kupicoo

Phillips Edison & Company, Inc. (NASDAQ:PECO) is a real estate investment trust (“REIT”) focused on grocery-anchored shopping centers.

While the company has a long operating history, its time as a publicly traded entity is significantly shorter, having gone public in early 2021. Since then, they have produced strong results and have maintained strong portfolio metrics that includes high occupancy levels, strong leasing spreads, and exposure to top tenants in the grocery industry.

YTD, shares are down about 6.5% and just under 3% over the past year. This compares favorably to the broader markets, which is down about 17% and 15%, respectively.

Seeking Alpha – Basic Trading Data Of PECO

Though the company makes for a balanced holding in any REIT-focused portfolio, uncertainty regarding the potential impacts of the Kroger/Albertsons merger on their portfolio, in addition to paired acquisition guidance, warrants a pause on any new or further initiation on the stock.

Elevated Exposure To Kroger And Albertsons Creates Uncertainty

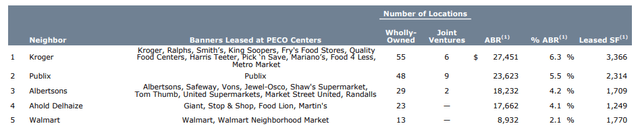

Among PECO’s top 25 tenants are Kroger (KR) and Albertsons (ACI). Together the two accounted for over 10% of the company’s annualized base rents (“ABR”) as of September 30, 2022. In addition, KR, at 6.3% of ABR, was PECO’s top tenant and one of only two to account for over 5% of ABR.

Q3FY22 Investor Supplement – Snapshot Of Top Five Tenants

The elevated exposure provides the company with the certainty of durable cash flows from one of the top grocers in the country. At the same time, however, it presents unique concentration risks, the obvious being the losses that would be incurred from the outright loss of the company as a tenant.

But in addition, the company would also be exposed to potential losses from store closures. And at present, this is a relevant risk due to KR’s recent announcement to buy rival, ACI, in a deal valued at +$24.6B, which, if completed, will go down as one of the biggest deals in the history of the grocery industry.

Already, the deal is facing regulatory hurdles that will likely drag on over the next several months. And as one part of the regulatory-clearing process, the two companies said that they would establish an ACI subsidiary that would consist of between 100 and 375 stores.

From there, the new operators would have the discretion of how best to capitalize on the value of the real estate. They could either continue operating the properties, sell, or even close them. Deciding which properties to include in the population will likely involve factors such as the level of overlap and figures surrounding sales per square foot

While management noted that the merger is positive news for PECO, citing the positive impacts of an expanding footprint of their top tenant, they still exhibited less certainty on the overall impact, given where the deal is in the current timeline.

PECO does operate in more secondary and tertiary markets with lower household incomes than their peer set. As such, if there were closures in their markets, it could prove more difficult to backfill vacant space with another quality name.

Narrowed Acquisition Guidance Limits Growth Prospects

PECO raised their guidance for both funds for operations (“FFO”) and same-store net operating income (“NOI”) as a result of strong property results from record occupancy and leasing spreads, in addition to lower-than-expected corporate and general and administrative (“G&A”) expenses.

Guidance for net acquisitions, however, was lowered by +$50M at the top end of the range. While that may not sound significant, it is cause for concern, given their dependency on it for earnings growth.

In the current period, for example, rental income increased +$14M from last year, driven in significance by their acquisition and disposition activity, which contributed +$7.3M of the total. In addition, overall third quarter FFO was up 26.4% but just 4.3% on a same-store basis.

Presently, leased occupancy stands at 97.1%. While this is up 150 basis points (“bps”) from Q3FY21, it is up just 30bps from Q2 and less than 100bps from Q1. Though it is possible to grow occupancy even further, the incremental benefit is limited.

There is also 70bps of opportunity embedded in their commencement spread, but this pales to the figures reported by similar peers within the sector, such as Kite Realty Group (KRG) and SITE Centers (SITC), who reported spreads of 290bps and 350bps, respectively.

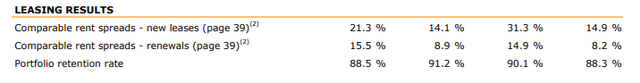

High occupancy levels do enable the company to drive rents. In the current period, for example, renewal spreads were 15.5%. This was up from the 14.4% reported in Q2 and the 14.7% from Q1.

But the good times are unlikely to last, as growth rates are more likely than not to moderate in subsequent periods due to tenant pushback. Signs of this are reflected in the current retention rate, which stands at 88.5%, down from the 92.1% rate last quarter and the 91.2% in the same period last year.

Q3FY22 Investor Supplement – Comparative Leasing Statistics For YOY and YTD Periods

A robust development pipeline, with 17 projects under active constriction that are expected to provide an estimated yield on cost of between 10% and 12%, provides one offset to the threat of a slowdown in occupancy and rate gains.

But this, too, may not provide as much bang for the buck than new acquisitions, which are presently targeted at unlevered internal rate of returns of 9% and above. While the returns of development are currently projected to be higher, the ultimate benefit could be lower due to unforeseen increases in the cost of development/lease-ups.

Liquidity And Debt Profile

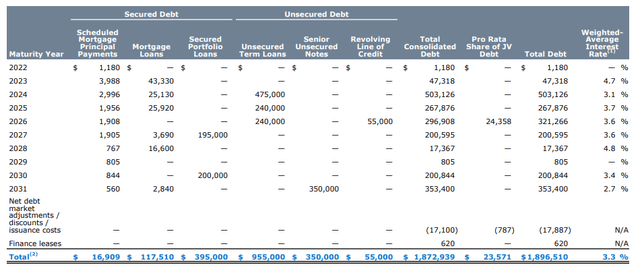

PECO has ample liquidity and has a manageable debt load amounting to 34% of their total capitalization as of September 30, 2022. And as a multiple of adjusted EBITDAre, net debt tracks within the mid-5 range, which is consistent with prior periods and below their targeted levels in the low-to-mid six range.

At current earnings levels, this suggests they can comfortably add another +$200M to +$385M to their debt load. This would elevate their debt exposure to their targeted range, yet it would have an immaterial impact on their existing debt covenants.

PECO also benefits from an accommodative debt ladder that is light on near-term maturities. With a weighted average years to maturity of 4.6 years, however, the company will need to begin addressing a higher share of maturities beginning in 2024. But their investment-grade credit ratings provide confidence that they will have readily available access to capital to satisfy these obligations

Q3FY22 Investor Supplement – Debt Maturity Schedule

They do also have over +$750M in available liquidity primarily through their revolver. Assuming those funds are available, the company could tap into that, if necessary, to roll over any incoming maturities. While it would come with a floating rate, the company has the flexibility absorb the hit, as 85% of their current load is fixed rate.

Dividend Safety

PECO currently pays a monthly dividend of $0.0933/share, which represents an annualized yield of about 3.50% at current pricing. For income-investors, the reoccurring monthly dividend check is certainly one positive. The yield, however, is unappealing, especially considering the alternatives available elsewhere, specifically in risk-free Treasurys, which are now yielding about 4%.

The payout has grown three times since their IPO, however. Initially, the payout was set at $.0850/share before quickly being increased 5.9% to $.09/share and then another 3.7% to its current level. And at a payout ratio of about 50%, the dividend is currently well-covered by FFO.

In addition, through nine months of the year, the company has generated about +$228.8M in operating cash flows and has paid out just over 40% of that in dividends. This provides them with ample remaining funds to allocate to their capital spending ambitions. With guidance recently narrowed for acquisitions due to the current market environment, this will free up funds for either additional developments or dividend increases.

Currently, the sector average payout is about 65%. At their current FFO levels, PECO could remain within sector averages even if they increased their dividend by about 28%. And at those levels, the dividend yield would be about 4.5%, and the payout as a percentage of annualized operating cash would track around 55%, which still provides ample residual funds for other capital priorities.

Uncertainties Limit Upside On Shares That Are Already Fairly Valued

PECO owns a quality portfolio of grocery-anchored neighborhood shopping centers and has benefitted from strong occupancy levels that are currently over 97%. This has provided the company with the pricing power to continuously drive rents. This in-turn is feeding into solid same-store earnings growth and positive revisions to full-year guidance.

In addition to continued earnings strength, PECO also maintains a conservative balance sheet with significant liquidity and sufficient capacity to take on a greater load, while remaining compliant with internal leverage targets and covenant requirements.

For income investors, the well-covered monthly dividend payment is a positive compared to the quarterly timetables deployed by most other REITs. Probable increases in the payout in future periods is another incentive to continue holding onto existing shares. The yield, however, is on the low-end compared to alternative investment options.

And for those seeking share price appreciation, the upside also appears to be limited. At present, shares trade at about 14.4x forward FFO, which is fair, considering peers, KRG and SITC, each trade several steps below that, at about 11x.

Furthermore, their acquisition guidance was recently scaled back and paired with higher hurdles on going-in rates. As a key part of their growth strategy, the narrowing was one blemish in an otherwise strong earnings release.

The company’s elevated exposure to both KR and ACI also creates uncertainties pertaining to potential store closures or sales. While the news was conveyed in a positive tone by management, it would be best to approach cautiously until there is further clarity.

For existing shareholders, PECO makes for a balanced holding in any REIT-focused portfolio. But shares aren’t yet worth an overweight position in the shopping cart.

Be the first to comment