Bernard Bialorucki/iStock Editorial via Getty Images

WeWork’s (NYSE:WE) occupancy rate dropped precipitously during the early days of the pandemic years, as stay-at-home orders kept people in their houses. The rise of WFH would then become a pertinent argument by bears, prophesying the end of all things that did not involve the internet. Hence, all notions that the pandemic would lead to permanent demand destruction went out the window when WeWork’s fiscal 2022 second quarter earnings showed occupancy returning back to pre-pandemic levels. The percentage of total desks that were rented out had only just hit a low point of 46% during the worst of the pandemic.

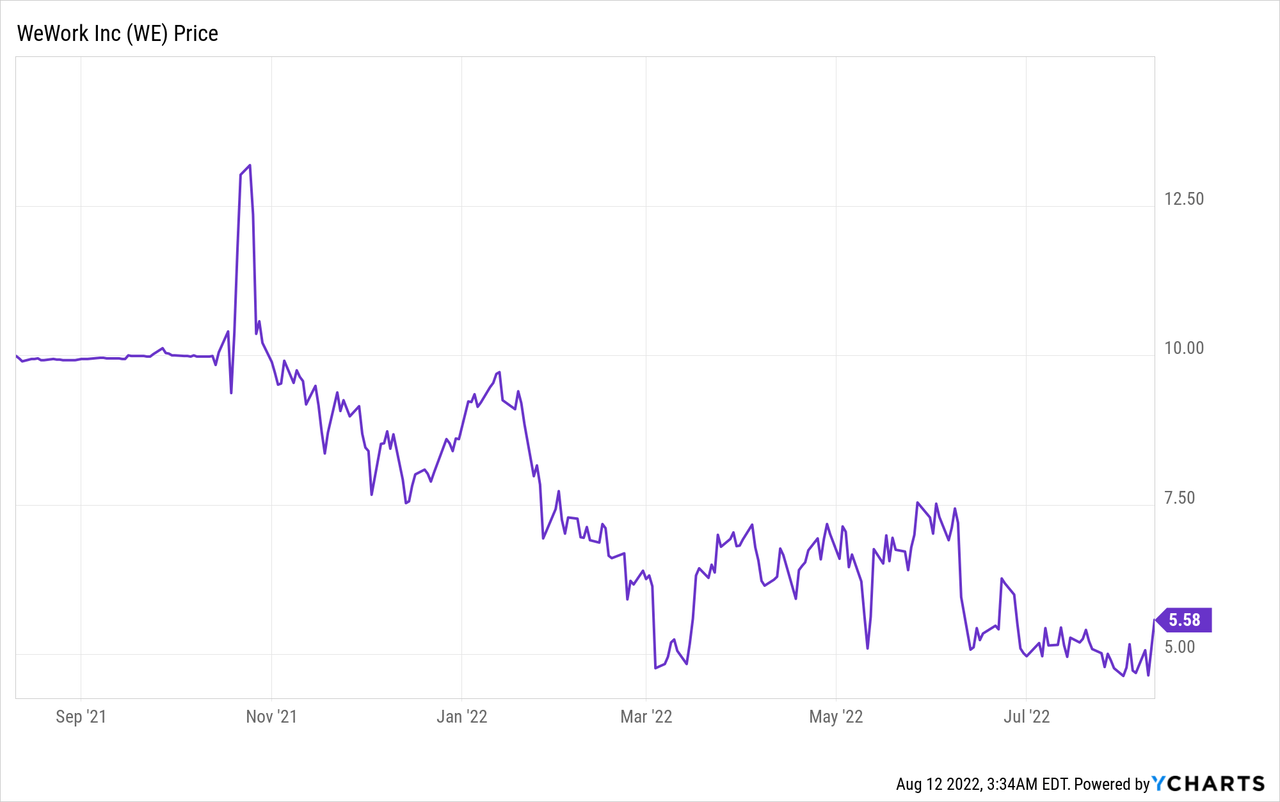

WeWork rightly pivoted to enterprise clients who were swapping long-term office leases for more short-term flexible working arrangements. The pandemic is now in the rearview mirror as the company attempts to improve profitability on the back of occupancy that has recovered. This might provide some solace for bulls who have seen WeWork’s share price decline to newer lows over the last nine months as rising inflation, a weakening economy, and a hawkish FED drove investors away from riskier growth stocks.

With its common shares currently changing hands at $5.58, the market cap of $4.07 billion is a long way away from the SoftBank-derived $47 billion valuation WeWork held when it was still private. The company faces somewhat of a bright future as large companies begin to divest fixed leases on emptying office space for more flexible working arrangements. WeWork offers these companies a distinct cost-saving package with the replacement of expensive corporate headquarters with beautifully designed workspaces in prime locations that their staff can access at any time.

UK-based Curry’s, one of the largest electronic retailers in the country, just abandoned its HQ in favour of WeWork’s coworking spaces. As more of these pre-pandemic office leases come up for renewal around WeWork’s core geographical markets, more businesses are likely going to assess the implications of renewal against the newer, more agile and creative workplace strategy being demanded by employees. The Curry’s deal is one of the first times a large company has wholly abandoned its HQ for WeWork in the UK and likely won’t be the last.

Strong Occupancy Led Revenue Growth As Losses Improve

WeWork’s reported earnings for its fiscal 2022 second quarter saw revenue come in at $815 million, a 37.4% year-over-year increase but a miss of $9.31 million on consensus estimates. Net loss at $635 million was a 31% improvement from the year-ago quarter and included around $391 million in non-cash expenses. Further, EBITDA at negative $134 million, was a $315 million improvement from the comparable year-ago period and was within the company’s guidance.

The company’s systemwide real estate portfolio now consists of 777 locations across 38 countries. This supports 917,000 desks and 658,000 physical memberships and was at an improved 72% occupancy during the quarter. Memberships also grew by 5% sequentially over the last quarter and 33% year-over-year. It’s important to note that while occupancy has improved, revenue is still below its pre-pandemic peak.

WeWork’s management has described the company as a Space-as-a-Service play, putting the growing number of All Access memberships into focus. This grew to 62,000 subscriptions for a $180 million to $190 million annual run rate.

WeWork’s total access to liquidity, which includes cash and unused debt capacity, stood at $1.7 billion at the end of the quarter. The company’s total cash burn during the quarter was just under $300 million against a cash component of its liquidity position that stood at $625 million. At the current rate of burn, WeWork’s cash position will be exhausted within two quarters and the company will begin to lean heavily on debt to remain a going concern. This will put pressure on a balance sheet already strained by $3.2 billion in long-term debt.

The company also reaffirmed its fiscal 2022 revenue guidance of $3.4 billion to $3.5 billion versus a consensus of $3.44 billion. Adjusted EBITDA is expected to be negative at between $400 million to $475 million.

An Unsurprising Revival

WeWork’s post-pandemic revival is not surprising to bulls who could see remote working as being a tailwind rather than a headwind to a flexible workplace company. Hence, WeWork is set to ride the hybrid working wave to newer revenue highs as some workplaces move away from their old normal.

The greater focus on enterprise clients has paid off and WeWork now faces a long journey to improve profitability as sustained demand for flexible working looks set to become the new normal. Whilst WeWork’s current status as a deeply unprofitable public company on the path to a dilutive equity raise to shore up a declining cash position looks lamentable, the company’s future from a demand perspective is bright. I’d keep the shares on a watchlist until underlying momentum with profitability can be ascertained.

Be the first to comment