bluebay2014/iStock via Getty Images

Introduction: How Have Tech Stocks Been Performing?

The era of free money ended with the FED’s hawkish pivot to a tighter monetary policy in November 2021. Since then, being a tech investor has been a harrowing ordeal, with tech stocks getting clobbered left, right, and center with little regard for the size or quality of these companies.

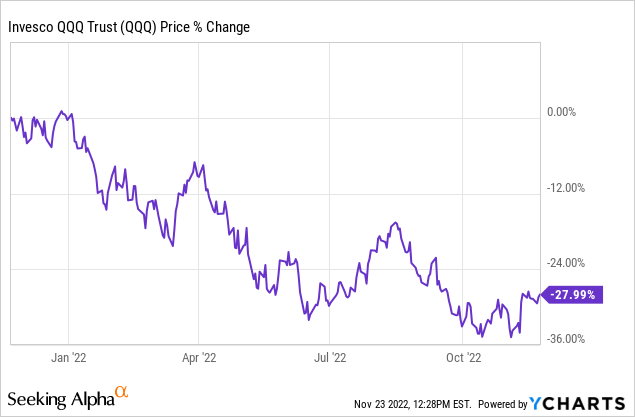

In 2022, the tech-heavy Nasdaq 100 Index (NASDAQ:QQQ) is down ~28%, and many tech stocks are down more than 50-90%+. An asset bubble has been pricked, and I don’t think the deflation of this said bubble is done yet, but more on that later. As you may know, speculative high-growth stocks topped out in early 2021, right around the time of the meme stock mania. And slowly but surely, the sell-off has broadened across the entire tech sector.

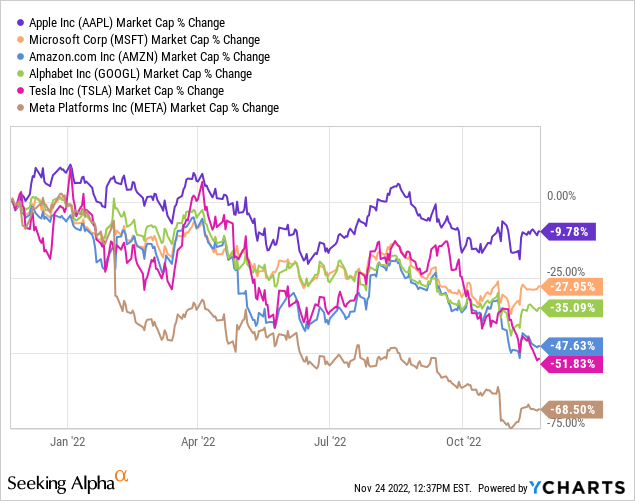

Over the last fifteen years, fortunes have been built in the technology sector, with investors riding a spectacular bull market. The “FAANG” or “MAFANG” stocks have become household names, and the rise of passive index investing led to astronomical valuations for these select few mega-cap tech stocks. However, the tide is running out, and nearly $5T in market capitalization has been wiped out across just these six names:

| Market Capitalization Lost From Highs | |

| Apple | ~$800B |

| Microsoft | ~$900B |

| Amazon | ~$900B |

| Tesla | ~$600B |

| Alphabet | ~$850B |

| Meta | ~$750B |

| Total | ~$4,800B or ~$4.8T |

I handpicked these six stocks for this note because they make up roughly ~45% of the Nasdaq-100, which is widely regarded as the most robust tech index (or ETF). Before we talk about the outlook for 2023, I want us to visualize and contextualize the recent performance of these big tech stocks:

Barring Apple (AAPL), all mega-cap tech names find themselves in the bear market territory, with Amazon (AMZN), Tesla (TSLA), and Meta (META) suffering catastrophic ~50%+ declines from their all-time highs. As interest rates go up, equity trading multiples come down. And the decline so far in tech can be attributed to a de-rating in multiples.

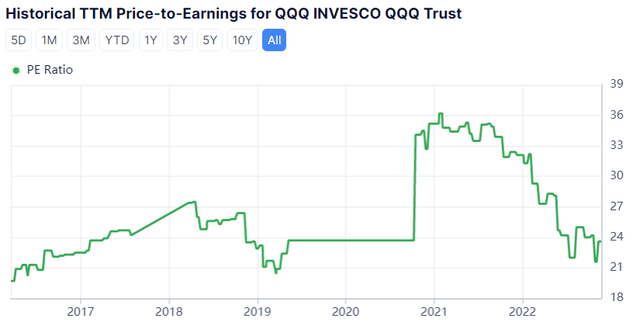

After trading at 36x P/E in early 2021, QQQ has undergone a vicious drawdown, and it now trades at ~24x P/E, which happens to be the 10-yr median multiple for QQQ. A lot of tech sector bulls believe that since trading multiples have normalized, we are ready for a rebound in 2023. However, we are no longer operating in a low-interest rate regime, and the FED is not done tightening yet! Moreover, an earnings recession is already here, and layoffs in tech are still in the first innings. So what’s the outlook for next year?

How Will Tech Stocks Perform In 2023?

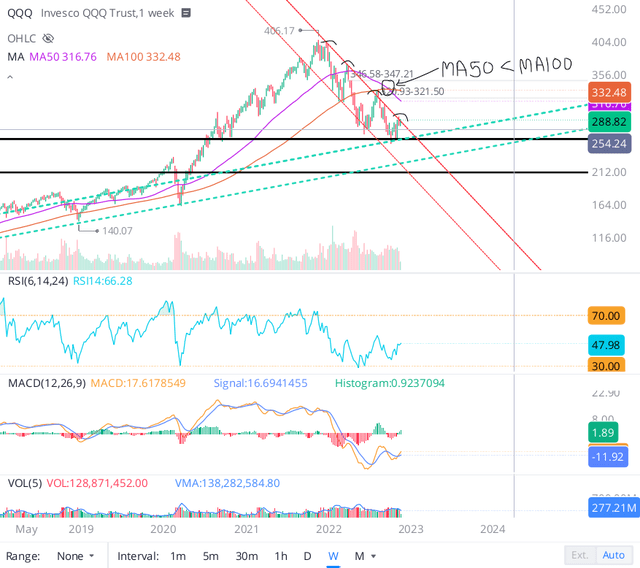

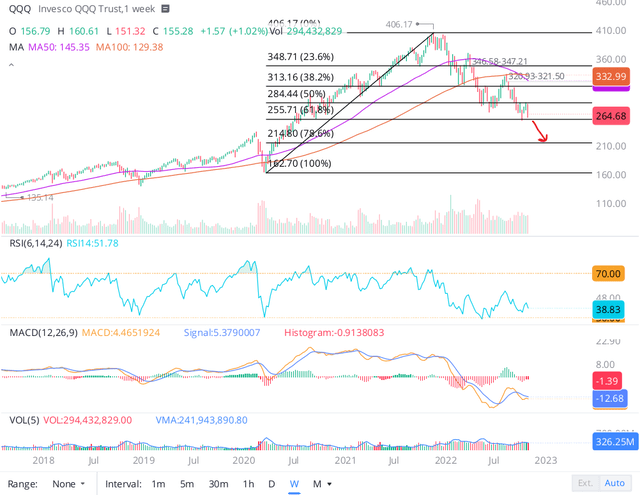

After hitting a new low in mid-October at ~254, QQQ has bounced up by ~14%, with investors seemingly celebrating a split government in the US and a change in tone from the FED with regards to the pace of future rate hikes.

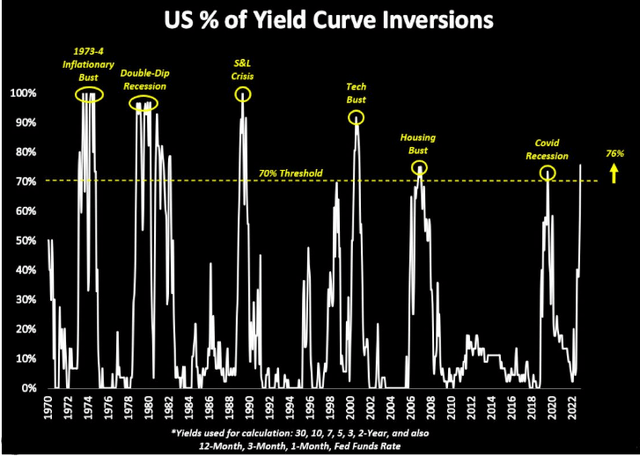

At November’s FOMC meeting, the FED raised rates by another 75 bps to 3.75-4%, and the projected hike for the December meeting now stands at 50 bps (with recent CPI prints showing signs of cooling down in inflation). While many market participants see slower rate hikes as the beginning of the end of this ongoing rate hike cycle, I think these investors are ignoring the fact that the FED is still looking to tighten into a massively inverted yield curve.

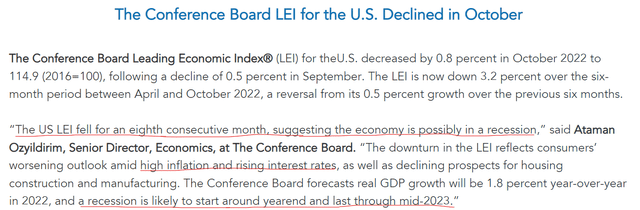

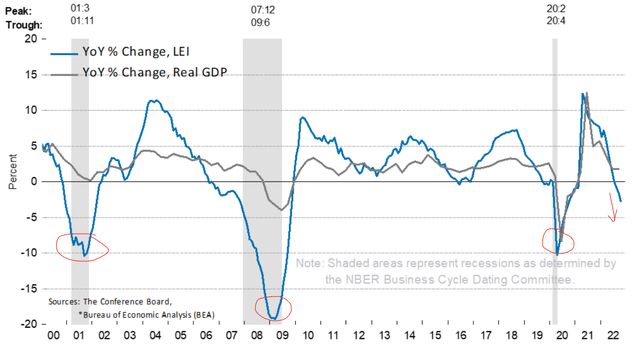

As inflation cools down, the FED could go slower from here on rate hikes; however, the FED’s resolve to hold rates higher for longer at terminal rates of 5-5.25% is dangerous for the economy. As per leading economic indicators, the US could be about to enter a recession in the first half of 2023. For months, I have insisted that recession is a far greater threat than inflation, and considering the FED’s aggressive monetary tightening actions, I think we are likelier to see a hard landing in the next few months. An earnings recession is coming, and even in a garden variety recession, we tend to see a 15-20% contraction in EPS in my view.

