smudja/E+ via Getty Images

What are cash dividends?

From the Latin “dividendum” meaning a “thing to be divided,” a dividend is a distribution of profits made by a corporation to its shareholders.

A cash dividend is declared by a corporation’s Board of Directors, and is paid to shareholders on a per share basis out of a company’s net profits. Companies usually pay dividends on a fixed schedule, such as quarterly, semi-annually, or yearly.

In the U.S., quarterly dividends are common, while in Australia and Japan, semi-annual dividends are typical, and in Germany, annual dividends are the norm. At any time, a company can declare a special dividend to reflect a special situation, such as the sale of a major asset.

Cash dividends are distributed to shareholders as electronic funds transfers or as paper checks. Shareholders holding preferred shares often receive preference over, and a slightly higher rate, than those holding common shares.

The first dividends were paid out by the storied Dutch East India Company which, between the years 1602 and 1800, paid an annual dividend of approximately 18 percent of the value of its shares.

Tip: It is important to remember that dividends represent cash assets leaving a company and going to its shareholders, thus reducing the company’s total assets once paid. To reflect this, the prices of stocks issuing dividends are automatically reduced by the value of their dividends on all public exchanges the morning after the dividend record date.

Understanding cash dividends

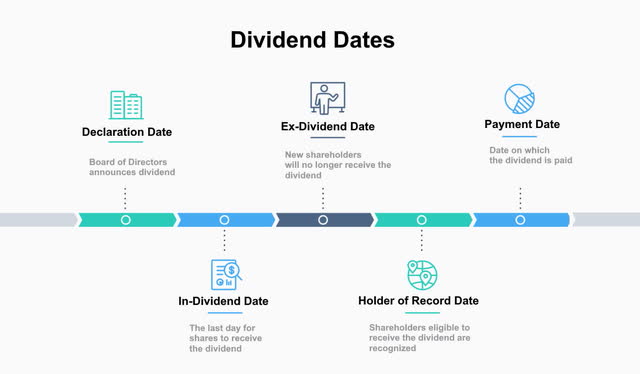

Cash dividends paid by public companies follow a process defined by the regulatory organizations, which revolves around specified dates. The following dates define the dividend process.

- The Declaration Date is the date on which a company’s Board of Directors publicly announces its approval of a dividend payment; a liability then appears on the company’s books.

- The Holder of Record Date (or simply the Record Date) is the date on which shareholders of record are eligible to receive the dividend. In other words, if you are a shareholder on the record date, you will receive the specified dividend.

- The In-Dividend Date is the last day on which shares bought will receive the dividend. (Since stock transactions require two days for settlement, the in-dividend date is two days prior to the record date for that dividend.)

- The Ex-Dividend Date is the date on which new purchasers will no longer receive the dividend. The ex-date occurs one day prior to the Record Date, This is also the date that the exchanges adjust the price of the stock lower by the amount of the dividend.

- The Cum Dividend Period is the number of days between the Declaration Date and the Ex-Dividend Date.

- The Payment Date is the date on which the dividend is actually paid to shareholders. It is the date you would actually receive the money on your brokerage account if you were eligible to receive it. (Payment dates might be as much as a few weeks after the record date to allow time for companies to process the payments.)

Dividend dates Source: iStockPhoto/Image created by author

Tip: Investors wishing to purchase or sell stock prior to the stock paying a dividend should pay close attention to record dates and remember that the trade and settlement process determines when you actually own a stock. Stock transactions do not settle for ownership purposes until two days after a trade. Thus, if you purchase shares of stock on a Monday, you don’t actually become a shareholder of record until Wednesday. If the record date for a dividend is on that Tuesday, you would not yet be a stockholder and would not receive that dividend.

Do all companies pay dividends?

A substantial number of public companies pay dividends, though not all. Young, growing companies typically don’t pay dividends because they are plowing their profits back into the company. Dividends are therefore more frequent among larger, older, and more established companies that are generating sufficient profits to distribute some to shareholders, while still having funds available for growth or expansion.

The companies most likely to pay a dividend are therefore large-cap companies, such as those included on the S&P 500 Index, and companies with regular, sustained revenue streams, such as utilities. According to the Financial Industry Regulatory Authority (FINRA), among the companies included in the Standard & Poor’s (S&P) 500 index, around 84 percent pay a dividend. This index is comprised of the 500 largest U.S. stocks by market capitalization.

Companies that decide to pay dividends, usually expect to continue the practice on an ongoing basis. While some may reduce or even suspend their dividends during periods when profits are low, as was the case during the Great Recession of 2008 and 2009, shareholders tend to place higher value in companies that pay dividends consistently and particularly favor those who increase their dividends over time. For many investors, dividends can be a steady source of income, rivaling that of fixed income investments.

Tip: Standard & Poor’s maintains a list of the best dividend paying companies, called the Dividend Aristocrats List. To be included, a company must: be part of the S&P 500 list; have increased its dividends every year for a minimum of 25 years; have a market cap of at least $3 billion; and have an average daily trading value of at least $5 million for the prior three months. The Dividend Aristocrats List is updated every January, and the 2022 list was released on January 3, 2022. It contains 65 companies including Chevron, General Dynamics, IBM, and Nucor.

Cash dividend calculation example

Companies declare cash dividends as payments per share of stock owned, making the dividend calculation for any shareholder a simple calculation. The formula would be:

Total cash dividend = (dividend per share) x (# of shares held)

For example, if a company pays a quarterly dividend of $.50 per share and a shareholder owns 1000 shares, the total cash amount of the dividend would be (1000) x ($.50) = $500.

An important way to measure a dividend for investors is the dividend yield, which is the percentage return of a company’s current dividend displayed on an annualized basis. This measure allows shareholders to easily compare their dividend to that of other stocks or to selected fixed income instruments. The formula for the dividend yield is as follows:

Dividend yield = (Current dividend)/(current stock price) x (# of(dividends paid in one year) x 100

If the sample dividend above was paid on a stock selling at $80 per share, then the dividend yield would be:

Dividend yield = ($.50)/($80) x 4

= 2.5%

Tip: When considering stocks based on their dividend yield, it’s a good idea to examine company financials to determine a company’s ability to sustain or grow dividends at the current rate and whether there are prospects for share price appreciation as well.

Stock dividends vs. cash dividends

In addition to cash dividends, companies may sometimes issue stock dividends, also known as scrip dividends, which are the issuance of additional shares in a company, or perhaps a subsidiary company to current shareholders.

As with cash dividends, stock dividends must be approved by the company’s Directors and announce publicly well in advance. Unlike cash dividends, however, which are paid in cash at regular intervals from ongoing profits, stock dividends are paid in stock and are typically one-time occurrences that result from spinoffs or other corporate actions.

Dividend tax considerations

While a stock dividend is not taxable until the shares are sold, a cash dividend is considered taxable income when paid and is subject to ordinary income tax rates. However, cash dividends that are deemed “qualified” by IRS definitions are eligible for lower long-term tax rates.

Bottom line

Cash dividends appeal to many companies as well as investors. They are a benefit to many investors who enjoy having part of their investment returns in cash or are using cash dividends as a source of ongoing income. For companies, cash dividend payments tend to attract longer term and institutional investors, who can provide lower volatility to their stock price.

Investors should consider the tax implications of cash dividends along with company financials to determine the suitability of having dividend-paying stocks in their portfolio.

Be the first to comment