motorider

This article was coproduced with Cappuccino Finance.

The real estate market has skyrocketed in the past couple of years, making many houses unaffordable. Rental rates also have climbed sharply, contributing to rising inflation.

Since housing construction is not keeping pace and America remains short on houses by several millions, the problem on our hands isn’t likely to go away anytime soon.

This brings my attention to REITs that focus on affordable manufactured housing. These houses are affordable, fast to manufacture, and easy to move (literally). These structures could help fill the shortage in residential living.

Meanwhile, the pandemic has brought a whole new appreciation for minimalism and the nomadic lifestyle, and these trends also could boost the manufactured housing industry.

The following three REITs are good choices to ride these trends.

Equity LifeStyle Properties (ELS)

Equity LifeStyle Properties has a unique business model. They own land and lease it to customers who own manufactured homes, RVs, and manufactured cottages on a long-term or short-term basis. Their business model is characterized by low maintenance costs and low customer turnover costs.

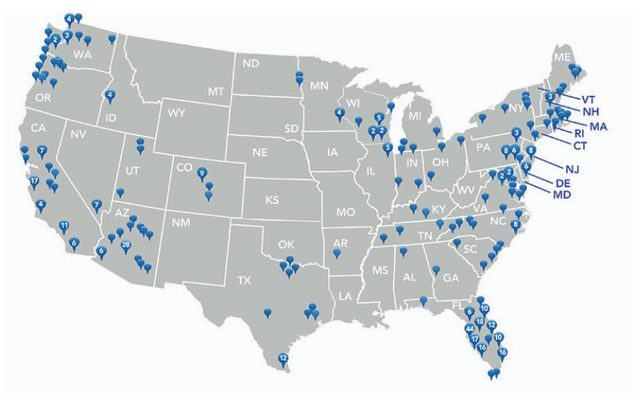

Equity Lifestyle’s portfolio is highly diversified across the U.S. They have more than 110 properties that contain a body of water and more than 120 properties within 10 miles of the coastal lines. The majority of their customers are retirees, vacationing families, and first- and second-time homebuyers. Overall, they have more than 400 properties (over 169,000 sites).

ELS Investor Relations

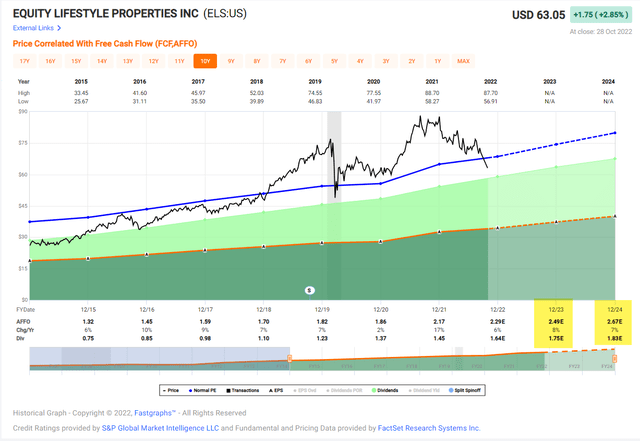

Equity Lifestyle has steadily grown and has been outperforming the S&P 500 for years. Their total return since their IPO is 6,871% (vs. 1,419% of S&P 500 during the same period), and the 10-year total return is 419% (vs. 238% of S&P 500).

Given their solid business model and recent real estate trends, it’s not surprising to see such strong results. I expect their outperformance will continue in the future.

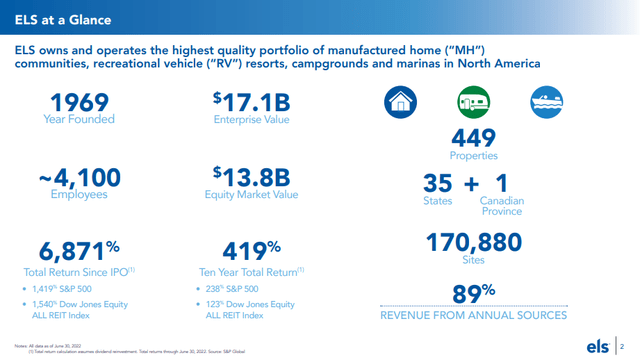

ELS Investor Relations

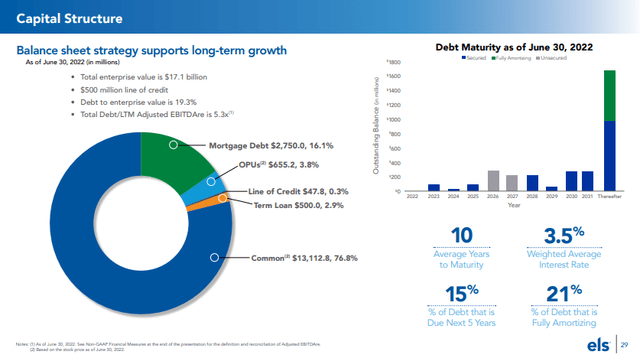

To sustain revenue growth and profitability, it’s critically important for a REIT to keep investing, developing, and redeveloping. Equity Lifestyle is doing a great job at acquiring new sites and developing/redeveloping existing sites to improve asset values. They have been steadily increasing their preservation and improvement budget since 2019, while also expanding their portfolio.

Their strategic choices should support their high growth trajectory well into the future.

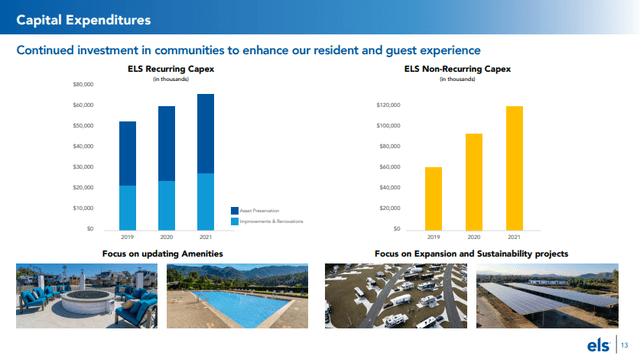

ELS Investor Relations

Equity Lifestyle also has been doing a great job at maintaining a strong balance sheet and stable capital structure. Their debt maturity schedule is well managed, and the average year to maturity is now 10 years. Also, the weighted average interest rate is low at 3.5%, and they have a $500 M line of credit.

They are financially sound and can support their growth plan without financial distress. Also, their dividend is safe, shown by a cash dividend payout ratio of 45.53% and AFFO payout ratio of 69.51%.

ELS Investor Relations

Their current valuation metric shows that they are undervalued. The P/AFFO ratio of 28.92x and P/FFO of 22.12x are well below their historical level. Given their financial stability and operational strength, I expect them to return to their historical norm in the long run.

FAST Graphs

Sun Communities (SUI)

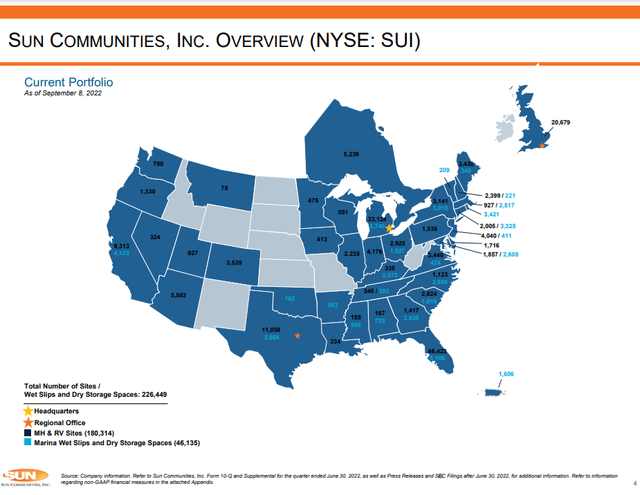

Sun Communities owns, manages, and operates manufactured housing communities, RV resorts, and marinas throughout the U.S. and Ontario, Canada.

They have more than 180,000 manufactured housing or RV resorts across the U.S. and Canada with over 660 properties. Their portfolio also includes over 46,000 marina wet slips and dry storage spaces.

SUI Investor Relations

Sun Communities have multiple drivers for growth. The weighted average contractual rent increase was 4.5% as of June 2022. They have spent $197 M to expand and improve their existing sites since 2020, and they still have over 10,000 sites available for expansion in 2022 and beyond.

