Toni M/iStock via Getty Images

Ethereum (ETH-USD) is at the center of decentralized finance, smart contracts, NFTs, and other fast-growing trends. I believe that these trends will support long-term price appreciation in Ethereum. However, a key part of the Ethereum story at this point is the consensus layer upgrades, which add short-term risk due to the technical complexity of implementing changes such as proof of stake. This risk will decrease over time, thanks in part to testing mechanisms such as shadow forks.

Introduction

Many people are invested in Ethereum because they view it as a scarce store of value or a good way to get indirect exposure to fast-growing areas like DeFi and NFTs.

However, Ethereum is currently in the middle of a series of highly technical upgrades as it transitions to proof of stake. Tracking the progress of the upgrades can be difficult, especially when some announcements are highly technical. For example, one recent announcement was that a mainnet “shadow fork” test merge was completed.

These announcements are often done through developers’ Twitter accounts, so they’re not always very easy to find or understand. In response to the above announcement, the top comment is:

For the average non-dev person who is interested in following this live, what are we looking for exactly? And how do we know if it’s successful or not? – The Great Thread

The purpose of this article is to answer this question by explaining what a shadow fork is, what it means for the consensus layer upgrades, and what it could mean for Ethereum’s price. Since this is my first article covering Ethereum, I will assume that readers have limited familiarity with the aforementioned concepts.

The Consensus Layer

Right now, Ethereum is great for smart contracts and DeFi, but the proof of work method that it uses to secure the network has made transactions expensive and raised environmental concerns.

The consensus layer – formerly known as Ethereum 2 – represents some major upgrades to Ethereum to address these issues. Most notably, proof of work is being replaced with proof of stake. Rather than using powerful computers to “mine” new Ethereum to secure the network, those who are already invested in Ethereum will be responsible for securing it using a process similar to a majority vote.

Although it’s a stretch to say that proof of stake is strictly better than proof of work, proof of stake and other consensus layer upgrades will further differentiate Ethereum from Bitcoin (BTC-USD) and provide the following unique benefits:

- Lower transaction (“gas”) fees

- Holders of Ethereum can earn continuously compounding interest

- Makes Ethereum deflationary instead of inflationary

- Lower energy usage (better for the environment)

The consensus layer upgrade is happening in three steps. The first step introduced the Beacon Chain, which can be thought of as an Ethereum clone that uses proof of stake but doesn’t yet support smart contracts and other core Ethereum features.

The Beacon Chain has already been live for over a year. Holders of Ethereum on exchanges such as Coinbase (NASDAQ:COIN) can convert their Ethereum to ETH2 and stake it to earn a yield, which is currently 3.68% APR on Coinbase. Both ETH and ETH2 have the same price. But ETH2 can’t be sold or even converted back to ETH until the main Ethereum and the Beacon Chain merge.

This merge is the second step in the consensus layer upgrades but it hasn’t happened yet. It’s slated for sometime in Q3 or Q4 according to the official Ethereum website.

The merge will mark the end of Ethereum’s use of proof of work, but there’s still a third group of upgrades planned. So, some features – such as selling staked Ethereum and using shard chains to lower fees and improve accessibility – won’t be implemented until after the merge is complete. But the merge is the critical next step in unblocking the remaining upgrades, so investors are watching it closely.

Testing The Merge

In a perfect world, Ethereum developers would code the merge and then execute it immediately. However, Ethereum’s code is complex and developers write buggy code all the time. So the merge plan must be tested extensively, just like any other code.

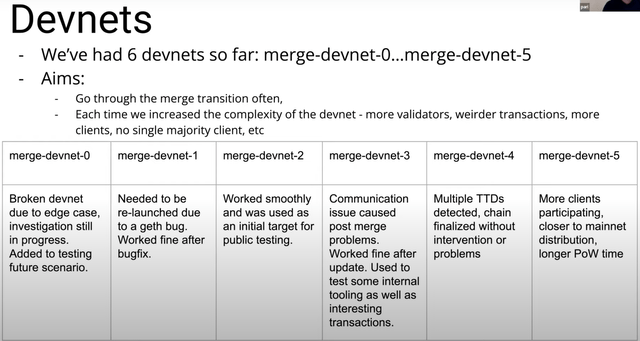

In order to test the merge, Ethereum developers create what are called devnets. These can be thought of as separate Ethereum implementations that are optimized for use by developers and other technically inclined members of the community. Transactions on a devnet are not reflected on the main Ethereum network and the amount of Ethereum in a devnet is essentially unlimited.

