eurobanks/iStock via Getty Images

Grayscale Investments Vs. The United States Of America

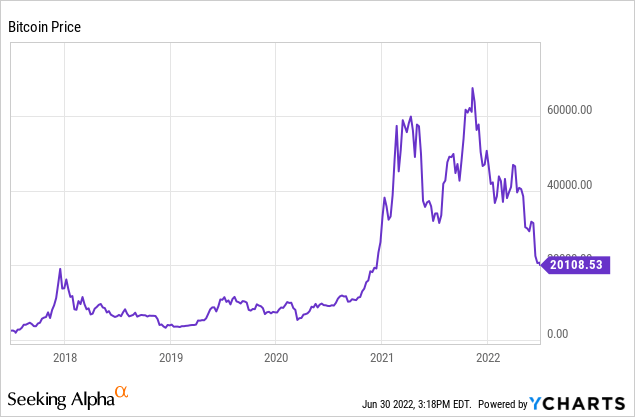

After a long wait, the Securities and Exchange Commission has ruled to deny Grayscale Investments’ petition to convert the Grayscale Bitcoin Trust (GBTC) into an open-ended ETF. The ruling is a blow to advocates for the integration of Bitcoin (BTC-USD) into the broader financial system. From my perspective, people are going to invest in crypto anyway, so why not give them a safe way to do so? The SEC ruling emphasized concerns about possible market manipulation with a Bitcoin ETF.

The need for crypto regulation is obvious at this point. Flashy people in the crypto world made grand promises that they were not able to keep, and millions of people (including me) gave them too much of the benefit of the doubt. A few people got yachts out of this, but millions of depositors will lose most or all of their savings invested. Recently, we’ve seen the high-profile failure of popular crypto firm Celsius (CEL-USD) and news of an impending bailout of BlockFi for pennies on the dollar. They almost certainly won’t be the last.

When a legal system designed centuries ago meets 21st-century technology, there’s bound to be conflict, but a lot of what has happened in the broader crypto world is no more innovative than when crafty American colonists invented new money to borrow a bunch of money and stiff their creditors in England in the 1700s (or when crafty mortgage bankers made crappy products in 2006). But as far as I can tell, Grayscale’s plan to offer a spot ETF is far less problematic at its worst than anything going on in the less-regulated or offshore/unregulated areas of crypto. And Bitcoin itself is blameless-it’s just preprogrammed digital money. It’s some of our darker tendencies as mankind to take advantage of our neighbors and prioritize the short run over the long run that are the true problems. 2022 has been a continual reminder that the world may not be the place that the idealists thought it was.

Grayscale filed an appeal with the D.C. Appeals court (the case is called Grayscale Investments vs. Securities and Exchange Commission). Representing Grayscale is Donald B. Verrilli Jr., who served in the Justice Department as Solicitor General under the Obama administration. As far as cases go, this actually isn’t super political but rather is very technical. I’m not a lawyer, but if you’re representing the government here, why not just approve the conversion? I don’t get it. It seems like the American public has given the SEC a mandate to approve the GBTC conversion, as evidenced by the fact that thousands of people wrote in to support it. Skimming the SEC decision, the points they’re making on wanting to avoid market manipulation are valid. But Canada has already approved Bitcoin ETFs, giving at least some framework.

I have a little money in GBTC, so I’m obviously disappointed about this, although if you’re pinning your hopes and dreams on crypto at this point, you’ve got other problems. I got the initial thesis of this trade wrong but will still hold. In a pattern that is likely familiar to event-driven traders – you’ll eventually win most of these special-situation-type trades by buying undervalued assets and selling overvalued ones. However, you can get so delayed by appeals and denials and antitrust and Congress and whatever else that it drags down your IRR. These trades are always interesting and sometimes fun, but again, that’s the risk you run.

If you’re interested in staying in, my understanding is that the D.C. Circuit is much more efficient than other courts which have large backlogs, especially the 9th Circuit, which covers the West Coast. It is expected to take about 9 months for a decision, per Grayscale. Quickly checking prices tells me that GBTC’s discount to NAV expanded a little today, but not dramatically (we’ll have more data after the close). The discount is still there, but the time to close it has lengthened, dealing a blow to investors large and small in the trust. Some people have been lining up short positions (generally via options) in other crypto companies like MicroStrategy (MSTR) to try to hedge out the price risk in the meantime.

Bottom Line

The SEC has denied Grayscale’s petition to convert GBTC into an ETF. GBTC lost the battle, and even if Grayscale wins the war (in appeals court), the IRR on the trade will be much lower than it would have been otherwise. The broader crypto ecosystem was touted as a new paradigm that could make the world a better place, but human nature seems to have gotten in the way, with the scale of deception and lies by many in the crypto world approaching what was seen in the crises of 2008, 1929, 1907, 1893, 1873, 1837, 1825, or earlier. I believe Bitcoin is tremendously valuable and firmly believe in the libertarian ethos that its earliest supporters embodied-allowing billions of people an alternative to the hyperinflationary currencies of developing countries and creating a check on excessive power on governments in all countries. However, the gold rush that happened after has showcased some of the worst of human nature, with more likely to come. Grayscale has always struck me as one of the “good guys,” even if the bar in the crypto world is so low you can step over it. I think they’ll eventually win approval, but it seems it may be a pyrrhic victory in the end. I’m very bullish in the long run on Bitcoin in general but expect the pain for BTC and GBTC to continue in the short run until the excesses are fully flushed out.

Be the first to comment