Also, they have spent over $11 B on acquisitions to increase their portfolio. Given these multiple layers of growth drivers, I expect them to continue to growth their revenue and FFO, which will support a higher dividend in the future.

SUI Investor Relations

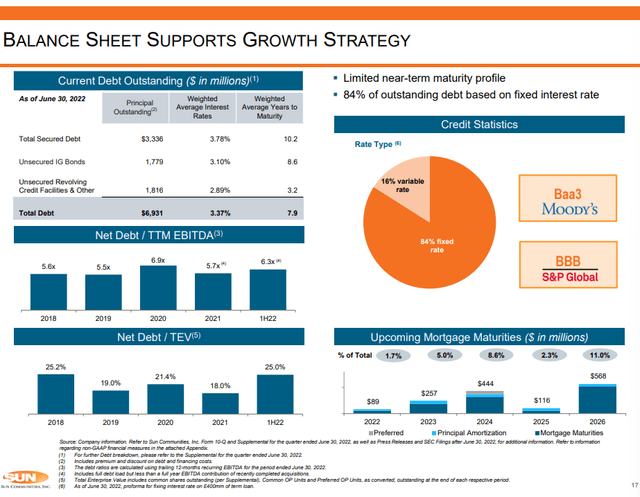

Sun Communities has a strong balance sheet to support their growth. Their Net debt to EBITDA is manageable at 6.3x, and the debt maturity schedule is well spread out over the next several years. Also, 84% of their debt is fixed rate, which is very favorable in this rising interest rate environment.

The dividend is safe at this point. The cash dividend payout ratio is 56.17% and AFFO payout ratio is 51.78%. These metrics demonstrate that there’s a substantial gap between the cash flow and dividend payout.

Also, their strong capital structures and stable operation ensure that their dividend payment will be well covered and safe in the future.

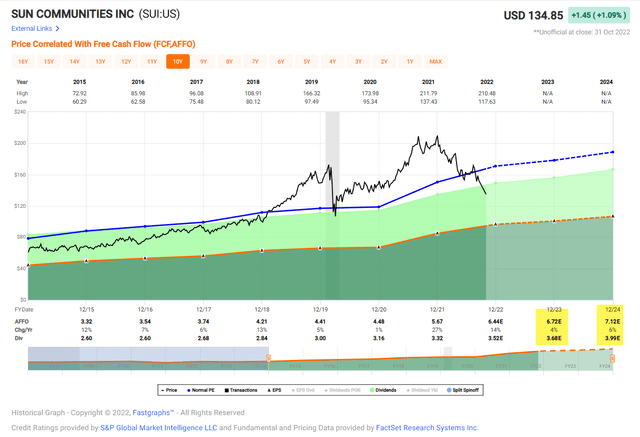

Sun Communities stock suffered 32% loss over the course of year, and the downtrend has created a great opportunity for investors. Their P/AFFO of 23.78x and P/FFO of 17.67x are more than 30% below their five-year average. I see Sun Communities stock price as undervalued at this point.

Also, iREIT rating tracker shows that Sun Communities’ margin of safety is at 19%, which further strengthens the argument that the stock is undervalued right now.

Their continuous investment, strong balance sheet, and operational stability will continue to contribute to their revenue and profit growth, and the stock price and dividend will grow accordingly in the future.

FAST Graphs

UMH Properties (UMH)

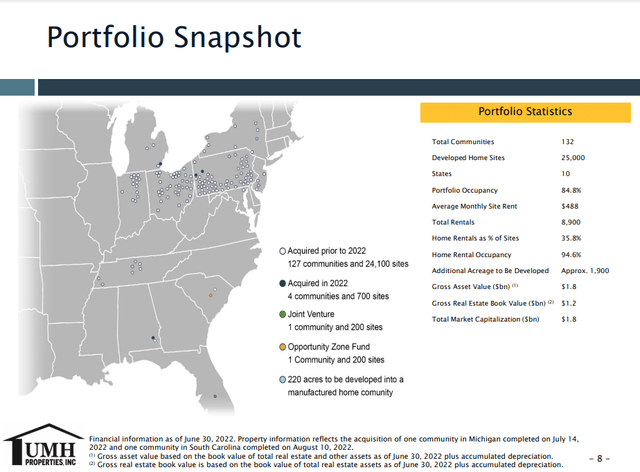

UMH Properties owns, operates, and manages manufactured homesites. Their portfolio includes 132 manufactured home communities (approximately 25,000 home sites) across the U.S. UMH’s properties are robust and in high demand (94.6% home rental occupancy).

