ZU_09/E+ via Getty Images

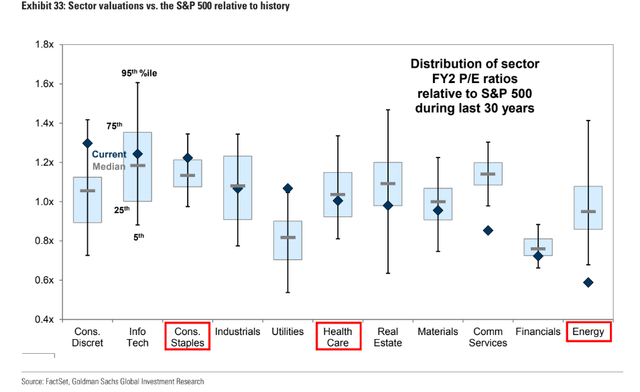

The Utilities sector trades at a record-high valuation, according to Goldman Sachs (GS). While the area would likely exhibit relative strength under a recession scenario, investors should scrutinize stocks in the defensive niche of the market when looking for safety.

One company reported solid earnings results earlier this month, but I see fundamental and technical reasons to sell.

Sector Valuation Relative to the S&P 500

Goldman Sachs Investment Research

According to Bank of America Global Research, WEC Energy Group (NYSE:WEC) operates as a diversified utility holding company whose wholly-owned subsidiaries provide regulated natural gas and electricity, as well as nonregulated renewable energy. Sixty percent of WEC’s EPS comes from its Wisconsin service territory, with Michigan, Minnesota, and Illinois commanding the remainder. The company currently has 1.6 million electric customers and 2.6 million gas customers with 69,000 miles of electric distribution and 46,000 miles of gas distribution.

The Wisconsin-based $30.6 billion market cap Multi-Utilities industry company within the Utilities sector trades at a high 22.3 trailing 12-month GAAP price-to-earnings ratio and pays a 3.0% dividend yield, according to The Wall Street Journal.

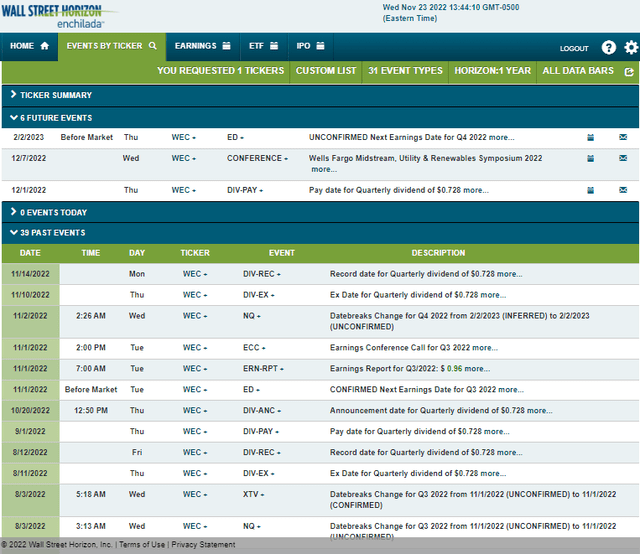

The firm reported an earnings beat back on November 1, and shares moved higher following that news. The stock was already in rally mode heading into the Q3 report. Moreover, WEC declared a $0.7275 dividend in October.

WEC trades at a premium multiple to its competitors in an already richly valued sector. Its strong management team and solid execution history might warrant a slightly above-market P/E, but with a GAAP earnings multiple above 22, there’s reason for caution. There are risks to its valuation including missteps with capex, regulatory and tax changes, unfavorable interest rate changes, and natural-disaster risk.

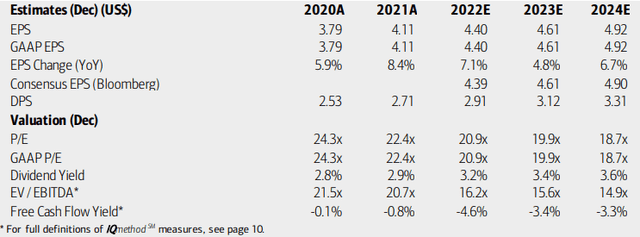

On valuation, analysts at BofA see earnings rising about with the rate of inflation this year and then slowing slightly in 2023. Steady per-share profit growth is then seen in 2024. The Bloomberg consensus forecast is about in line with what BofA sees.

I remain concerned about the operating and GAAP P/Es even with the assumed EPS advances. While utilities commonly trade at high EV/EBITDA ratios and negative free cash flow due to high capex and fixed costs, I think the current volatile and uncertain market environment has led to a too-high valuation.

WEC Energy: Earnings, Valuation, Dividend Forecasts

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Thursday, February 2, 2023, before market open. Before that, though, WEC’s management team is expected to present at the Wells Fargo Midstream, Utility & Renewables Symposium 2022 from December 6 through 8. Occasionally, business updates are provided at these events, which can result in share price volatility.

Corporate Event Calendar

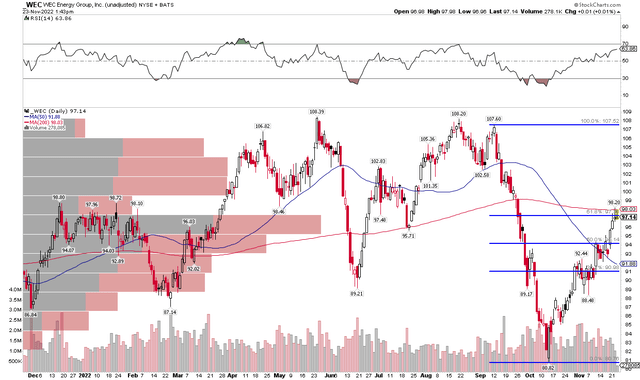

The Technical Take

I had a hold on WEC back in June, and not a whole lot has happened since then. The stock is about flat while the market is up 6%. Shares dumped in September as investors shunned the Utilities sector safety play amid sharply higher interest rates. The group has gotten its act together, and WEC, too, is up more than 20% from its October low.

Notice, however, that the stock is now back to a key spot – the flat 200-day moving average and Fibonacci retracement resistance. I think the stock could pull back here. Look for support in the $87 to $88 range, but even there, the stock remains pricey on a fundamental basis.

Overall, I think WEC is now a sell. A risk to that call is if the broad market sees selling pressure – it’s likely that rates would fall due to recession risks and Utilities would be back in relative favor.

WEC: Shares Rebound Right Into Resistance

The Bottom Line

WEC is yet another expensive Utilities sector company. The yield is not that high, and the earnings multiple is north of 20 after a 20% advance off the October low. Shares look like a technical sell to me as well.

Be the first to comment