly proud of.

I like to think of investing in dividend stocks as a perpetual loan of sorts. Essentially, every dividend is a repayment of your original capital. Eventually, holding long enough, you have the position “paid off.” It is all return back into your pocket from that point forward.

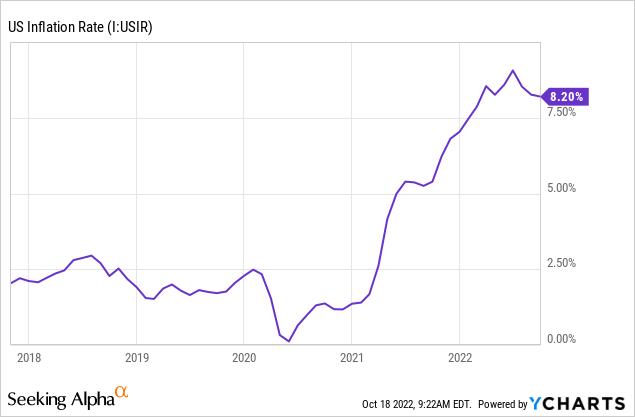

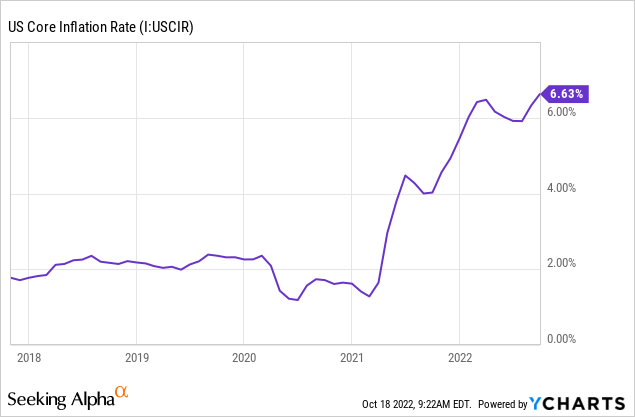

These dividend growth stocks can be even more critical in the current environment as it combats inflation. With the rising prices, an income investor needs a growing income to compensate for the buying power erosion. So far, inflation appears to have peaked but continues to stay elevated nonetheless.

Inflation has come in hotter than expected for the last two months now. This only means the Fed can remain aggressive in raising rates and creating a volatile equity market. Additionally, the Core CPI has hit a new 40-year high.

All of this being said is important to understand my approach to dividend stocks and why screening dividend stocks can be important for income investors. These are October’s 5 dividend growth stocks that might be worthwhile for a deeper exploration. As with any initial screening, this is just an initial dive – more due diligence would be necessary before pulling the trigger.

The Parameters For Screening

I’ll be using some handy features that Seeking Alpha provides right here on their website for this screen. In particular, I will be screening utilizing their quant grades in dividend safety, dividend growth and dividend consistency.

Dividend Safety is relatively self-explanatory. These will be stocks that SA quants show reasonable safety compared to the rest of their various sectors. The grade considers many different factors but earnings payout ratios, debt and free cash flow are amongst these. This category will be stocks with A+ to B- ratings.

For the dividend growth category, we have factors such as the CAGR of various periods relative to other stocks in the same sector. Additionally, the quants also look at earnings, revenue and EBITDA growth. As we will see, this doesn’t mean that every stock with a higher grade has the growth we are looking for. This just factors in that the dividend has grown or earnings are growing to support dividend growth possibly. For these, the grades will also be A+ through B- grades.

Finally, for dividend consistency, we want stocks that will be paying reliable dividends for us for a very long time. In particular, hopefully, they are raising yearly, though that isn’t an explicit requirement. We will also include stocks with a general uptrend in dividend payments, which means there could have been periods where they paused increases for a year or two.

After looking at those factors alone, we are left with 566 stocks at this time-from September’s 517 listings. I’ll link the screen here, though it is a dynamic list that constantly updates regularly. When viewing this article, there could be more or less when going to the link.

From there, I wanted to narrow down the list a lot more. I then sorted the list by forward dividend yield, highest to lowest. Since these will be safer dividend stocks in the first place, screening for those among the higher payers shouldn’t hurt.

