PaulGrecaud

Thesis

I believe that West Fraser Timber Co. Ltd. (NYSE:WFG) (TSX:WFG:CA) is a well-managed company that is currently trading at an attractive valuation. The company faces near-term challenges with higher interest rates impacting housing affordability and investment demand. However, chronic underinvestment in the US and Canadian housing stock in the last two decades provides long-term demand for the company’s products.

Background on West Fraser

West Fraser is a Canadian diversified wood products company that produces lumber, engineered wood products (OSB, LVL, MDF, plywood, and particleboard), pulp, newsprint, wood chips, other residuals and renewable energy. The company is based in B.C., Canada and has operations in Canada, Southeastern U.S., the UK and Europe.

What attracts me to West Fraser over their peers is their capital allocation during the recent period of strong earnings.

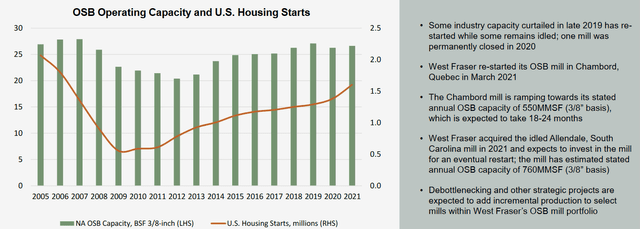

On February 1, 2021 West Fraser acquired Norbord, the world’s largest manufacturer of OSB, for $3,482 million through the issuance of 54.5 million additional common shares. This acquisition significantly changed their earnings mix, reducing their dependence on lumber prices which should reduce their earnings volatility over the long term (slide 3). They have also acquired an OSB mill and a lumber mill in the U.S. South.

Since the acquisition, West Fraser has repurchased 37 million shares, roughly 67% of the shares issued. They have also increased their dividend twice in 2022, from $0.20 per quarter in Q4 2021 to $0.30 per quarter in Q2 2022. They have paid a dividend for the last 32 years during both strong and weak years for the industry.

West Fraser has very little debt and the little that they have is locked in at quite low interest rates, either as fixed rate debt or through an interest rate hedge. They currently have sufficient cash to pay all their debt. This is consistent with their business strategy of maintaining a prudent balance sheet. This low debt level gives them borrowing capacity for future accretive acquisitions using debt, and makes the company a more attractive to me than Weyerhaeuser (WY) with its higher debt.

The company also has a team of senior leaders that have navigated previous cycles with the company. Three of the five named executive officers have over 20 years of experience with the company (page 91), and three of the eleven members of the Board have over 11 years of experience with the company (page 36). This gives me confidence that the company has a team with experience navigating economic downturns.

Ultimately, as a supplier of wood products, the company is exposed to the current market price for their products. I will explore at the market supply and long-term demand for wood in the sections below.

Lumber and OSB Supply

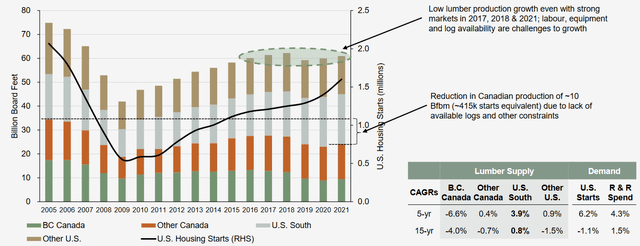

The supply for lumber decreased by roughly 45% between 2005 and 2009 before recovering and since 2016 has been stable.

West Fraser Q2 Earnings Presentation, Slide 28

West Fraser Q2 Earnings Presentation, Slide 30

While billions have been spent on improving production at existing mills and restarting old mills that were idled, there has been little appetite for investing in new mills.

Some forest-products executives said they are considering acquisitions with their fast-accumulating cash. But there aren’t many new mills on the drawing board for North America.

“We are going to be ultra cautious on what we do in those regards,” Canfor Corp. Chief Executive Don Kayne told investors last month when the company reported record quarterly profits. “We don’t mind at all having a little extra cash around for sure, considering what this industry goes through.”

B.C., Canada has also had a significant reduction in lumber supply which is not likely to abate given the current political climate and a reduction in the number of trees allowed to be harvested. This is discussed further in the section outlining risks below. As a result, production capacity and supply will likely increase slowly with improvements at existing facilities, but there are no significant investments in new mills that have been publicly announced.

Long-Term Demand for Wood

I remain bullish on the long-term demand for wood due to chronic underinvestment in the US and Canadian housing stock in the last decade.

Freddie Mac released a research note on May 7th, 2021 that highlighted the growing deficit in the housing stock. Here is an extract from their note, emphasis added by me:

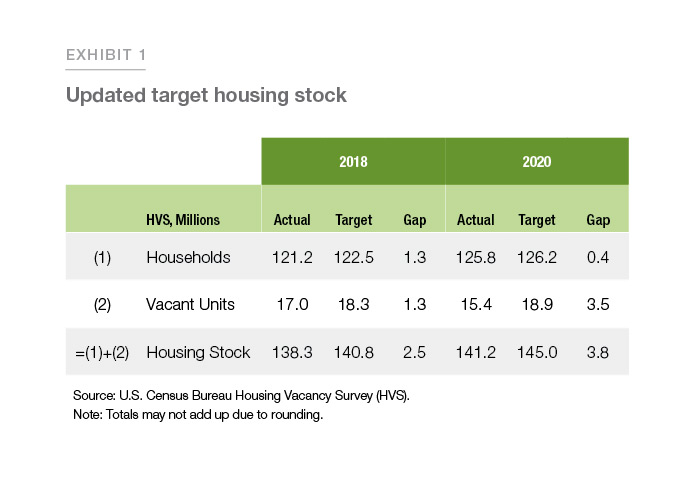

Our analysis estimates the housing shortage not only based on the actual number of households but also considers the latent demand and the number of vacant units. A well-functioning housing market requires some vacant properties for sale and for rent.

Exhibit 1 shows the updated target housing stock numbers. As of the fourth quarter of 2020, the U.S. had a housing supply deficit of 3.8 million units. These 3.8 million units are needed to not only meet the demand from the growing number of households but also to maintain a target vacancy rate of 13%. Between 2018 and 2020, the housing stock deficit increased by approximately 52%.

The main driver of the housing shortfall has been the long-term decline in the construction of single-family homes. That decline has been exacerbated by an even larger decrease in the supply of entry-level single-family homes, or starter homes.

Freddie Mac Freddie Mac

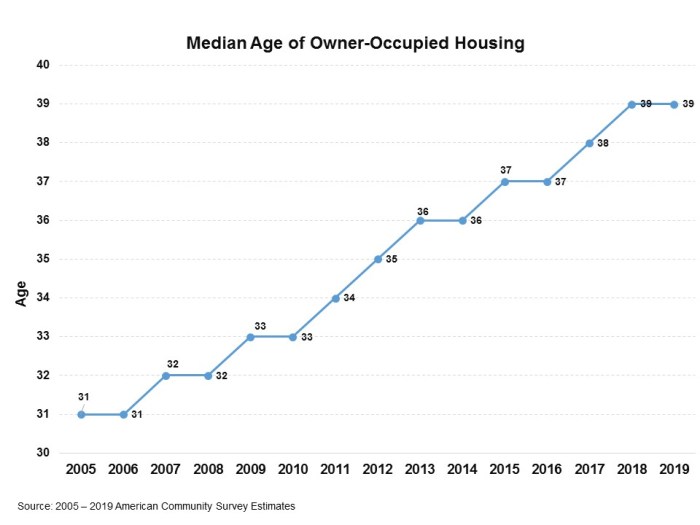

It doesn’t come as a huge surprise then that the median age of the US house has increased from 31 years in 2005 to 39 in 2019, suggesting that further renovations will be required to maintain the existing housing stock or to bring those houses up to current code.

EyeonHousing.org

There may also be an increase in the number of potential uses of wood in the future. In 2015, Ontario changed laws allowing wood frames for up to 6-stories (up from 4-stories). British Columbia made this change in 2009 and had over 50 6-story wood framed buildings in the first 5 years after passing the law. The more jurisdictions that this is applied to creates a further increase in potential demand for wood.

Politically, there have also been a number of policies to promote both demand and investment in the housing sectors of both the US and Canada. This at minimum shows that the governments see a need for investment in the sector, further supporting the case for robust demand.

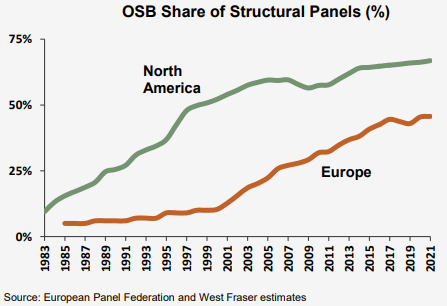

Lastly, West Fraser is expanding into the European OSB market which has a lower penetration rate than North America. If the adoption of OSB in Europe continues its positive trend, this supports an assumption that EU OSB margins should improve with volume etc.

West Fraser Q2 2022 Earnings Presentation, Page 20

Discounted Cash Flow Valuation

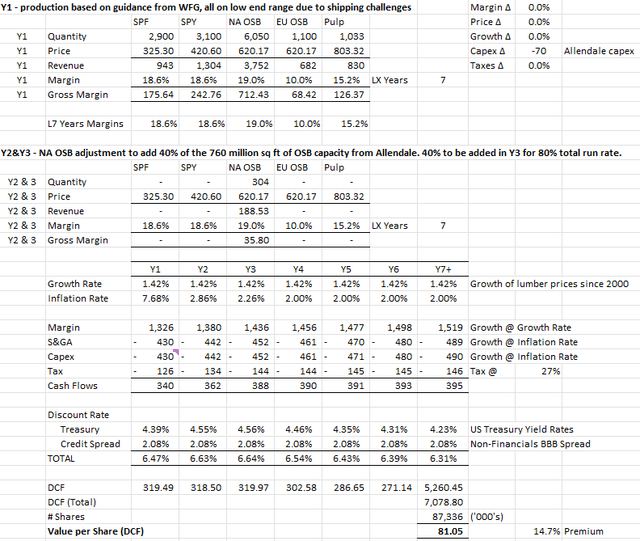

The following is my Discounted Cash Flow model, with my assumptions outlined below:

The assumptions in this model are outlined below. References to the 2022 guidance comes from the Q2 Report, pages 3-4.

