shapecharge/iStock via Getty Images

Investors and traders alike are concerned about what investments they should make on behalf of their portfolios and retirement accounts. We, at TheTechnicalTraders.com, continue to monitor stocks and commodities closely due to the Russia-Ukraine War, market volatility, surging inflation, and rising interest rates. Several of our subscribers have asked if changes in monitor policy may lead to a recession as higher rates take a bigger bite out of corporate profits.

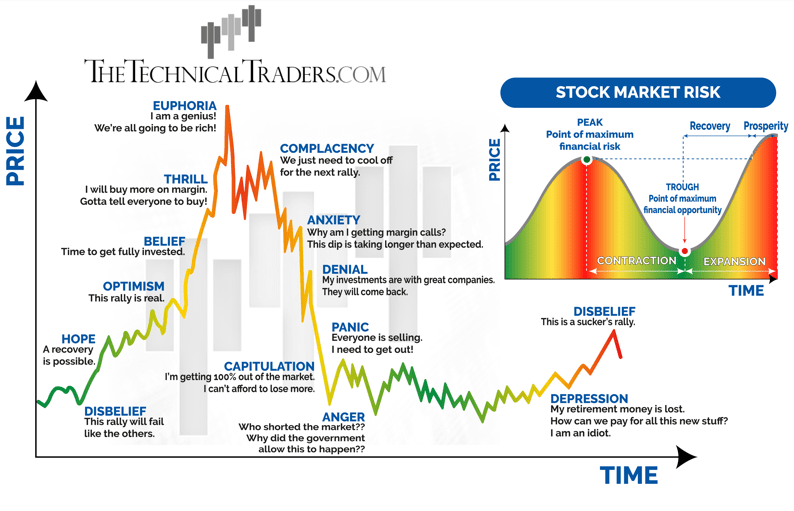

As technical traders, we look exclusively at the price action to provide specific clues as to the current trend or a potential change in trend. We review our charts for both stocks and commodities to see what we can learn from the most recent price action. Before we dive into that, let’s review the various stages of the market; with special attention given to expansion vs. contraction in a rising interest rate environment which you can see illustrated below.

Pay Attention To Your Stock Portfolio

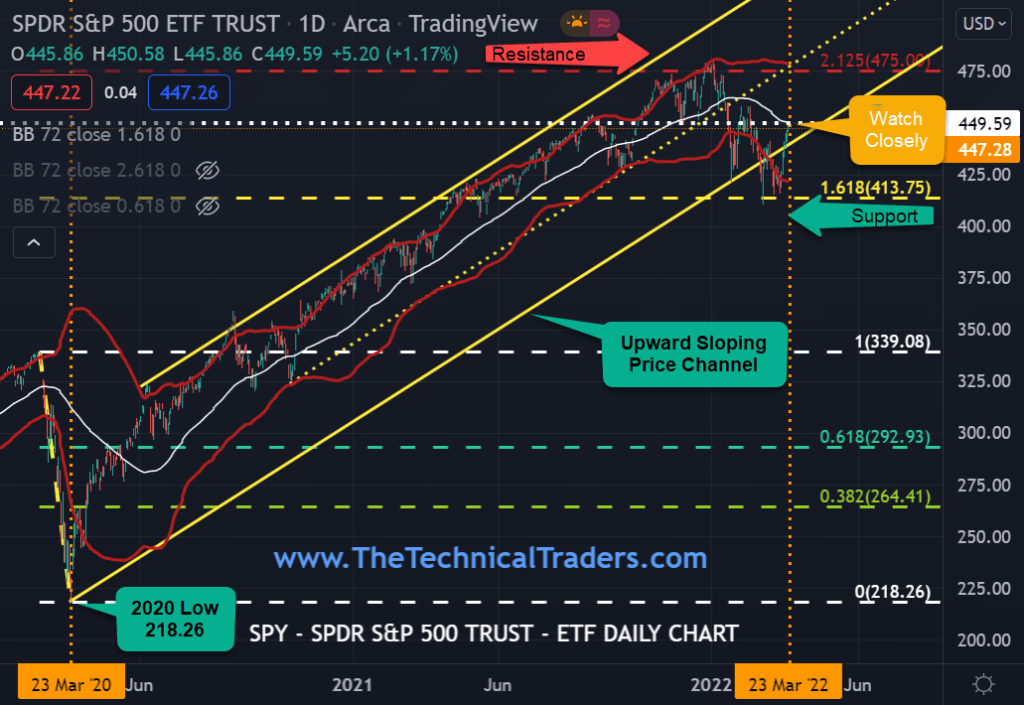

We are keeping an especially close eye on the price action of the SPY ETF. The current resistance for the SPY is the 475 top that happened around January 6, 2022. This top was 212.5% of the March 23, 2020, low that was put in at the height of the Covid global pandemic.

The SPY found support in the 410 area at the end of February. If you recall (or didn’t know), 410 was the Fibonacci 1.618 or 161.8 percent of the Covid 2020 price drop. Now, after experiencing a nice rally back of a little over 50%, we are waiting to see if the rally can continue or if rotation will occur, sending the price back lower.

