Ron and Patty Thomas/E+ via Getty Images

Milwaukee-based WEC Energy Group (NYSE:WEC) is the second-largest Midwestern utility behind Minnesota’s Xcel Energy (XEL), providing electricity and natural gas to 4.4 million customers throughout Wisconsin, Illinois, Michigan and Minnesota. Closing in on 20-years of consecutive dividend raises, WEC is well-known to dividend growth investors as one of the top-performing utility stocks in the sector and a cornerstone of many DGI portfolios.

In this article I’ll look into WEC’s valuation, dividend history, and price action in light of the macro environment, and consider how the stock will perform in a recession to determine a course of action. As a Milwaukee native and former customer of their Wisconsin arm We Energies, I can also offer some anecdotal views about their service and local reputation in relation to Wisconsin’s other well-known utility Alliant Energy (LNT).

Premium Valuation for a Premium Record

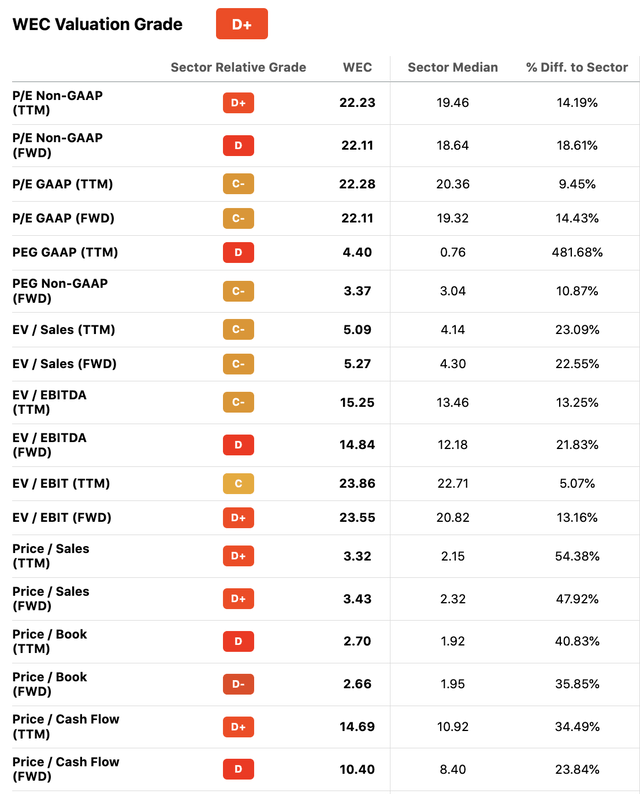

The numbers alone show us why WEC is a top utility company that commands a premium valuation. In fact, the company trades at a premium to its sector on every traditional value metric:

WEC Valuation Grades (Seeking Alpha)

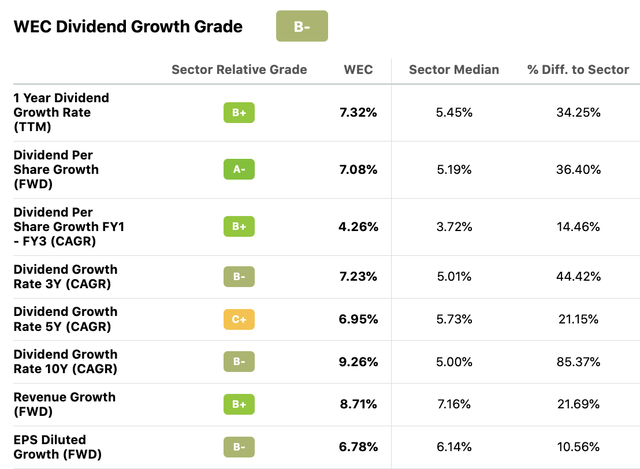

The reason is simple: a long history of consistent revenue and EPS growth and dividend strength, every metric of which is significantly above the utility sector median:

WEC Dividend Growth Grades (Seeking Alpha)

Compared to its own historic valuation, I believe that WEC is fairly valued at present. Its PE, PS, EV/S, and PB levels are all within 5% of its 5-year averages, and its forward revenue and EPS growth remain strong at 8.71% and 6.55% and are above its historical averages. Note that most US utilities have had record-breaking years, and WEC’s impressive YoY revenue growth of nearly 15% will not likely continue going forward.

A Long-Term Wealth Compounder

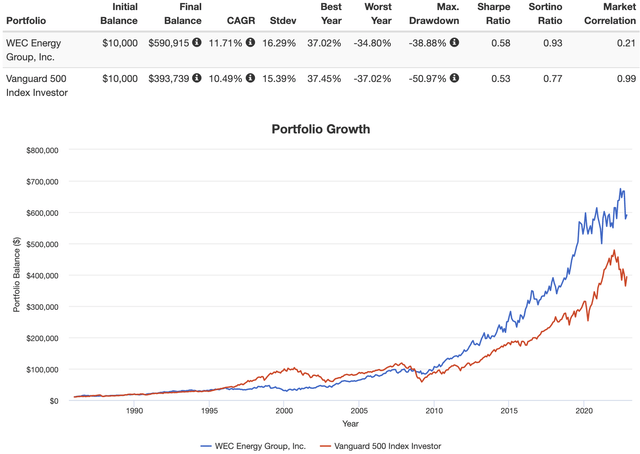

Looking at WEC’s long-term performance against the S&P 500, we see that over the past few decades its dividend compounding and low volatility propelled it to significant outperformance, although not quite as impressive as we saw with Southern Company (SO) in my last article here. Interestingly, WEC only started pulling ahead near the end of the Great Recession, which might bode well for its performance should a US recession be confirmed soon.

WEC vs S&P 500 (PortfolioVisualizer.com)

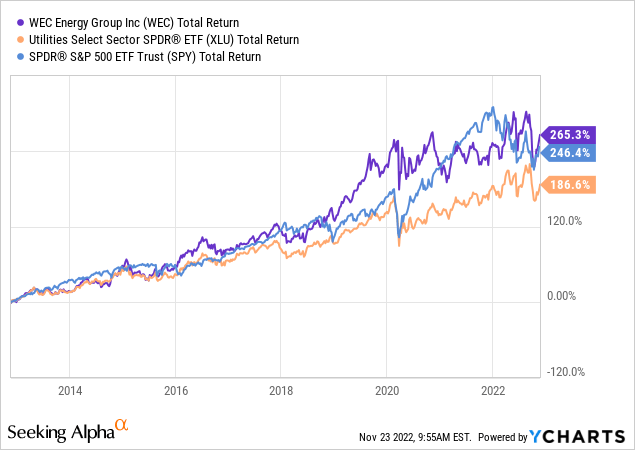

We know that the utility sector has been more resilient than the overall market during the past tumultuous year, but looking at the ten-year chart we see that WEC’s total return has outpaced both the sector (XLU) and the S&P (SPY) over the longer term as well, keeping up with SPY even during the bull market from 2013-2020 and only being surpassed for one year during the post-COVID bubble.

This is not to say that past performance is any indication of future returns, but simply to show that WEC is a low-volatility wealth compounder that should be bought and held for long periods and does not need to be sold when growth equities begin to surge again.

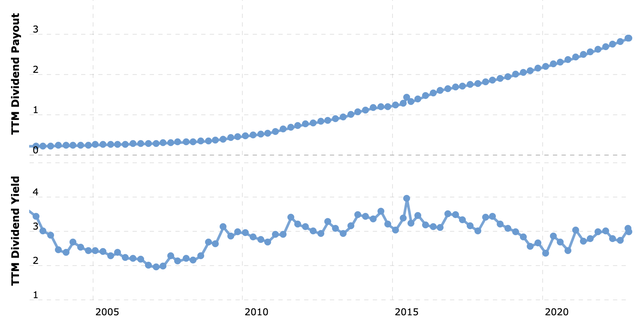

Taking a look at WEC’s dividend history, we can see how its nearly 9.23% 10-year dividend CAGR has exponentially increased shareholder payouts over the past decade. However, in recent years lower dividend hikes in the 6.5-7.5% range have been relatively disappointing. This year’s 7.32% raise was a good start compared to its 5-year CAGR of 6.63%, so I’m hoping that the new interest rate environment will push management to lift WEC’s dividend growth rates above 7.5% again in future years.

WEC Historical Yield (macrotrends.com)

Given its relatively low 3% yield, WEC’s dividend payout ratio of 65% is in line with peers and should enable many years of at least 6-7% dividend hikes given the company’s projected forward EPS growth.

Lastly, while a dividend cut is extremely unlikely at this point in WEC’s history, investors should be aware that WEC actually paid its first dividend in 1989 and had a dividend growth policy through the year 2000, when it halved its payout and restarted its current DG streak in 2003-2004.

Reputation on the Ground

Having grown up in Milwaukee, I eventually became a customer of both We Energies and its smaller peer Alliant when I owned an old American Foursquare summer home in the beautiful farming town of Monroe, Wisconsin seen above. I’ve also had friends who were employed by WEC in Milwaukee. Lest it like I’m just writing to extoll WEC’s corporate virtues, I can share a few anecdotes to counterbalance my positive take on the stock.

As is the case with many shareholder-friendly, financially disciplined companies, WEC’s Wisconsin subsidiary We Energies is known to be rather “hardcore” when it comes to cost-saving measures. While full-time employees seem to be content and Glassdoor ratings are decent, We hires a large number of seasonal customer care / telecollector employees each year during its busiest months and then dismisses them when it no longer needs the extra help, often leaving those temporary employees uncertain about when they will be let go and need to look for new jobs. The company also has a local reputation for cutting off service very quickly when bills are late with little room for negotiation — in fact, this was my friend’s mandate when he was with the company.

My overall experience as a We Energies customer was fine — my gas bills were often quite low, although so were natural gas prices at the time — but the most noticeable thing to me at the time was how poor their web interface was compared to my electricity provider Alliant. I will examine LNT more closely in a future article, but I can confidently say that in Wisconsin, Alliant is leaps and bounds ahead of We Energies in the technology department. Alliant’s web interface was easily the best utility account interface I’ve ever used, having lived in a number of different states and now internationally, and the company in general has been more forward-thinking about green energy, which is perhaps not surprising given that it is based in the progressive state capitol of Madison and not in the racially divided, post-industrial town of Milwaukee.

Of course using telecollector contractors and having an outdated website are not necessarily unusual practices for utilities in general, but I think investors should be aware that on a customer level, We Energies and by extension WEC’s reputation is somewhat cutthroat, outdated, and negative for many in Wisconsin.

With that said, the company’s regulatory environment there continues to be friendly, as business-friendly conservatives have entrenched a significant majority in the state legislature via years of gerrymandering, despite WI having a Democratic governor and remaining a close 50-50 swing state in national elections.

Conclusion

WEC has held up extremely well during this period of rampant inflation and rapid Fed rate hikes, especially considering its relatively low yield. It commands a premium valuation due to its consistent record of higher-than-average growth and dividend CAGR, and we’ve seen that it is currently trading in line with its historical valuation metrics. Recent years have seen minimal share buybacks, so investors can view its dividend yield as an accurate gauge of value.

Although I clearly view WEC as a SWAN utility and always safe for long-term holders to cost average into, since its stock has already rebounded nearly 20% from its mid-October low below $83 and currently trades at an even 3.00% yield, I would prefer a slightly larger margin of safety before initiating a position or making a large share purchase given the rising interest rate environment and a possible recession on the horizon. For now I rate the stock a hold and recommend buying if it falls below $90 and/or when it yields at least 3.25%.

Be the first to comment