PeopleImages/iStock via Getty Images

Westrock Coffee (NASDAQ:WEST) is a company focused on providing coffee, tea, and extracts to large customers such as restaurant chains, retail, gas stations, and foodservice.

The company has two primary lines of business today. The first is producing coffee and tea for its customers. The firm is fully integrated; it buys coffee direct from farmers in places such as Rwanda and then roasts and packages the beans itself. The company also has a flavorings, extracts, and ingredients business which provides concentrates to go into things such as cold coffee drinks, milkshakes, ice cream, sauces, and so on.

The company recently came public via a merger with Riverview Acquisition Corp. SPACs have been a dreadfully performing group of stocks in 2022. It’d be easy to dismiss Westrock out of hand due to being a SPAC. However, I’d argue that Westrock is one of the rare few SPACs that deserves a second look.

Things I Like About The Business

Westrock is run by CEO Scott Ford. Ford was previously CEO of telecom company Alltel from 2002 on until 2007 when it was sold to private equity and then flipped to Verizon (VZ) for $28 billion. During his tenure, Alltel was known for making smart acquisitions at reasonable prices and turning a seemingly disparate collection of holdings into a greater whole that Verizon was willing to pay up for.

Ford launched Westrock with operations buying coffee directly from farmers in Rwanda in 2009. Over the years, it has expanded both organically and through M&A, going into roasting, packaging, coffee sourcing in other countries, and so on. Recent key additions have been to launch manufacturing in Malaysia and the opening of a new U.S. roasting to ready-to-drink packaging facility.

I find the business model intriguing because it solves a key concern for its customers. Large restaurants franchises, convenience store chains and the like don’t want to waste a lot of time and energy shopping for their coffee, tea, and ready-to-drink products. A service provider that can deliver a good product at a reasonable price across the whole category is going to make life much easier. As Westrock controls the entire supply chain up to the end customer, it makes for an easy experience for its clients:

Westrock’s integration (Corporate presentation)

This is so much the case that some of Westrock’s U.S. customers have been clamoring for the company to begin selling its products internationally as well; this led to the launch of the Malaysia plant, and the company has plans for other international markets as well.

According to Ford, the company’s total addressable market is well into the tens of billions of dollars and the company is only at $960 million of annual revenues today. This gives it plenty of room to grow, both organically and via M&A, in coming years. The international expansion plans seem particularly compelling.

Also, younger consumers’ preference for cold coffee drinks is a plus, as Westrock is a leader in producing the extracts and flavors that make these cold beverages tasty. Over time, Westrock plans to go into more packaging formats which will extend its reach in this area as well.

My Concern: Low Gross Profit Margins

The one thing that is really holding me back from getting too excited is due to the relatively low gross profit that it earns on its sales:

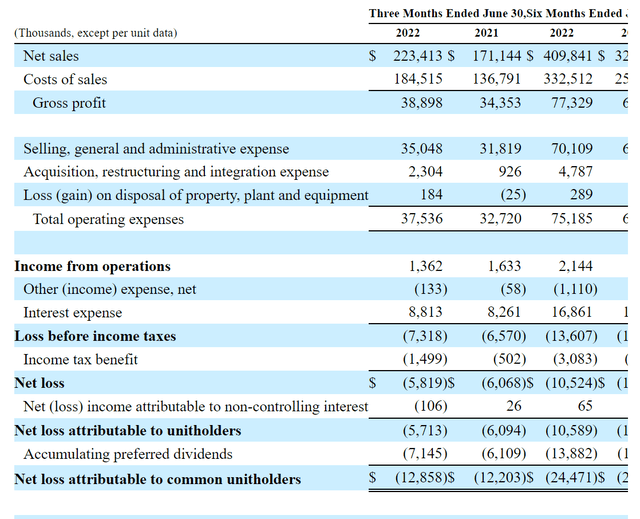

Income statement (WEST 10-Q)

As you can see, the company only earned $39 million of gross profit on $223 million of sales in Q2 of this year, which works out to a 17% gross margin. This was down from last year, when the company’s gross margin was closer to 20%.

Typically, I think of packaged foods companies as earning gross margins in the high 20s to mid-30s range rather than struggling to break 20%. As you can see, with Westrock’s current gross margin, the company barely covers its SG&A costs, and it lost money outright after factoring in other expenses such as interest.

Ultimately, I expect the company’s margin should rise over time as it gains more scale and continues to add additional markets and manufacturing capacity. This doesn’t seem like a business that should have to be stuck with perpetually low margins. However, it is something to watch. Perhaps there is something with the way the company sources coffee directly that causes it to earn less than we might anticipate. It’s also hard to pencil out how much of the current profitability issue might be due to inflation and other temporary macroeconomic factors that we’re seeing at the moment.

There is no publicly traded company that is equivalent to Westrock. You can value pieces of the business based on peers that engage in that one segment, but the idea of doing everything in house from import/export through roasting and packaging and then selling to end customers is a distinct business model.

As such, we’re somewhat flying blind here in terms of guessing where the company’s long-term unit economics will settle out. I’m inclined to give the company the benefit of the doubt. However, it’d be much easier to make a firm investment decision after seeing another two or three years of operating results.

WEST Stock Verdict

“We’re a very normal business that happens to be in a transition state.” – Westrock CEO Scott Ford, from this excellent interview.

In that interview, Ford described the company’s decision to go public via a SPAC. The company was able to complete the SPAC within a few months — which is far from usual in the current operating environment — in part because it is already a large company with clearly demonstrated commercial prospects and strong revenues. However, Westrock’s financials are currently in flux given its rapid expansion efforts. This, in Ford’s view, made a SPAC a good method of going public. Cash now gives the company more flexibility to keep expanding while also being able to address its existing debt.

Will WEST stock be punished for using a SPAC to go public? As Ford himself commented in the interview, “everything that goes through a de-SPAC is crazy for six months or so,” and that’s how I see it as well. This is a complex business with a bunch of moving parts. There’s no one direct peer to it listed today. It will take investors time to come to understand the business and get a handle on where operating results will be in a steady state.

On top of that, the business is not earning today what it can presumably earn in the future once new manufacturing capacity is built out and the company has the capacity to deliver on potentially lucrative growth opportunities.

Based on the company’s financial results in 2022, I don’t see this as an especially compelling price to buy WEST stock. However, Ford did great work with Alltel. And I believe the M&A vision that Ford has outlined for the coffee industry is sensible and has a reasonable shot at success.

Given the brutal market for SPACs, there doesn’t appear to be much reason to rush to buy WEST stock right at the $10 SPAC price. That’s doubly the case given the broader bear market we find ourselves in today. However, this is one I’ve added to my watchlist, and would definitely revisit if shares trade down toward $7 or $8 in coming months.

Be the first to comment