Commodity Markets Surged

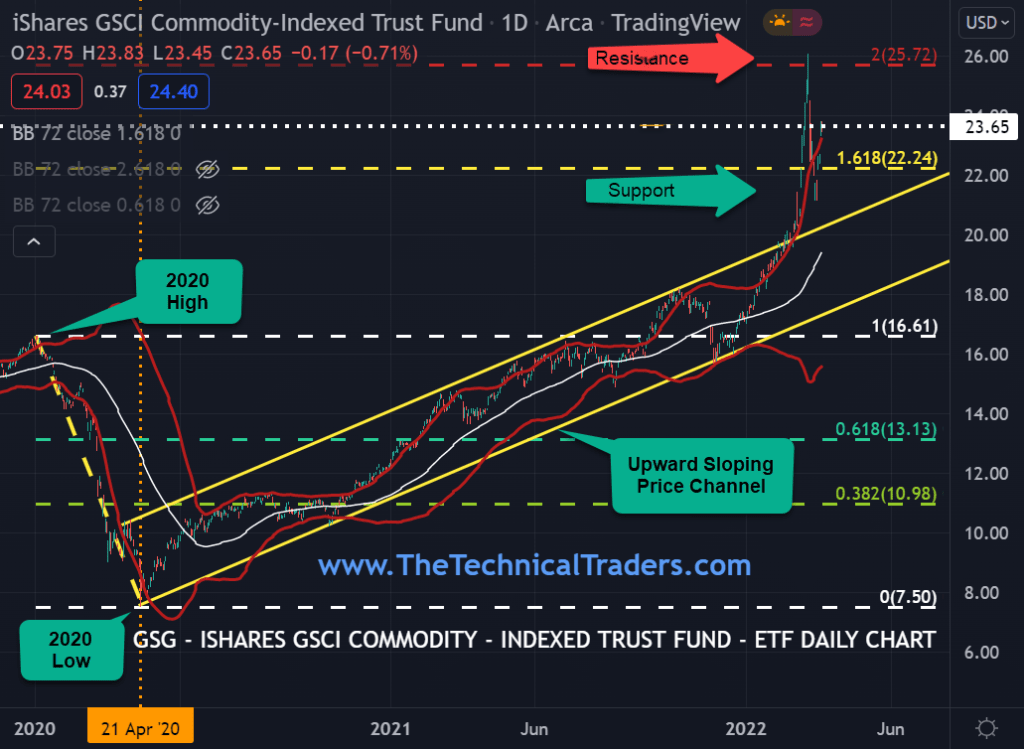

The commodity markets experienced a tremendous rally due to fast-rising inflation, especially energy, metals, and food prices.

The GSG ETF price action shows that we recently touched 200%, or the doubling of the April 21, 2020, low. Immediately following, similar to the SPY, the GSCI commodity index promptly sold off only to then find substantial buying support at the Fibonacci 1.618 or 161.8 percent of the starting low price of the bull trend. Resistance for the GSG is at 26, and support is 21.

A Strengthening US Dollar

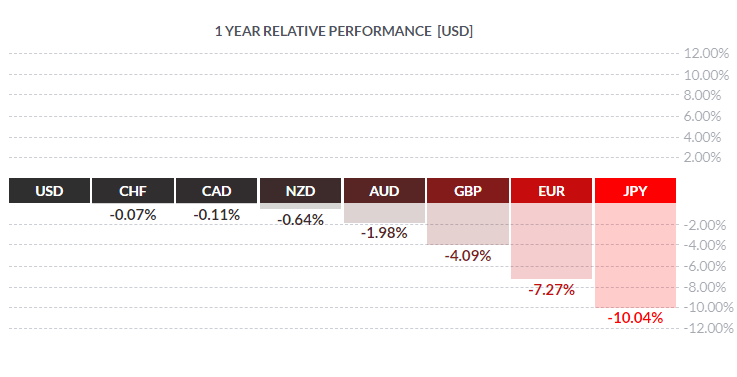

The strengthening US dollar can be attributed to investors seeking a safe haven from geopolitical events, surging inflation, and the Fed beginning to raise rates.

The US Dollar is still considered the primary reserve currency as the greatest portion of forex reserves held by central banks are in dollars. Furthermore, most commodities, including gold and crude oil, are also denominated in dollars.

Consider the following statement from the Bank of International Settlements www.bis.org ‘Triennial Central Bank Survey’ published September 16, 2019: “The US dollar retained its dominant currency status, being on one side of 88% of all trades.” The report also highlighted, “Trading in FX markets reached $6.6 trillion per day in April 2019, up from $5.1 trillion three years earlier.” That’s a lot of dollars traded globally and confirms that we need to stay current on the dollars price action.

Multinational companies are especially keeping a close eye on the dollar as any major shift in global money flows will seriously negatively impact their net profit and subsequent share value.

The following chart by www.finviz.com provides us with a current snapshot of the relative performance of the US dollar vs. major global currencies over the past year:

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment