Darren415

This article was first released to Systematic Income subscribers and free trials on Nov. 27.

Higher-quality income securities have rarely offered more attractive yields in the recent past than what’s on offer right now. Bank preferred securities, many of which are either investment-grade or issued by investment-grade companies, continue to trade at yields of 6-7%. To get this kind of yield in 2021, investors would have had to buy CCC-rated bonds. In this article, we take a look at Wells Fargo & Company (WFC) preferred shares which carry 6-6.6% yields and whose yields, in some cases, are expected to rise north of 8% over the next year or so.

A Look At WFC Preferreds

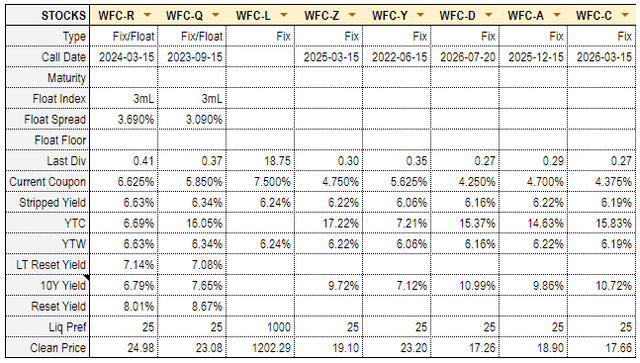

Overall, there are 8 exchange-traded WFC preferreds. Two are callable Fix/Float, 5 are callable Fixed-rate, and 1 is non-callable, convertible Fixed-rate.

The stocks are listed in the table below.

Systematic Income Preferreds Tool

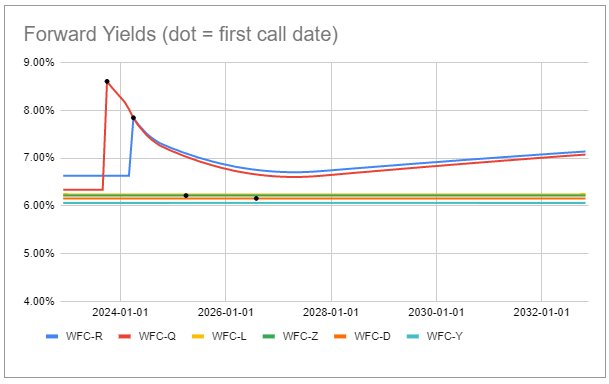

It can be easy to get lost in the details – one way we cut through the noise is to eyeball the forward yields of the stocks. Fixed-rate preferreds have flat lines in this chart since their yield, based on today’s price, will not change so long as the stock remains outstanding. The yields of Fix/Float stocks are shown based on their current fixed-coupon (the flat line in the chart up to the first call date) and a moving line based on forward Libor at any given date. We leave out WFC.PA and WFC.PC for clarity as they would look pretty much like WFC.PD in the chart.

Systematic Income Preferreds Tool

The first thing that jumps out from the chart is just how odd it looks. The two Fix/Float preferreds: (WFC.PR) (blue line) and (WFC.PQ) (red line) dominate the yields of their Fix/Float counterparts (i.e., they are above the yield of the Fixed series “forever”).

Typically, you don’t see a stock in a given suite with the highest yield across the entire time horizon – normally a Fix/Float stock would have a lower yield today than a Fixed-rate stock but a higher expected yield after the first call date so that, on a kind of averaging basis, the Fix/Float preferreds look comparable to their Fixed-rate counterparts. Is there a rational factor at play?

In our view, the answer is yes. First, in case of a sharp reversal in risk-free interest rates, the Fixed-rate preferreds would outperform. For this reason, high-quality long-duration (i.e., Fixed-rate) preferreds have a kind of tail-risk hedging feature that Fix/Float preferreds lack. Fixed-rate preferreds now trade at a lower yield but only because the value of this hedge is not apparent.

Second, Fixed-rate preferreds trade at lower prices today and so provide a potential uplift in case of redemption. WFC fixed-rate preferreds have a YTC about twice that of their Fix/Float counterparts. Arguably, this is not an entirely independent positive feature of these preferreds. A redemption of the Fixed-rate preferreds is much more likely when interest rates move significantly lower (especially without credit spreads blowing up). However, there is always a chance that the preferreds also get called for no good reason. This kind of lottery ticket profile may be useful, though, it’s not something that should be anyone’s base case.

The third reason why the Fixed-rate preferreds may make sense here is if short-term rates fall much lower than what is currently priced into markets. Short-term rates are expected to reverse their rise in 2023 and bottom in 2027 at around 3%. It’s entirely possible that either inflation is tamed much more quickly and/or we see a hard landing that takes care of inflation by itself, allowing the Fed to move rates significantly lower.

The breakeven when WFC Fix/Float preferreds reach a similar yield to their Fixed-rate counterparts is around 0.5% below the 3% expected trough in the short-term rate consensus, i.e., if short-term rates fall towards 2.5% rather than 3% as markets expect. If short-term rates fall below 2.5%, Fixed-rate preferreds yields will start to exceed that of the 2 Fix/Float stocks.

Ultimately, there is no right and wrong here, and it makes sense to hold both Fix/Float (for their higher base case yield) as well as Fixed-rate preferreds (for their potential hedging/outperformance benefit in case of a rate reversal). The proportion between the two really depends on the individual views, i.e., income-focused investors may want to go for the yield while total return/tactical investors may want to tilt in part to Fixed-rate preferreds.

The WFC preferreds suite shows that, as is the case in most cases, there is no one single “best” preferred in a suite. Different preferreds can outperform in different scenarios.

For example, in a scenario where inflation subsides quickly and interest rates move significantly lower while credit spreads remain stable, we would expect the lowest-coupon preferred (WFC.PD) to outperform since it has the longest duration in the suite. If credit spreads tighten sharply as well, (WFC.PY), the only currently redeemable stock, can easily outperform as it might just get redeemed.

Investors who prioritize call protection may want to allocate to (WFC.PL) which is non-callable. The stock is convertible, however, this would happen when the common trades north of $200 versus $47.44 as of this writing, which is obviously a low-probability event.

Overall, in the more likely scenarios, in our view, of inflation and Fed Funds remaining relatively sticky, we would expect the Fix/Float preferreds to deliver the highest yields in the suite and perform well overall.

In our own allocation within the suite, we recently rotated to WFC.PQ from WFC.PL to take advantage of its higher yield profile as well as the more likely scenario of interest rates remaining elevated over the medium term.

There are two cases in which we would consider making a rotation to another preferred in the suite. One is that WFC.PQ starts to significantly outperform WFC.PR next year as its higher yield comes more clearly into view after its first call date. The other case is that inflation falls decisively and/or we see a hard landing in the economy, in which case Fixed-rate preferreds could very well outperform.

Be the first to comment