To test the merge, a devnet is created and then transitioned from proof of work to proof of stake, just like what will eventually happen to the mainnet. Throughout the process, a variety of unique situations are tested by – among other things – throwing random input at the devnet and seeing if it breaks.

As shown in the graphic above, there have been six merge devnets so far, and each produced a different result. The first couple devnets had serious bugs. But the more recent ones validated more complex situations and have essentially worked as intended. That’s a good sign for the upcoming mainnet merge.

Because these devnets are just intended to test the merge, they typically only run for a couple of weeks or months and then get shut down. This makes testing the merge on a devnet a bit unrealistic. A testnet might have 1 MB of state data, probably even less. But the mainnet – which has been running for years and is constantly processing transactions – has over 50 GB of state. That’s about 50,000 times more state.

More state means that it will take longer to sync on the mainnet. The longer the process takes, the more potential there is for bugs and other issues. A truly realistic test would be executed on a net with as much state as the mainnet. Enter shadow forking.

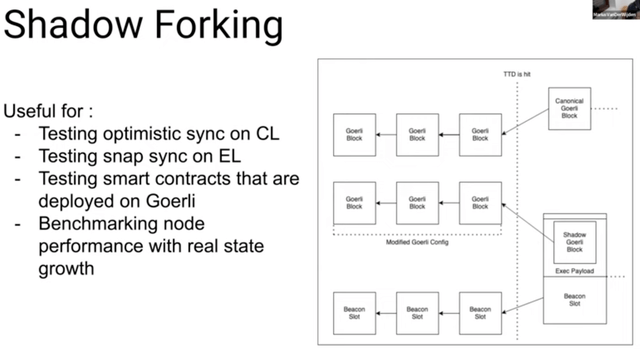

A shadow fork is conceptually similar to a devnet except that it copies the state of a different network (devnet or mainnet) instead of having its own separate state. For example, a shadow fork of the main Ethereum network still receives all transactions going to the mainnet. This fork can transition to proof of stake while still having mainnet transactions and other history/state information. After a successful merge on the shadow fork, it then continues on the proof of stake chain, ignoring any blocks that are added using proof of work on the mainnet.

Even for the less technically inclined, the value of a shadow fork for testing and validation should be clear. Doing a merge with millions of dollars’ worth of transactions sending Ethereum around the world is quite different from doing a merge on a test network with a few developers doing fake transactions. The shadow fork allows developers to test the former more realistic scenario.

So, to directly answer the question posed on Twitter, a successful shadow fork would expose all the issues that would come up when doing the mainnet merge. When the mainnet is merge-ready, a successful shadow fork would not expose any issues.

ETH Price Implications

As the early testnets demonstrated, it’s possible that the merge will cause real issues for Ethereum and its holders. The recent merge on the first mainnet shadow fork also exposed multiple issues that the prior testnets didn’t catch.

A successful merge will be good for Ethereum long-term, but until it’s complete, there’s execution risk. Even post-merge, there will be further execution risk relating to follow-up upgrades and proof of stake security.

I believe that demand for Ethereum (and thus Ethereum’s price) is to some extent correlated with the probability of a successful merge; some would-be buyers of Ethereum will remain on the sidelines until they believe that the merge will be successful. Thus, Ethereum’s “fair” value increases with each successful and realistic test merge.

Of course, there are many factors that impact Ethereum and we can’t expect its price to increase every time a successful test is done. Cryptocurrencies are always volatile.

Another merge-related factor that could negatively impact Ethereum’s price is the unlocking of staked ETH2 for trading some time after the merge completes. Right now, there are 8 million ETH2 staked, which represents a couple of days of ETH trading volume and about 7% of the total Ethereum supply. That’s a non-trivial number that could cause a “sell the news” event, although most people staking ETH2 are likely long-term holders.

So in the short term, we could get a sell the news event after the merge due to a short-term supply spike. Or we could get a buy the news event if lower merge-related risk causes increased demand. It’s easy to see why I always say that short-term price action is difficult to predict.

However, as described previously, the consensus layer upgrades and proof of stake provide multiple benefits that will be good for Ethereum in the long term. Long-term investors should thus hope for a successful merge, and they should be happy that shadow forks and other testing mechanisms were invented to increase the chance of the merge being successful.

Conclusion

Seeing Ethereum’s developers talk about their results with the shadow fork tests increased my confidence that the merge is well-tested and that it will ultimately be successful. I’m a long-term holder of Ethereum and have about half of my Ethereum staked as ETH2. I’ll continue to accumulate more Ethereum after events like shadow fork tests that increase my confidence in a successful merge. The next shadow fork of the mainnet is scheduled for April 22nd.

Be the first to comment