UMH Investor Relations

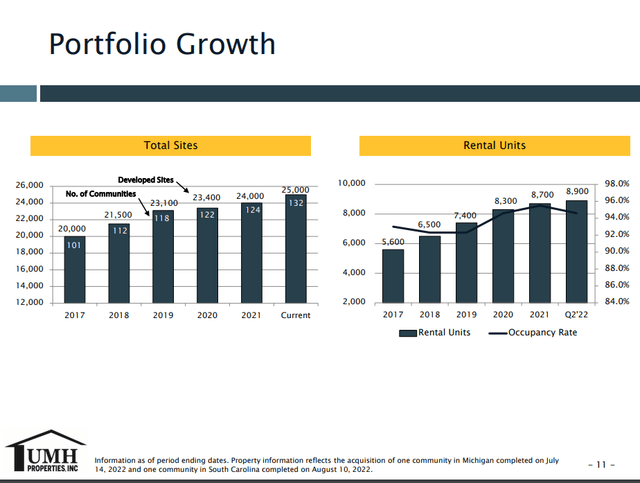

Through consistent investment and expansion, UMH’s portfolio has been growing steadily. The total number of communities grew from 101 in 2017 to 132 in 2022, and the number of developed sites grew from 20,000 in 2017 to 25,000 in 2022.

UMH Investor Relations

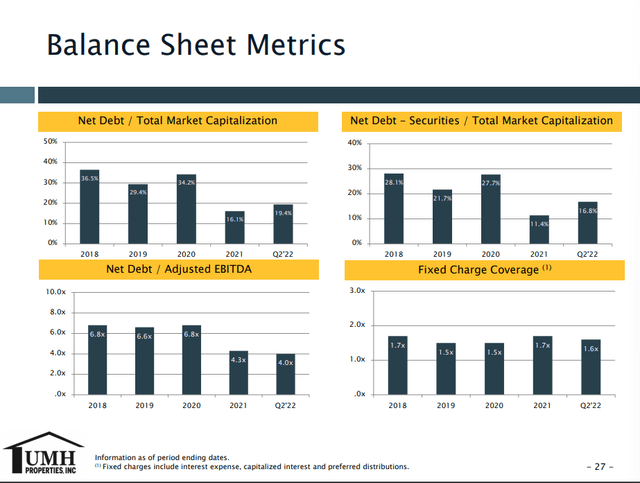

UMH has been managing their balance sheet very well. Their net debt to total market capitalization is 19.4%, and net debt to adjusted EBITDA is at 4.0x. Also, their fixed charge coverage is around 1.6x.

The debt schedule is very well managed and spread out for the next several years. Such a strong balance sheet and favorable capital structure will allow UMH to achieve their growth target and return additional value to its shareholders.

UMH Investor Relations

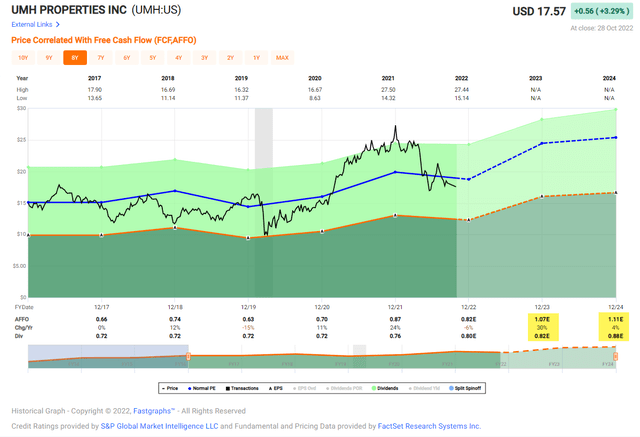

During the latest earnings call, management mentioned that the effect of the recapitalization will appear in the second half of the year, and after the redemption of preferred stock, the payout ratio was about 87%.

They have increased their dividend two years in a row and are on track for additional increases.

The P/FFO of 16.12x and P/AFFO of 20.04x are well within their historical valuation metric, and therefore, I believe they’re fairly valued at this point.

