cagkansayin/iStock via Getty Images

Amgen Inc. (NASDAQ:AMGN) will acquire Horizon Therapeutics Public Limited Company (NASDAQ:HZNP) for $116.50 per share, a market cap of $27.8 billion, and an enterprise value of $28.3 billion. I mentioned a wide range of potential deal values in my previous article, and, unfortunately, the deal came in slightly below the low end of my wide $120-190 range and below my expected deal value range of $135 to $150 per share. This is a somewhat disappointing end to my investing journey with Horizon, but I am not unhappy about this deal as it will free up quite a bit of cash to deploy to other stocks I like.

The deal is expected to close in the first half of 2023, but I do not intend to wait for the deal to close and will wind down my position in the following weeks and will look to deploy the cash elsewhere.

Sanofi kickstarted the buyout process, but Amgen prevailed

Horizon’s 8-K filing with the SEC revealed that Sanofi (SNY) kickstarted negotiations and Horizon determined it is in the shareholders’ best interest to approach other potential bidders. Three other companies were contacted, an undisclosed Company A, Amgen, and Johnson & Johnson (JNJ). Company A declined to submit an offer, J&J indicated it will evaluate the information shared by Horizon, Amgen submitted an initial bid, and Sanofi increased its proposed price.

On November 29, Horizon released a statement of a possible offer under Irish Takeover Rules, confirming the interest of J&J, Sanofi, and Amgen, but J&J quickly dropped out on December 3, and that left Sanofi and Amgen as the only two potential acquirers.

At Horizon’s instruction, Sanofi and Amgen submitted revised offers on December 9, and on December 10, discussions continued with both companies submitting additional offers at higher prices. Horizon determined that Amgen’s offer was superior, Sanofi dropped out, and Horizon accepted the $116.50 per share offer from Amgen.

Why now and why ‘just’ $116.50 per share

I wondered why the company would consider selling itself during this difficult period for the equity markets with biotech exchange-traded funds (“ETFs”) iShares Biotechnology ETF (IBB) and SPDR S&P Biotech ETF (XBI) being 24% and 54% off all-time highs, respectively, and why it ended up selling itself for what I consider to be a low buyout price.

There is no clear answer, but if I were to speculate, I would say the company made that decision due to two potential concerns about Tepezza:

- Lack of conviction in Tepezza outperforming market expectations in the following quarters or driving increased shareholder value even if it grows as expected.

- Concerns about competition – primarily Viridian Therapeutics’ (VRDN) candidates in development for TED that could be more convenient to administer than Tepezza and that could even have superior efficacy. There is still limited data, but VRDN-001 seemed to drive better efficacy after six weeks of treatment than Tepezza did at the same time point in phase 2 and phase 3 trials (granted, that is just in six TED patients, and it could just be that VRDN-001 works faster than Tepezza).

And since Tepezza represents between 60% and 70% of Horizon’s valuation, it is not too surprising the board has entertained the initial offer from Sanofi and that it invited other bidders to capture shareholder value while Tepezza is still the only product in the TED market.

I was not too concerned about the threat of Viridian or other potential candidates in development for the treatment of TED but did consider Viridian’s approach as very valid and I have built a position in the stock over the last two years as a potential pure-play in TED, and a way to leverage my conviction in this rapidly growing and attractive market. There is definitely room for more than one or two players in this market and often the market expands further with the introduction of a second product.

Amgen obviously does not seem concerned about these threats and the management team mentioned on the acquisition call that they will leverage their biologics expertise to manage Tepezza’s product life cycle and that includes potential subcutaneous formulations that Horizon is already working on – initially with Halozyme’s (HALO) Enhanze technology for subcutaneous delivery of high volume IV products, and more recently with Xeris Biopharma (XERS) for subcutaneous delivery of a low volume, high concentration version of Tepezza.

What Amgen is getting

I wrote extensively about Horizon over the years, including a very detailed and very bullish article in late August in which I outlined the reasons why I believe Horizon is one of the best investment opportunities in biotech. The stock was trading at around $59 per share at the time.

I continue to believe Horizon is worth at least $152 per share, and up to $189 per share, but I am acknowledging the difficult market conditions and a depressed valuation prior to the buyout negotiations as reasons for the buyout price not reaching those levels. And the significantly expanded pipeline did not receive any credit in that valuation range and it had the potential to significantly increase shareholder value in the following years.

Horizon generated approximately $1.4 billion in non-GAAP operating cash flow in the last four quarters and this number should increase in the following quarters. Amgen also expects to generate approximately $500 million in annual cost synergies. It looks like Amgen is getting Horizon for approximately 14 times next year’s cash flow, assuming the mentioned synergies and a modest increase in cash flows from Horizon’s base business.

In addition to Tepezza which is the primary reason for the acquisition, Amgen is getting Krystexxa for which Horizon expected to generate more than $1.5 billion in annual peak sales (it has generated $500 million in net sales in the first three quarters of 2022), and Uplizna, which Horizon expected to generate more than $1 billion in annual peak sales in the approved indication NMOSD and two additional indications in late-stage development – generalized myasthenia gravis and IgG4-related disease.

There are also three additional rare disease products Ravicti, Procysbi, and Actimmune, but they are delivering modest growth and Ravicti is going generic in 2025.

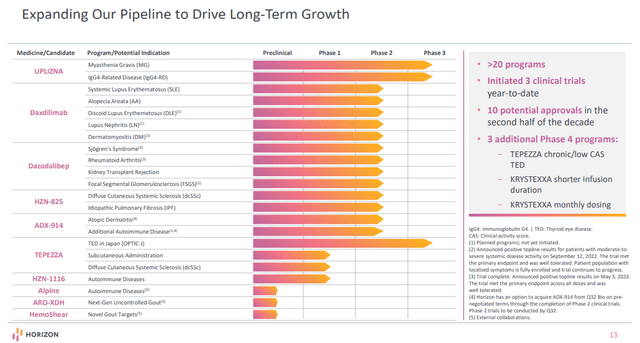

Horizon has worked extensively over the last few years to build a pipeline behind these approved products and I believe it has succeeded with the acquisition of Viela Bio last year and with additional in-licensing deals. Daxdilimab and dazodalibep could address multiple autoimmune conditions, each, HZN-825 is in development for the treatment of idiopathic pulmonary fibrosis and diffuse cutaneous systemic sclerosis, and there are earlier-stage candidates HZN-1116, HZN-467 (formerly ARO-XDH), ADX-914, and additional preclinical programs.

Horizon Therapeutics presentation

Overall, Horizon estimated that the combined annual peak sales potential of the existing product portfolio and the pipeline is more than $10 billion, and I agree. Amgen could end up with annualized cash flows from this acquisition in excess of $4 billion in five to six years, and I believe Horizon is a bargain at an enterprise value of $28.3 billion.

Conclusion

I believe $116.50 per share is a suboptimal exit for Horizon shareholders and that Amgen is getting a great deal. Tepezza is a great growth asset with multiple years of growth in the primary acute TED market, chronic TED market (phase 4 results are expected in Q2 2023), and international expansion, Krystexxa still has a long runway, especially now that is approved for use in combination with methotrexate that improves both the efficacy and safety of Krystexxa, and there is also the very promising pipeline behind these growth products that could supplement Amgen’s growth in the second half of the decade.

The size of the deal may invite some regulatory scrutiny, but there is no real overlap between Horizon’s and Amgen’s assets and I expect the deal to close in a timely manner in the first half of 2023.

Be the first to comment