The Conference Board The Conference Board

Now, technology companies (not stocks) have traditionally shown secular growth, i.e., less vulnerability to economic cycles. However, unlike 2007-08, technology is now ubiquitous, and big tech giants are severely exposed to economic cycles, as evidenced by the ongoing growth slowdown and earnings recession seen in their Q3 reports:

| PE ratio | Forward-PE Ratio | Q3 Y/Y Revenue Growth (%) | Q3 Y/Y EPS Growth (%) | |

| Apple (AAPL) | 22.65x | 22.08x | +8.14% | +4.03% |

| Microsoft (MSFT) | 23.86x | 23.21x | +10.60% | -13.28% |

| Amazon (AMZN) | 83.61x | 82.6x | +14.70% | -9.68% |

| Tesla (TSLA) | 64.10x | 49.91x | +55.95% | +97.92% |

| Alphabet (GOOGL) (GOOG) | 17.19x | 17.97x | +6.10% | -24.29% |

| Meta (META) | 8.65x | 9.99x | -4.47% | -49.07% |

Source: YCharts (Data as of market close on 4th November 2022)

Among these names, only Tesla’s and Apple’s Q3 reports were impressive. In my view, Tesla will continue to grow even in the event of a recession because EV adoption is still in the early innings. On the other hand, I think Apple will struggle to sell as much hardware in 2023 as it did in the last couple of years as consumers already struggling with higher prices (due to inflation) face a recession. Alphabet’s Q3 report was ok, but the pain in advertising and rising operating costs are set to hurt more in upcoming quarters. While Meta’s expense guide for 2023 was the big issue in its report, Amazon’s Q4 guide for sales was well below expectations. Further, Microsoft’s report highlighted a softening PC market and a deceleration in the Cloud (AWS slowed too). And chip makers like Nvidia (NVDA) and AMD (AMD) are struggling with inventory gluts. Over the years, we became accustomed to flawless quarterly reports from the FAANGs, and in that context, the Q3 earnings season for these tech giants was a string of disappointments. From a fundamental perspective, tech stocks are looking weak in the current stage of the business cycle, with the macroeconomic environment set to get even more challenging in 2023.

According to TQI’s Valuation Model, Apple and Microsoft are still trading at a 25-30% premium to their fair values (and that’s without consideration of an earnings recession in 2023). Tesla is fairly valued, and the other three are undervalued. However, Mr. Market has a tendency to overshoot to the upside and undershoot to the downside! Honestly, I don’t see the tech stocks entering a new bull market next year until and unless the generals lose their valuation premiums first. Yes, tech stocks have come down a lot, but the correction so far has just eliminated some of the froth, and there’s a long way to go before this sector becomes attractive again.

As I have discussed in the past, technology stocks like Apple and Microsoft are still trading at lofty multiples (~25x P/E), and in an earnings recession, these two names could get crushed 30-50%+ from current levels. And then there are a host of unprofitable tech names that are still getting clobbered all over the place with no regard for quality tech stocks either.

While we have already seen a considerable pullback in QQQ (much more so than SPY), I think we have more downside in QQQ as the sectoral rotation away from technology is set to continue for the foreseeable future. I don’t know if we will see a 50% decline from current levels; however, the $215-235 zone is very much in play, and an earnings recession could take us down there in the first half of 2023.

With all of this being said, individual stock investors with a long-term investment time frame and a stomach for volatility should look for opportunities in this market, as we have deals galore in the tech sector right now. For example, Meta at ~10-12x forward P/E or Tesla at ~30x forward P/E (much higher future growth potential than Meta). As an investment community, we will always pursue bold, active investing with proactive risk management at The Quantamental Investor. And considering the fundamental and technical views presented in this note, we are implementing option-based hedges into our core portfolios for next year, and we will continue to deploy our cash positions (~50% of our AUM) on a bi-weekly basis to accumulate our high conviction stocks throughout 2023.

Bottom Line

In my view, the pain for tech stocks is far from over, with generals like Apple and Microsoft still trading at premium valuations. The likelihood of a recession is rising, and tech stocks (along with broader equity markets) could continue to remain under pressure in 2023. As I see it, there are select opportunities in the tech sector that are well worth buying right now, and individual stock investing with dollar-cost averaging plans and proactive risk management is the best way to operate in this bear market.

Key Takeaway: I rate QQQ a “Sell” at $290, with a target of $215-235 by the end of Q2 2023.

Thanks for reading, and happy investing. Please share your thoughts, questions, and/or concerns in the comments section below.

Be the first to comment