Black_Kira

Navigating the opportunities within the comparatively nascent EV industry will see winners and losers emerge. But how real are the concerns around the battery upstream market and could this genuinely be the next automotive supply chain crisis? In what way can automakers achieve economies of scale while feasibly navigating fluctuating commodity prices to deliver competitively priced EV offerings? This challenge will fundamentally define how the competitive landscape of the automotive industry transpires this decade.

Battery raw material: A critical bottleneck within growing EV supply chain

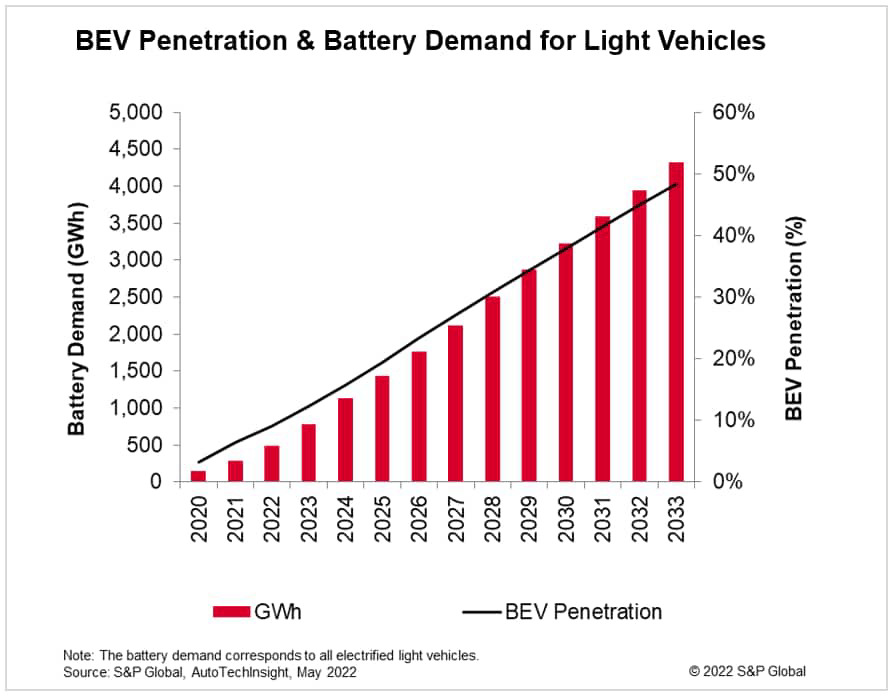

Annual production volumes of BEVs are forecast to increase from around 4.8 million in 2021 to more than 50 million in 2034. As a result, unprecedented quantities of battery-grade commodities are needed to support such an uptick and ensure a successful global transition to battery electric vehicles. S&P Global Mobility considers this figure to mandate a shift from needing 260 GWh of predominantly lithium-ion batteries in 2021 to some 4,568 GWh in 2034 to support BEV demand, with an additional 147 GWh required to support hybrid vehicles. While many potential constraints exist along the battery value chain, an abundant and financially sustainable supply of raw materials such as nickel, lithium, and cobalt will be critical to all-electric vehicle (EV) battery chemistries.

Battery metals: Critical impact, but smaller in quantity

In terms of the raw material constituents of a battery pack, the quantity of material and value of material are unrelated. A typical battery pack within a battery-electric vehicle (BEV) weighs more than 500 kg and the portion of battery cells and, specifically cathode, weights are about 50% and 20%, respectively. Within this, the percentage of nickel and cobalt weight within a battery pack featuring a nickel-cobalt-manganese (NCM)-based cathode chemistry is even smaller, with 10% and less than 1%, respectively, subject to the chosen portions of the chemical constituents. This is not to mention lithium, the weight percentage of which is also small, even though it is hard to measure it separately since it exists in the form of ions from multiple components.

