JHVEPhoto/iStock Editorial via Getty Images

It’s been a tough start to the year for the restaurant industry group (EATZ), with many casual dining brands seeing relentless selling pressure and the index falling ~7% year-to-date. Wendy’s (WEN) has been one of the sanctuaries among the turbulence, down just ~4% year-to-date despite inflationary pressures, subdued December traffic, and staffing headwinds that continue to impact the industry. This is likely because the quick-service segment has seen better traffic performance than other segments. With the stock in the middle of its recent trading range, I remain neutral at $22.70, but I would view any dips below $21.00 as low-risk buying opportunities.

Wendy’s Hot Honey Duo (Company News Release)

Just over two months ago, I wrote on Wendy’s, noting that the company’s strong unit growth outlook and plans to return capital to shareholders made it an attractive buy below $20.00 per share. The stock did not quite retreat to this ideal buy zone, finding support at $20.35 and rallying 20% from these levels. Since then, the company has seen continued menu innovation, with the Hot Honey Chicken Breakfast Sandwich and the Hot Honey Chicken Sandwich (Made to Crave) offering, and while industry-wide traffic was subdued in December, fast-casual and quick-service names have been better performing segments. Let’s take a look at recent developments and the updated low-risk buy zone for the stock:

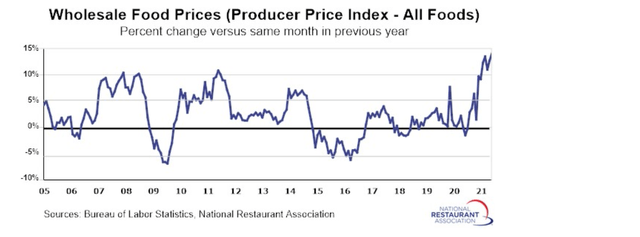

Wholesale Food Prices (National Restaurant Association, Bureau of Labor Statistics)

Since November, we’ve seen several negative developments for the industry as a whole, with the emergence of Omicron, persistent inflationary pressures, and labor tightness. In the case of Omicron, it has impacted industry-wide traffic, with Black Box Intelligence reporting that traffic was down 8.4% in December and that sales growth was negative for a 5th consecutive week (week ending January 23rd, 2022). This is not ideal and certainly below some of the industry-wide forecasts pre-Omicron, with the hope that traffic could return to normal as cases improved post-Delta.

When it comes to staffing and inflationary pressures, wholesale food prices were up more than 10% on a year-over-year basis in December, and the industry has found itself ~1 million jobs below pre-pandemic levels despite a 13th consecutive month of employment gains. This is a medium-term headwind that could continue to put pressure on wages in the industry as brands are forced to be more competitive to retain and attract talent to ensure they can operate at normal hours and maintain a positive guest experience.

Fortunately, for companies like Wendy’s, Chipotle (CMG), McDonald’s (MCD), and some other fast-casual/fast-food chains, they were in the better performing segments. At the same time, brands relying on mostly dine-in to generate sales saw a pullback in traffic with some anxiety related to Omicron. This means that Wendy’s has lower risk of missing its Q4 2021 and Q1 2022 sales/earnings estimates relative to casual dining peers, where estimates may not have been conservative enough pre-Omicron.

From a margin and staffing standpoint, Wendy’s has been less immune to the pressure than peers like Chipotle. In fact, Chipotle has reported minimal labor disruptions, which could be helped by its generous wage increase last year to $15.00/hour. Notably, it grew margins on a two-year basis, a deviation from its peer group. Having said that, Wendy’s has been relatively conservative on taking price, and it has continued to broaden its Made to Crave menu. This should help increase its average ticket (premium price points) and could aid in clawing back some margin losses (Q3 restaurant margins declined 200+ basis points to 14.4%).

Wendy’s Made To Crave Menu (Company Website)

Meanwhile, the company is also investing heavily in breakfast ($25 million in planned advertising spend in 2021) and continues to see progress on this front. As noted in the Q3 Earnings Call, breakfast sales exited Q3 at 7.5% of total sales, and the company grew its QSR burger morning meal traffic share. As awareness increases around breakfast and we see a steady increase in those working from home returning to offices, this should be a tailwind for this segment. With this boosting average unit volumes and providing sales leverage, breakfast is another opportunity to claw back some margin losses. Notably, Wendy’s nabbed the #3 spot in the overall morning meal share in QSR burgers.

Obviously, inflationary pressures, the risk of new variants, and a much tighter labor market have made the industry less desirable as a whole than pre-COVID-19. The exception is brands that have flourished and gained meaningful market share, like Chipotle and Wingstop (NASDAQ:WING), helped by their superior digital penetration.

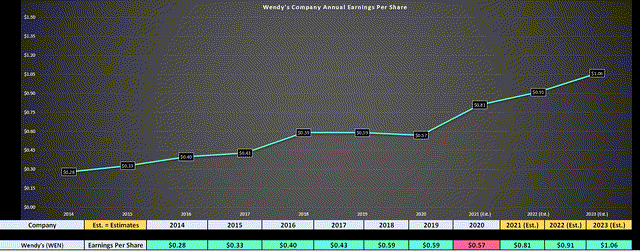

However, fast food is better positioned than casual dining if investors are looking for exposure to the space. Meanwhile, Wendy’s has a strong development pipeline and has guided for mid-single-digit compound annual unit growth. This is helping Wendy’s to steadily grow annual earnings per share, more than can be said for some casual dining names. Most importantly, though, the industry-wide negativity looks to be mostly priced into Wendy’s at current levels, with its valuation catching up after 12 months of sideways trading.

Wendy’s Earnings Trend & Forward Estimates (YCharts.com, Author’s Chart)

Looking at WEN’s earnings trend above, we can see that the company has an impressive track record of annual EPS growth, boasting a compound annual EPS growth rate of ~16.4% since FY2014. This assumes that the company meets FY2021 estimates of $0.81. If we look ahead to FY2022 and FY2023 forecasts, its compound annual EPS growth rate is expected to remain above 15%, with estimates of $0.91 and $1.06, respectively. Even if WEN misses these estimates, though, and annual EPS comes in at $1.04 in FY2023, the stock still looks very reasonably valued, as I will highlight below.

Valuation & Technical Picture

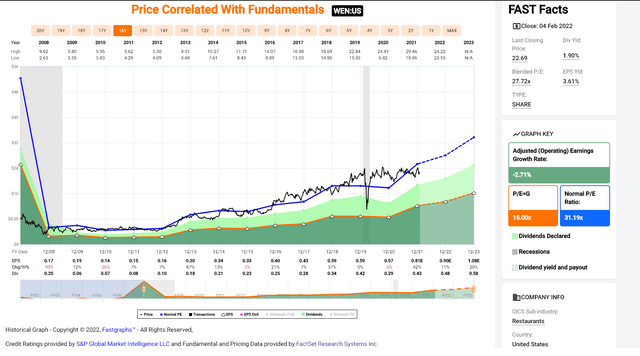

Let’s look at Wendy’s valuation below. As we can see, the stock has historically traded at an earnings multiple of ~31 over the past 15 years, with an earnings multiple near 32 since the Great Financial Crisis. From a valuation standpoint, the best time to buy WEN has been below 26x earnings, evidenced by its share price troughs in Q4 2014, Q4 2015, Q3 2016, and Q4 2018.

Based on a current share price of $22.70 and FY2022 estimates of $0.91, Wendy’s trades inside this ideal buy zone, sitting at ~25x FY2022 earnings estimates. So, after its recent dip, the stock checks the boxes from a valuation standpoint, and it is worthy of keeping on one’s watchlist in case we see further weakness.

Wendy’s Historical Earnings Multiple (FASTGraphs.com)

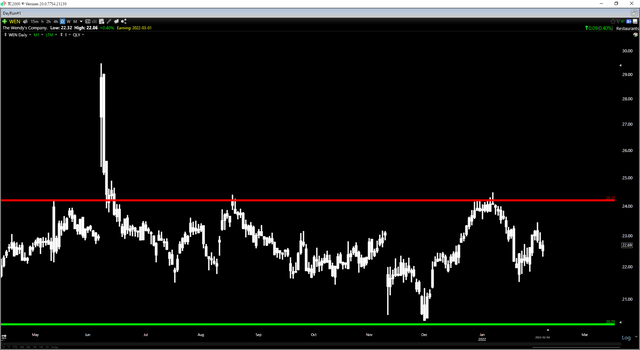

Moving to the technical picture, though, Wendy’s is sitting in the middle of its 1-year trading range, with strong support at $20.25, and the stock continues to find resistance in the $24.20 – $24.40 zone. With the stock trading at $22.70 after a pullback in sympathy with the general market, WEN’s reward/risk ratio comes in at 0.60 to 1.0, based on $1.50 in upside to resistance and $2.45 in downside to support. This does not meet my criteria for entering new positions, with a requirement for a minimum 4 to 1 reward/risk ratio. So, while the valuation remains quite attractive, I don’t see a low-risk buy point just yet.

Having said that, after the December share-price decline and a slightly higher low in place, we have the confirmation of strong support in this area, suggesting that any corrections towards this level should present buying opportunities. So, if WEN were to dip below $21.00, where it would have $0.75 downside to support and $3.20 in upside to resistance, this would line up the technicals and valuation, offering a low-risk entry point for investors. Of course, there’s no guarantee that the stock dips this low, but this is an area I’m watching to start a new position in the stock.

While Wendy’s may not be the highest-growth story in the restaurant space, especially with many high-growth concepts like Portillo’s (PTLO) and Dutch Bros (BROS) going public, it is a steady earnings grower with a solid international opportunity. Assuming the company can meet guidance, we should see a 5%+ compound annual unit growth rate, which is very respectable for a company of its size. Given WEN’s attractive dividend yield (1.9%), the potential for continued share buybacks, and an overall generous capital allocation program relative to peers, I would view weakness below $21.00 as a low-risk buying opportunity.

Be the first to comment