JHVEPhoto/iStock Editorial via Getty Images

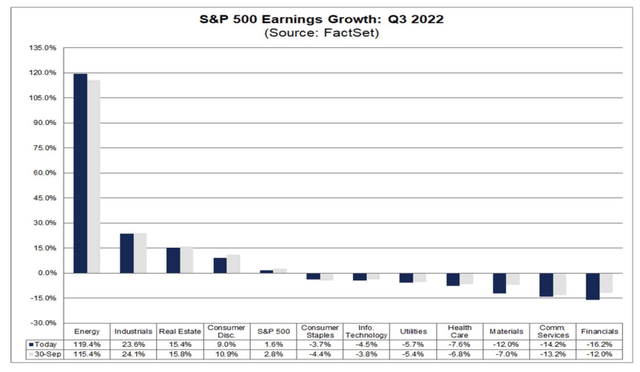

FactSet notes that the Energy sector is expected to have grown earnings by a staggering 119.4% in the third quarter.

Energy’s Impressive Q3 Earnings Growth

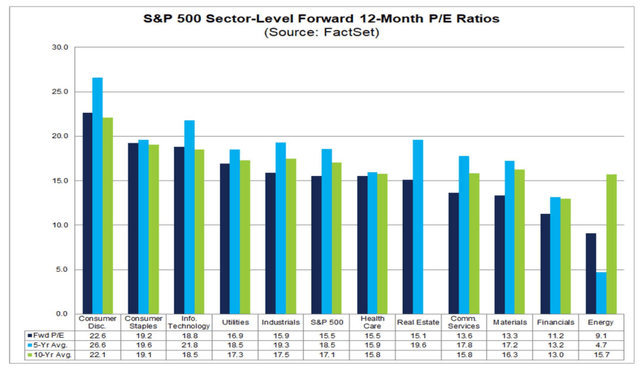

That’s coupled with a low 9.1-times trailing 12-month price-to-earnings ratio for the sector as of last Friday. One well-known global energy player reports its Q3 results tomorrow morning: Baker Hughes Company (NASDAQ:BKR).

S&P 500 Sector Valuations

According to Bank of America Global Research, BKR was formed through the merger of Baker Hughes and GE Oil & Gas in July 2017. It is the second-largest oilfield services and equipment company in the world by market cap behind Schlumberger (SLB). The company is an interesting vehicle to use for exposure to various niches of oil and gas value chains.

Amid volatile global oil prices, earnings consistency should be better with BKR given its newly diversified operations. Cost savings following the 2017 merger should gradually continue to be accretive to earnings, too, helping margins.

The Texas-based $24.4 billion market cap Oil and Gas Equipment and Services industry company within the Energy sector has negative GAAP earnings over the last 12 months and pays a decent 3.0% dividend yield, according to The Wall Street Journal.

The latest round of OPEC+ production cut news is a general tailwind for the sector, as it continues to be the best among all 11 groups of the S&P 500. Moreover, an improving supply chain helps diversified players like BKR. Of course, global economic uncertainty and weakness could pressure shares in the coming months. Other downside risks include a slowing of demand for oil and gas, reduced capital spending on energy, and changes to land rights in some countries where BKR does business.

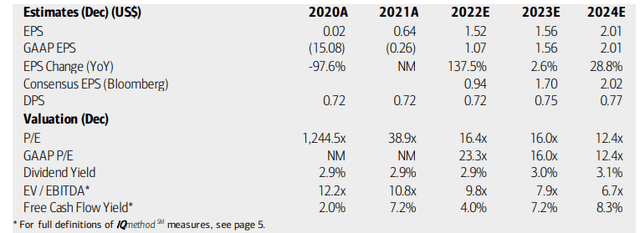

On valuation, BofA analysts expect GAAP earnings to turn positive for its full-year 2022 due to higher energy prices. Both operating and as-reported EPS numbers will be solidly in the black through 2024, per BofA and the Bloomberg consensus forecast. Dividends, which had been steady since 2020, look to be back on the rise starting next year.

On a forward valuation basis, the stock looks rather cheap using 2023 and ’24 EPS figures. What I like is improving free cash flow yield over the coming quarters, too. Overall, the valuation looks compelling now that we have some insight into 2024 estimates and a lower stock price.

Baker Hughes Earnings, Dividend, And Valuation Forecasts

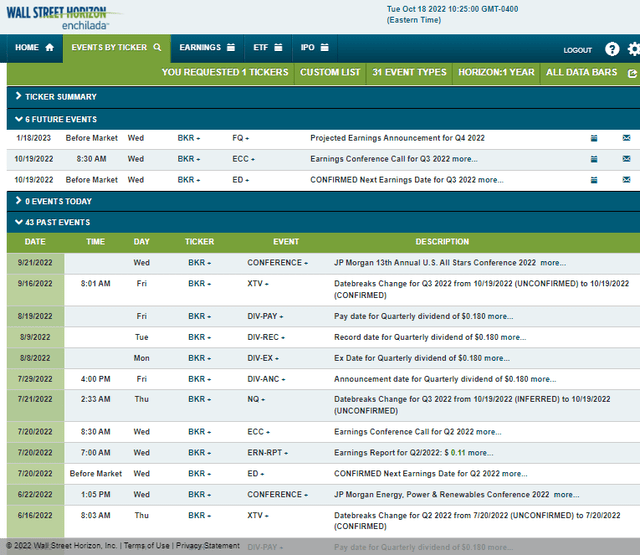

Looking ahead, Wall Street Horizon reports that BKR has a confirmed earnings date of Wednesday, Oct. 19, BMO with a conference call immediately after results hit the tape. You can listen live here.

Corporate Event Calendar

The Options Angle

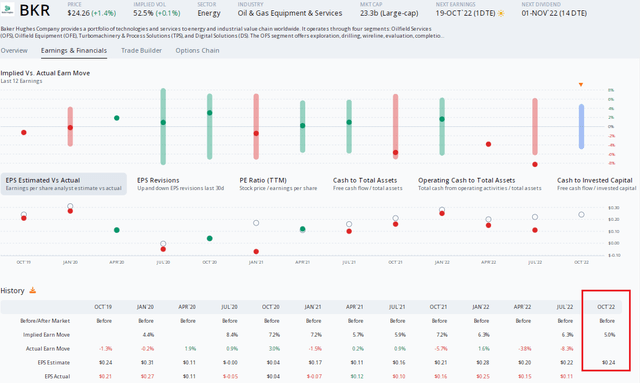

Data from Option Research & Technology Services (ORATS) show a consensus EPS figure of $0.24 for Wednesday’s Q3 report. That would be a positive reversal from $0.16 of per-share losses reported in the same quarter a year ago. Unfortunately, the stock has a poor earnings beat rate history, missing estimates in each of the previous five quarters, according to ORATS. Since it last reported, there has been one analyst upgrade of the stock and a single downgrade.

In terms of the expected stock price swing, ORATS shows an implied move of just 5.1% using the nearest-expiring at-the-money straddle. That is the smallest expected swing dating back to January 2020. Overall, the options look cheap given the high volatility in the market, but a weak post-earnings share price reaction trend warrants caution for the bulls.

BKR: A Small Expected Earnings Move Priced In

The Technical Take

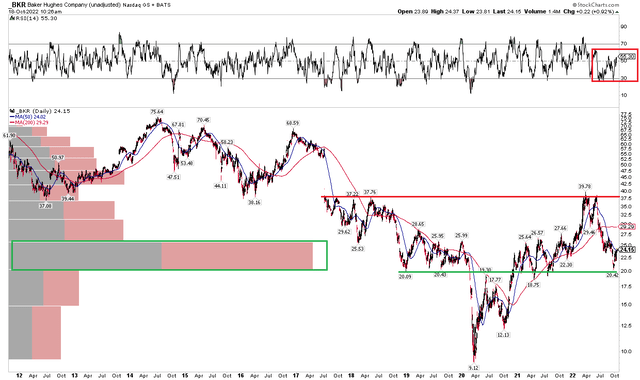

BKR pulled back to key support near $20 a few weeks ago. That retracement also took shares to an important demand zone as measured by the volume-by-price indicator on the left side of the chart below. I noted that support price back in July before the stock turned lower after its Q2 earnings report. I was admittedly early on the bullish call as I saw some support in the $26 to $27 area. That could be minor resistance on the way up.

Now, a refreshed chart still shows more upside risks than downside risks, though the weekly RSI indicator up top on the chart remains in bearish territory – I would like to see a thrust above 60 to help confirm a bullish price trend. Overall, long here with a stop under about $18.50 looks good. Profits should be taken on a move up to the high $30s.

BKR Shares Bounce Off Support

The Bottom Line

With a small expected earnings-related stock price move this week, don’t expect a quick move down to support or up to resistance soon. Investors should own this stock for a longer-term advancement potential. The fundamentals look better now that there is clarity on future profit potential. Moreover, solid free cash flow should warrant dividend increases in the coming years.

Be the first to comment