B4LLS/iStock via Getty Images

WCC’s Drivers Are On Solid Ground

WESCO International (NYSE:WCC), which provides distribution, logistics services, and supply chain solutions in the US and internationally, focused on a service fee model at the start of 2022. It benefited from cross-selling synergies through complementary products and services following the Anixter acquisition in 2020, as I discussed in my previous article. Ongoing construction and elevated bidding activity in the non-residential market have helped the company maintain an upward push. The operating margin will benefit from increased operating leverage on higher sales.

Cash flows continued to weaken in 1H 2022, which can jeopardize any necessary balance sheet deleveraging. However, the CSS segment will likely underperform in 2H 2022 because of the price hike’s limited impact and supply chain disruptions. Recently, it has undertaken a $1 billion share repurchase program, which, along with achieving the deleveraging target, would also improve shareholder value. The stock is relatively undervalued compared to its peers. Because the indicators point to a soft landing of the ongoing recession, buying the stock would offer value to the investors at the current level.

Cross-Selling Increases Synergies

WCC’s cross-sell initiatives after the Anixter acquisition denotes a complementary portfolio of products and services between WCC and Anixter and new awards. Recently, it increased the FY2023 sales synergies target by 40% of the last target, to $850 million. Earlier, in Q1, it had increased the target by 42% from the previous target.

The company’s cross-sell initiatives capture demand driven by secular growth. In Q2, it recognized ~$200 million in revenue from cross-selling. The 31% sequential rise in cross-sell denotes a complementary portfolio of products and services between WCC and Anixter. The spectacular rise in cross-sells opportunities reflects three awards, which, put together, would result in $165 million in additional sales value over the next five years.

FY2022 Estimates And Challenges

Based on backlog expansion and the cross-sell revenue growth, its management revised the FY2022 sales growth to a range of 16%-18% from the previous range of 12%-15%. This means the company will outgrow the industry sales by 400 basis points. A price hike would account for the majority of the revenue addition. While demand for WCC’s products, services, and solutions will be steady, it can face challenges from supply chain constraints, input cost inflation, and uncertainties in 2H 2022. Also, the adverse foreign exchange rates can reduce sales by 100 basis points in FY2022.

The company’s Communications & Security Solutions (or CSS) segment will likely underperform in 2H 2022 because the price hike will be less effective in this business. Also, the supply chain disruptions can have a relatively higher impact on this segment. A utility customer will shift from a full revenue model to a service fee model. The transition would also lower sales by 0.5%, although the EBITDA margin will remain unaffected.

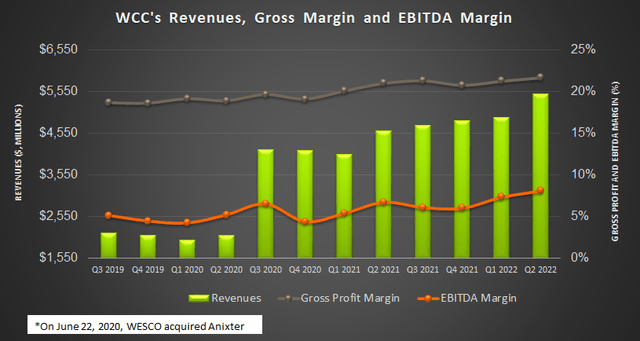

The management also expects to generate 7.8%-8.0% of EBITDA margin, reflecting increased operating leverage on higher sales and a gross margin improvement. Overall, it expects to generate $1.68 billion in EBITDA in FY2022, which is 9% above the previous guidance.

Industry Activities Have Not Crashed

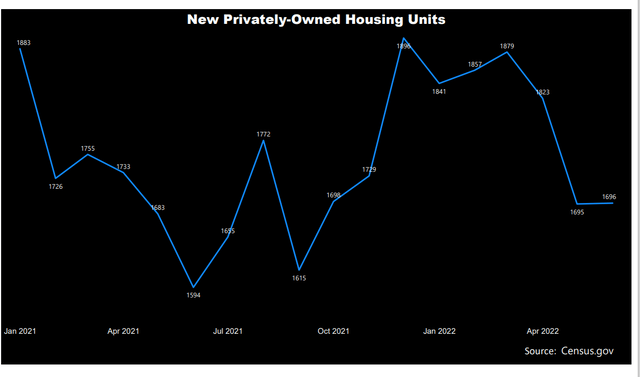

The ISM Manufacturing Prices Index declined marginally in July 2022 compared to the previous month, led by lower new order rates, although supplier deliveries improved. In July, the US unemployment (3.5%) was lower than in the previous three months. The addition to the privately-owned housing units decreased marginally (by 1.3%) in July compared to a month ago, although it was fairly down compared to the beginning of the year. The unemployment rate contraction is a positive for WCC, although the fall in PMI and housing units will add to the near-term uncertainty and lower growth opportunities.

The Segment Drivers Explained

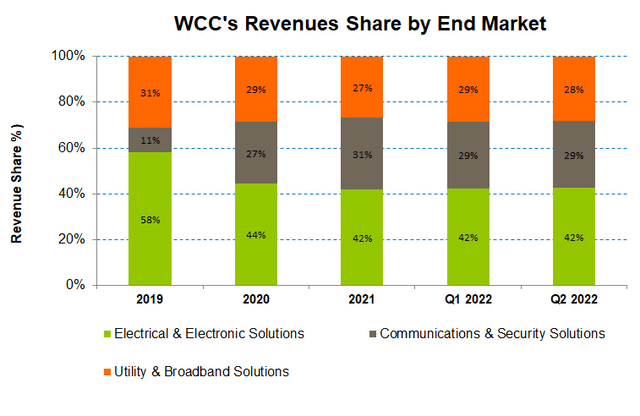

The Electrical & Electronic Solutions segment accounted for 42% of its Q2 2022 sales. Revenues in this segment were 11.5% higher than in the previous quarter. The steady construction business elevated bidding activity, and non-residential market recovery led to the rise in revenues in the segment. The Communications & Security Solutions (or CSS) segment was up by 11.7% in Q2 (quarter-over-quarter) due to security integrators’ growth, cloud applications, and wireless, data center, and hyper-scale projects. Although the supply chain constraints affected the segment adversely, it managed to mitigate it through a quarter-over-quarter pricing hike.

The Utility & Broadband Solutions (or UBS) segment, which accounted for 28% of the Q2 sales, saw sales increase by 10% in Q2 2022 due to broadband business recovery as demand for data and high-speed connectivity, including home-based applications, increased. Many utility and public power customers are investing in grid hardening and modernization, which provided a tailwind to the UBS topline growth.

A Q2 Margin Analysis

Although Wesco’s gross profit margin did not change much, the EBITDA margin expanded in Q2 compared to Q1. The company passed the supplier price increases to its customers, leading to margin improvement. However, it incurred higher expenses related to its investment in systems and digital tools, which partially the adjusted EBITDA growth.

Cash Flows And Debt

In 1H 2022, WCC’s cash flow from operations (or CFO) turned substantially negative compared to the previous year. Despite a 21% rise in revenues in the past year, its working capital requirements increased following increased receivables. Its inventory balance increased to support the backlog and address the supply chain challenges. So, the company’s free cash flow (or FCF) also turned negative in 1H 2022. It expects to spend ~$120 million in capex in FY2022.

Although the company’s liquidity ($666 million) was high, its debt-to-equity ratio (1.24x) is significantly higher than its competitors (HDS, DXPE, and FAST). Its debt-to-EBITDA target is in the range of 2x to 3.5x. However, negative free cash flow would make deleveraging (lowering debt compared to equity) challenging. In June, its board approved a $1 billion share repurchase program. The management believes that following its cash deployment in the Anixter acquisition, it is now close to the deleveraging target so that the share repurchase will drive shareholder value.

Relative Valuation And Target Price

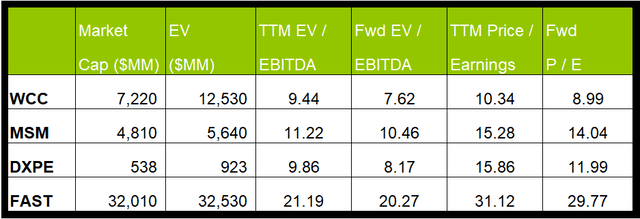

WCC’s forward EV/EBITDA multiple compression versus the current EV/EBITDA (i.e. fall in the forward EV/EBITDA versus current EV/EBITDA) is steeper than peers, which means WCC’s EBITDA can rise more sharply than peers. This typically results in a higher EV/EBITDA multiple than its peers. However, the stock’s EV/EBITDA multiple (9.4x) is lower than its peers’ (MSM, DXPE, and FAST) average of 14.1x. So, it is undervalued compared to its peers. Wall Street analysts suggest a higher (23%) upside.

Why Do I Upgrade WCC?

In my previous article, I discussed its shifts from a full revenue model to a service fee model, while the company was hindered by the adverse effect of supply chain constraints and free cash flow dry-up. I wrote:

I see short-term concerns over the operating margin triggered by supply chain constraints and commodity price inflation. Cash flows also weakened severely in FY2021, which can be concerning given an overly leveraged balance sheet.

At the end of Q2, cash flow remains a concern, but increased cross-sell revenue generation, revised Anixter synergy gains, and low relative valuation makes a more convincing case for a rating upgrade.

What’s The Take On WCC?

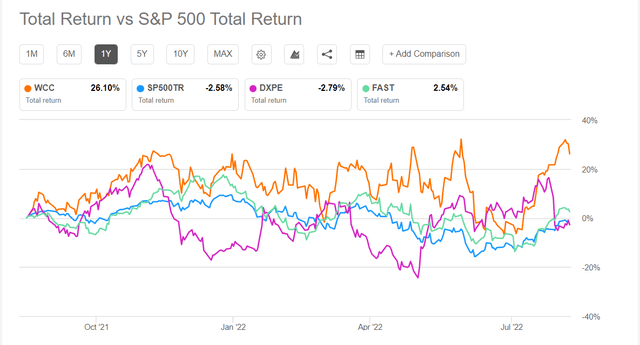

WCC’s cross-sell initiatives after the Anixter acquisition denotes a complementary portfolio of products and services between WCC and Anixter and new awards. Ongoing construction activity, elevated bidding activity, and non-residential market recovery have helped the company maintain an upward push. The operating margin will receive a shot from increased operating leverage on higher sales. So, its stock price outperformed the SPDR S&P 500 Trust ETF (SPY) in the past year.

A business-to-business distributor and supply chain solution provider like WCC has room for a stock price appreciation in the short-to-medium term. On the other hand, a supply chain-related cost hike can offset the margin gains in the short term. Plus, a high debt-to-equity ratio reflects financial risks, although the company is inching towards its debt-to-EBITDA target. I do not see any significant risks on the economic horizon.

Be the first to comment