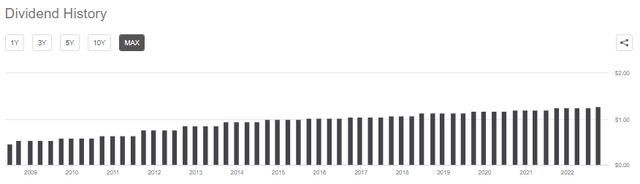

I will share the top 25 that showed up as of 10/04/2022.

One interesting name to make an appearance on the top of this list is Genco Shipping & Trading Limited (GNK). The high yield is certainly striking, but this company pays a variable dividend. We will skip over this name as I’m more looking to focus on companies that pay a more consistent dividend that’s trending higher over time. Due to the nature of the shipping business, I couldn’t imagine any name that would make it on this list to cover.

City Office REIT (CIO) is also going to be passed over. This REIT seems like it’s heading in the right direction and raised its dividend after cutting in 2020. However, even before that cut in 2020, they weren’t growing their dividend but simply maintaining it.

We are skipping out on Spirit Realty (SRC) – same as we did last month – due to the cut in the dividend, reverse split and lack of dividend growth since that time. However, they did raise in their latest quarter finally, which is something probably worth exploring, but not for today’s article.

Additionally, we see Blackstone (BX) make this list. However, due to their variable dividend, we are leaving this name out too. I had recently taken a look at this company, where I found it to be quite attractive otherwise. It just isn’t exactly what I’m looking for on this monthly screening article.

OneMain Holdings (OMF) is also an interesting name, but one we just covered in August. We also took a look at Innovative Industrial Properties (IIPR), Alpine Income Property Trust (PINE), TC Energy (TRP) and LyondellBasell Industries (LYB) at that time too.

ONEOK (OKE), Moelis & Company (MC), Western Union (WU) and Cogent Communications (CCOI) were all covered in just last month’s article.

That leaves us with Altria Group (MO), Hess Midstream (HESM), Urstadt Biddle Properties (UBA), Pembina Pipeline Corp (PBA) and Philip Morris (PM). Four of these names we’ve taken a look at previously, but it was at least a quarter or more ago. PBA is a new name and an interesting name to make this monthly list.

Altria Group 8.82% Yield

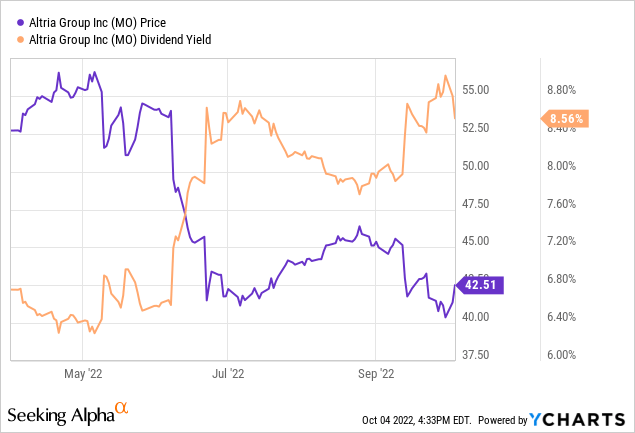

MO is an income investor favorite. We last touched on this name in June. Since that time, the company’s yield has spiked as shares have come under pressure.

Ycharts

A lot of this has to do with the general weakness in the overall market. However, it also came as there was a Juul ban during June. Since then, while the products were to remain on the shelf, even worse but perhaps expected news is surfacing. Juul Labs is reported to be preparing for Chapter 11 bankruptcy. This was just days after MO announced they were ending their noncompete agreement with Juul.

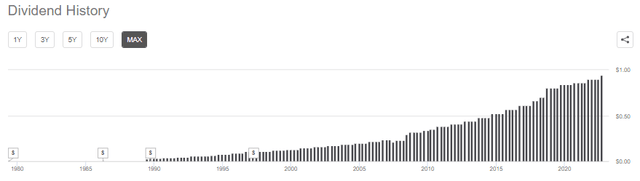

All this being said, that didn’t stop this dividend machine. They still announced their annual increase in August. It was good for a 4.4% boost from $0.90 to $0.94 a quarter. That was year number 53 in a row, quite the feat. This is especially true in an environment that grows more unfavorable for the tobacco industry.

MO Dividend History (Seeking Alpha)

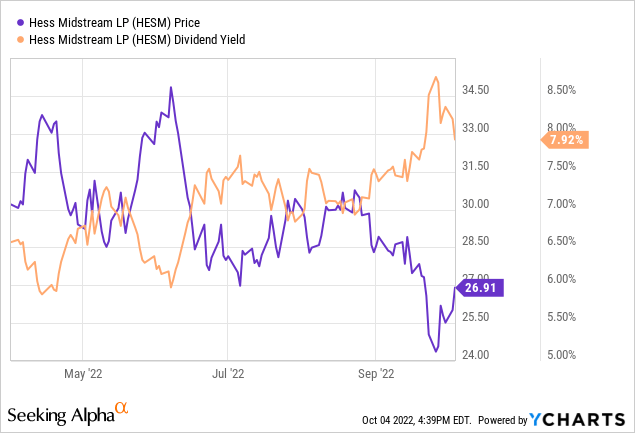

Hess Midstream 8.24% Yield

They are a midstream c-corp, an important distinction because that means a 1099 instead of a K-1 for investors come tax time. HESM describes itself as a “fee-based, growth-oriented midstream company that owns, operates and develops a diverse set of midstream assets to provide services to Hess and third-party customers.” They operate in “gathering, processing and storage and terminaling and export.”

The last time we took a look at HESM was in July. The general story is the same here as it was with MO. The price has declined, and that has pushed the yield up. However, there have been added pressures as the price of crude oil has come down. That’s despite their fee-based operations that should shelter the company from being too volatile.

Ycharts

That being said, the yield hasn’t only been rising due to a price decline. Despite the weaker unit price, they have continued to raise their distribution. They announced another increase for the Q3 payout, which was announced shortly after the July article.

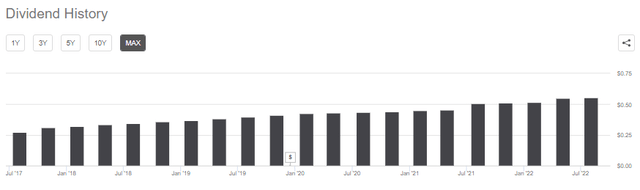

HESM Dividend History (Seeking Alpha)

Urstadt Biddle Properties 5.65% Yield

UBA was also covered in July and making another appearance this month. This name has been making a fairly regular appearance on this monthly screen. As a REIT, it tends to support a higher yield, which makes it a natural fit.

However, the main caution here is that it is a relatively smaller REIT. As a smaller REIT, they are more susceptible to having a few leases that could cause them trouble. For the most part, that hasn’t impacted them negatively until COVID. Before that, they had been raising their dividend regularly.

PBA Dividend History (Seeking Alpha)

They continue to have 77 properties total but were able to increase base rents by 4.3% for the three months ended July 31st, 2022. With a high level of inflation, growing rents can be important. Just as important is keeping your properties leased, where 92.1% was leased. A slight improvement from the nine months prior when properties were leased was 91.9% at the end of October 31st, 2021.

FFO for the previous quarter was $0.38, compared to the dividend of $0.2375. That type of coverage should provide further room for increases moving forward. Instead of just going for the dividend though, they have very recently announced a 2 million share repurchase program. That can make their plans to return capital to shareholders more flexible.

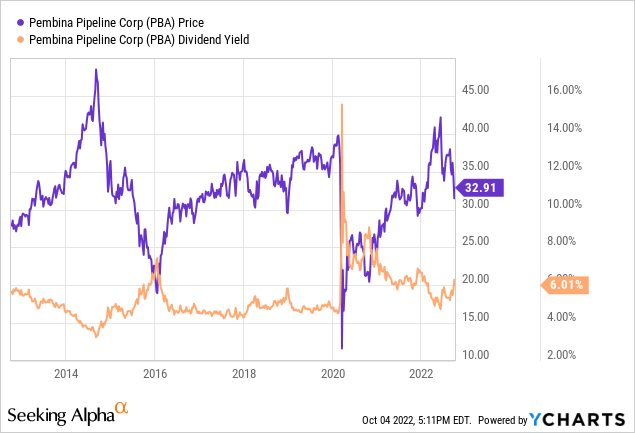

Pembina Pipeline 5.87% Yield

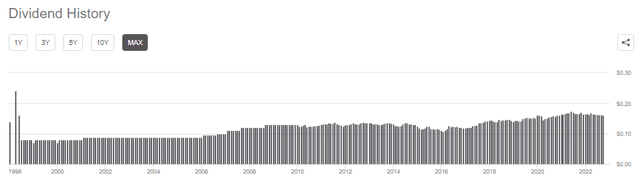

PBA is the new name that has made the list for the first time. This is an interesting name as they pay a monthly dividend, which can be favored by some income investors. The more regular payouts can provide a more steady cash flow to retirees.

They describe themselves as a “leading North American energy infrastructure company with diverse and integrated assets strategically located to service world-class geology.” So we have another midstream energy name make the list this month, with operations in both oil and natural gas.

It certainly has been a strong run for energy companies through the last couple of years, after reaching significant lows in the COVID crash when oil went negative briefly.

When looking at the dividend history, one thing that might catch an investor’s attention is what seems like a variable monthly dividend. That isn’t the case, though. Instead, they are a Canadian company that pays in Canadian Dollars. The “fluctuations” we see from month to month are simply currency differences from CAD to USD.

PBA Dividend History (Seeking Alpha)

The yield has come up recently due to the pressure on the share price – as we’ve seen across the board. That being said, it isn’t over the 2020 levels but is still well above the pre-COVD yields we can see. Despite this, they just recently raised their distribution once again.

Ycharts

Philip Morris 5.84% Yield

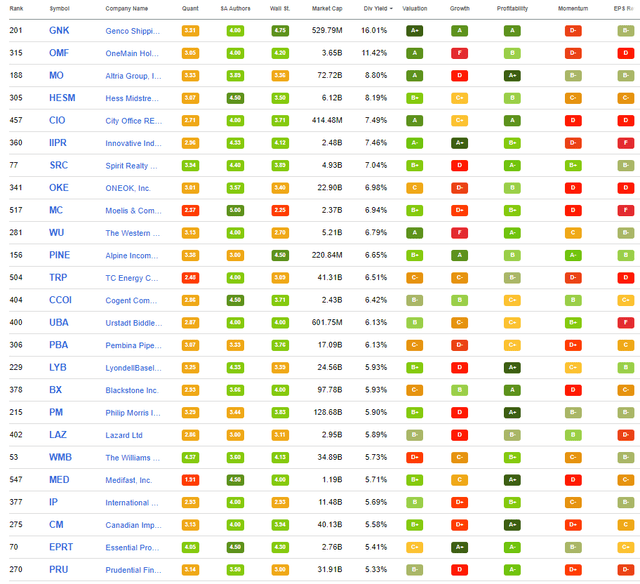

Last but not least, we have PM. This is another income investor favorite out of the tobacco industry. PM has also raised its dividend since the last time we covered this name. This was a 1.6% boost from $1.25 to $1.27. So a much more mild increase than we saw from MO.

Of course, their history isn’t as long as Altria’s track record as they were spun off from Altria. That hasn’t made it any less impressive since they’ve been standing independently.

PM Dividend History (Seeking Alpha)

They last reported a non-GAAP EPS of $1.48, which puts the payout ratio at nearly 86%. For most companies, that could be seen as quite elevated. However, it isn’t overly excessive when you consider that MO is also at a payout ratio of nearly 75% based on its last earnings and recent dividend increase.

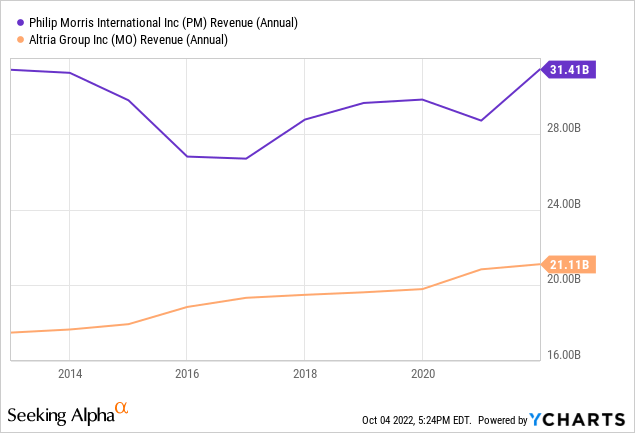

PM faces the same problems as MO. However, with an international focus, they seem to be able to work in some markets that appear to be less hostile to smoking. Both have been able to still generate consistent revenue, despite the continued decline in cigarette sales.

Ycharts

Both companies seem to be making pivots into alternatives from combustible cigarettes. But that is where PM has seemed to have more success than MO, with the heated tobacco unit showing meaningful increases in shipment volume. That resulted in a 7.7% increase across the globe versus cigarette volume showing an increase of 1.4% in the first six months of 2022.

Be the first to comment