Philiphotographer

WTI oil prices are back below $90/barrel. While prices are still historically high, they’re still 25% below peak prices of roughly $120/barrel hit earlier in the year. That weakness has translated to oil prices. The Vanguard Energy ETF (VDE) is down more than 20% from its peak. That has muted the recovery and, as we’ll see throughout this article, opened new opportunities.

There are 3 stocks we recommend taking advantage of at this time.

Exxon Mobil

Exxon Mobil (NYSE:XOM) is the largest oil company in the world, with a market capitalization of more than $350 billion.

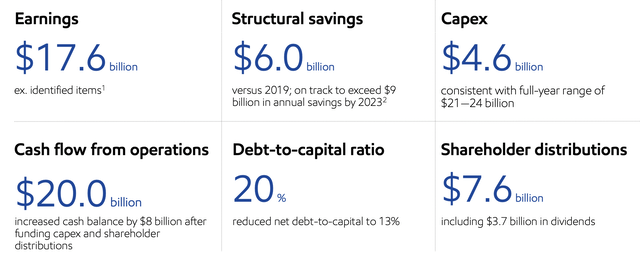

ExxonMobil Investor Presentation

The company was spending $10s of billions during the downturn, and that cash spending is now starting to pan out. The company is still spending more than $20 billion annualized and has been spending substantial amounts on shareholder distributions. The company earned a massive $15 billion in FCF for the quarter.

That puts the company square at an almost 20% FCF yield. The company has an almost 4% dividend yield and a roughly 5% share buyback yield, driving direct high single-digit shareholder returns. The company’s recent weakness has put it almost 15% below its 52-week high, representing a strong investment time as its yield drops below 4%.

Hess Corporation

Hess Corporation (NYSE:HES) has a unique portfolio of assets and it’s undergoing massive growth.

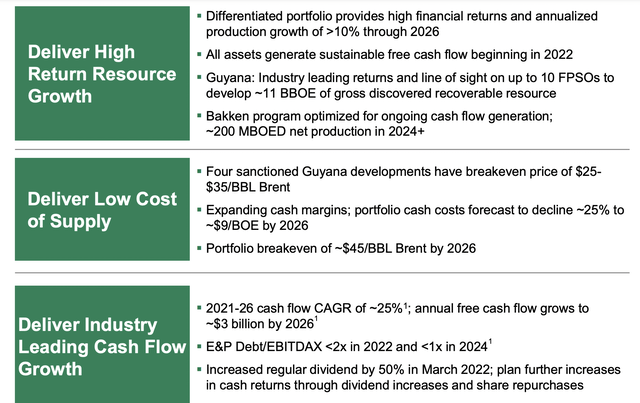

Hess Corporation Investor Presentation

The company is focused on ramping up production from its impressive Guyana assets. It expects production growth of >10% through 2026 and $3 billion in FCF by 2026. That’s at $65/barrel, showing that the company has significantly more cash flow potential versus current levels. The company is consistently discounted because of its minimal current FCF, but we expect that to grow.

The company expects annual FCF to grow 25% annualized. The company recently increased its regular dividend by 50% and we expect that to continue growing with additional buybacks. The lower current cash flow means the company’s stock has fallen further (~20%) meaning now is an opportune time to invest for the long run.

Energy Transfer

Energy Transfer (NYSE:ET) has strong direct shareholder returns with additional potential on top of that.

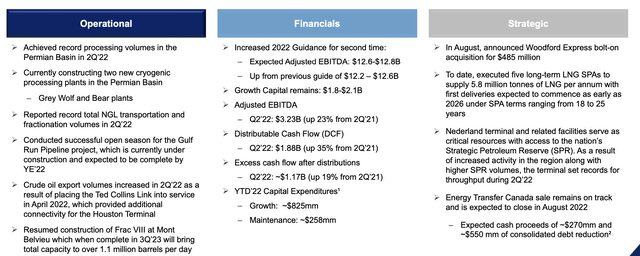

Energy Transfer Investor Presentation

The company’s core strength starts with its 8.5% dividend yield. That by itself helps justify a substantial part of the company’s valuation into a retirement portfolio. However, the company’s distributions are less than 50% of its DCF. The company still has plenty of cash leftover for a variety of uses and debt it can comfortably afford.

The company is continuing to invest heavily in growth, but we’d like to see it expand other shareholder rewards. Regardless of how the company spends money, we expect it to pan out well. The company is now almost 10% below its 52-week highs, representing a strong entry point and a boost in the company’s yield.

Our View

We do not expect oil prices to return to $120 / barrel and stay at that level forever; however, we do think that prices will remain elevated for the long run. Companies are keeping capital investing low and instead focusing on strong shareholder returns. More so during the price collapse, many companies got their breakeven prices down towards $30-40 / barrel counting dividends.

That means that the companies are incredibly profitable at a variety of prices. At high double-digit prices/barrel, these companies can all generate double-digit shareholder yields and generate yields from a variety of other sources. We see all of these investments as valuable components to any retirement portfolio for the long run.

Thesis Risk

The largest risk to our thesis is crude oil prices. The companies we’ve discussed above have the ability to generate double-digit returns at current oil prices and have their shareholder rewards predicted at $50 or less per barrel. However, just under three years ago, prices were negative. That could happen again, significantly hurting shareholder rewards.

Conclusion

The weakness in the oil markets represents opportunity. Prices that were on their path to recovery have seen those recoveries reverse despite their double-digit FCF yield even at current prices. We see that as a valuable opportunity to invest in the long run for retirement, building up a portfolio of valuable long-term investments.

Hess Corporation, Exxon Mobil, and Energy Transfer all generate near high-single digit direct shareholder rewards, with continued growth investments. Hess Corporation especially is focused on massive growth, which will pay-off, and they each have numerous levers to pull for shareholder returns, making them all valuable investments.

Be the first to comment