Parradee Kietsirikul/iStock via Getty Images

Pfizer (NYSE:PFE) will acquire Global Blood Therapeutics (NASDAQ:GBT) for an enterprise value of $5.4 billion, or $68.50 per share. Pfizer is getting Oxbryta, a drug approved for the treatment of sickle cell disease, and a very decent pipeline also focused on the treatment of sickle cell disease.

Pfizer believes that GBT’s pipeline can generate more than $3 billion in worldwide peak annual sales, but to get there, it will certainly need to generate very strong data with GBT601, because Oxbryta and inclacumab are unlikely to come close to those levels, at least based on the to-date growth trends of Oxbryta and the to-date commercial success of inclacumab’s competitor – Novartis’ (NVS) Adakveo.

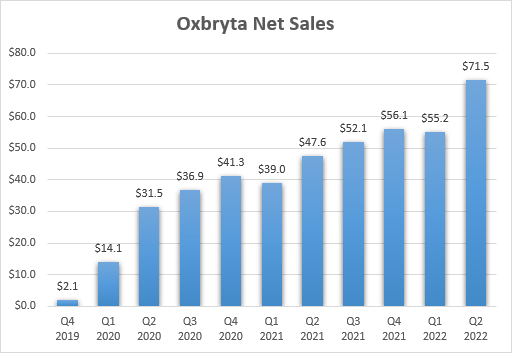

COVID-19 was seen as a major roadblock to Oxbryta’s uptake after the promising initial launch, but COVID-19 cases have waned and sales of Oxbryta have not recovered in a way that would make it a multi-billion blockbuster drug. But it still looks on its way to at least $1 billion in peak annual sales.

Oxbryta net sales growth since launch (GBT earnings reports)

On the other hand, I was and still am, very bullish on GBT601’s prospects as it looks like a more potent drug than Oxbryta, and it can be dosed once a day and at a much lower dose that could reduce some of the gastrointestinal side effects of Oxbryta.

We have seen little clinical data of GBT601 to date, but so far, it looks much better than Oxbryta.

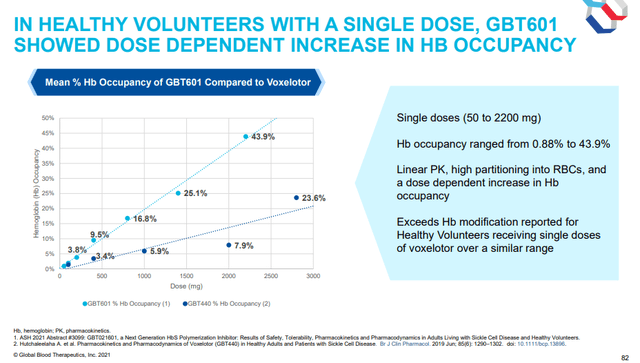

A single dose of GBT-601 achieved much higher hemoglobin occupancy in healthy volunteers compared to Oxbryta. Higher hemoglobin occupancy should result in better efficacy in SCD patients.

Hemoglobin occupancy of GBT601 compared to Oxbryta (GBT investor presentation)

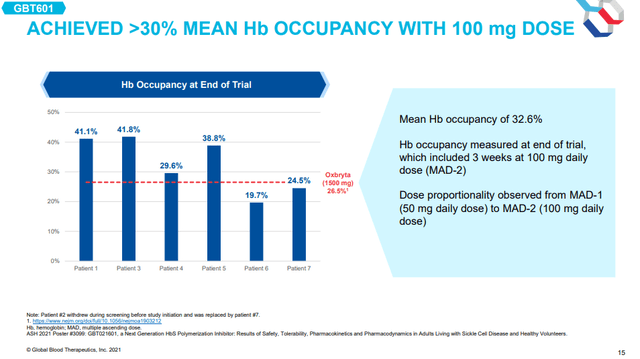

There was also a small cohort of six SCD patients in the phase 1 trial and they received 50mg in the first treatment period and 100mg in the second treatment period as maintenance dosing that was preceded by two loading doses of 200mg and 300mg during the first treatment period and 400mg and 500mg during the second treatment period.

After the second treatment period, hemoglobin occupancy in these six patients had reached 32.6% and this compares favorably to 26.5% Oxbryta achieved in the phase 3 trial. The company noted that dose-proportionality was observed from the first period with a 50mg maintenance dose to the second period with a 100mg maintenance dose.

Hemoglobin occupancy of GBT601 in SCD patients (GBT investor presentation)

This suggests a higher dose of GBT601 could drive hemoglobin occupancy even higher.

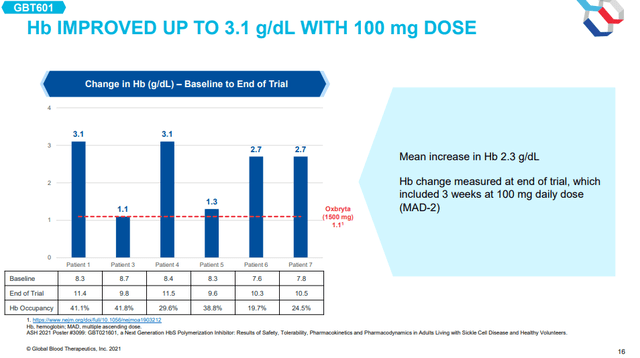

And while the cohort was small, the higher hemoglobin occupancy resulted in a mean increase in hemoglobin of 2.3g/dL. That is double the 1.14g/dL hemoglobin increase of 1,500mg dose of Oxbryta achieved in the phase 3 HOPE trial in the phase 3 trial.

