We Are

Large valuation cuts occurred in the business development company (“BDC”) sector last month as a result of the central bank raising interest rates to their highest level since 2008.

As a result, BDCs such as Bain Capital Specialty Finance, Inc. (NYSE:BCSF) have begun to trade at a significant discount to net asset value.

Even though I prefer to buy a BDC if the price is right, which is usually the case if a BDC’s stock sells at a large enough discount to net asset value for me, I believe Bain Capital Specialty Finance has a too-narrow dividend safety margin.

Given that the BDC cut its dividend during the previous recession, the 11% yield is likely to be a trap for income investors.

Portfolio Evolution And Concerns

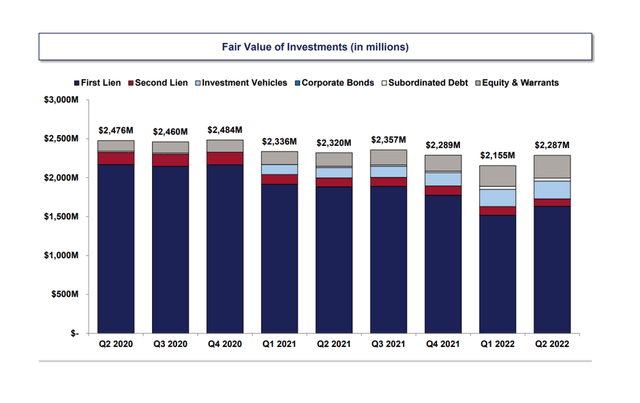

At the end of 2Q-22, Bain Capital Specialty Finance’s investment portfolio was mostly made up of First Liens, the most secure type of debt in which a professional debt investor can invest. First Liens are typically highly secured with a very low default probability.

Bain Capital Specialty Finance’s portfolio at the end of the June quarter consisted of 71.4% First Liens, 12.7% Equity, 10.0% Investment Vehicles (Equity & Subordinated Debt), 4.2% Second Liens, and 1.7% Subordinated Debt.

At the end of 2Q-22, the portfolio was valued at $2.8 billion, a 6.1% increase QoQ due to $481.9 million in gross investment fundings in the second quarter. However, the portfolio fell 8% from a year ago due to pandemic headwinds and deteriorating portfolio performance.

Fair Value Of Investments (Bain Capital Specialty Finance)

The problem with Bain Capital Specialty Finance is that its portfolio has grown riskier in the last year.

In 2Q-22, Bain Capital Specialty Finance’s First Lien investments accounted for 71.4% of total portfolio assets, compared to 81.1% in the prior year. This means that the BDC purposefully reduced its exposure to lower-risk First Lien investments while increasing its exposure to higher-risk investments such as equity (common and preferred), which increased from 7.5% last year to 12.7% in 2Q-22.

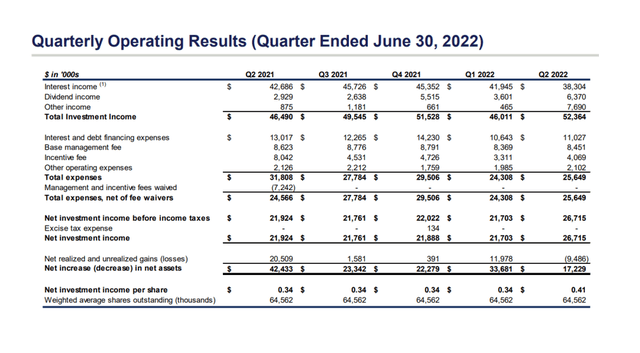

Weak Dividend Coverage

In the previous year, Bain Capital Specialty Finance’s dividend pay-out ratio was 95%. The previous four quarters’ pay-out ratio was 100%, and dividend coverage only improved due to higher net investment income in 2Q-22. The margin of safety here, in my opinion, is very small, and investors should keep in mind that the business development company cut its dividend payout by 17% in 1Q-20.

Past dividend cuts do not inspire confidence in a BDC’s net investment income potential, and given that the long-term trend for Bain Capital Specialty Finance’s portfolio value is declining, I believe the risk of another dividend cut is quite high here.

Quarterly Operating Results (Bain Capital Specialty Finance)

Why would income investors want to buy a BDC with a declining portfolio value and an almost 100% pay-out ratio when they can buy a business development company with a higher margin of safety, such as Goldman Sachs BDC, Inc. (GSBD), which had a pay-out ratio of 85% in the previous year?

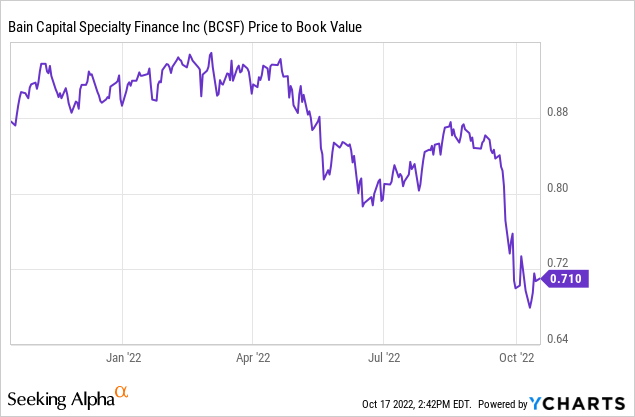

29% Discount To Net Asset Value

The stock of Bain Capital Specialty Finance is now trading at a 29% discount to net asset value, but there could be good reasons for this.

One reason is that the deteriorating overall portfolio composition, which is now more heavily skewed toward higher-risk investments, reflects increased investment risk for income investors.

The second reason is that, as I demonstrated in the previous section, the BDC continues to have very poor dividend coverage.

Third, during the pandemic, Bain Capital Specialty Finance cut its dividend, resulting in a lower trust score for the business development company.

Despite the fact that BCSF’s discount to book value increased in September, the discount is not large enough for me to consider the business development company’s 11% dividend yield.

Why Bain Capital Specialty Finance Could See A Higher Valuation

Bain Capital Specialty Finance’s stock price may rise in the short term, as it has fallen from $15 to $12 in just six weeks, and some investors, enticed by the 11% dividend yield, may buy the dip.

Fundamentally, I don’t see many reasons why BCSF’s valuation could rise, other than a surge in new investment funding (unlikely due to higher financing costs) and improved dividend coverage (also unlikely).

My Conclusion

Even though the stock price and valuation for Bain Capital Specialty Finance fell significantly in September, I believe the company represents a value trap for investors because it barely covers its dividend with net investment income, and the portfolio is not as well positioned as it was last year, despite the fact that a recession has become much more likely recently.

The 11% yield appears appealing, but given that Bain Capital Specialty Finance’s portfolio value is not as secure as it once was and that the BDC cut its dividend during the pandemic, I believe BCSF is not worth the risk here.

Be the first to comment