anatoliy_gleb

WFRD Gathers Impetus

In the middle of 2022, Weatherford International’s (NASDAQ:WFRD) operating segments have started benefiting from the growth in drilling and evaluation, primarily from the Middle East and Latin America. In the US, the company has struck a couple of significant contracts with major customers in the Bakken and the Gulf of Mexico. In international markets, pricing will improve based on increased tendering activity and a tight equipment supply.

The current US recessionary environment poses a challenge, though. If the energy price loses momentum, it can affect the drilling activities, adversely impacting NOV’s Well Construction and Completions segment profitability. The management expects to generate positive FCF in 2022 as the overall profitability improves and capex reduces. The stock is reasonably valued compared to its peers. With the momentum on its side, I think investors would do well to invest in the stock.

The Key: Contracts And Margin Expansion

Over the past few quarters, Weatherford International has shifted its strategy following the market condition. I discussed this in my previous article. While it highlighted the high-margin offerings earlier in the year, it currently places even greater emphasis on directed growth and margin expansion. The change in focus has resulted from the demand side’s uncertainty and the energy price’s robustness in 2022. The demand for artificial lift has been growing among the E&P operators. From December 2021 to June 2022, the drilled and completed well count was higher (32% and 7% up, respectively), while the drilled but uncompleted wells declined by 12%. Riding the drilling activity recovery, it received a three-year contract from Shell (RDS.A) to provide cementing products and casing accessories in the Gulf of Mexico. With Hess Corporation (HES), it inked a deal to supply artificial equipment and services in its Bakken operations.

The company’s Production Intervention (or PRI) segment lags rig count. Now that the US rig count has increased by 30% year-to-date and has remained steady, the PRI segment has started outperforming. In Q2, its topline increased by 21%, outpacing the company revenue growth. WFRD has benefited due to technical differentiation and tight oilfield equipment supply on the pricing front. As a result, equipment utilization has improved. So, the company could implement contract renewals at higher prices. Higher operating leverage will allow it to expand margin and improve free cash flow, which has underperformed until now.

International Operation Growth

Demand will likely pick up in Asia, Latin America, and the Middle East in 2H 2022 and beyond in international territories. Growth in drilling and evaluation will primarily emanate from the Middle East and Latin America. Here, pricing will improve based on increased tendering activity and a depleted supply of natural resources. The well construction and completion activities are on secular growth and would increase gradually over the long term in the upcycle.

Among the most notable contracts in Q2 was a five-year contract for directional drilling, measurement trial drilling, and logging-while-drilling services and a six-year contract to deliver tubular running service in Thailand.

Q3 2022 Estimates: Revenue And Margin

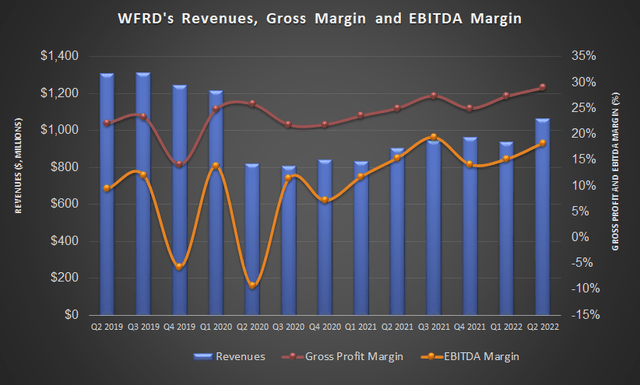

In Q3 2022, the management expects revenues to increase by “low to mid-single digits” in all the segments compared to Q2 2022. As the demand side strengthens, the adjusted EBITDA margins can improve by 25 to 50 basis points versus the Q2 level (17.5%).

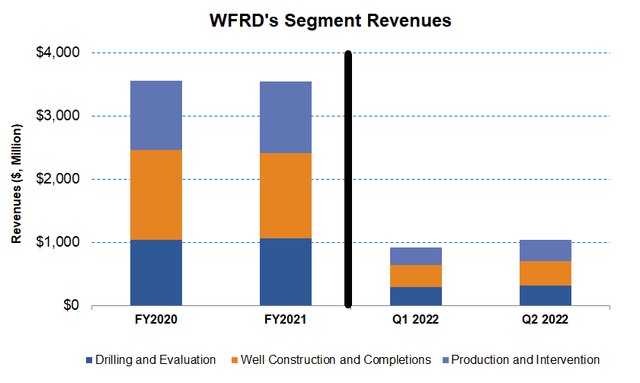

In FY2022, WFRD’s revenues can grow by “mid-teens” compared to FY2021. The revenue forecast for DRE has been revised upwards to “mid to high teens” growth, while WCC is expected to deliver “low to mid-teens.” The company’s FY2022 adjusted EBITDA margins can expand by at least 100 basis points. Over the next several years, the company aims to achieve high-teens EBITDA margins.

Analyzing The Q2 Financial Results

In Q2 2022, higher demand for managed pressure drilling (or MPD) and drilling services in Latin America and the Middle East led to a 9% revenue growth in the Drilling and Evaluation segment. Also, a higher fall-through for drilling services in Latin America 160 basis point adjusted EBITDA margin expansion in Q2.

The company’s Well Construction and Completions segment saw an 11% revenue growth in Q2 following higher demand for tubular running services and completions in the Middle East, North Africa, and Asia regions. Although volumes increased, the adjusted EBITDA margin shrank sequentially in Q2 due to an adverse change in revenue mix.

The Production Intervention segment registered the steepest revenue growth (21% up) among the operating segments in Q2, led by a significant increase in intervention services and artificial lift demand. The adjusted EBITDA margin also extended by an impressive 610 basis points from Q1 to Q2 due to increased revenues and a higher margin fall-through in all the key regions the company operated.

The Current Financial State

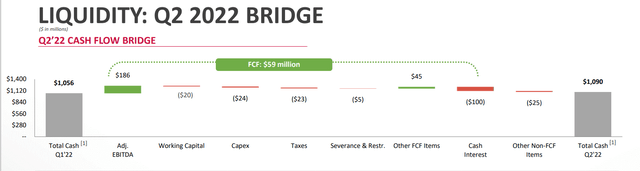

WFRD’s Q2 2022 Investor Presentation

As of June 30, 2022, WFRD had a debt of $2.4 billion, while its cash & equivalents were $1.1 billion. Although revenues increased, its cash flow from operations remained negative in 1H 2022 compared to a year ago. Although free cash flows (-$106 million) remained negative, they improved compared to a year ago. The company has revised its FY2022 capex downward by 14% from the previous guidance as it cut down investments in Russia. Also, supply chain delays and efficient asset base contributed to lower capex. In FY2022, it expects to achieve $100 million in FCF.

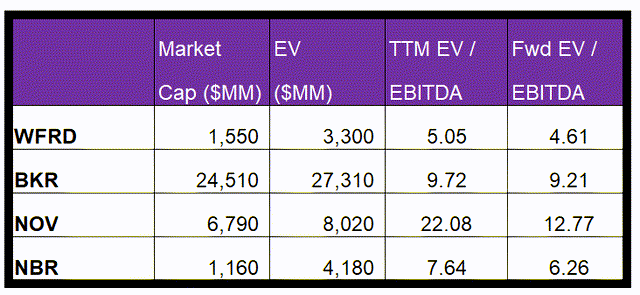

The company’s debt-to-equity (or leverage) ratio of 4.9x remained one of the highest in the industry and is higher than its peers (BKR, NOV, NBR). During Q2, it paid down senior notes partially as it improved its capital structure.

The Relative Valuation Analysis

Weatherford’s current EV/EBITDA multiple contraction relative to the forward EV/EBITDA multiple is less steep than its peers’ average because sell-side analysts expect its EBITDA to increase less sharply than the peers in the next four quarters. As expected, the stock’s EV/EBITDA multiple is much lower than its peers’ (BKR, NOV, and NBR) average of 13.2x. So, the stock is reasonably valued with a positive bias.

Analyst Rating And Target Price

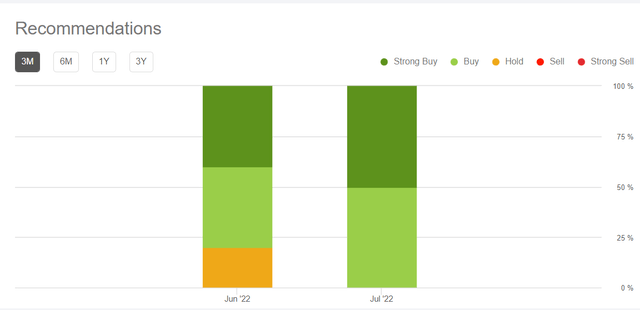

Four sell-side analysts rated WFRD a “buy” in July, while none of the analysts rated it a “hold.” The consensus target price is $42.5, which yields ~93% returns.

According to Seeking Alpha’s Quant Rating, the stock has a “Hold” rating. The ratings are positive to moderate on revisions and valuation but are bearish on profitability, momentum, and growth.

Why I Changed My Call?

In my previous article, I picked up the positive momentum NOV was demonstrating at the start of the year but fell shy of suggesting a “buy” for the investors because of its balance sheet weakness. I wrote,

“Despite some slackness in the Well Construction and Completions and Production and Intervention segments, the company’s emphasis on margin expansion paid off. The demand for its integrated MPD and TRS services is rising in the US. Internationally, the Middle East and Latin America will lead the charge in 2022.”

While these observations were close to its actual performance, it made a few adjustments, like focusing more on directed growth and margin expansion. It won many significant contracts in the US GoM and international regions and is currently benefiting from the start of an upcycle. So, despite the weaknesses, I think it can produce better returns for the investors in the medium to long term.

What’s The Take On WFRD?

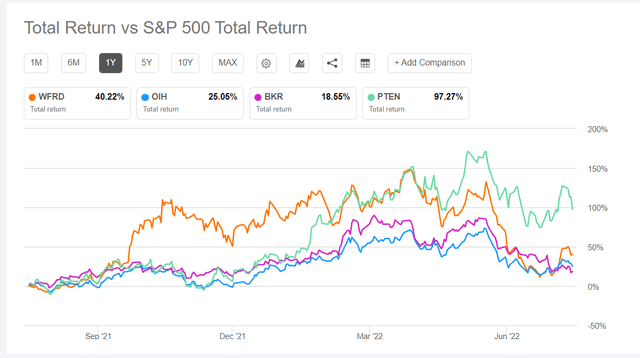

The well construction and completion activities are on secular growth and will likely pick up in Asia, Latin America, and the Middle East in the current upcycle. The company has struck a couple of significant contracts with major customers in the US and other regions that will propel the topline in the coming quarters. The PRI segment, which typically lags rig count, is now catching up and will likely start outperforming in the near term. So, the stock outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

However, the energy demand’s resilience will be tested if the US recession blooms to the full extent. Also, its leverage ratio remains one of the highest in the industry and can be a concern for investors. The management expects to generate positive FCF in 2022. Plus, robust liquidity would reduce the financial risks. I would suggest investors buy the stock at this level.

Be the first to comment