Zhonghui Bao/iStock via Getty Images

In a previous report, I had a look at the what AerCap shares were worth according to our estimates and I concluded that while I was looking to build a bullish thesis for AerCap there was very little that would support a bullish thesis and it seems that the market has agreed as shares have given up 9% of their value and are now trading around one to $3 per share higher than what we saw as a reasonable value for AerCap at this time. In a future analysis, I will be revisiting the subject to see whether we see any value in shares of AerCap from here with access to more recent numbers.

What we’re seeing is that competitor Air Lease Corporation (NYSE:AL) has not seen swings in share prices as wild as AerCap’s and in this report, I will look at possible reasons and provide an analysis on what I think shares of Air Lease Corporation should be trading at.

Is Air Lease Corporation really outperforming?

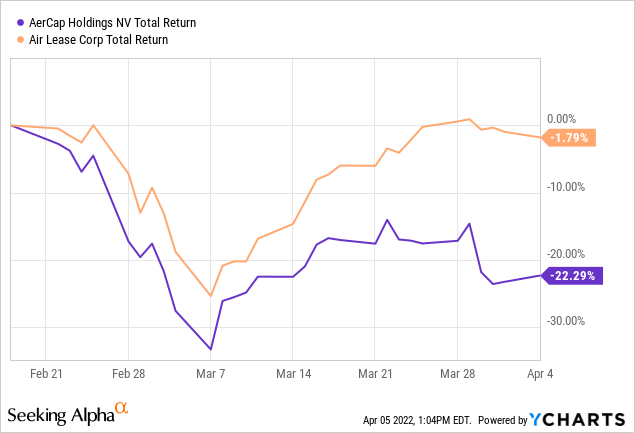

Just like with Boeing and competitor Airbus, I often see comparison between AerCap and Air Lease Corporation where readers are trying to make a case for one being better than the other. The figure above clearly shows that since the invasion of Ukraine by Russia, AerCap lost 22.3% of its value while Air Lease Corporation has been more or less flat. By many, this is attributed to AerCap having more exposure to the Russian market for aircraft leasing. However, as I will show, this is a view that cannot be backed by the numbers.

So, what’s the real reason that Air Lease Corporation has been performing better? We see that generally AerCap and Air Lease Corporation have been showing a similar pattern since the invasion. However, on the 16th of March we see that Air Lease Corporation starts following a pattern directed upward which was driven by news that the lessor does not expect any impairment on the flight equipment located in Russia in the near term. That’s in contrast with AerCap, which disclosed during the presentation of its Q4 2021 and FY2021 that it does expect impairment charges:

We expect to recognize an impairment on our assets in Russia that have not been returned to us as early as the first quarter of 2022, although we have not determined the amount of any impairment.

That’s in line with my views shared in a report published on March 2 and in my opinion is one of the two reasons that shares of AerCap have fallen more than shares of Air Lease Corporation. So what’s the second reason?

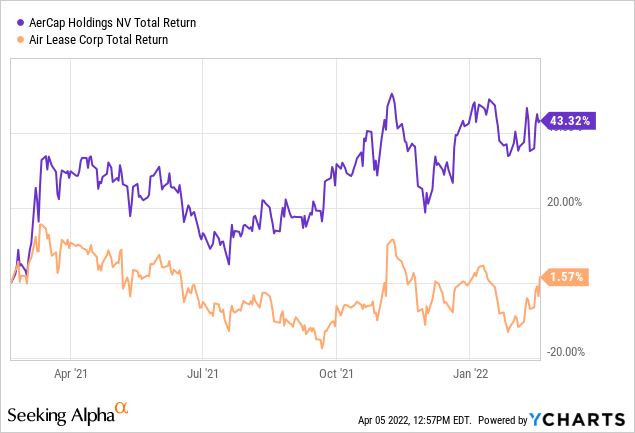

For that we consider the performance in the year prior to the invasion:

What becomes clear is that shares of AerCap have had a much higher return than shares of Air Lease Corporation. This has been driven by the acquisition of GECAS, which has been well received by investors. That also means that after a significant run up in the 12 months prior to the invasion, one could expect that the invasion would also provide an amplified signal for profit taking for AerCap shareholders. So saying that Air Lease Corporation has been doing better because of better risk management cannot be concluded from share price performance. In fact, from the point one year prior to the invasion to today shares of AerCap rose over 11% while shares of Air Lease Corporation have been flat.

The five-year share price return including dividends shows that Air Lease Corporation has been the better investment driven by stronger share price performance during the pandemic and a less severe sell off in response to the situation in Ukraine, but for most of the past five years AerCap has been performing better. So, it seems that investors have been using events such as the pandemic and the invasion to take profit for their AerCap shares.

Portfolio exposure: No huge difference

Based on our assessment of flight equipment values using the TAF Airline Fleet Monitor Russia, we estimated that AerCap had around $3 billion worth of aircraft active in Russia on a flight equipment value of $58 billion, which would put the exposure at 5.2% fairly consistent with what AerCap communicated earlier. AerCap also provided its updated numbers for Q4 2021, putting the equipment active in Russia at $3.3 billion on a total flight equipment value of $57.8 billion putting the exposure at 5.7% which is slightly higher than our estimate.