Price hiccups in battery metals

Nickel, cobalt, and lithium are three critical battery metals that may become bottlenecks within the battery supply chain. The potential risks from these metals have been evidenced by recent battery metal price volatilities. For example, according to S&P Capital IQ, the LME nickel three-month official price was hiked by 150% to reach near USD48,000 per ton in the March 2022 peak (two weeks after the Russian invasion of Ukraine) from the July 2021 price level of USD19,000, and then settled down again near USD19,000 as of 15 July 2022. Cobalt price hikes have been relatively mild, nearly 60% up at its peak in March 2022 and came down to a 15% year-over-year increase as of now.

In contrast to nickel and cobalt, lithium is still trading at a high level, partly because of its irreplaceability in the lithium-ion battery. According to S&P Global Commodity Insights, the lithium carbonate CIF North Asia price is above USD70,000 per ton as of now, up by more than 600% from the USD10,000 level a year ago.

Why not pursue nickel and cobalt-free batteries?

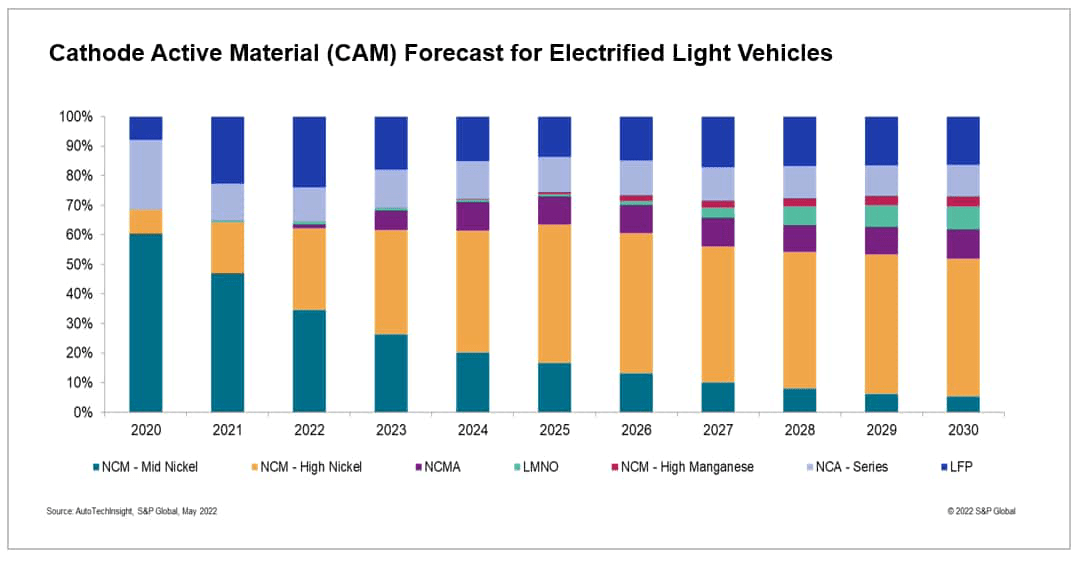

On the back of battery metal price volatilities, it has become more economically attractive for OEMs to initiate a cathode chemistry transition from high nickel NCM (nickel cobalt manganese) or NCA (nickel cobalt aluminum) to LFP (lithium iron phosphate), which contains no nickel and cobalt. However, even as a cheaper and attractive alternative, LFP will not likely replace NCM/A due to its inherent limitations on energy density for light passenger vehicles. S&P Global Mobility expects NCM high nickel cathode will have the largest share with almost 50% in 2030 from 25% in 2022.

Within NCM/A, cobalt is the most viable element so far to enable a high energy density and a long battery cycle life as it stabilizes the layered cathode atomic structure. There are many feasible alternatives such as LMNO (lithium manganese nickel oxide), high manganese NCM to replace or minimize cobalt usage to avoid high price and unethical issues related to cobalt mining. Meanwhile, nickel is harder to be replaced than cobalt as its role is critical to achieve high energy density, which is directly translated into EV driving range.

