Trygve Finkelsen/iStock Editorial via Getty Images

Dear readers/Followers,

In this article, we’ll be taking another look at the oil company Neste (OTCPK:NTOIY). The company is Finnish, commands a €28B+ market cap, has markets around the entire world, operates two large refineries in the Nordics, which account for almost 20% of the Scandinavian production capacity, and has an appealing overall profile, which is why I’ve been pushing capital to work here.

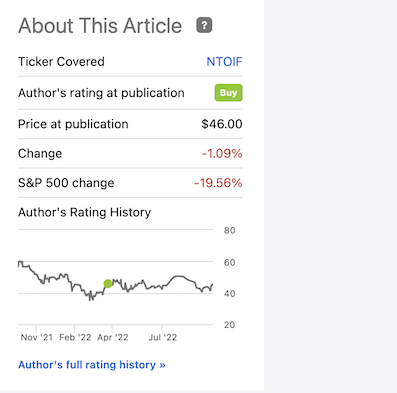

Nope – not the greatest yield, but the investment in the company has held up excellent against the market turbulence.

Neste IR (Neste IR)

Revisiting Neste – The Finnish Oil Major

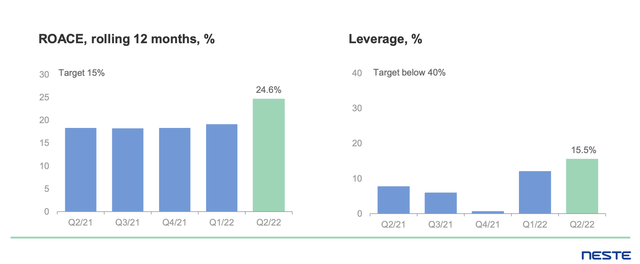

The company is a superb performer in difficult environments due to a mixed focus on renewable fuels and legacy. The way the company works has ensured not only good margins – but record-high margins. The company’s renewable products segment delivered those records here, and this combined with some exceptionally strong legacy/diesel/gasoline segments. Here are some return metrics for the business.

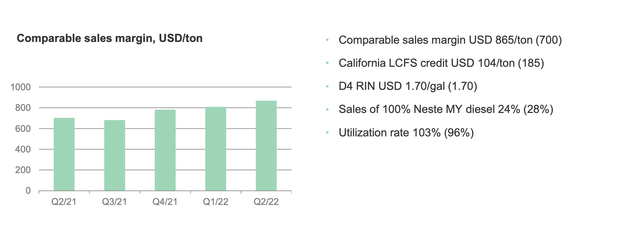

Most of these improvements come from volume increases, but even more from sales margins – the company delivered substantial margin improvements due to sales prices. We’re looking at an extremely tight feedstock market, with prices for things like vegetable oils and fats – soy, rapeseed, palm oil, animal fat – at close to record levels.

Take a look at some of these margins for the diesel market, for instance.

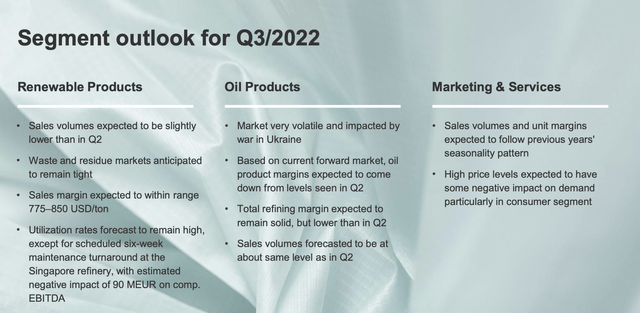

Oil margins are even better – but the market for these fuels is currently just superb, so it’s not strange that the company is performing well. Everyone in the industry seems to be doing very well. It’s crucial not to get caught up in the “legacy high”, because I’m confident that sooner or later, we’ll see a reversal in a negative trajectory here, going forward.

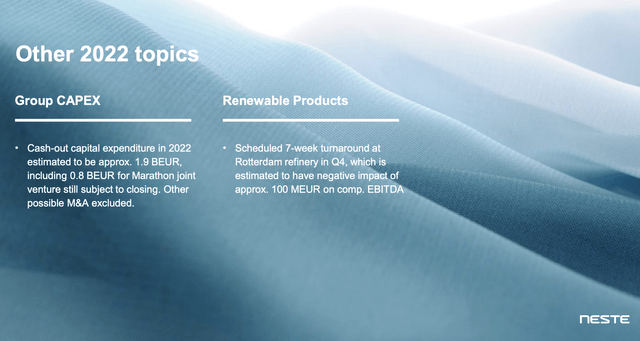

At that point, that’s when things like renewable and non-legacy assets and capabilities matter more. Neste has the right focus – a focus on growth in renewable, with CapEx for expansion in Europe as well as Singapore. The company is slowly growing its renewable aviation and renewable chemical segments. The outlook, going forward, is another upside for the long term.

The company does have some near-term short term maturities of upward of over €500M this year, but it also has liquidity of over €2.5B, with cash of around half that, and an average interest rate of 1.1% at 2.8 years. There are no covenants in the company’s existing loan agreements that would significantly impact the business.

The company’s fundamental upside remains its capacity, expertise, and market position. Neste operates two large refineries, the Porvoo, with a 205kbbl/d capacity, and the Naantali refinery, at 56kbbl/d capacity. This is around 20% of the capacity in all of the Nordic regions, and the company’s main markets are for the moment, found in Scandinavia.

Aside from its Scandinavian capacity, the company balances traditional with renewable refining, and all of its products are in the “premium” space. The company owns the world’s largest renewable diesel plants in Singapore as well as Rotterdam with a combined capacity of 1600kt/y, which use NEXBTL technology for a new generation biofuel. The company also has a 45% stake in a 400kt/y base oil plant in the nation of Bahrain.

With legacy, most of those operations have already been divested, and the buyer of most of them was Chevron (CVX). Neste has invested massive amounts of CapEx to get here over the few years, and its EPS trends are subject to heavy volatility due to policy risks from various environmental agencies around the globe.

Neste owns over 800 fuel stations in Finland and 266 stations in Baltic countries (as well as Russia, though the future of these remains to be seen) with the station division acting as an outlet for the company’s products.

On a high level, the company continues to generate sales of €10-€15B per year, with a 33/33/33 split between Oil Products, Renewable Fuels, and Marketing & Services. it’s expected that the renewable split of this mix is going to be significantly different going forward, and less of a Finland exposure (40%) than the company currently has.

Over the past few years, the renewable performance that the company has seen has highlighted the increased appeal that the company’s products have. With oil gaining, all of the company’s segments have been firing on all cylinders, and the company calls its strategy execution “on track”.

The upward potential trajectory for Neste from here on and forward is massive. Higher renewable appeal and focus, with scaling projects across the world, planned to start in early 2023 is set to increase the company’s sales significantly going forward. The asset utilization rate remains at very high levels as well.

Even if the company’s sales products on a global basis were to fall, which I do not believe that they will do quickly in the current market. The company is a successful hedger, and despite increased prices, margins are stable. Legacy oil product performance was higher – and will likely keep climbing in the environment we’re currently in.

Going forward, I expect the following things from Neste. I expect Neste to start scaling its capacities on an international basis. Given the company’s low leverage and good cash situation, Neste can pull some levers here to scale things up fairly quickly. I expect the company’s appeal to stay resilient due to the mix of aviation and automotive fuel that the company has, and the fact that the company can use ten different types of feedstock (animal fats, used cooking oil, and residues from vegetable oil processing). Palm oil was the major input at the start but now has, a lesser, variable weight (waste and residues account for around 80% of the company feedstock). Neste has acquired several companies to strengthen its collection of used cooking oil.

I expect the mix for the company to weigh more heavily to aviation fuel as cars become more EV-based (the expectation for how much this will be of course varies depending on what you look at).

However, there is an absolute lack of low-carbon alternatives in aviation applications for larger planes, and the company has estimated the demand for renewable fuels in the sector at 5Mt today, growing to over 20Mt by 2030. The Singapore market is expected to target this.

I expect Neste to continue its journey as a part-legacy, but heavy-focus renewable fuel producer, with a future focus on aviation fuel and commercial fuel, as opposed to standard gasoline for the non-commercial market.

I argue that the combination of its products and specifics all but insulates this company from the wilder swings so otherwise typically inherent to the oil/energy sector – though it also doesn’t have the massive yield you might associate with energy at only 1.77% at today’s valuation.

Neste’s Valuation

I continue to view Neste as substantially undervalued to its potential future results. I believe that going forward, premium fuel producers like Neste, especially with a focus on renewable and an interesting feedstock mix, will be awarded higher premiums.

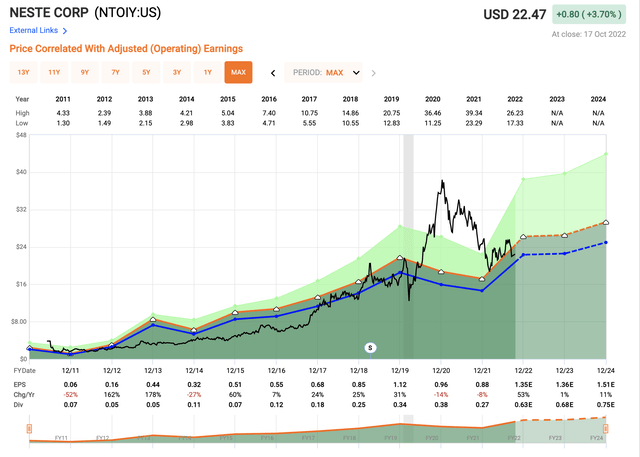

The company was flying high for the longest time, before finally settling below its usual trading range.

Neste valuation (F.A.S.T graphs)

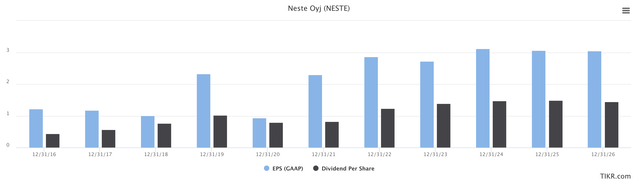

Specifically, I would say that we’re looking at 2022E adjusted EPS growth of over 40% for the year, followed by double digits in 2024, with somewhat less in 2023. Here are the current expectations for the company’s trends for the next 2-3 years. The dividend is set to grow as well, with a potential 3% forward yield here.

Neste EPS/Dividend forecasts (TIKR.com/S&P Global)

Unlike some companies where you can say that it’s undervalued from a growth perspective, or a NAV perspective, or a peer perspective, or an analyst perspective, but not all – Neste is undervalued on every single basis. This following a 1-year 20%+ drop in valuation and share price. The reason for this decline is the strategic change for Neste for almost a decade. The company was a major oil producer that went into and started focusing on renewable diesel. Initially, this was a large-scale “science project” for the company, but the market appreciation for this recycled product has been massive.

Converting Neste’s output to oil barrel equivalent, the net margin (EBIT/output) in renewables was c. $80/bbl in 2019, against a mere $5/bbl for the oil products division.

I’m not shifting my DCF targets for the company here, nor am I adjusting my 6-7% annual sales growth rate. Peers still don’t really exist, outside of some smaller companies or even more niche than Neste.

Current S&P Global analyst valuation targets are far higher than mine. From a range of €42 on the low end and €65/share on the higher end, 20 analysts come to an average of €53. 10 analysts are at “BUY” or “Outperform”. This comes to an undervaluation of at least 16% of the analyst estimate, as things look now.

I land somewhere between my NAV and DCF at around €46, conservative. I believe going above €50/share starts to be somewhat optimistic, and as for that €75/share, I’d love to see what renewable demand scenarios of double-digit growth that analyst has.

So, Neste is still a “BUY” here for me.

For my thesis, this is the update.

Thesis

My thesis for Neste is now as follows:

- Neste is perhaps one of the most interesting oil/energy companies in Europe. They’ve found their niche, and they’ve pivoted at what I view as exactly the right time to serve a market that’s going to need their products for the next few decades at the very least.

- Neste has strong financials and very strong potential. Even if the yield today isn’t that impressive, future returns could easily go into high double or low triple digits.

- I started with a $5,000 position a few months back – I’ve since doubled down on that position.

- Neste is a “BUY” with a price target of €46 here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment