MarsBars

Asset-light companies provide great diversification to any income portfolio, especially ones that may be heavily concentrated around asset heavy industries such as real estate investment trusts (“REITs”). This brings me to Manulife Financial Corporation (NYSE:MFC), which has posted a negative 2.4% total return since I last visited the stock in August, better than the 7.8% decline in the S&P 500 (SPY) over the same timeframe.

While growth investors may not be content with the performance, a stagnating share price is not all bad for value investors seeking to DRIP dividends at attractive prices. In this article, I highlight why MFC remains a worthy candidate for a high income portfolio.

Why MFC?

Manulife Financial is one of the oldest companies in the world, having been around for 130 years. It is one of the Big 3 life insurance companies in Canada, sitting alongside peers Sun Life (SLF) and Great-West Lifeco (OTCPK:GWLIF). Beyond life insurance, MFC also provides wealth management products and services to individuals and group customers in Canada, the U.S., and Asia.

Notably, Manulife has a growing presence in Asia, which is home to some of the world’s fastest-growing economies. The company has a significant presence in the region, including operations in China, Japan, and Southeast Asia, which provides it with access to a large and growing customer base.

While MFC is demonstrating strong results, it’s clear that business is slowing down amidst a tough macroeconomic backdrop and higher interest rates. This is reflected by global wealth and asset management net inflows of C$3 billion during the third quarter, as compared to C$9.8 billion during the prior year period.

Core earnings also fell by 14% YoY on a constant currency basis, but that was due to a C$256 million charge to MCF’s Property & Casualty reinsurance business due to Hurricane Ian, the costliest hurricane on record to hit Canada in late September. Despite this one-time event, MFC’s operating fundamentals remain strong, generating a core return on equity of 10.3%, and general expenses were in line with last year.

Also encouraging, MFC’s management is shareholder friendly, executing on C$1.4 billion worth of share buybacks during the first nine months of the year, equating to 3.1% of the outstanding float. It also maintains a strong A-rated balance sheet with a LICAT ratio of 136%, sitting well above the 90% regulatory requirement.

Looking forward, MFC’s wealth management business could see benefits from accelerated onboarding of agents as well as simplified ways to connect with clients. These highlights were outlined by management during the recent conference call:

In the U.S., while automating the background check process, we reduced the amount of time to onboard producers within our traditional brokerage channel by 92%. And in Global WAM, we made a number of enhancements to our digital platform in Retirement, including rolling out functionality that enables members in Canada to book one-on-one meetings with a Manulife PlanRight financial advisor directly in the mobile app. We saw successful engagement in the third quarter with approximately 1,400 advisors meetings requested.

Meanwhile, MFC appears to be a solid choice for income investors, as it currently yields 5.7%, and the dividend comes with a safe 39% payout ratio. MFC also has 9 years of dividend growth under its belt and has a 5-year dividend CAGR of 10%.

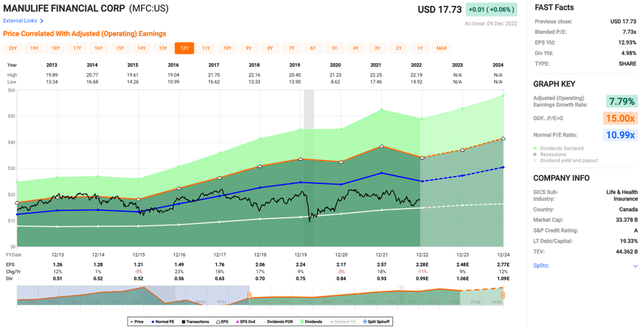

MFC also appears to be attractively valued at the current price of $17.73 with a forward P/E of 7.8, sitting well below its normal P/E of 11 over the past decade.

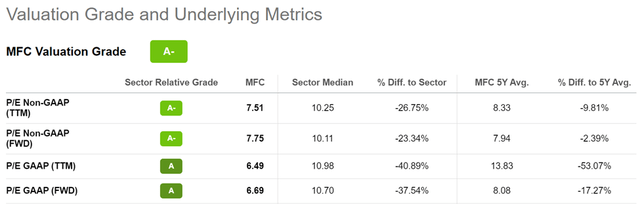

As shown below, MFC carries a valuation grade of A-, with a P/E that sits well below that of the sector median. Analysts estimate 6% annual EPS growth over the next 2 years, and have a consensus Buy rating with an average price target of $22.87.

MFC Valuation Grade (Seeking Alpha)

Investor Takeaway

Overall, Manulife Financial Corporation seems to be a solid choice for income seekers. MFC has a long operating history and exposure to emerging markets, which could provide it with tailwinds over the long term. While a global economic slowdown would undoubtedly impact the underlying business, many of these factors already appear to be baked into the low valuation. Lastly, its current yield of 5.7%, dividend growth track record, and attractive valuation make Manulife Financial Corporation appealing for potentially strong total returns over the long run.

Be the first to comment