Supply and demand outlook for battery raw materials

Battery metal demands will increase dramatically to follow the BEV adoption curve while the growths in battery metal supplies will likely be in doubt as supplies are not flexible enough to keep up with demands. S&P Global Mobility expects that annual lithium demand from all battery applications (light vehicle being majority but also including energy storage system, portable electronics applications) will reach 1.97mn tons in 2030, growing 28% CAGR (compounded annual growth rate) from 0.27mn tons in 2021. Likewise, nickel demand from all battery applications will reach 1.80mn tons in 2030, growing 34% CAGR from 0.16mn tons in 2021.

However, the industry is facing challenges on securing supplies as typical battery metal mines require more than 5 years to begin operation in case of green field projects. Furthermore, for nickel in particular, only high purity, class one nickel can be used for battery application which comes from mostly sulfidic mines only.

Battery upstream has become too important to outsource

Auto OEMs had delegated most of battery metal purchasing to cathode and cell manufacturers until the price disruptions in battery metals happened. In recent months, to name a few OEMs in North America, Tesla (TSLA), GM (GM), Ford (F) and Stellantis (STLA) all signed long-term contracts directly with battery metal miners. S&P Global Mobility has been actively researching battery upstream in recent months to establish the complete dynamics of battery metal supply & demand in light passenger vehicle and will publish the resulting forecast dataset and analysis in the coming months.

Potential geographical risks also lie in battery chemical refining

Now, many people tracking the battery upstream market acknowledge the reality that nickel and cobalt are vulnerable to macro risks after the recent series of price volatilities. Furthermore, well understood is that high geographical concentrations of nickel and cobalt exist in Russia and in Republic of Congo, respectively, nations of known instability.

On the other hand, lithium is one of the most abundant metals in the earth’s crust, so lots of lithium mining projects have been initiated across all regions of the world. However, if we go one notch down toward the downstream, a high degree of geographical concentration in battery chemical refining can be found. For example, converter facilities of lithium hydroxide and carbonate, which are refined chemicals from mining (either from lithium spodumene ore or brine) and mixed to form cathode, are highly concentrated in China. According to S&P Global Commodity Insights, 89% of lithium hydroxide converters capacities is in China, followed by 5% in Chile and only 3% in the U.S in 2022.

The reshoring of entire battery supply chain to the US

Currently, the US heavily relies on foreign countries to secure batteries, and it plans to re-shore not only battery cell facilities, but also the whole battery supply chain from mining to recycling. According to National Blueprint for Lithium Batteries published by FCAB (Federal Consortium for Advanced Batteries) in June 2021, the U.S owns 0%/10%/2%/6% of global cathode/anode/electrolyte/separator manufacturing facilities while China possesses 42%/65%/65%/43% of them.

While it looks feasible for the US to achieve the independence of battery cell and some materials manufacturing in a decade, battery metals have their own intrinsic limitations. According to the same report, the percentage of US reserves of lithium, cobalt and nickel are estimated to be only 3.6%/0.7%/0.1% of total world reserve, respectively. Therefore, the US national strategy of battery metals is focused on securing the access from partners and allies while eliminating the dependency on nickel/cobalt and developing sustainable domestic sources through R&D efforts.

Sustainable lithium mining with advanced technology

Among many efforts to secure domestic battery metal production, advanced lithium mining has been actively researched in the US. In November 2021, CTR (Controlled Thermal Resources) started its drilling program at the Hell’s Kitchen Lithium and Power project in California. Hell’s kitchen project plans to use geothermal energy for the novel extraction technology called DLE (direct lithium extraction) which will be able to achieve less contamination, less water/land usage with shorter production time. According to NREL (National Renewable Energy Laboratory), DLE could be a game-changing extraction method, potentially delivering 10 times the current US lithium demand from California’s Salton Sea known geothermal area alone.

CTR’s project has been jointly developed with a technology partner startup called Lilac Solutions and is expected to deliver its first lithium carbonate products in 2023. General Motors and Statevolt are major EV customers who agreed to procure volumes from this project.

OEMs’ strategy on battery raw materials

With a paradigm shift in vehicle powertrain being evident, the question is no longer will there be a shift away from ICEs but rather how quickly can we shift to more greener ways of transport. OEMs have pledged billions of dollars in investment and elusive long-term plans to make this shift. With a limited supply of raw materials and an increasing demand for EVs, OEMs that manage to gain supply of raw materials in the long run will be ahead of the competition.

