BCFC/iStock Editorial via Getty Images

So far this year I have bought two stocks. I’ll leave one for a possible future article. The larger buy was McKesson Corporation (NYSE:MCK). I initiated a position in McKesson on January 20 at $255.23. I added on February 28 at 270.05. I added again on March 18 at $291.15. It is trading above $325 as I write this line. It’s possible that I will add again but I will likely look to buy a correction. If this article is the first to bring MCK to your attention, however, you may consider buying at least a starter position now. It has run up quite a bit since my first purchase but it remains cheap. There’s just one reason I bought in stages. It looked too good to be true. What was I missing? Why is McKesson so cheap?

Why McKesson Is Cheap And Might Be Perfect Stock For The Present Market

My primary reason for buying McKesson was that despite having serious reservations about the present market valuation I was holding a bit too much cash. To whittle down my cash position a few percent I needed to buy a high quality company that was cheap and safe. A company with moderate dependable top line growth would be perfect. Rapid growth often comes with too much risk and companies with high growth levels rarely remain under the radar. In sum, what I wanted was a company in a solid industry with fundamentals that would continue to do well no matter what was going on with the markets, the economy, the Fed, the inflation rate, and any negative repercussions of the war in Ukraine. McKesson checked all the boxes.

After studying MCK for a month and looking it up in obscure sources nothing jumped out at me as a problem. McKesson appeared to fly under the radar because its business is unsexy and hard to understand. It’s the largest of three major drug distributors. Along with AmerisourceBergen (ABC) and Cardinal Health (CAH) it constitutes 90% of the drug distribution business. The industry is a small niche in the drug industry which takes the distribution task, which has a small profit margin (about 1.7% for McKesson) compared to the huge margins sought by drug companies which create, manufacture, and market what they hope will be blockbuster drugs. The major drug companies basically have bigger fish to fry. They prefer not to deal with the problem of delivering their product to retailers like CVS (CVS) or Walmart (WMT), maintaining warehouses of inventory, some of which must be refrigerated, and taking care of nitpicking details like billing and collecting.

Broadly speaking a drug distributor is a remora which hitches a ride on the back of a shark. By serving the drug industry it is able to ride the expanding health care industry without the risks of actual drug development. Distributors benefit from diversification that comes with serving many companies and have smoother growth and in the aggregate keeps up with the industry. While their margin on sales is small, their Return on Equity and Return On Invested Capital are quite good because aside from warehouses their need for capital expenditure is quite small.

Making McKesson harder to understand is the fact that branded drugs make up 70% of revenues but only 30% of profits. Generic drugs conversely make up 30% of revenues but 70% of profits. This is somewhat counterintuitive but branded drugs, which are more expensive, are distributed at a fixed fee-for-service rate for individual companies. With generic drugs, which often have multiple providers, distributors are able to negotiate better rates. Details like this contribute to the difficult in analyzing McKesson and its peers. The three leading companies understand that competing with each other by price would serve no useful purpose. Their one overriding advantage is the oligopolistic structure of the industry. Any price cut would be matched, there would be no significant change in market share, and everybody would be worse off.

In sum, the business of the drug distribution industry lies in relieving drug companies of the distribution function which no drug company would want to do for itself. The margins don’t compare with those of successful drugs and the distributors provide a necessary service that is not convenient or efficient for individual drug companies. On the other hand the distributors benefit from being diversified in the drug companies they serve. They also enjoy the cost saving advantage that comes with scale. They further share with the drug companies the benefit that comes with clients who must buy their products regardless of economic conditions. Thus they are protected against both recessions and inflation and can go about their business with indifference to any particular economic condition.

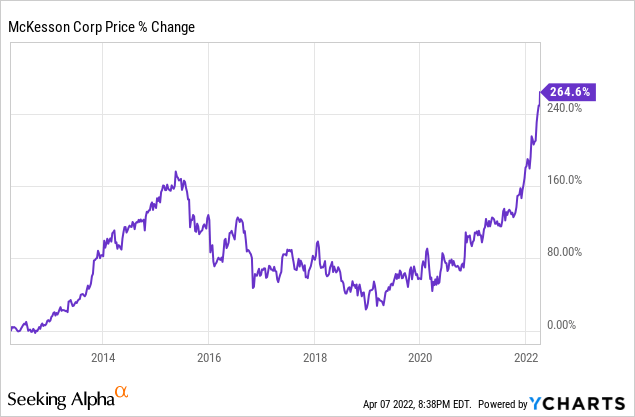

My premise was that McKesson was a mis-priced stock held down by known risks which should have already been fully discounted. The market had simply been slow to let go of worries about risks which were largely in the past. (I will discuss those risks later.) Meanwhile McKesson has rallied persistently from the pandemic bottom in March 2020 but continued to sell at a PE around 12. It finally broke out decisively from a seven year base to a new all-time high. December of 2021. Here’s the chart for the past decade.

Despite the powerful rally McKesson sells at just 13.5 time trailing earnings. One likely reason is that it doesn’t fit conveniently into any preferred category, including stable dividend stocks. It has solid top line growth which such companies as Coca-Cola (KO), Clorox (CL), Procter & Gamble (PG), Hershey (HSY), and McDonald’s (MCD) do not, but it sells at about half their P/E ratios. The simple reason is the market’s decade long search for yield. McKesson’s dividend yield is a minuscule .6%, although it increases every year. The shareholder return at McKesson is much better, with buybacks at about 3.2% annually. For whatever reason many investors continue to prefer straight cash which doesn’t require them to perform the modest task of selling a few shares. A McKesson shareholder could simply sell 3.2% of shares annually and enjoy the tax advantage of long term capital gains. There’s no market category encompassing companies which provide most of their shareholder return in buybacks.

McKesson Has Great Fundamentals

The table below provides ten years of operational numbers which match up with the chart in the above section:

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | TTM | |

| REV | 122B | 122B | 137B | 179B | 191B | 199B | 208B | 214B | 231B | 238B | 257B |

| SGA | 3.7B | 4.11B | 5.39B | 7.9B | 7.4B | 7.4B | 8.1B | 8.4N | 9.2B | 8.8B | 10.2B |

| SHS | 251M | 239M | 233M | 235M | 233M | 223M | 209M | 197M | 182M | 161M | 156M |

| EPS | 5.61 | 5.80 | 6.20 | 7.65 | 9.95 | 23.5 | .30 | .17 | 5.02 | (28) | 9.12 |

| LTD | 3.1B | 4.5B | 8.9B | 8.2B | 6.5B | 7.3B | 7.0B | 7.3B | 6.2B | 6.3B | 5.3B |

| FCF | 10.4 | 8.9 | 11.p | 11.1 | 13.0 | 18.9 | 18.1 | 17.72 | 21.42 | 24.3 | 27.9 |

Each line selected from the SA information on financials comes with an explanation that should help explain 10 years of McKesson history. In order:

- The top line, revenues (REV), basically shows the steady upward march of sales at a rate close to 8% compounded.

- The line for Selling, General & Admin Expenses (SGA) almost tripled while revenues slightly more than doubled. While the percentage of revenues was small, at around $10 billion, the addition to operating expenses took a 30% bite out of operating earnings for the TTM number. This was not lax cost control but involved increased expenses to track opioid distribution in particular as well as legal fees.

- The line for shares outstanding (SHS) shows the steady buybacks at a rate of about 3.2%, reducing the share count by 37% over ten years.

- Earnings per share (EPS) are interesting mainly because restructuring costs, mainly in Europe, and write downs of the non-cash item Goodwill, reduced earnings sharply in 2018/2019. The negative number for 2021 reflects the entire after-tax hit of the opioid settlement ($8 billion before taxes) which was taken in the first quarter of the 2021 fiscal year resulting in the negative $28 per share earnings. The actual cash payments will be spread out over 18 years.

- Long Term Debt (LTD) has declined 30% since 2019. With a market cap of over $47B its $5.3B of net debt is a very conservative 10% of Enterprise Value.

- Because of restructuring expenses, write downs of Goodwill, and the one-time opioid impact on earnings, per share free cash flow (FCF) is a better measure of the amount of cash actually thrown off by McKesson’s business.

Factor Grades, Quant Rankings, And Analyst Ratings

FACTOR GRADES:

The factor grades make sense and are consistent except for Growth, for which the exceptional events described in #4 above serve as the explanation. The gradual decline in Valuation was to be expected as McKesson rallied strongly for two years and the current B- Grade reflects the fact that as strong as price action has been, recent earnings and earnings expectations have kept up.

QUANT RANKINGS:

Sector: Health Care

Ranked in Sector: 3 out of 1059

Industry: Health Care Distributors

Ranked in Industry: 1 out of 9

Ranked Overall: 37 out of 4295

These Quant Ranking are the best I have seen at SA. McKesson beats all competitors in Health Care Distribution. They are well into the top 10% of all companies covered on Seeking Alpha. Most interesting to me, of the 1059 companies in the Health Care Sector McKesson is ranked #3. This is important for two reasons: (1) Health care companies are among the highest quality businesses and (2) The health care sector is among the best performers in the current market environment.

ANALYSTS:

Only one SA analyst has provided a ranking, rating McKesson a buy.

Of fifteen Wall Street Analysts there are 7 Strong Buys, 4 Buys, 3 Holds, and 1 Sell.

What Are The Risks?

There are several risks with McKesson that deserve discussion:

- McKesson has simply run up too far too fast. When it first came to my attention I saw how far it had come and waited for a correction. When no correction materialized I gritted my teeth and started a position. That initial position bought in late January is up 27.5%. The important thing to remember (as I told myself with each subsequent buy) was how amazingly cheap it had been when the rally started. Its operational performance in the Q3 report were excellent and it’s astonishing how cheap it still is. It still looks buyable. A correction would make it more buyable.

- Opioids. The legal action leading to an $8 billion settlement was undeserved. The DEA failed to do its job, the drug manufacturers failed to do their job, doctors failed to do their job, and the patients themselves took drugs at a level which flew in the face of common sense. The trouble was that the three drug distributors were a cash-rich entity easy to define. How could they possibly have weighed the impact of their distributed drugs without knowing what other sources were shipping? They were prudent to settle, but their expanded role as traffic cop has raised their Selling, General & Administrative expenses materially. The opioid crisis is probably behind them, but they continue to be an easy target.

- Amazon (AMZN) puts itself in the picture. McKesson stock fell about 20% in Q4 2017 as the word got out that Amazon would start distributing pharmaceuticals. It quickly recovered. Amazon anxiety recurred when Amazon bought PillPack on June 28, 2018, and introduced Amazon Pharmacy on November 17, 2020. In both cases there was less reaction in McKesson’s stock price as the primary target was CVS and other retailers.

- One should bear in mind that Amazon disruptions sometimes fail. When Amazon bought Whole Foods, grocery stocks fell about 30% but quickly recovered. Haven, a partnership of Amazon, JPMorgan (JPM), and Berkshire Hathaway (BRK.A)(BRK.B) was created in 2018 to make health care cheaper and more rational. It was shut down on January 4, 2021, with an acknowledgement that the health care industry was more complicated than they had realized. Cutting out the middleman turned out not to be so simple..

- McKesson’s defenses against Amazon start with that low 1.7% margin on sales. In generics, which produce 70% of profits, Amazon will struggle to institute McKesson’s model of playing generics off against one another. Walmart will prefer to continue with McKesson. Amazon will need personnel to administer its role in policing controlled substances and will find itself an easy target for litigation just like the present drug distributors. One can present scenarios in which Amazon makes a successful attack on the retail drug industry but its competitive advantage is not obvious and major damage to the distributors would likely be many years in the future.

The Rewards Outweigh The Risks

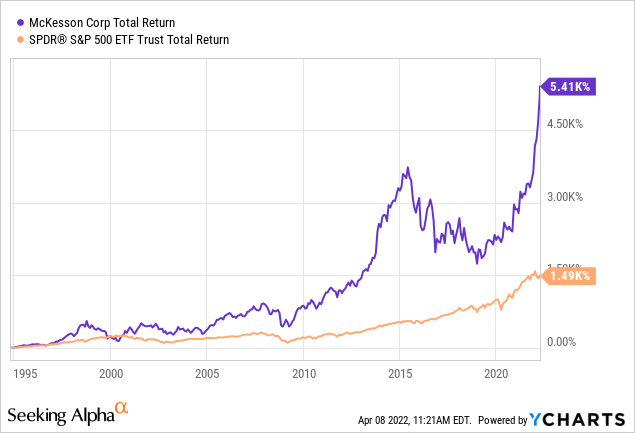

McKesson ranks #83 by market cap in the S&P 500 (SPY). The chart below shows that McKesson has outperformed the S&P 500 by 360% since 1995. That’s a spectacular record for what started as a small dull company and there is no evidence that its outperformance will decline any time soon. Its ability to outperform in deep bear markets, 2000-2003 and 2008-2009 being clear on the charts, shows that the characteristics of its industry make it highly defensive under tough market conditions. The fact that it is #37 out of 4295 stocks on the Seeking Alpha site speaks volumes. Despite an industry-specific bear market from 2016 to 2020 it is obvious that it has bounced back spectacularly. It is #3 of 1059 health care stocks in a market which currently favors the health care industry.

Trading at 325 as I write this line, McKesson still has a P/E of just 13.5. The market is still in the process of catching on to a stock which deserves a P/E of at least 15-16 providing a target fair value of 355 to 390. If things go reasonably well, the rally in McKesson may have quite a way to go. A correction in the meantime is fairly likely but, barring a total market collapse, is likely to be brief. It’s your call.

Be the first to comment