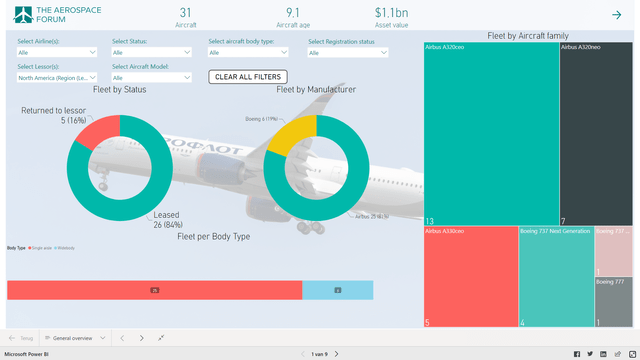

Exposure Air Lease Corporation in Russia (AeroAnalysis)

Air Lease Corporation had flight equipment value $22.9 billion by the start of the year. Our research indicated that there were 31 aircraft on lease in Russia valued S1 billion. Those numbers are fairly consistent with the 29 aircraft valued over $1 billion communicated recently. It puts the exposure at 4.4 to 4.8 percent. That’s lower than the exposure AerCap has in terms of relative numbers and certainly in terms of absolute numbers, but the difference is not huge. The exposure for AerCap is around 5% to 6% vs. 4 %to 5% for Air Lease Corporation. I think the notion that AerCap had an exposure that in relative sense was magnitudes bigger was simply wrong.

Also, the notion that AerCap had major exposure to state-owned AerCap was not correct as our research showed this was just 12% to 14% of aircraft that AerCap had leased to Russian carriers and less than a percent of the flight equipment value. The advantage Air Lease Corporation had was that it indeed does not have aircraft on lease to state owned airlines. However, we still saw 16% of the fleet being re-registered which has happened without the lessor’s approval vs. 15% for AerCap. So, up until now we don’t see the absence of exposure translating in lower re-registration activity for jets owned by Air Lease Corporation.

Air Lease Corporation valuation

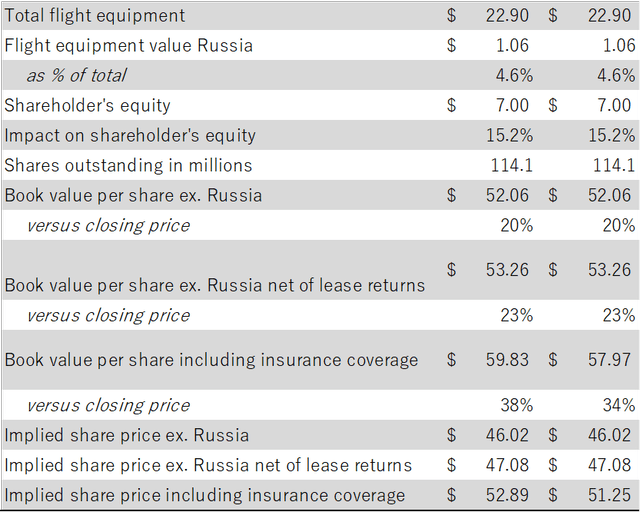

Air Lease Corporation Valuation (The Aerospace Forum)

For Air Lease Corporation, we’re seeing that the value of the equipment leased to Russian airlines represents around 15% of the shareholder equity, whereas this is around 20% for AerCap. The result is that Air Lease Corporation has a book value per share excluding assets leased to Russia that is 18% higher than the current price of $43.21 per share compared to 8% for AerCap. One should not forget that AerCap shares started to decline from a higher base and while it decline more relative to Air Lease Corporation, it’s still trading closer to book value. When including assets already returned, Air Lease Corporation is trading at an even higher discount to book. The big unknown is how strong Air Lease Corporation’s insurance policy is.

Air Lease Corporation stated the following regarding war risk insurance:

As a standard in the industry, airline operator’s policies contain a sublimit for third-party war risk liability generally in the amount of at least $150 million. We require each lessee to purchase higher limits of third-party war risk liability or obtain an indemnity from its respective government.

That’s rather vague as it doesn’t provide a clear pointer to what extent Air Lease Corporation is covered. If we take a loss cap of $150 million for the insurance (not a sublimit), then the coverage is around half a billion of dollars accounting for the fact that some airlines have leased assets from Air Lease with a value lower than $150 million. We also have taken an insurance coverage of up to $750 million which would cover the sublimit for the five operators that Air Lease has leased aircraft to. In both cases, 50% to 70% of the asset value is covered and 13% of the asset value has already been recovered for a total of 63% to 83% of the asset value. In comparison, AerCap repossessions and war risk insurance would only cover 50% of the asset value. That also explains why AerCap has filed separate all-risk claims with an amount of $3.5 billion

So, Air Lease Corporation has a book value per share that is roughly a third higher than its closing price giving it a price-to-book that’s lagging its historical price-to-book ratio. Excluding all assets in Russia, shares are undervalued by 3.5%. When we are including the recovery of assets, this increases to 9% and to 18% to 22% when including possible insurance coverage but insurance coverage is tricky because most insurance companies have a clause that allows them to cancel the insurance with a seven-day notice which is something that competitor AerCap does not have. So, how much Air Lease Corporation will stand to benefit from insurance remains to be seen.

Conclusion

To me it seems that shares of Air Lease Corporation offer up to 22% upside from the most recent closing price driven by a higher discount to book price. Repossession activity expressed as percentage of the value leased to Russian operators is about equal for Air Lease Corporation and AerCap, so I don’t see a reason there to say that one lessor is doing better than the other. When it comes to coverage, notwithstanding a seven-day notice that might work against Air Lease Corporation, the lessor seems to be better covered than AerCap but nothing can be said with certainty as public details on the insurance policy are lacking.

Furthermore, the progress in repossessions will further support share prices for both lessors so I wouldn’t say that one lessor is better than the other but with the information we have now it does seem that shares of AerCap lost more value compared to pre-invasion levels but compared to the book value it is Air Lease Corporation that is trading at a higher discount. I remain comfortably invested in AerCap for the time being, as I believe that its scale and the prospects of the market over the longer term have a lot of value to offer for shareholders. I’m not invested in Air Lease Corporation at this moment but do consider its current price levels to be attractive for investment.

Be the first to comment