Production / Sales Quantity is based on midpoint of the production guidance for 2022 as a projection of long-term production/sales. Y2 and Y3 increase in OSB volume reflect the Allendale plant producing at 40% in Y2 and 80% from Y3+. Sales Price is based on the average price of each product from 2014 to 2019, as disclosed in the company’s previous annual reports. 2020 and 2021 are excluded as the prices reflect the surge in sales prices due to COVID-19 which make them unlikely to represent future sales prices.

Margins are based on the average margins achieved from 2015 to 2018. 2019 to 2021 are excluded: 2019 because margin compression occurred that has since resolved, and 2020 and 2021 as the margins were significantly above long-term trends during COVID-19. EU OSB margin is assumed to be 47% lower than NA as this was their proportionate margin in 2021, but there isn’t much history on this.

Growth rate is based on their growth in production volume from 2012 to 2021. Inflation is based on the projected annual inflation rate in the US from 2022 to 2027.

SG&A expenses are based on 2022 guidance, increasing with inflation. Capital expenditures are based on 2022 guidance, adjusted for $70 million due to the Allendale of expenditures being incurred this year, increasing with inflation. Taxes are based on the 27% statutory tax rate.

Risk free rate and credit spreads are based on relevant duration US Treasury rates and non-Financials BBB spreads as of October 20th.

Some of these assumptions are conservative.

Production/Sales Quantity assumes that they operate at midpoint vs peak capacity in the long term. Using high end volume estimates adds $6.16 to the per share value. If management’s volume estimates for F2022 included a reduction due to transportation challenges then this would further increase production / sales quantity above the model value.

The model assumes that Allendale only ever operates at 80% capacity beyond Y3 due to uncertainty about the maximum potential output of the mill. Using 100% production capacity adds $2.66 to the per share value.

Assumed EU margins are low, but they are expected to invest in that market and expand margins. It was also the first year of operations and so further efficiencies should be expected. Increasing margins from 10% to 11% increases the valuation by $1.12 per share. In addition, purchase price accounting increased the European EWP cost of goods sold by $7 million. Adjusting for the purchase price adjustment adds $0.35 to the valuation.

On August 20, 2021 West Fraser performed a Substantial Issuer Bid to acquire 10.3 million shares at $76.84 USD per share. On April 20, 2022 they performed a second Substantial Issuer Bid to acquire 11.9 million shares at $95.00 USD per share. For the 6 months ended June 30, 2022 they acquired 6.7 million shares at $83.76 USD per share on average under a Normal Course Issuer Bid (page 50). All these data points point to management believing that the share price should be higher than what they’re trading at today, further supporting the model’s valuation.

Risks

As with any discounted cash flow valuation, interest rates have an inverse correlation to the present value of the cash flows. A 1% increase in the interest rates across the curve would reduce the model valuation to $67.00, 5.2% below the current share price.

West Fraser’s business is exposed to a number of risks:

- Interest Rate

- British Columbia Allowable Cut

- Transportation Challenges

Higher interest rates would impact housing affordability and therefore demand for building materials, at least in the short term. I believe the historic underinvestment in the U.S. housing sector would make the recovery faster than previous cycles where there was a surplus in houses.

Management has highlighted that the provincial government in BC, Canada, a region where West Fraser has six lumber mills and two pulp mills, has reduced the number of trees allowed to be harvested. This may reduce the efficiency of West Fraser’s mills. The company has managed this risk by moving capacity from BC to the US South. From 2004 to 2021, West Fraser’s exposure to BC fiber was reduced from 77% to 24% (slide 17).

The company must transport its fiber and finished products from rural areas where the trees are harvested, to populations that demand their product. In Q4 2021, Management highlighted that flooding in BC has also created transportation challenges for the company as railway lines and truck routes had been washed out. This will remain a risk that management is not able to control.

While these risks are present, I believe that, overall, Management has done a good job of reducing exposure to the company, and do not see these risks outweighing the positives outlined previously.

Conclusion:

West Fraser is an attractive company at the current valuation levels. I remain bullish for its long-term potential and the demand for its products.

The Discounted Cash Flow value of the shares is $81.05 using conservative assumptions, with up to $10.29 of additional per share value if slightly more aggressive assumptions are used. As with any Discounted Cash Flow, any future increase in interest rates will reduce the valuation; however, I believe the strengths of the company outweigh the risks.

Be the first to comment