martinrlee

The global payments market is dominated by the latest hot tech apps and remittance services. With the continued development of the blockchain and digital assets, old ways of moving money would seem to be going the way of the dodo bird. Earlier this year, a major money services company slashed its full-year outlook in its Q2 earnings report, in part due to exposure to Russia. Investors will look for more details from Western Union (NYSE:NYSE:WU) at its October 20 analyst day. Meanwhile, its holders have endured tough losses this year but are at least paid to wait.

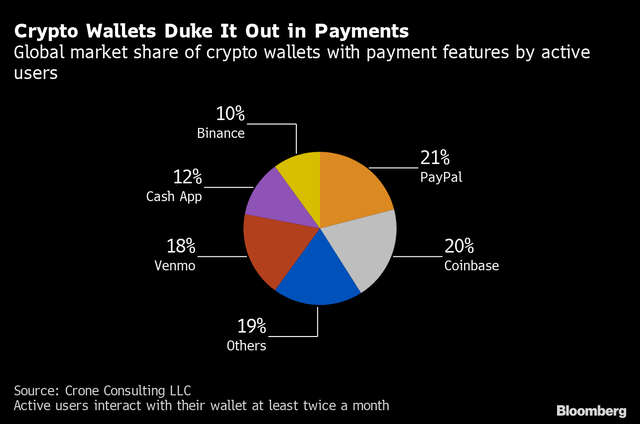

Big Payments Competition From Crypto & Apps

According to Bank of America (BAC) Global Research, The Western Union Company is a leading provider of global money transfer services, with a network of more than 500,000 agent locations in over 200 countries and territories. Western Union primarily caters to unbanked and underbanked consumers around the globe. Western Union has expanded its presence in the B2B global payments business with the acquisitions of Travelex Global Business Payments and Custom House.

The Colorado-based $5.8 billion market cap IT Services industry company within the Information Technology sector trades at a low 6.9 trailing 12-month GAAP P/E ratio and pays a high 6.1% dividend yield, according to The Wall Street Journal. I noticed the stock has an elevated 8.5% short float percentage, so the stock could jump on unexpected positive news.

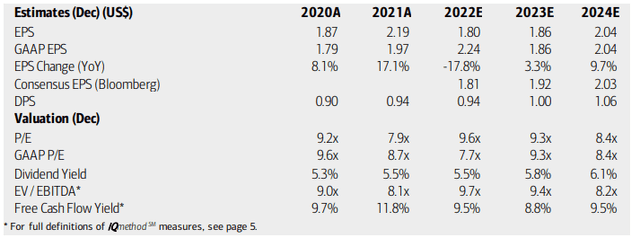

On earnings and valuation, EPS is seen as falling sharply this year after a jump in 2021. Next year’s and 2024’s EPS growth is decent, and the dividend is seen as increasing. The EV/EBITDA multiple is elevated given uncertain earnings consistency over the coming years. Still, WU generates solid free cash flow and the forecast operating P/E is attractive. Overall, the company has a lot to prove to regain its earnings traction under a new CEO amid an environment with so many other digital remittance providers, but much of that appears baked into the stock price.

WU Earnings, Valuation, and Dividend Forecast

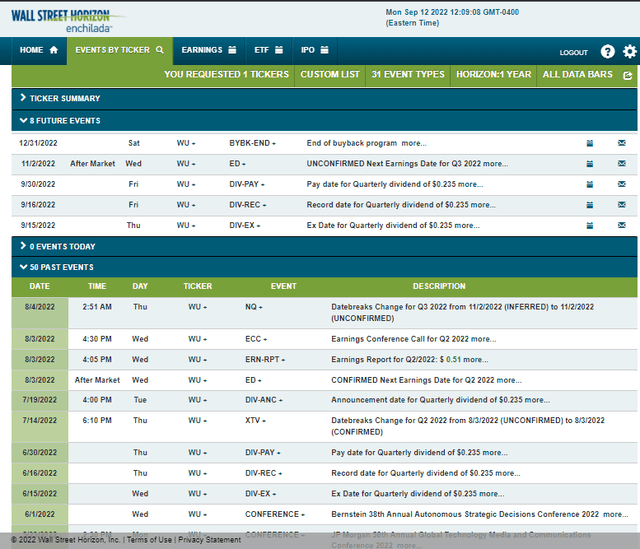

Western Union’s corporate event calendar shows an upcoming dividend ex-date of Thursday, September 15. After that, Wall Street Horizon’s data show an unconfirmed Q3 2022 earnings date of Wednesday, November 2 after market close. The company’s buyback program is also slated to finish at the end of 2022.

Corporate Event Calendar

The Technical Take

While WU’s valuation and yield look good to me, the chart recently had a bearish break below the $16 to $16.50 range. Until it climbs back above that key level, which dates back to 2016, investors should stay away. Moreover, there is significant overhead supply in the upper teens to low $20s that might be tough to get through. The technical picture suggests that risks are skewed bearish.

WU Technicals: Shares Fall Below Key Support

The Bottom Line

Long-term investors can probably dip their toes into Western Union here now that so much negativity has been discounted into the stock price following a 43% drop off its 2021 high. The problem is the bearish trend and technical chart. The stock price might just move sideways from here, but the upshot is that holders can collect a big yield. Given good free cash flow, that yield should be safe for now.

Be the first to comment