FAST Graphs

Risk

Like many other materials, the cost of building materials for manufactured homes has been steadily increasing, and it shot up in the past couple of years.

The total cost to build a manufactured home rose by 30% in 2021 alone. These rises in building costs can negatively impact demand for manufactured homes and the communities.

One of the trends contributing to the growth of manufactured home communities was the shift towards a remote work environment and people’s minimalistic lifestyle during the pandemic.

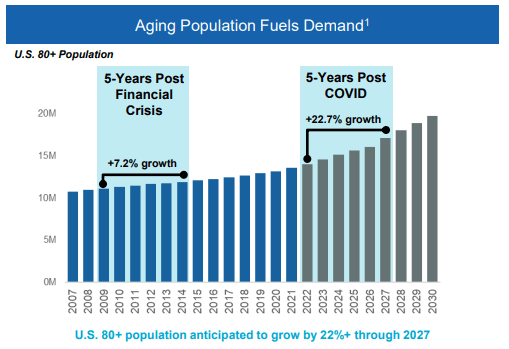

As vaccines roll and more people return to their pre-pandemic lifestyle, the demand for manufactured homes will moderate. However, the demographics favor this sector and is why we believe the so-called “silver tsunami” will provide plenty of demand in the years ahead.

VTR Investor Presentation

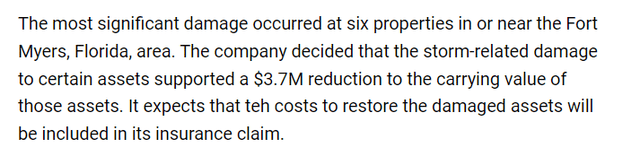

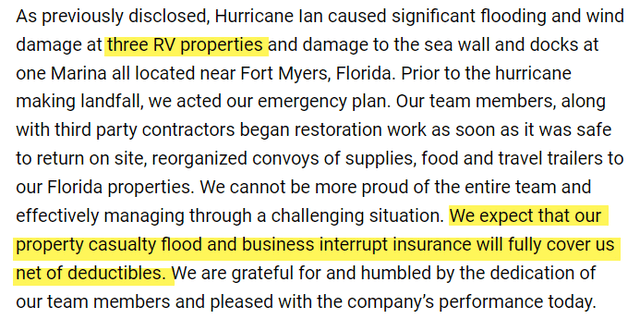

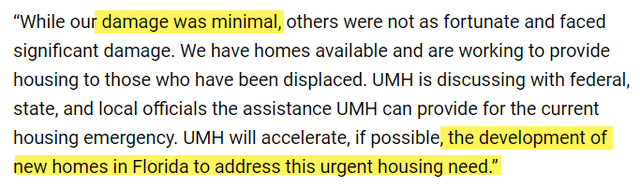

Also, with regard to Hurricane Ian:

Equity Lifestyle

Sun Communities

UMH Properties

Conclusion

Housing affordability is increasingly becoming an issue for many Americans. Especially, if high inflation and high interest rates continue, the demand for affordable housing market will increase even further.

The manufactured home community could provide some relief for this shortage, and the above three REITs are good options to play this trend.

The overall market volatility has brought their stock prices down substantially in the past several months and created an opportunity to take advantage of a lower entry point for these REITs.

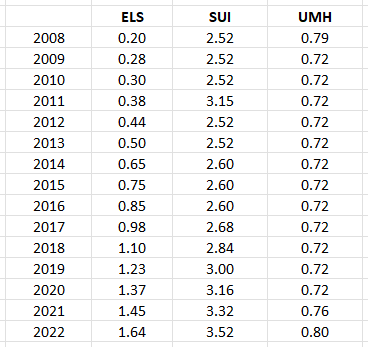

Dividends per Share

iREIT

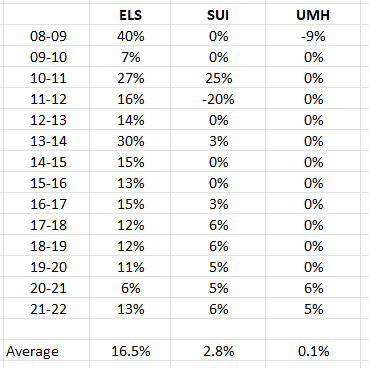

Dividend Growth

iREIT

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment