VLG/iStock via Getty Images

Berry Global Group, Inc. (NYSE:BERY) has been getting crushed in the second half of 2022, falling from a 52-week high of $74.73 in early January 2022, to a 52-week low of $44.52 on October 13, 2022, primarily from declining revenue and challenging inflation that it has yet to fully capture back.

Since September 22, 2022, to November 7, 2022, the company was trading rangebound until it finally broke out to reach about $62.00 per share, before slightly pulling back to $60.00 per share as I write.

Because the Federal Reserve isn’t done raising interest rates yet, and inflation likely to remain fairly high for some time, the company will remain under some pressure, especially in the first half of 2023, until it mitigates much of the inflation headwind.

I also think it’s going to have to reduce the size of its debt load more because of the high payment costs at these interest rate levels.

While the company may continue to experience some temporary revenue headwinds, its bottom line should remain robust and continue to generate a lot of free cash flow, which does solve a lot of the short-term challenges the company faces.

In this article we’ll look at some of the recent numbers, and what to expect from 2023.

Some recent numbers

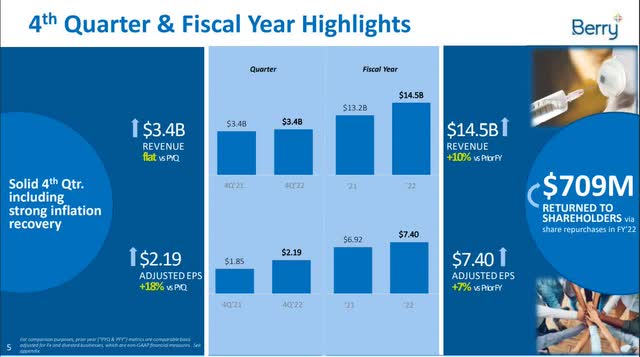

Revenue in the fourth fiscal quarter was $3.42 billion, down 6.76 percent year-over-year, and missing by $223.41 million, and flat sequentially. Full-year revenue was $14.5 billion, up 10 percent year-over-year.

Earnings per share in the quarter were $2.19, beating by $0.04, and up 18 percent compared to the prior quarter. Earnings per share for full-year 2022 was $7.40, up 7 percent from full-year 2021.

Free cash flow for full-year 2022 was $876 million.

The company held cash and cash equivalents of $1.41 billion at the end of the reporting period, with long-term debt of $9.24 billion.

Among the challenges the company faces were in regard to Fx headwind, inflation impact, softer industrial and distribution markets globally, and destocking of COVID products.

To improve the bottom line going forward BERY will continue to work on inflation recovery by raising prices and lowering costs throughout 2023.

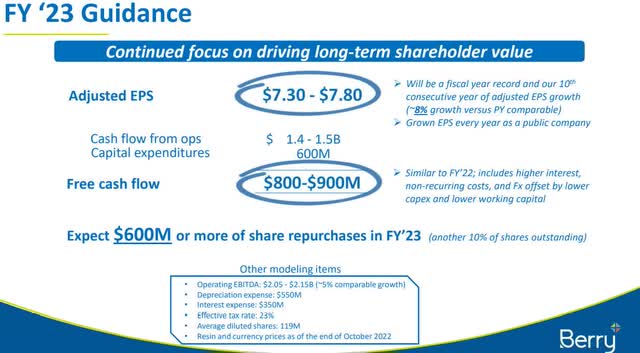

As for 2023, management guides for adjusted EPS to be in a range of $7.30 to $7.80, which would represent a fiscal record for the company if achieved.

Free cash flow for 2023 is projected to be from $800 million to $900 million, basically flat in comparison to 2023. The flat guidance is from the impact of higher interest rates, Fx and one-time costs.

Segments and performance

BERY competes in four segments: Consumer Packaging – International; Consumer Packaging – North America; Health, Hygiene, & Specialties; and Engineered Materials.

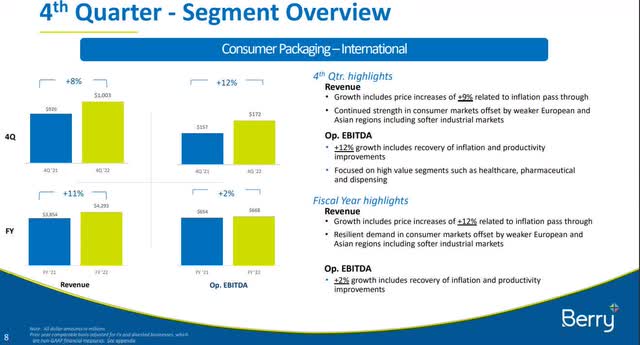

Consumer Packaging – International

Revenue in ‘Consumer Packaging – International’ was $1 billion, up 8 percent from the fourth fiscal quarter of 2021. Full-year revenue in the segment was $4.3 billion, up 11 percent year-over-year. That points to slowing sales at the end of its fiscal year.

Op. EBITDA for the quarter was $172 million, up 12 percent from the $157 million in Op. EBITDA from the same reporting period of 2021. Full-year op. EBITDA for 2022 was $668 million, up 2 percent from the $654 million in op. EBITDA for full-year 2021. While revenue in this segment slowed down in the second half of fiscal 2022, op. EBITDA accelerated during the same time frame.

Consumer Packaging – North America

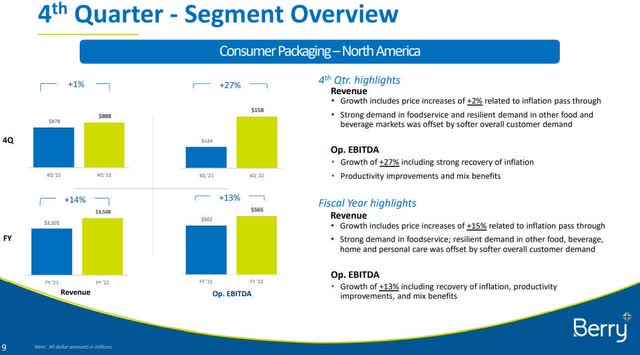

Revenue from ‘Consumer Packaging – North America’ for the fourth fiscal quarter of 2022 was $888 million, up 1 percent from the fourth fiscal quarter of 2021. Full-year revenue in the segment was $3.54 billion, up 14 percent from $3.1 billion in full-year revenue from 2021. That of course underscores the revenue slowdown in the reporting period.

Op. EBITDA in the fourth fiscal quarter of 2022 was $158 million, up 27 percent from the op. EBITDA of $124 million in the fourth fiscal quarter of 2021. Full-year op. EBITDA was $565 million, up 13 percent from the op. EBITDA of $502 million for the full-year 2021.

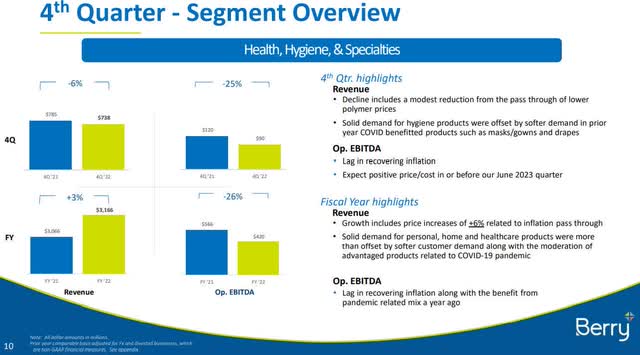

Health, Hygiene, & Specialties

Revenue in the fourth fiscal quarter of 2022 in ‘Health, Hygiene, & Specialties’ was $738 million, down 6 percent from the $785 million in revenue in the fourth fiscal quarter of 2021. Full-year revenue in the segment was $3.2 billion, up 3 percent from the $3.1 billion in full-year revenue from full-year 2021. Once again, this confirms slowing sales as measured against the prior quarters.

Op. EBITDA in the fourth fiscal quarter of 2022 was $90 million, down 25 percent from op. EBITDA of $120 million in the fourth fiscal quarter of 2021. Full-year op. EBITDA in the segment was $420 million, down 25 percent from full-year 2021 op. EBITDA of $566 million. Taking time to recover against inflation was the primary contributor to EBITDA underperformance in the quarter, and for all of 2022along with a decline in sales of products associated with COVID-19. The company believes by the end of the second half of calendar 2023 it should have a positive price-cost in the segment.

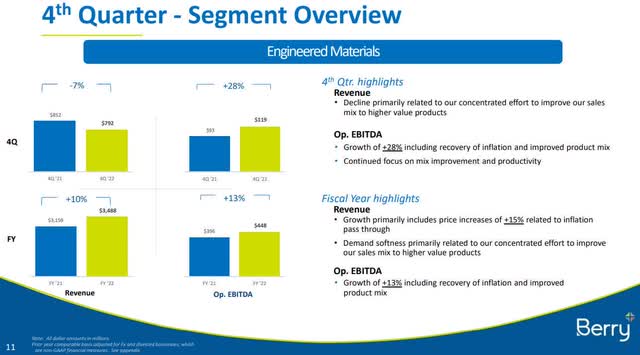

Engineered Materials

Revenue in the fourth fiscal quarter of 2022 in ‘Engineered Materials’ was $792 million, down 7 percent from the fourth fiscal quarter of 2021 of $852 million. Full-year revenue was $3.488 billion, up 10 percent from $3.159 million revenue for the full-year 2021.

Op. EBITDA in the fourth fiscal quarter of 2022 was $119 million, up 28 percent from the $93 million in op. EBITDA in the fourth fiscal quarter of 2022. Full-year op. EBITDA in the segment was $448 million, up 13 percent from 2021 full-year op. EBITDA of $396 million.

Taken as a whole, the decline in revenue reflected the overall drop in revenue for the fourth fiscal quarter of 2022, reinforcing the company was losing momentum on that front. At the same time, op. EBITDA remained robust, underscoring the strong cost management of the company as it responded to changing market conditions.

For the full fiscal year cost inflation was $1.6 billion, which was offset in 2022, but has room for improvement in fiscal 2023.

Conclusion

While the company has been performing well under in the current economic environment, it has been losing some momentum on the revenue side but remaining strong with EBITDA and free cash flow.

After the recent recovery of its share price from its 52-week low, I think the company is likely to correct again because of the expected weaker first half of 2023, based upon effects of seasonality, timing of actions taken concerning reducing costs, and the time lag associated with inflation recovery.

The company expects it to take the first half of calendar 2023 before getting things to where they want them in regard to inflation recovery and the impact of higher interest rates. With that in mind, I think the stock is likely to trade somewhat volatile within a tight range until there’s more visibility on how the company is dealing with cost containment and revenue growth over the next couple of quarters.

Since it generates so much free cash flow, I’m not concerned about its debt load and if there are ongoing slowdowns from macro-economic weakness. Even so, it could temporarily weigh on the performance of the company.

The company has paid down its debt by close to $3 million over the last three years, with $1 billion of that being during the last quarter. It has also been approved to acquire another $709 million in share purchases, and added a dividend, supporting the belief the company isn’t going to lack for free cash flow in the quarters and years ahead.

If considering taking a new position in BERY, I would suggest waiting for a pullback. For those already having a position in the company, it could be a good time to consider adding to your position once the share price falls again, because this is a good company that, over time, is going to continue to grow at a steady pace.

Be the first to comment