GBT601 hemoglobin increase in SCD patients (GBT investor presentation)

One issue Oxbryta has is the modest reduction in vaso-occlusive crisis (‘VOC’) episodes. There were 3 VOCs in 2 of the 6 SCD patients in the trial of GBT601. At the time the data were presented, management noted they do not expect GBT601 to reduce the rate of VOCs in the initial treatment period, but over time, and that hemoglobin occupancy in these two patients was the lowest at 19.7% and 24.5%, respectively.

Overall, the preliminary hemoglobin occupancy and hemoglobin increase data look very encouraging and I believe GBT601 has the potential to be a significant improvement over Oxbryta. As such, I believe its peak sales potential is higher than Oxbryta’s and that it could generate more than $2 billion in global peak annual sales. Of course, this will come at the expense of Oxbryta which GBT601 should completely cannibalize.

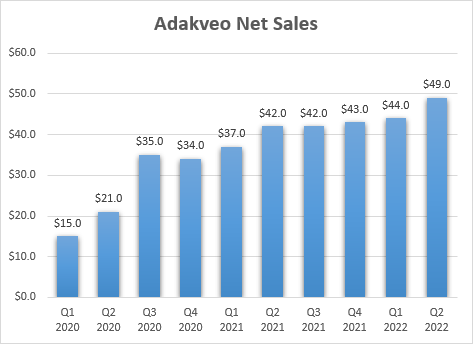

The third potential product candidate is inclacumab, a P-selectin inhibitor. Novartis’ Adakveo shares the mechanism of action to inclacumab, and it is approved to reduce the rate of VOCs in SCD patients. GBT believes inclacumab is a more potent P-selectin inhibitor and that it could be dosed every three months as opposed to the once-monthly dosing of Adakveo.

Adakveo net sales growth (Novartis earnings reports)

GBT has decided to run two phase 3 studies with inclacumab:

- The first study is for chronic VOC prevention, the same as Adakveo. The primary endpoint is the VOC rate after 48 weeks of treatment. 240 patients will be randomized 1:1 to inclacumab 30mg/kg and placebo every 12 weeks.

- The second study will focus on acute re-admission after VOC. The goal is to reduce re-admissions after the patient has already experienced a VOC and was hospitalized because of it. The primary endpoint of this study is the proportion of patients with at least one re-admission by day 90. This trial will enroll 280 participants with half receiving inclacumab 30mg/kg and the other half placebo.

If both studies are successful, inclacumab would have a better data package than Adakveo which is only indicated for chronic use. As such, I believe inclacumab can generate between $300 million and $500 million in annual sales by the late 2020s.

In addition Oxbryta, GBT601, and inclacumab, GBT has additional preclinical candidates, but I would not assign value to any of them at the moment.

Conclusion

For $5.4 billion, Pfizer is getting:

- Oxbryta, a product with an annualized net sales run rate of close to $300 million based on Q2 net sales of $71.4 million, and with the potential to exceed $1 billion in annual peak sales in 3-4 years.

- GBT601, the next-generation Oxbryta with potential for significantly improved efficacy and greater than $2 billion in annual peak sales potential. Of course, this means GBT601 will completely cannibalize Oxbryta.

- Inclacumab, a potential best-in-class P-selectin inhibitor that I believe can generate $300 million to $500 million in annual sales by the late 2020s.

At 2.1 to 2.3 times my peak sales estimate range, and at less than 1.8 times Pfizer’s peak sales estimate range, I believe Pfizer is getting good value for GBT.

Another way to look at it is the forward 5-year revenue multiple. As noted in my recent article on Seagen (SGEN), the median 5-year revenue multiple is around 8 and GBT’s is around 4.4 since its 2027 consensus revenue estimate is $1.23 billion. This also shows Pfizer is getting good value for GBT.

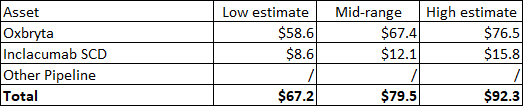

My valuation on GBT was higher than what Pfizer is paying, but I did not include all the stock options and convertible notes. When I adjust the share count, my valuation range is $67-92 per share.

Author’s valuation of GBT (Author’s estimates)

The deal price of $68.50 is just slightly above the low end of the adjusted range, but I am satisfied with the price I am getting because I was considering reducing my valuation range as Oxbryta has not performed as well as I expected since I added the stock back to the portfolio in late 2020. However, I should note that GBT601 was not included in my valuation, but its contribution would not have been significant because it would cannibalize Oxbryta and because it would take longer to get to annual peak sales of $2 billion.

GBT was one of my higher conviction portfolio holdings (9 of 10) and I will close the position soon and will be looking to redeploy the proceeds in the following days and weeks.

Be the first to comment