Scott Olson

A Quick Take On Weber

Weber (NYSE:NYSE:WEBR) went public in August 2021, raising approximately $250 million in gross proceeds from an IPO that priced at $14.00 per share.

The firm sells food grilling products and related accessories to consumers worldwide.

Given the firm’s contracting performance across major financial metrics, its high cost structure and macroeconomic headwinds, my outlook for the stock is a Hold for the near term.

Weber Overview

Palatine, Illinois-based Weber was founded nearly 70 years ago to sell a wide variety of grills and related technologies to consumers in over 75 countries worldwide.

Management is headed by interim Chief Executive Officer Alan Matula, who has been with the firm as Chief Technology Officer and Chief Information Officer and was previously CIO at Royal Dutch Shell plc.

The company’s primary offerings include:

-

Charcoal grills

-

Gas grills

-

Smokers

-

Pellet grills

-

Electric grills

-

Weber Connect technology-enabled grills

The firm pursues an omni-channel strategy, selling through distributors, to large retailers, both offline and online, as well as direct-to-consumer.

Management says that its direct-to-consumer channel has been the fastest growing channel since 2018.

Weber’s Market & Competition

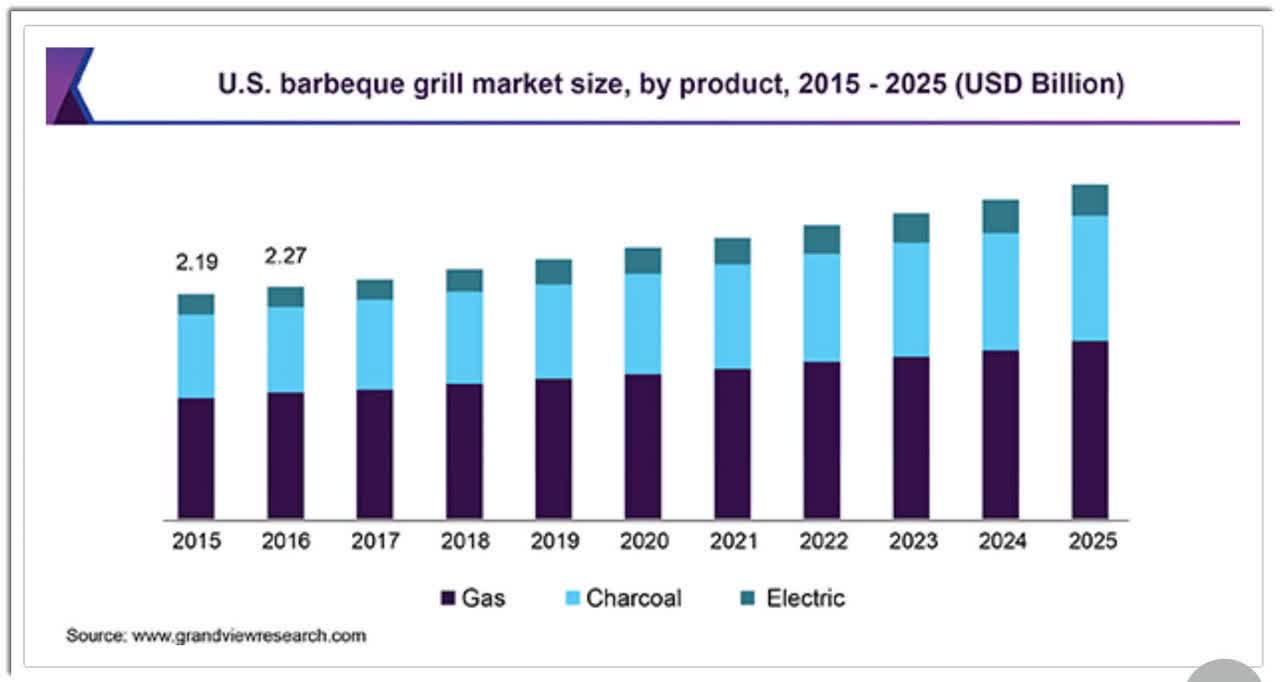

According to a 2019 market research report by Grand View Research, the global market for barbeque grills was an estimated $4.8 billion in 2018, and is forecast to reach $7 billion by 2025.

This represents a forecast CAGR of 4.5% from 2019 to 2025.

The main drivers for this expected growth are a rising trend of cookouts on weekends and holidays as well as younger demographics driving growth.

Also, below is a chart showing the recent historical and projected future growth trajectory of the U.S. grill market:

U.S. Barbeque Grill Market (Grand View Research)

Major competitive or other industry participants include:

-

Traeger

-

Kingsford

-

Dansons

-

Blackstone

-

Big Green Egg

-

Broil King

-

Campingaz

-

Char-Broil

-

Landmann

-

Napoleon

-

Nexgrill

-

Pit Boss

-

Ziegler & Brown

-

Others

Weber’s Recent Financial Performance

-

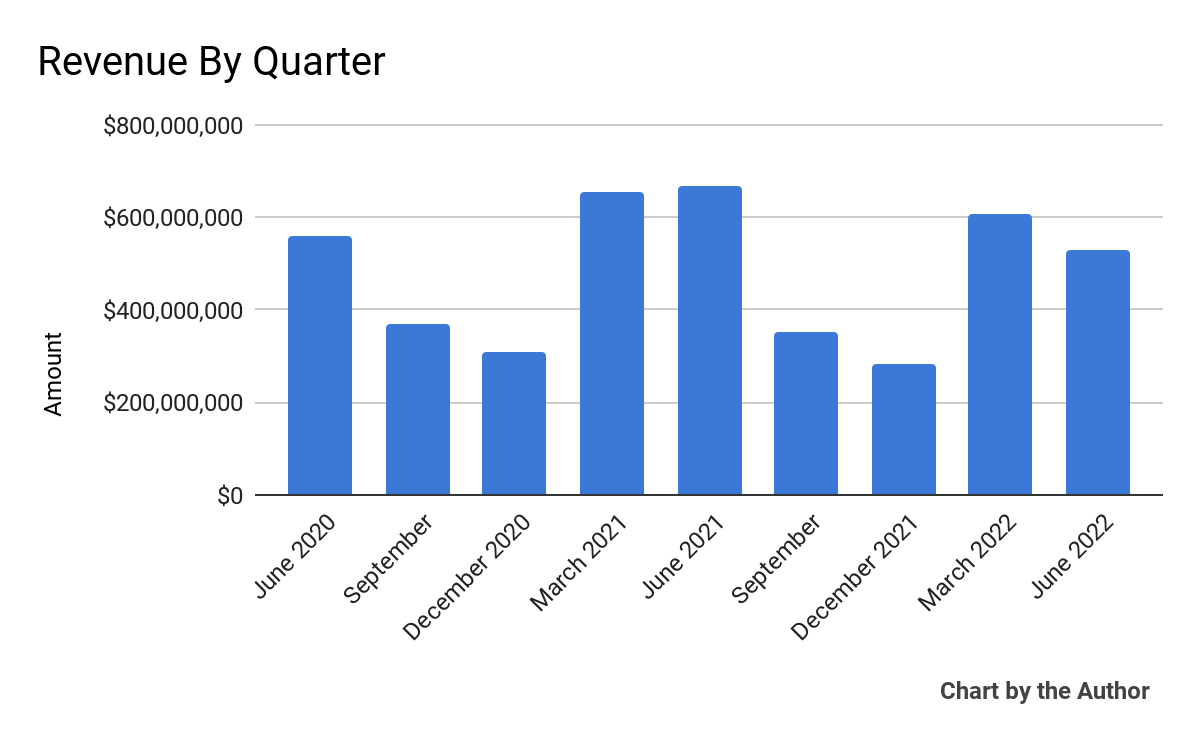

Total revenue by quarter has produced the following results:

9 Quarter Total Revenue (Seeking Alpha)

-

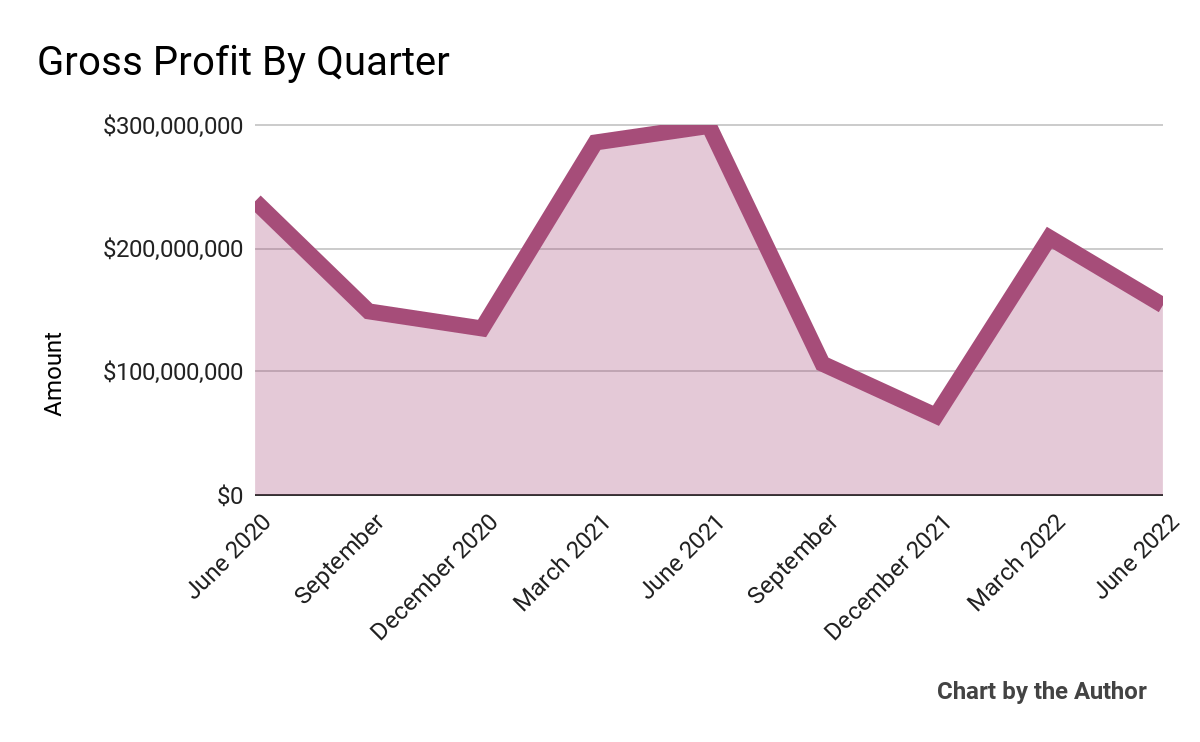

Gross profit by quarter has produced similar results as that of total revenue:

9 Quarter Gross Profit (Seeking Alpha)

-

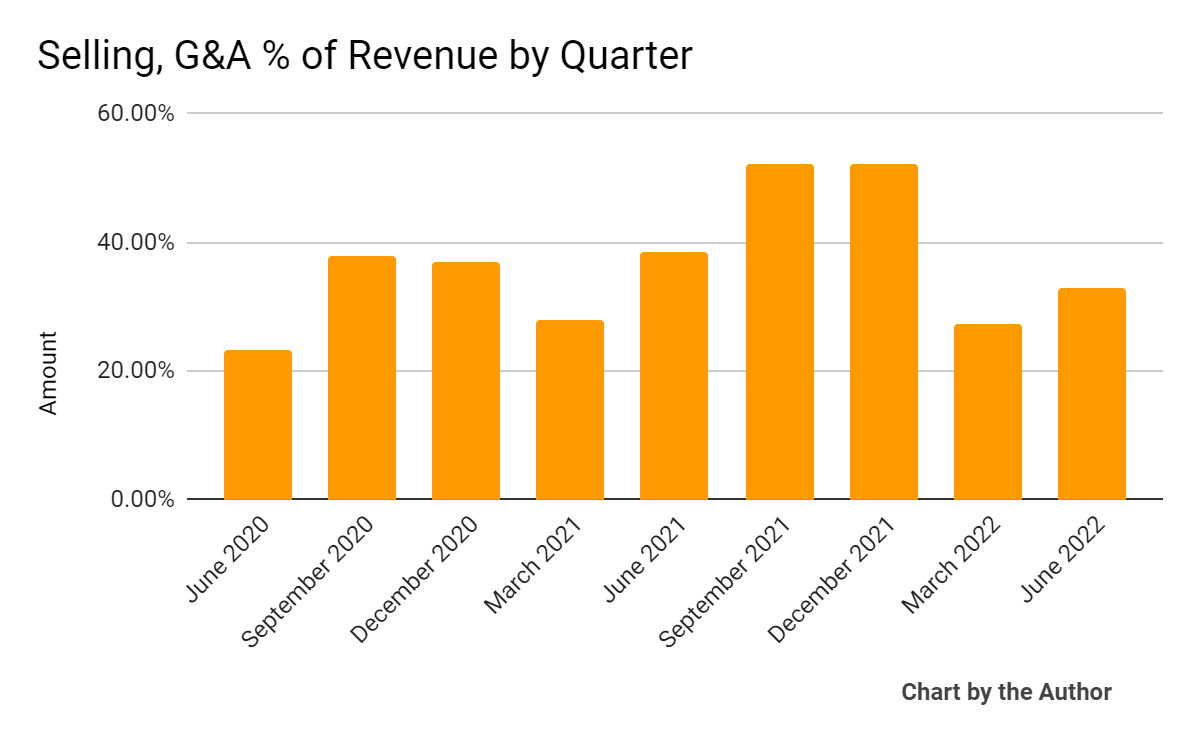

Selling, G&A expenses as a percentage of total revenue by quarter have fluctuated as follows:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

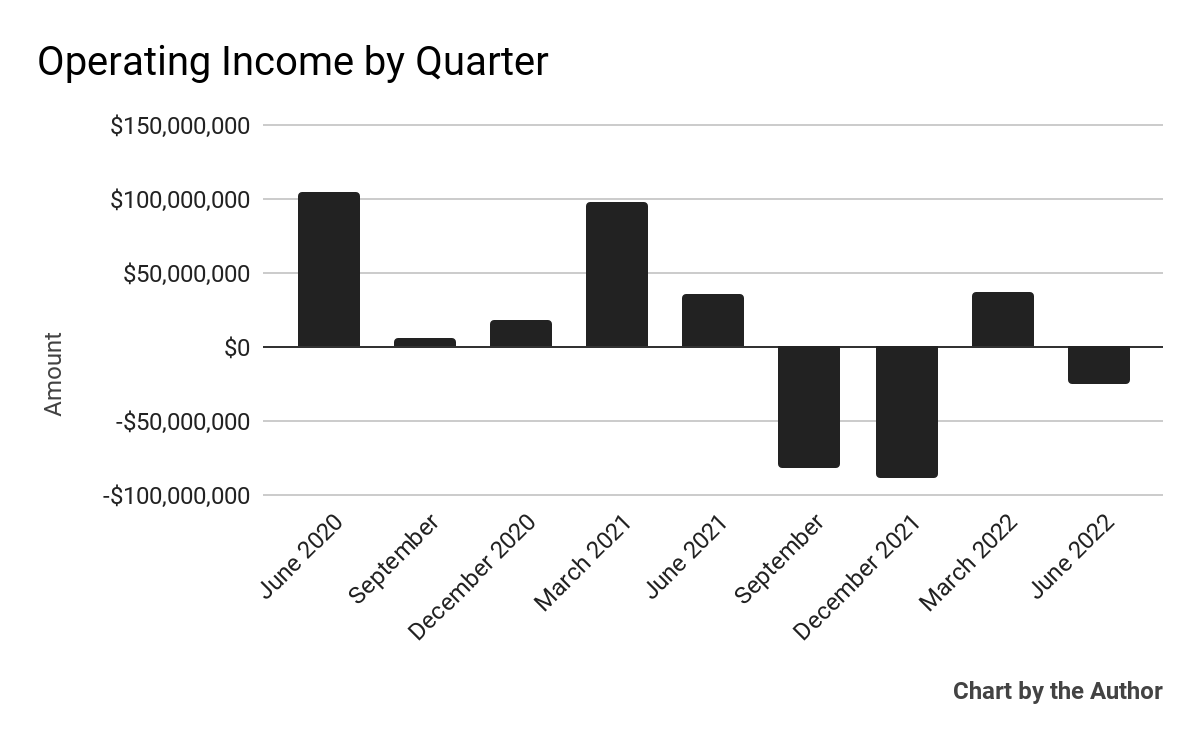

Operating income by quarter has worsened in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

(All data in above charts is GAAP)

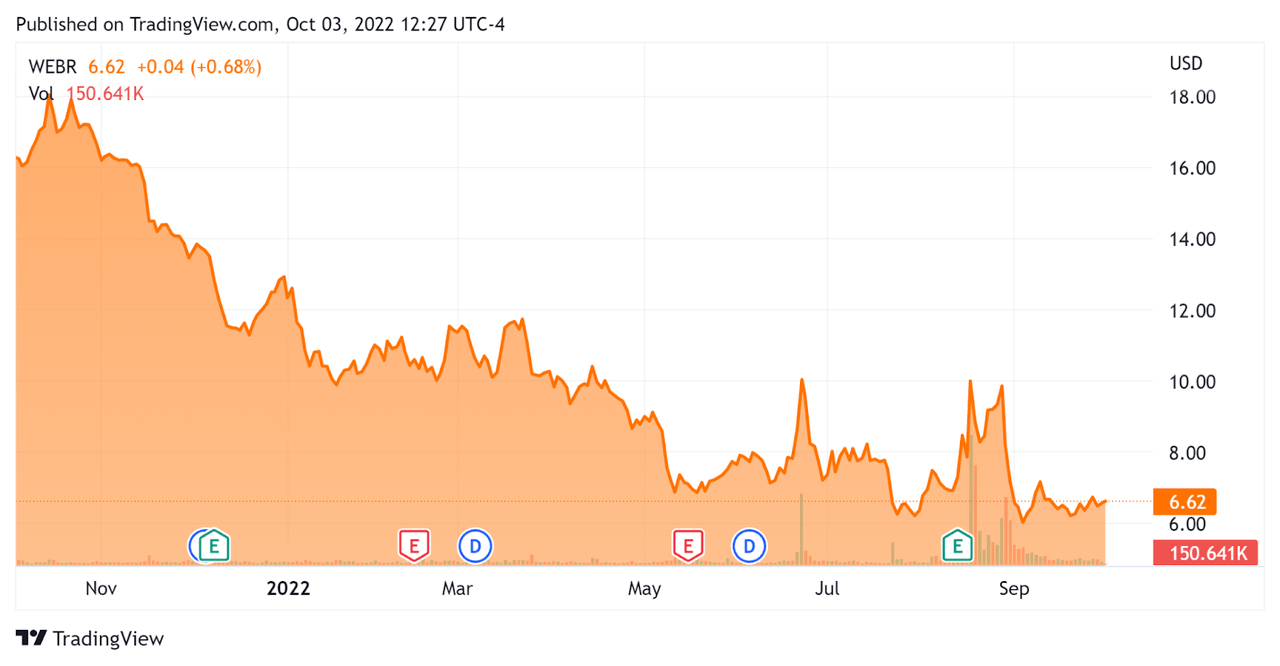

Over the past 12 months, WEBR’s stock price has fallen 61.7% vs. the U.S. S&P 500 index’s drop of around 15%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Weber

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.86 |

|

Revenue Growth Rate |

-11.6% |

|

Net Income Margin |

-5.0% |

|

GAAP EBITDA % |

-5.9% |

|

Market Capitalization |

$1,890,000,000 |

|

Enterprise Value |

$1,510,000,000 |

|

Operating Cash Flow |

-$263,200,000 |

|

Earnings Per Share (Fully Diluted) |

-$3.51 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Traeger (COOK); shown below is a comparison of their primary valuation metrics:

|

Metric |

Traeger |

Weber |

Variance |

|

Enterprise Value / Sales |

1.06 |

0.86 |

-18.9% |

|

Revenue Growth Rate |

4.6% |

-11.6% |

–% |

|

Net Income Margin |

-34.6% |

-5.0% |

-85.5% |

|

Operating Cash Flow |

-$74,670,000 |

-$263,200,000 |

252.5% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On Weber

In its last earnings call (Source – Seeking Alpha), covering FQ3 2022’s results, management highlighted the recognition of the Weber brand as a global leader in outdoor cooking products.

However, given the rapid change in consumer demand post-pandemic and in the face of high inflation, new interim CEO Alan Matula outlined a variety of steps the firm is taking, including ‘remov[ing] management layers and organiz[ing] into vertical cross-functional orientation in each outdoor cooking category.’

But, the firm is facing contracting demand from consumers, with significantly reduced foot traffic into retailers along with lowered spending due to a variety of reasons.

As a result, the Board has suspended the company’s dividend and management has instituted reductions in capital spending and begun a headcount reduction of 10% at all levels of the organization.

As to its financial results, revenue dropped 21% year-over-year due to lowered demand as well as foreign exchange headwinds due to the strong dollar against major foreign currencies.

Gross margin also dropped substantially, from 44.7% in 2021 to 29.1% this quarter, due to commodity price inflation and lower production volumes, which were only partially offset by price increases.

Selling, G&A expenses dropped due to cost-cutting and lower stock-based compensation.

For the balance sheet, the firm finished the quarter with $52.8 million in cash, equivalents, and trading asset securities and $1.278 billion in long-term debt.

Over the trailing twelve months, free cash used totaled a whopping $366.6 million.

Looking ahead, management has withdrawn its forward guidance and said it is ‘working proactively with [its] lending patterns to stay in compliance with [its] credit agreement.’

Regarding valuation, the market is valuing Weber at a lower EV/Revenue multiple than competitor Traeger, which is not surprising given that at least Traeger is producing slight growth, whereas Weber is in substantial revenue contraction.

The primary risk to the company’s outlook is its heavy debt load and bloated cost structure in an historic contraction period for the industry.

Furthermore, the U.S. economy appears to be slowing into recession territory, adding more pressure to consumer spending.

Given the firm’s contracting performance across major financial metrics, its high-cost structure and macroeconomic headwinds, my outlook for the stock is on Hold for the near term.

Be the first to comment