Andres Victorero

By Daniel Prince, CFA

Risk-adjusted return is a critical element to successful long-term investing, and one often overlooked — or misunderstood — by newer investors. I view risk-adjusted returns as perhaps the most important, least understood part of investing; after all, the return potential of any investment should be viewed in the context of the risks it takes to achieve that return.

So, what is “risk-adjusted return”?

Risk-adjusted return is a calculation of the return (or potential return) on an investment such as a stock or corporate bond when compared to cash or equivalents. Risk-adjusted returns are often presented as a ratio, with higher readings typically considered desirable and healthy.

How To Calculate Risk-Adjusted Return

The Sharpe ratio formula is one of the most-commonly cited measures of risk-adjusted return. Developed by Nobel laureate William Sharpe, the Sharpe ratio calculates the return (or expected return) of an investment in excess of a “risk-free” security. While no investment is 100% risk-free, short-term U.S. Treasury bills are often used as the proxy for risk-adjusted comparisons. You can find Sharpe’s formula and a hypothetical comparison of two investments here:

Sharpe Ratio = (Return – Risk Free Rate) / Volatility

The table below shows the returns and Sharpe Ratio of two hypothetical investments. You had to withstand twice as much volatility — the degree of variation in the price of a security over time — to achieve the same portfolio return for Investment B vs. Investment A, meaning Investment A was a better performer on a risk-adjusted basis.

| Return | Risk Free Rate | Volatility | Sharpe Ratio | |

|---|---|---|---|---|

| Investment A | 11% | 1% | 10% | 1 |

| Investment B | 11% | 1% | 20% | 0.5 |

For illustrative purposes only. Past performance does not guarantee future results.

Why Measuring Risk-Adjusted Return Is Helpful

I’m not suggesting investors need to start calculating Sharpe ratios or other sophisticated metrics for their portfolios. But I do believe it is important to understand the concept. Recent history explains why.

The past 12 months provide a good — albeit painful — reminder of why the importance of risk-adjusted return can’t be overstated. During bull markets, most investors focus on return in its most basic form, without taking into consideration the risks they’re exposed to in order to achieve said returns. Unfortunately for most, the risks aren’t evident until after it’s too late and the market turns sharply lower.

For example, when the so-called FAANG stocks (Facebook (META), Amazon (AMZN), Apple (AAPL), Netflix (NFLX) and Google (GOOG) (GOOGL)) were outperforming the broad market, investors may not have been focused on how rising rates could hurt the appeal of those mega-cap growth names.1

When U.S. rates were at or near zero, investors were willing to pay up for the FAANG’s expected long-term cashflows. But once the Federal Reserve started aggressively raising interest rates, investors became more focused on near-term cashflows… and valuations. From Dec. 31, 2021 to June 30, 2022, the average price-to-earnings ratio for the FAANG stocks dropped 38% as the Fed Funds Rate went from 0% to 1.5% over the same time period.2

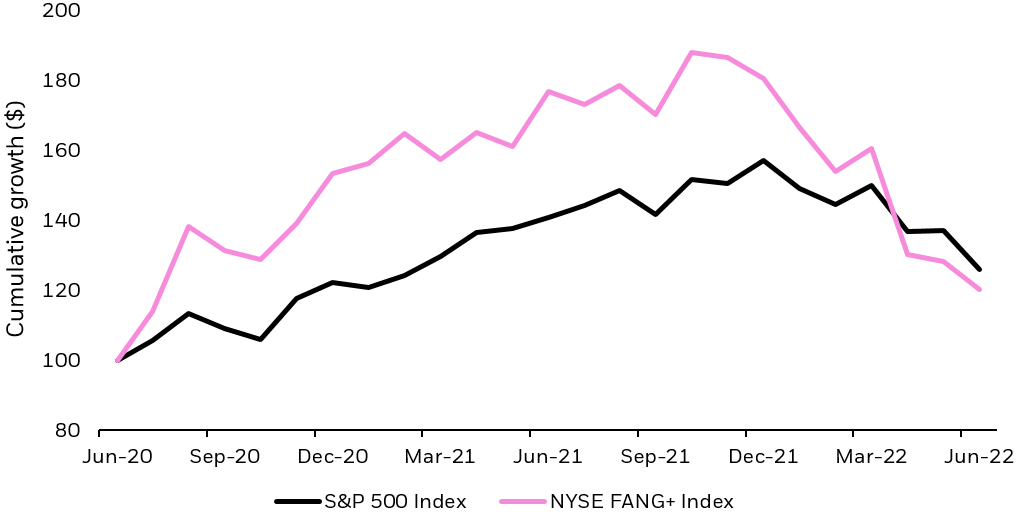

As a result, the once high-flying FAANG names fell 33% in the first half of 2022, with individual names such as Netflix and Meta Platforms down more than 50% each, versus a 20% decline for the S&P 500.

FAANG stocks vs. S&P 500: Once hot names underperform in first half of 2022

Chart description: This chart shows the performance of the NYSE FANG+ Index vs. the S&P 500 for the past two years. (Source: Morningstar as of 6/30/2022. Using total return which assumes the reinvestment of dividends.)

Past performance is not indicative of future results. Indexes are unmanaged and one cannot invest directly in an index.

Manage Market Volatility, And Your Own Emotions With Risk-Adjusted Returns

One way to think of risk-adjusted return is that it’s like the speed limit for your car. If your destination is 60 miles away, you can get there in just over one hour if you stick to the 55 MPH limit. Or you can get there faster if you’re willing to drive above the speed limit. The faster you go, the quicker you could arrive. However, going above the speed limit increases your risk of getting a ticket, having to swerve wildly to avoid accidents, or something worse. And the faster you go the higher the odds of a bad outcome.

The same is true of your investing. Building a diversified portfolio based on one’s risk tolerance and investment goals may feel like a slow (even boring) approach that means it could take longer to reach your destination (investing goals). But you most likely increase the odds of getting there. Focusing on hot trends may seem like a faster route to your goals and it may even be so for a time, but you also increase the risk of a financial ‘accident’.

Considering the risks — and the risk-adjusted return — of your portfolio will go a long way to helping you stay on track, and on schedule while pursuing success in your investing journey.

© 2022 BlackRock, Inc. All rights reserved.

1 For ETF holdings, please visit each featured funds’ webpage by clicking on the “view” link under each funds’ name. Specific companies or issuers are mentioned for educational purposes only and should not be deemed as a recommendation to buy or sell any securities. Any companies mentioned do not necessarily represent current or future holdings of any BlackRock products.

2 Source: Morningstar, Bloomberg.

3 Source: Morningstar as of 6/30/2022 using total return which assumes the reinvestment of dividends. FAANG returns represented by the NYSE FANG+ Total Return Index.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

The iShares Minimum Volatility Funds may experience more than minimum volatility as there is no guarantee that the underlying index’s strategy of seeking to lower volatility will be successful.

Diversification and asset allocation may not protect against market risk or loss of principal.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA®”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell or S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, which is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

© 2022 BlackRock, Inc. All rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

iCRMH0822U/S-2303268

This post originally appeared on the iShares Market Insights.

Be the first to comment