vzphotos

We reaffirm our earlier sell rating on Western Digital Corporation (NASDAQ:WDC). Our bear thesis is based on our belief that the company does not present a favorable risk-reward profile. WDC is a storage company. The company juggles the two main segments of storage: Hard Disk Drives (HDDs) and Solid State Drives (SSDs). Both segments are in decline due to weakening consumer spending.

We believe demand dynamics do not favor the storage sector and won’t be for a while. We believe the weakened consumer spending is spilling over to cloud segments. The company’s 2Q22 already reported an 8% year-on-year decline. We believe WDC’s stock will pull back further before it rebounds and recommend investors sell now, and we wait for the demand dynamics to stabilize.

Weakening consumer spending has dried up SSD demand

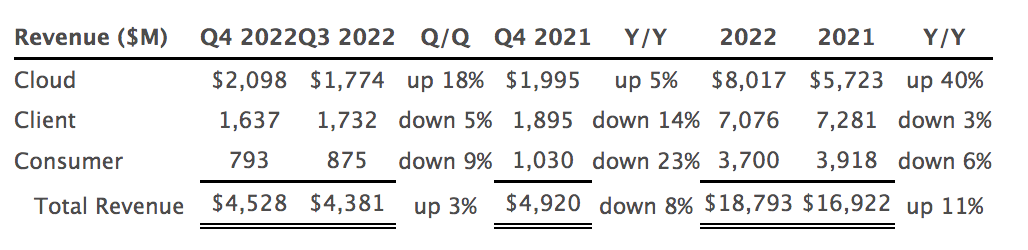

WDC operates in HDD and SSD market segments – both negatively impacted by the declining demand for PCs and smartphones. HDDs are traditional storage devices for large-capacity data storage. Previous to SSDs, HDDs were used in data storage in PCs, gaming devices, iPods, and servers. Now HDDs are utilized more for large-capacity storage, mainly in data centers and the Cloud. SSDs use newer technology that stores data for instant accessibility of data . SSDs are taking over the market for PC and smartphone data storage. The client (PCs) end market makes up 36% of total revenue, while Consumer represents 18%. We are worried about WDC because weakening consumer spending is drying up SSD and HDD demand for PC Clients and consumer segments. The Client segment is down 14% year-on-year, while the Consumer is down 23%. The following chart from 4Q22 earnings shows end market revenue trends.

WDC

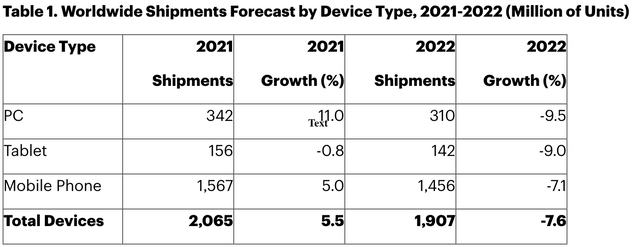

We attribute the decline in WDC business to weakening consumer spending. According to Counterpoint, the “global smartphone market declined by 9% YoY and 10% QoQ to 295 million units in Q2 2022.” The same downward trends are visible in PC shipments. The global PC market has declined 12.6%, according to Gartner. The following graph from Gartner outlines the forecast calling for a decline in PC and smartphone shipments.

Gartner

There is no clear end in sight for the weakening consumer spending brought on by geopolitical tensions, inflationary pressures, and supply chain issues. In turn, we believe WDC will continue to see weak demand in these markets, and we continue to be sell-rated on the stock for these reasons.

Weakening consumer spending is spilling into Cloud, too

In 4Q22, WDC reported 46% of its revenue from its cloud segment. Cloud is not directly exposed to sluggish consumer demand but is still affected by it. In the Cloud, companies store massive amounts of data, mainly on HDDs. As consumer demand for new devices weakens, investments into Cloud infrastructure also slow, impacting demand for HDDs. Our continued sell-rating on the stock is because we believe weakening consumer spending is now spilling into the cloud segment. Weak demand for PCs and smartphones will likely lower cloud demand coming forth. We believe WDC will continue to experience demand headwinds and recommend selling the stock.

Valuation

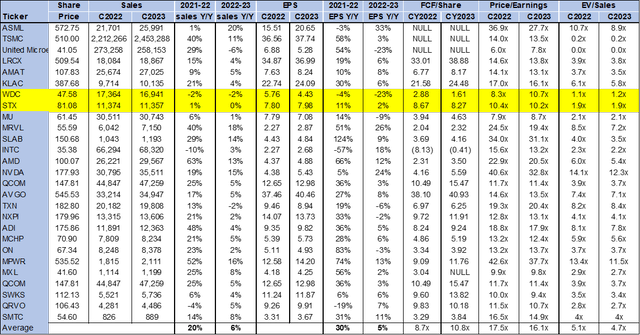

WDC is trading cheaply at 10.7x C2023 on a P/E basis EPS $4.43 compared to the peer group average at around 16x. On EV/sales, WDC is trading at around 1.2x C2023 compared to the group average at around 4.7x. While the stock is trading cheaply, we still do not believe it is an attractive buy. Instead, we believe the valuation gap to peer groups is unlikely to change materially due to the current structural headwinds in the storage industry.

The following chart illustrates WDC’s peer group valuation.

Refinitiv

Word on wall street

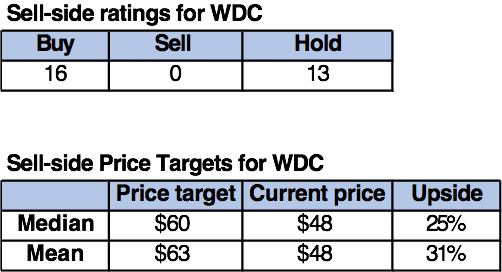

Of the 29 analysts covering the stock, 16 are buy-rated, and the remaining are hold-rated. WDC is currently trading at $48. The median price target is $60, and the mean price target is $63, with a potential 25-31% upside.

The following chart illustrates sell-side ratings and price targets for WDC.

Refinitiv & Techstockpros

What to do with the stock

We are bearish on WDC and expect the stock to remain under pressure in the near term. We see no significant growth catalysts for WDC in the near term and instead see demand headwinds on both HDD and flash fronts. We recommend investors sell the stock before it dips further.

Be the first to comment