gsheldon

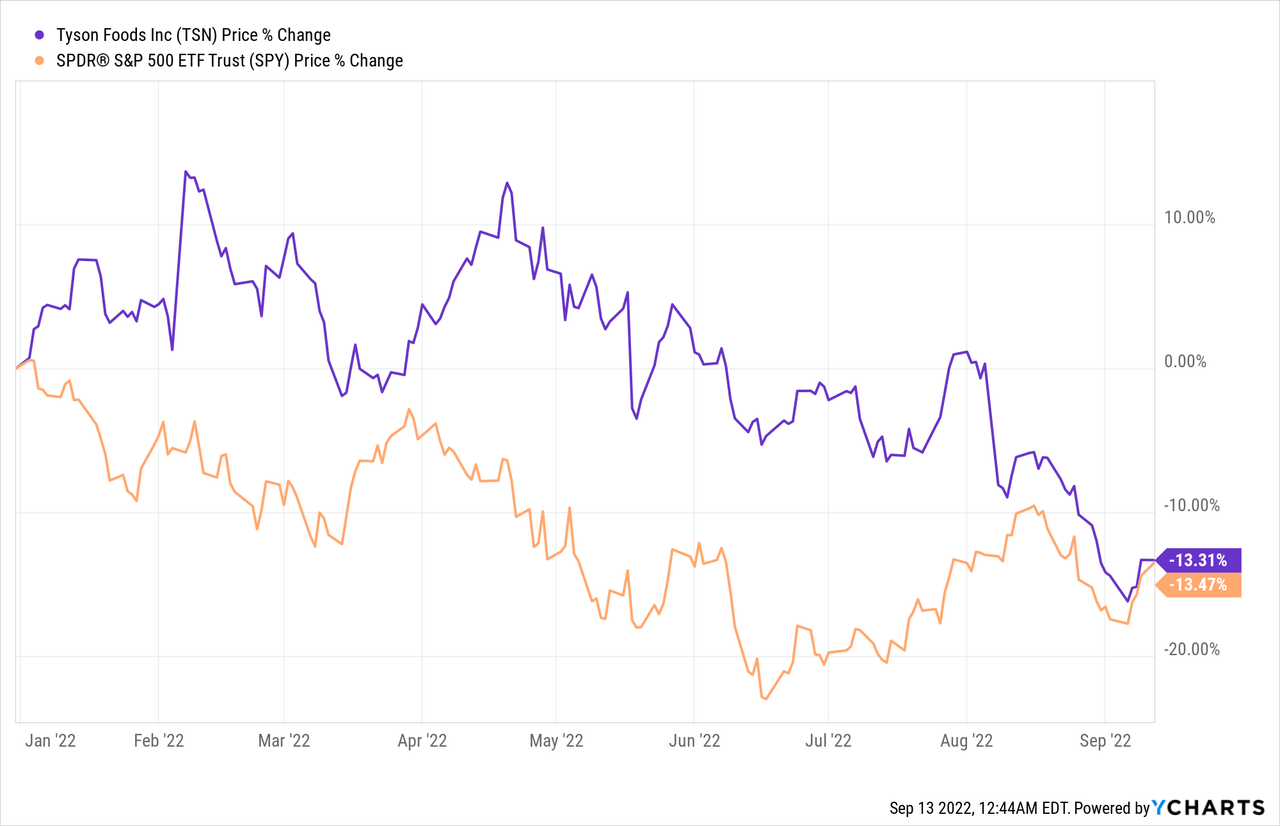

Tyson Foods, Inc. (NYSE:NYSE:TSN) is a long-standing, well-recognized business with strong pricing power and a sustainable dividend of 2%. While many stocks have been suffering significant losses year-to-date and the S&P500 is being down by more than 13%, TSN’s stock price has been in-line with the broader market decline period, particularly due to the recent earnings induced selloff.

In May 2022, we published an article titled: “Tyson Foods: A Good Place To Hide In A Volatile Market.” It highlighted the main factors that we believed made Tyson Foods stock a ”buy” at that time. In this article, we will revisit TSN and update our previous thesis, incorporating the new information obtained since May, including an updated view on the macroeconomic environment and the recent financial performance of the firm.

Before we start, let us point out why we rated TSN as a “buy” in May:

- Strong financial performance in the first quarter, partially driven by the high demand

- Attractive valuation based on a set of traditional price multiples

- Attractive strategic initiatives focusing on cost savings

- Strong track record of returning value to shareholders, including dividends and share buybacks.

Despite the recent selloff induced by its worse than expected earnings results and outlook, we still believe that Tyson Foods’ stock is attractive in the current market environment for three reasons.

1. Financial performance is not directly impacted by consumer sentiment

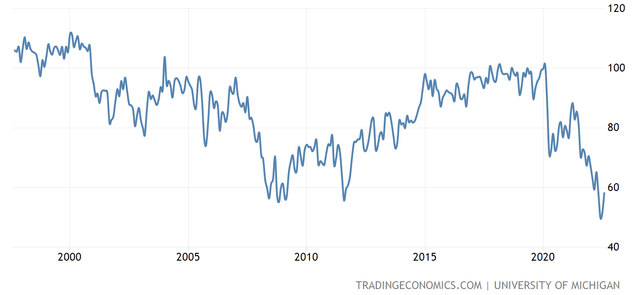

Consumer confidence – a leading economic indicator – is often used to estimate the potential changes in the consumer spending behavior in the near future. A low or declining confidence indicates that people are becoming less certain about their financial outlook and are more likely to start saving a larger portion of their income. This behavior is often expected to impact the demand for durable, discretionary, non-essential items. As TSN, together with its subsidiaries, operates as a food company worldwide in the consumer staples sector, their products could be categorized as essentials. While consumers switching to lower cost alternatives may have an impact on TSN’s financial performance, we believe that this impact is not likely to be substantial.

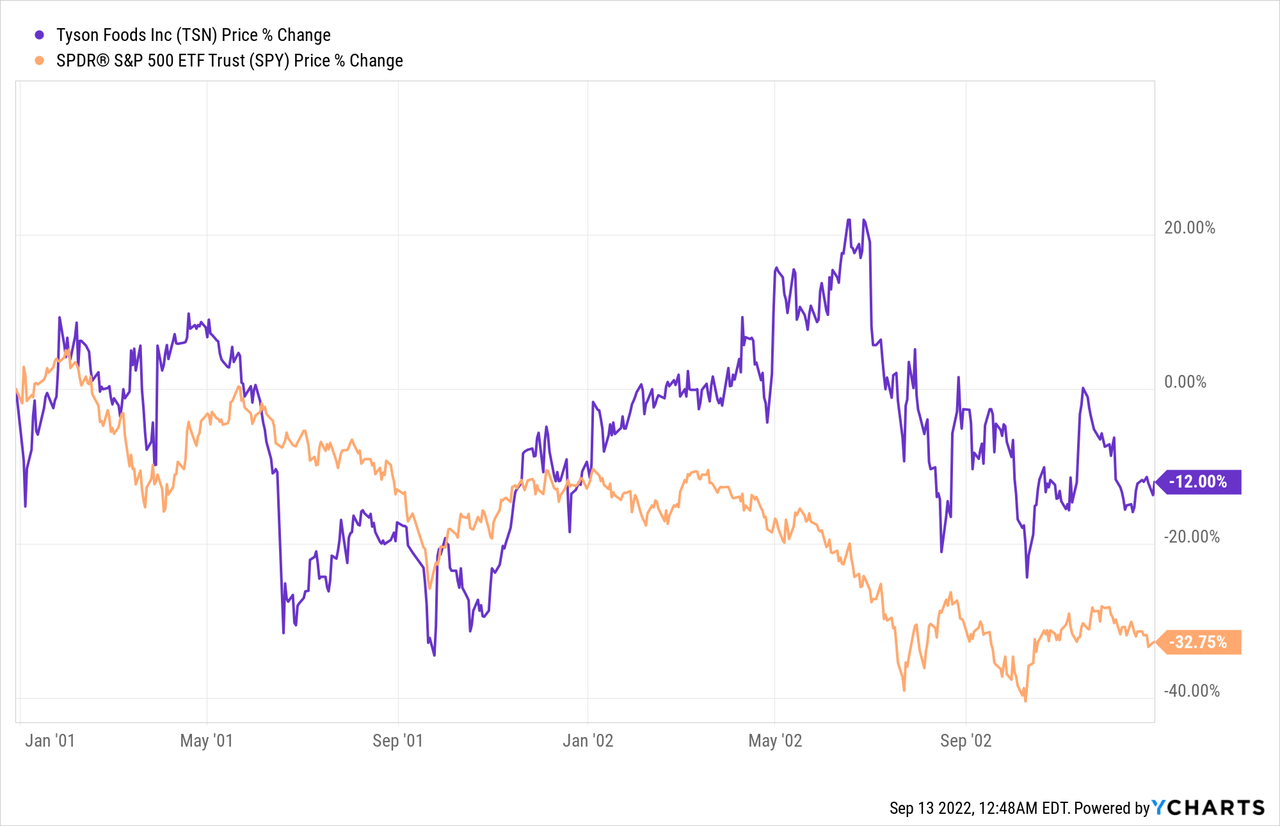

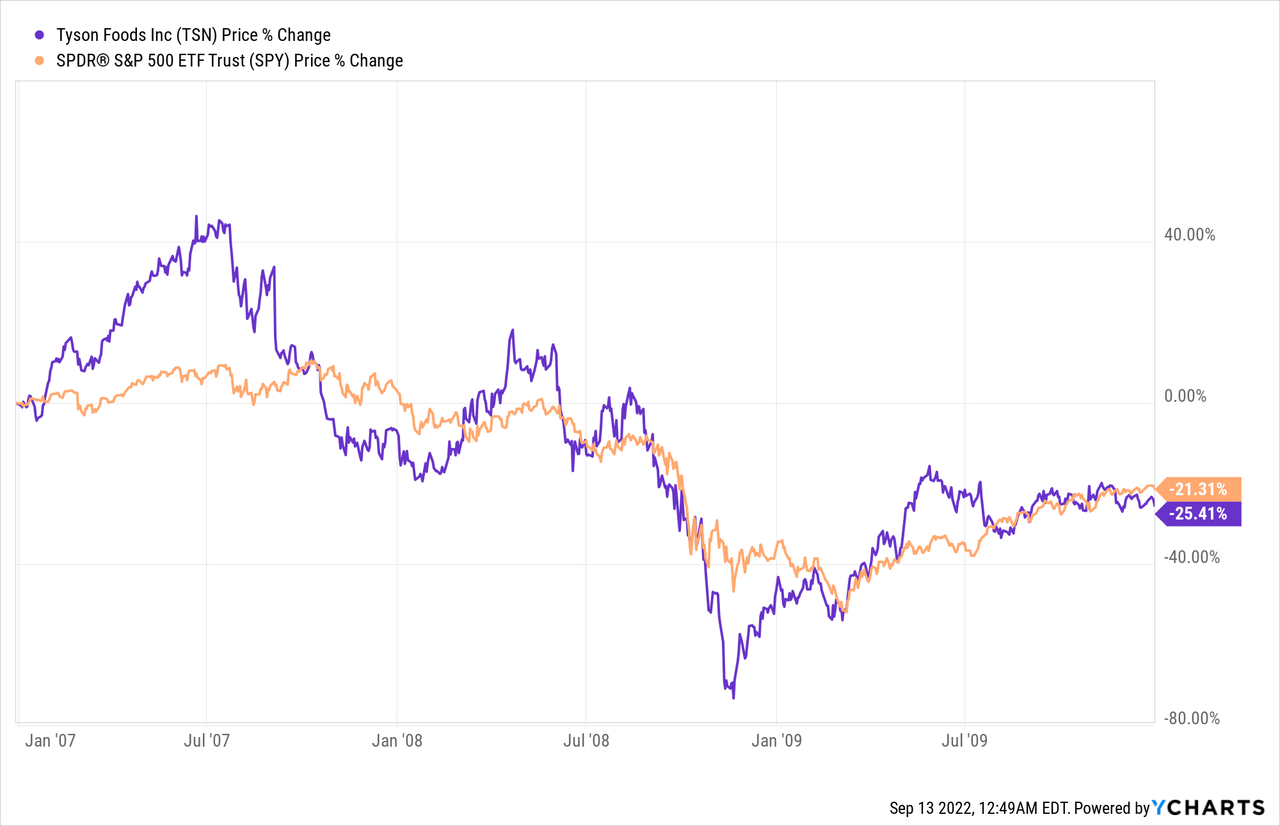

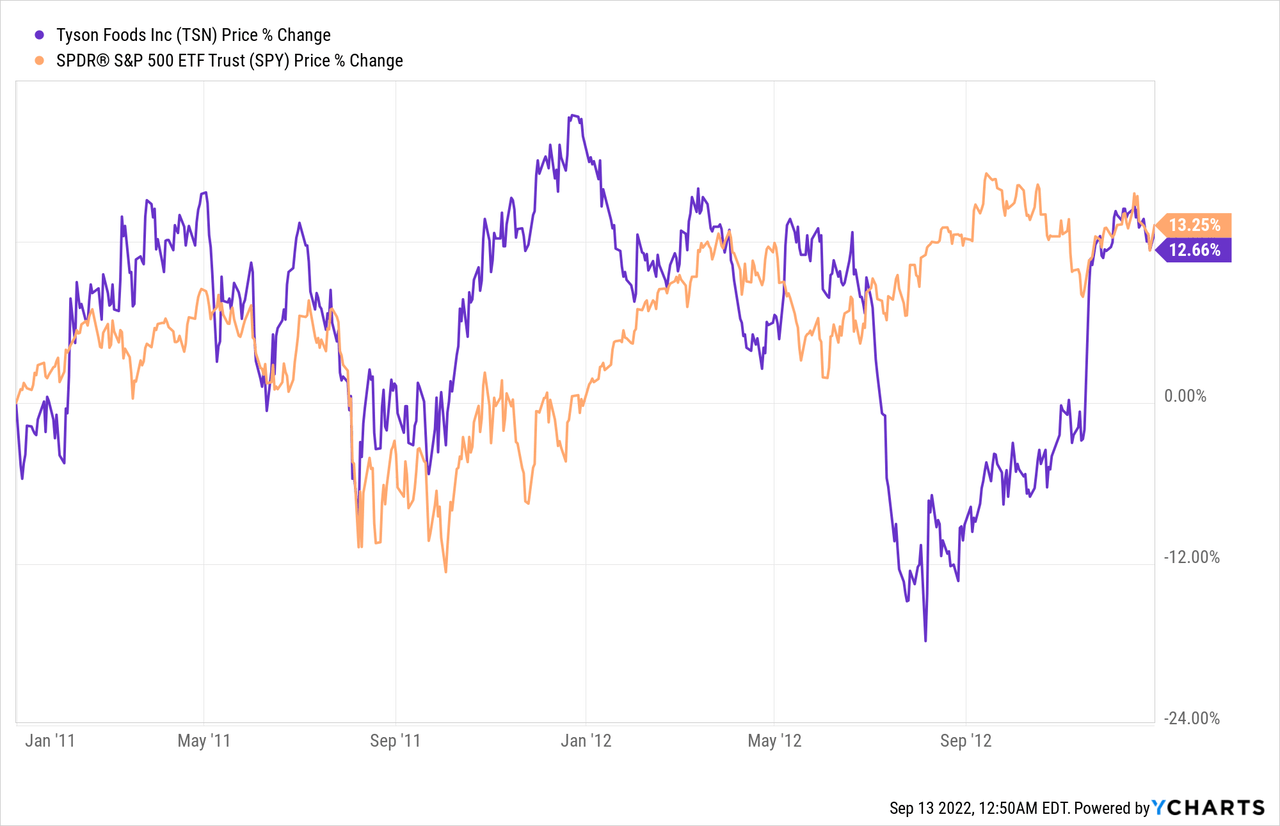

To support our thesis, let us take a look at how TSN’s stock has performed during periods of low consumer confidence in the last 20 years.

U.S. Consumer confidence (Tradingeconomics.com)

2001-2003

2007-2010

2011-2013

While elevated input costs and a tight labor market combined with supply chain disruptions keep negatively impacting TSN’s business, the demand for their products remains high. Although two out of three times TSN performed in-line with the broader market, in our opinion TSN is currently well-situated to outperform the broader market once again.

You may ask why? And this takes us to our next two reasons.

2. Tyson’s international segment is relatively small – financial performance is not significantly impacted by the strong USD against other currencies

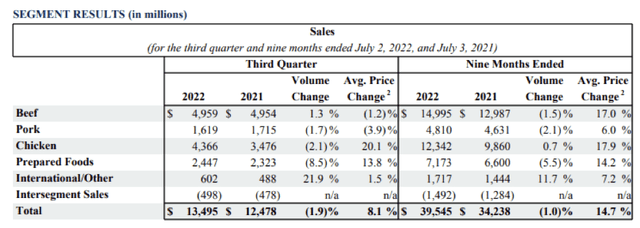

In 2022, many firms which are generating substantial revenue outside of the United States have been hurt by the currency exchange headwinds. While Tyson Foods operates internationally, only less than 5% of their revenue was generated in the international segment in Q3, ended July 2, 2022. Further, results are expected to be lower this year in the international segment due to COVID-19 related restrictions and supply chain disruptions.

Segment results (TSN)

For this reason, we believe that Tyson Foods is not that vulnerable to the currency headwinds as compared to some of its competitors.

3. Tyson Foods’ planned cost savings and investments are on track

In their latest quarterly report, the firm provided an outlook on their planned cost savings:

Beginning in fiscal 2022, we launched a new productivity program, which is designed to drive a better, faster and more agile organization that is supported by a culture of continuous improvement and faster decision making. We are targeting $1 billion in productivity savings by the end of fiscal 2024 and more than $400 million in fiscal 2022, relative to a fiscal 2021 cost baseline. We are currently on track to achieve our planned productivity savings for fiscal 2022.

Also a positive sign that the firm is actively working on the mitigation of labor related challenges and actively investing to expand capacity and improve automation.

We expect capital expenditures of approximately $1.9 billion for fiscal 2022. Capital expenditures include spending for capacity expansion and utilization, automation to alleviate labor challenges and brand and product innovation.

In our opinion, focusing on future objectives even, when the current market environment is quite uncertain, can make Tyson Foods a better and more efficient company in the years to come.

Key takeaways

Since May 2022, the macroeconomic environment has not improved materially. Input prices have remained elevated, supply chain constraint still impact Tyson’s performance and a tight labor market keeps creating headwinds. On the other hand, TSN is not likely to be significantly impacted by the current low consumer confidence.

TSN’s progress with its cost reduction and efficiency improvement initiatives to reduce the impact of labor shortages is going according to plan. These initiatives are likely to result in an improvement of the financial results in the years to come.

Tyson Foods is not as impacted by the currency exchange headwinds as are some of its competitors, because its revenue from the international segment accounts for less than 5% of the total revenue.

For these reasons, we reiterate our “buy” rating on the stock.

Be the first to comment