sb2010

When you think of packaging, you might think of general packaging goods for food, drinks, various consumer goods, or something like that. But it’s also true that packaging dedicated toward niche products is also in demand. A great example of this can be seen by looking at the healthcare space. The production of integrated containment and delivery systems that are used for injectable drugs and other health care products is necessary in order for the medical space to properly operate. And one firm dedicated to providing these types of offerings is West Pharmaceutical Services (NYSE:WST). Recently, shares of the enterprise have dropped significantly, driven by high trading multiples and a downward revision in expectations for the 2022 fiscal year. Even though shares have tumbled quite a bit, I do not think that they are yet worthy of a ‘buy’ rating. This does not mean that I don’t think the company is a quality operator. I do think it is a truly solid business with a bright future. However, shares are still rather lofty and the downward revision in expectations weakens the bullish argument to some degree. Given these considerations, I’ve decided to keep my ‘hold’ rating on the company, reflecting my belief that it’s likely to generate returns that are more or less in line with what the broader market should achieve for the foreseeable future.

A dose of pain

Back in early July of this year, I wrote an article that took a rather neutral stance on West Pharmaceutical Services. I lauded the company’s performance in the prior few years. I also said that its future looks bright and that it would likely to fare well for its investors in the years to come. However, I also couldn’t get past the fact that shares looked quite pricey at that moment. And as a result, I ended up rating the firm a ‘hold’. Since then, the company has performed worse than I anticipated. While the S&P 500 is down by 6.4%, shares of West Pharmaceutical Services have dropped by 20%.

Given this massive return disparity, you might think that there was some fundamental reason for this pain. But based on my assessment, that is not the case. To see what I mean, we need only look at data covering the second quarter of the company’s 2022 fiscal year. This is the only quarter for which data was not available when I last wrote about the company but is available today. Sales during that quarter came in quite strong at $771.3 million. That’s 6.6% higher than the $723.6 million the firm generated the same quarter one year earlier. To be clear, the increase in sales does hide some significant weakness that the company experienced. For instance, the Contract-Manufactured Products category of the company saw revenue plunge by 13.6%, with organic revenue down by 8.9%. The as-reported sales decline can be chalked up to foreign currency fluctuations. Management said that a decline of sales of components for diagnostic devices more than offset sales price increases. At the same time, revenue associated with the Proprietary Products segment of the business jumped by 11.3%, with organic revenue coming in stronger at 18.3%. Like the Contract-Manufactured Products unit, Proprietary Products was negatively impacted by foreign currency fluctuations. Growth in the company’s high-value product offerings really helped to push sales higher.

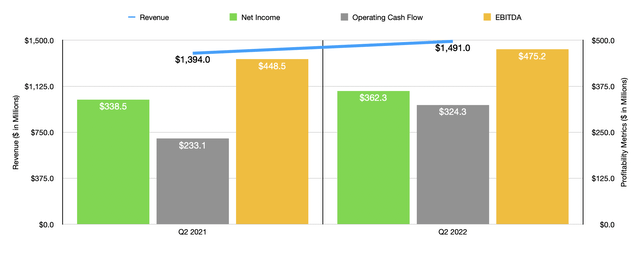

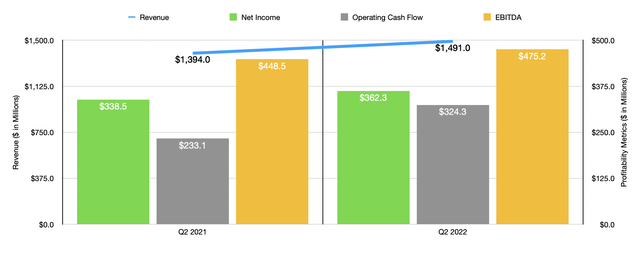

This rise in revenue brought with it an increase in profits and cash flows. During the quarter, net income came in at $188.5 million. That’s marginally higher than the $187.3 million in profits generated the same quarter one year earlier. Inflationary pressures were responsible for pushing the company’s gross profit margin down from 43.5% to 41.7%. The company also suffered from higher income tax expenses. This is not to say that everything was bad on the bottom line though. For instance, selling, general, and administrative costs, dropped from 12.8% of revenue to 10.6%. Even though net income rose only modestly, other profitability metrics came in far stronger. Operating cash flow rose from $144.4 million in the second quarter of the 2021 fiscal year to $173.1 million the same time this year. Meanwhile, EBITDA rose from $238.9 million to $256.3 million.

As the chart above illustrates, this increase in revenue and rise in profits was also important when it came to total results covering the first half of the 2022 fiscal year relative to the same time one year earlier. Revenue, profits, and cash flows are all higher year over year due to the strength across both quarters. But when it comes to the 2022 fiscal year as a whole, management has had some bad news. At present, the company is forecasting revenue of between $2.950 billion and $2.975 billion. This is actually down from the prior expected range of between $3.05 billion and $3.075 billion. Even with this downward revision, management says that organic revenue should be up 11% year over year. What’s really remarkable is that this increase is slated to occur even as COVID-related sales are forecasted to drop by about 20%, or $85 million in all. The sales increase is also coming in spite of the fact that the company is now forecasting $190 million worth of headwinds caused by foreign currency fluctuations. That compares to the prior expected figure provided of $115 million.

On the bottom line, the firm is forecasting earnings per share of between $9 and $9.15. This is also down from the $9.30 to $9.45 previously forecast. Part of this is due to increased foreign currency pain. The company is forecasting $0.55 per share in pain associated with foreign currency fluctuations this year. Previously, that forecast called for pain of $0.38 per share. Using midpoint expectations, the earnings per share guidance should translate to net income of $710.6 million. No guidance was given when it came to other profitability metrics. Using performance figures so far for this year, I forecasted operating cash flow of around $627.1 million and EBITDA of $951.7 million for 2022 as a whole.

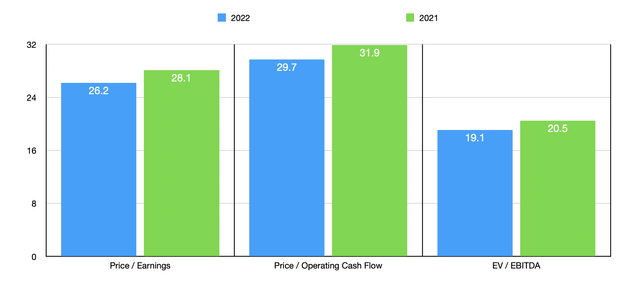

Given these figures, we can calculate that the company is trading at a forward price to earnings multiple of 26.2 and at a forward price to adjusted operating cash flow multiple of 29.7. Significantly lower than either of these though is the EV to EBITDA multiple, coming in at 19.1. In addition to EBITDA just being higher than the other metrics, we also are benefiting from the fact that the company has cash in excess of debt of $466.5 million. To put the pricing of the company into perspective, it’s worth noting that shares are cheaper than if we used data from the 2021 fiscal year. Those multiples would be 28.1, 31.9, and 20.5, respectively. As part of my analysis, I also compared the firm to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 24.9 to a high of 105. And on an EV to EBITDA basis, the range was from 17.1 to 49.3. In both cases, one of the five companies was cheaper than West Pharmaceutical Services. Meanwhile, using the price to operating cash flow approach, the range was between 16.6 and 43.8. In this scenario, four of the five companies are cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| West Pharmaceutical Services | 28.1 | 31.9 | 20.5 |

| Waters Corp. (WAT) | 33.3 | 30.9 | 24.0 |

| PerkinElmer (PKI) | 24.9 | 16.6 | 17.1 |

| ICON (ICLR) | 105.0 | 25.3 | 49.3 |

| Avantor (AVTR) | 49.0 | 26.5 | 24.8 |

| Mettler-Toledo International (MTD) | 51.7 | 43.8 | 36.7 |

Takeaway

The data provided today tells me that West Pharmaceutical Services is a solid company that would likely continue to fare well in the long run. Having said that, the decline in guidance, combined with its lofty share price, has led me to be somewhat bearish in the short term. I wouldn’t go so far as to rate the company a ‘sell’, because it takes a very high trading multiple to justify rating such a high-quality company that way in my book. But I do think that the company makes for a solid ‘hold’, candidate at this time.

Be the first to comment