Investment in lithium mining companies

In light of concerns around supply chain ownership, an increasing number of OEMs have sought to get more directly involved in upstream raw material supply. Stellantis has invested in Vulcan energy’s upcoming projects in Germany’s Upper Rhine Valley to mine lithium hydroxide. Volkswagen (OTCPK:VWAGY) and Renault have also signed supply agreements with Vulcan Energy to obtain raw lithium from 2026. Ford has loaned over half a billion dollars to Australia’s Liontown resources to expand their mining and have signed an agreement to obtain lithium.

OEMs have invested in CAM (cathode active material) companies and lithium mining companies and in return signed long-term offtake agreements to make sure they are not gasping for raw materials in the future.

Joint ventures and agreements

With many mines beginning operations in Africa and South America, major OEMs have signed agreements with companies to obtain raw materials. CAM companies such as Umicore have signed MoUs with Volkswagen and Automotive cells company (the joint venture by Mercedes-Benz (OTCPK:DDAIF), Stellantis and Total energy) to supply cathode materials. Renault (OTCPK:RNSDF) has supply agreements with Terrafame for Nickel and with Morocco’s Managem group to supply cobalt, BMW (OTCPK:BMWYY) and Managem have signed a multi-million euros deal for the supply of cobalt. GM has inked a deal with Glencore for long-term supply of cobalt.

Silicon anode batteries

To avoid the supply crunch of anode material – graphite, OEMs are looking into silicon-based anode for EV batteries. Mercedes-Benz-backed battery company Sila is all set to manufacture batteries with silicon anode chemistry in North America. Tesla is looking to make changes to its battery cells to include a high percentage of silicon. Porsche (OTCPK:POAHY), Volvo (OTCPK:VOLAF) and Daimler (OTCPK:DTRUY) have invested in companies dealing with high silicon battery technology.

Solid-state batteries

Ford, GM, Mercedes-Benz, Volkswagen, Stellantis, and BMW have all invested in companies dealing with solid-state batteries. Solid-state and semi-solid-state batteries are said to be cheaper and have higher energy density than traditional Li-ion batteries bringing the overall cost of the vehicle down.

Conclusion

The automakers best placed to grow in the emerging global EV market have a number of features in common. Early investment in a variety of battery chemistries provided by a multitude of suppliers will help achieve the scale they require while giving a degree of resilience from commodity price fluctuations and supply chain security. Such supply of critical raw materials is typically largely locked in through direct upstream partnerships, with the likes of Volkswagen and Tesla taking much more ownership and stake in the critical elements of the cell manufacturing process. At the same time, these OEMs, along with the likes of Daimler and BMW, have made deliberate attempts to move product offerings upmarket and indeed prioritize larger segment, high specification vehicles to absorb pricing impacts and prioritize in the face of the ongoing semiconductor crisis. This has ensured impressively higher levels of profitability in the face of, in some cases, lower sales.

That said, the risks around supply of critical battery cell cathode commodities such as lithium and nickel place the EV market in genuine peril. It seems evident that sufficiently abundant quantities of these elements exist and there is an appetite to mine them. However, whether scale can be achieved quickly enough to deliver them at a price that appeases their extractors while making for both affordable and profitable EVs across mass market sectors remains to be seen. Less discussed potential bottlenecks around production capacity for intermediate processing and availability of the complex machinery to perform operations such as cathode drying could derail OEM aspirations. The industry will almost certainly continue to wrestle with supply chain constraints that have the potential to thwart the EV revolution just as it is gaining momentum. This may, by default, provide an opportunity to nations such as China and South Korea, and their leading suppliers, to achieve scale ahead of others around the globe possessing ambitious, but inherently riskier plans as industry fast followers. Alternative chemistries free of such reliance on the stated raw materials, such as sodium-ion, deliver possibilities. However, a different array of technical compromises (such as energy density) will naturally influence technical suitability for the full suite of automotive applications.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment