MF3d

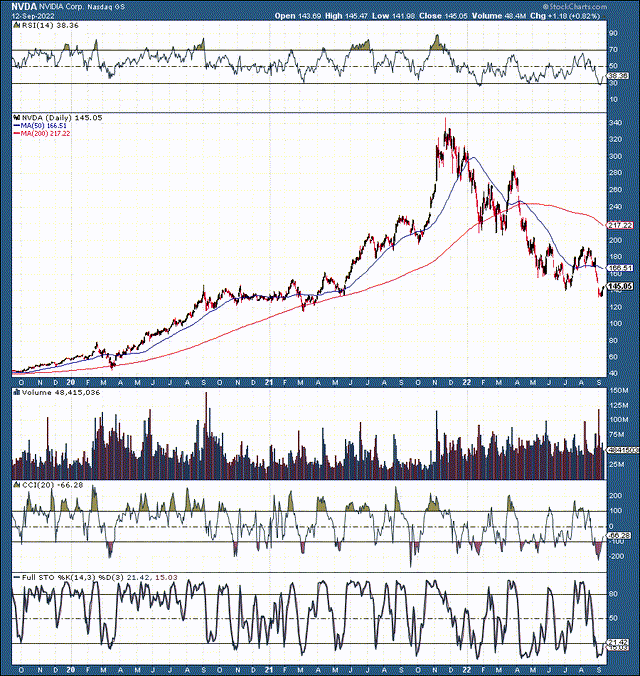

I posted a sell alert article on Nvidia (NASDAQ:NASDAQ:NVDA) around the stock’s recent highs. Since Nvidia’s high in mid-August, the stock dropped by about $60 or roughly 30%. Now, I also want to disclose that this was not my first top call on Nvidia, as I used Nvidia’s incredibly overvalued stock as a prime example to point out the tech top last fall. But I’m not here to bash Nvidia. Instead, I just want to be clear that Nvidia is an excellent company that often has an inflated stock price.

Nevertheless, I have owned Nvidia, and the stock has brought remarkable gains over the years. While the company is facing near and intermediate-term problems, there are several bright spots to consider, especially longer-term. As the bear market persists, Nvidia’s stock price could hit a new low. However, longer-term Nvidia has extraordinary growth and profitability potential, and its stock price will likely appreciate considerably as the company advances in future years.

Nvidia Stock – Often Gets Ahead Of Itself

Nvidia’s stock got ahead of itself in recent years. We saw remarkable appreciation from about $40 in 2019 to roughly $350 in 2021. In fact, Nvidia’s stock price got so vertical that it was one of the most prominent signals that the tech top of 2021 was about to blow off. At its 2021 highs, Nvidia was trading at around 100 times TTM non-GAAP EPS and 40 times TTM sales. Now, the stock has been doing quite a bit of deflating since the bubble popped, and there may be more downside in the coming months.

Additionally, Nvidia is experiencing fundamental issues as its cryptocurrency and gaming businesses decline. The company recently delivered lower than anticipated revenues and profitability results. Moreover, Nvidia guided lower its Q3 revenues to just $5.9 billion vs. nearly $7 billion (previously estimated). Furthermore, there will likely be additional downward EPS and revenue revisions in the coming quarters. Therefore, the stock could experience more pain soon. Nevertheless, Nvidia’s problems are transitory. The company’s revenue growth, profitability, and stock price will recover after this temporary downturn. Consequently, I am rating Nvidia a hold here and reiterating my buy-in price target range in the $100-120 zone.

The Bad News – Getting Priced In Now

Yes, we know about Nvidia’s crashing cryptocurrency business. Nvidia said its crypto mining segment declined by approximately 66% YoY to just $140 million in revenues in Q2. While this decline may seem massive, let’s keep things in perspective. $140 million represents only around 2% of Q2’s total revenues for Nvidia. Therefore, the crypto mining segment is much less significant for Nvidia long term than some may think. As a bonus, Nvidia’s revenues could get an additional boost if mining GPU sales start booming again in the next crypto bull cycle.

The Gaming Slowdown Is Transitory

Nvidia’s gaming revenues dropped by a whopping 33% YoY. While this decline is significant, it can be explained by several phenomena. First, there was a massive increase in gaming interest throughout the coronavirus pandemic and subsequent lockdowns and shutdowns. Billions of people were shuttered indoors, and many resorted to gaming. The gaming boom also increased GPU prices, creating shortages, price spikes, and higher revenues for Nvidia.

However, now that billions of people are vaccinated against the coronavirus, more people are spending time outdoors, and a fewer percentage of people are sitting indoors playing video games. Therefore, GPU demand is lower, GPU prices are down, and Nvidia’s gaming revenue is slumping.

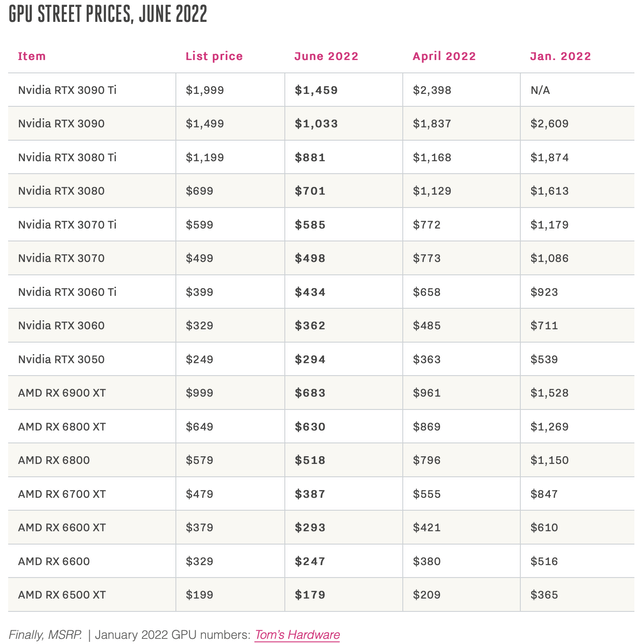

GPU Price Trend

At the start of this year, we had many top GPUs selling at two times MSRP or higher due to the lingering chip shortage. Moreover, in April, prices were still quite inflated, selling well above MSRP in most cases. However, we see a steep drop in June, with the most expensive GPUs dropping below MSRP.

Nvidia RTX 3080

The RTX 3080, one of Nvidia’s best-selling GPUs, has dropped from a price of nearly $2,000 to just around $700 in recent months. This chart provides insight into the GPU market and Nvidia’s gaming revenue dilemma. GPU prices came up too high too quickly and essentially had one way to go, down. However, this dynamic is not a permanent problem, as the market will digest the GPU issue and should normalize in time. Nvidia’s gaming revenues should not continue their decline for long. Nvidia produces (arguably) the best discrete GPUs and remains the dominant leader in this market globally.

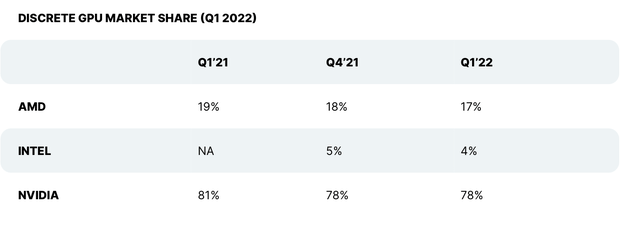

Nvidia dominates the discrete GPU market. Due to its products’ high quality, performance, and durability, the company will likely continue dominating the space for many years. Therefore, while Nvidia is experiencing gaming revenue declines, this should not be an ongoing issue. We must also consider the global economic slowdown and the Russia/Ukraine war disrupting sales. In time, the global downturn will conclude, Nvidia’s gaming revenues will straighten out, and the company’s gaming segment should begin growing again.

Now, The Bright Spot

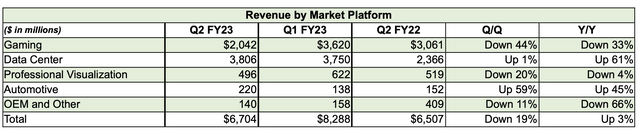

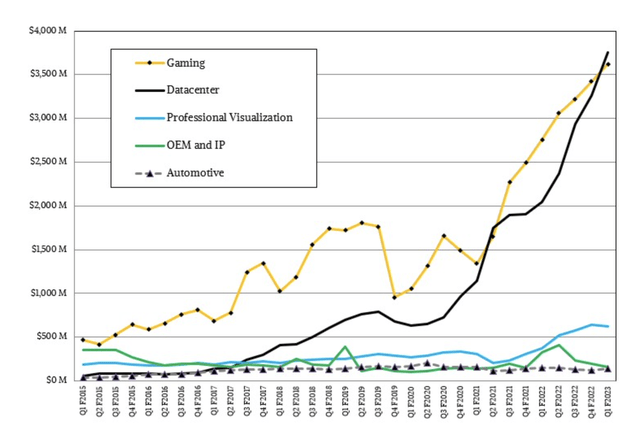

Nvidia revenues (investor.nvidia.com )

Nvidia posted a 61% YoY revenue surge in its data center business. With more than $3.8 billion in revenues last quarter Nvidia’s data center segment is its most prominent business now.

Data Center Surpassing Gaming in Q1

We see the surging data center business surpassing gaming revenues in Q1. We should continue seeing the positive trend in data center growth as Nvidia grows more prominent in this space. Additionally, once Nvidia’s gaming revenues return to growth we should see combined revenue growth accelerate. Further, Nvidia is expanding its operations in AI and the automotive industry, delivering 45% YoY sales growth last quarter. With time, this relatively small revenue stream should transition into a revenue growth pipeline for Nvidia.

Price Projections

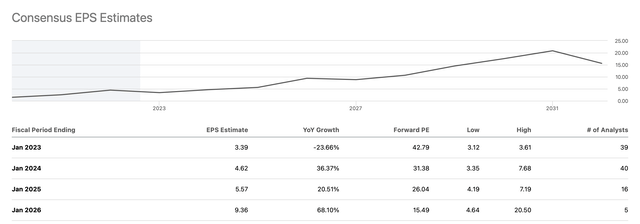

EPS estimates (SeekingAlpha.com)

While Nvidia is going through a period of EPS decline, the downtick will likely be temporary. We should see Nvidia’s EPS recover and reach around $6-7 in fiscal 2025, and the company may earn approximately $10 in fiscal 2026 (fiscal 2026 is essentially the calendar year 2025). Given that we are looking out several years in advance and uncertainty regarding several fundamental factors exists, Nvidia’s current forward P/E of about 25 times fiscal 2025 and 15 times fiscal 2026 EPS projections seem high.

However, Nvidia will become much more attractive with its stock price at around $100. If the company earns in the mid-range of my estimates (roughly $6.50 in fiscal 2025/calendar 2024), it will be trading at only around 15 times 2024 estimates. Likewise, if the stock drops to $100, Nvidia will sell at only about ten times 2025 (calendar) estimates. If we’re assessing earnings shorter-term, I’m looking for about $5.50 in EPS next year. This projection places Nvidia’s forward P/E ratio in the 18-22 range if the stock drops to the $100-120 level. Therefore, the $100-120 range is a highly attractive entry zone for Nvidia’s stock.

Also, longer-term shares could go much higher:

| Year (fiscal) | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 |

| Revenue Bs | $27 | $32 | $38 | $45 | $54 | $65 |

| Revenue growth | 1% | 18.5% | 19% | 18.4% | 20% | 20% |

| EPS | $3.40 | $5.50 | $6.50 | $10 | $12.50 | $15 |

| Forward P/E ratio | 22 | 23 | 24 | 25 | 25 | 25 |

| Stock price | $120 | $150 | $240 | $313 | $375 | $450 |

Source: The Financial Prophet

It will be difficult not to see Nvidia go significantly higher as the company’s earnings improve in the coming years. As the company’s profits straighten out, even a relatively low forward P/E multiple of 25 or below should enable shares to move significantly higher as we advance. Thus, the stock could appreciate by 100-200% over the next few years. Consequently, you have a decision to make. You can buy the stock now around the $140-150 and risk having it going lower in the near or intermediate term. Or you can hold off and wait for the $100-120 buy-in range but risk missing out on buying Nvidia if it doesn’t decline that low. You also have a third option, to initiate a partial position now, and wait to see if you can pick up shares at a lower level. However, regardless of the case, it seems like Nvidia is a solid long-term investment, and the company’s stock should be considerably higher several years from now.

Risks to Nvidia

While I am bullish on Nvidia in the intermediate and longer-term, technically, we are still in a bear market. Therefore, we may see the stock bottom out at a lower level. In a bearish-case scenario, Nvidia may find its base around the $120 level. However, near-term declines should be transitory and not affect my stock’s intermediate/long-term price target. Additionally, Nvidia could face increased competition in the GPU sector and other areas the company operates in.

Moreover, the company could face margin pressure due to higher costs associated with inflation, leading to decreased profitability. Ultimately, the company could deliver less growth and worse EPS than my estimated forecast. Investors should scrutinize these and other risks before investing in Nvidia.

Be the first to comment