bjdlzx/E+ via Getty Images

The market tends to overreact. Goldman Sachs, late to the party once again, has adjusted its oil forecast to average $135 / barrel for the remainder of the year. The group also expects summer prices towards $160 / barrel, with gas prices to match, in a difficult environment. As we’ll see throughout this article, we expect prices to actually come down from current levels.

Russia vs. Ukraine

The largest impact on the markets is the war between Russia and Ukraine, as Russia invaded the Democratic country. Western nations reacted with strong support of Ukraine and substantial sanctions on Russia, one of the largest global crude oil exporters. That has put substantial pressure on the overall markets at a time when demand is increasing significantly.

However, Russia is running out of allies and struggling. The company has recently changed the scope of its campaign to focus on the east of the country, and China’s President Xi has recently pushed the company to surrender. The company has minimal allies although its finances have been supported in the immediate term by prices.

Eventually, though, we expect the battle to slowdown. Rumor has it that Russia used up a substantial part of its capacity early in the battle to position itself well. The country is struggling. While we are by no means an expert on the situation, we expect that Russia will power through until getting a victory that can be used for propaganda purposes, and then back up.

Whether that will result in reduced sanctions remains to be seen. However, even if it doesn’t, over the coming months other countries will reduce their reliance on Russia.

Demand Destruction

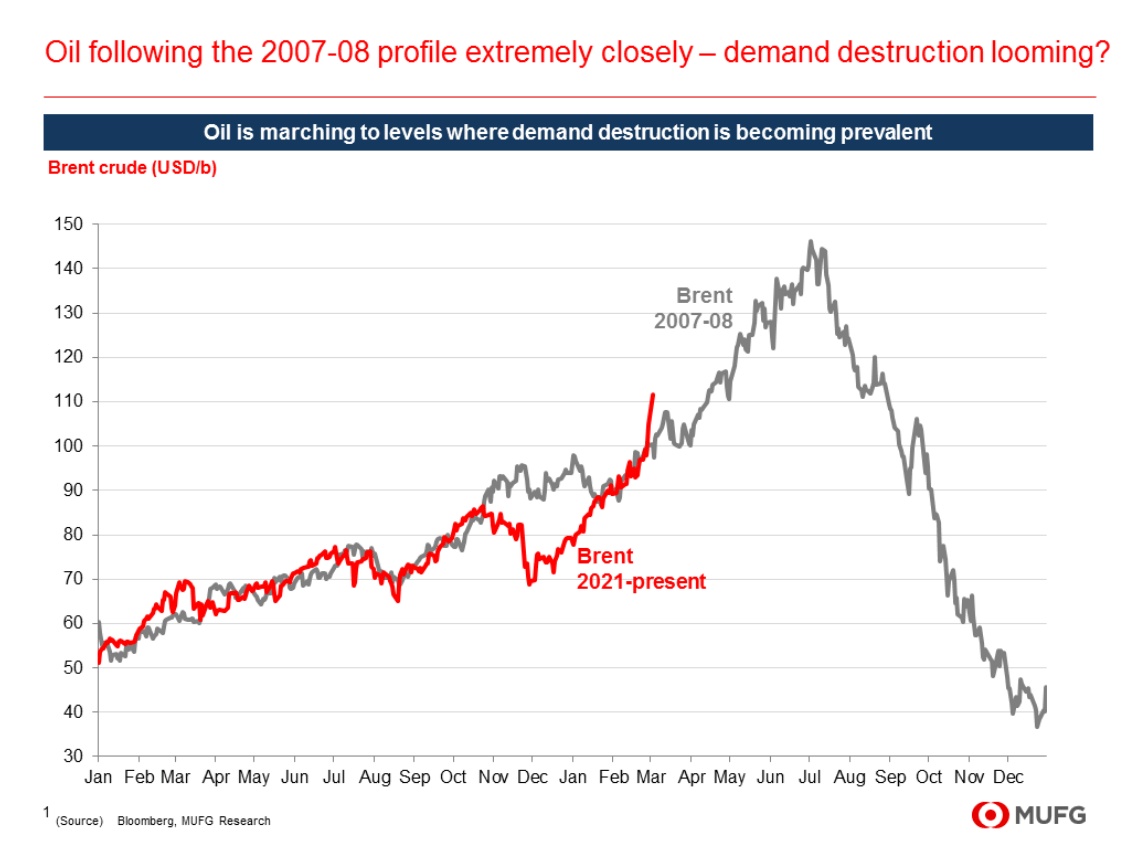

Additionally, with gasoline topping $5 / gallon for the first time ever, we expect demand destruction to increase, especially with family budgets hurt by the overall spending environment.

Despite the summer driving season coming, we expect that families will be looking to travel less given current prices, or potentially do shorter trips. Expensive airfare, as scheduling issues lead to cancelled flights, will also lead to lower fuel demand in the market, helping to keep prices from increasing rapidly.

The U.S. is beginning to see some signs of demand destruction in motor fuel oil, and we expect that to increase. Despite a recovering economy, with travel reopening from COVID-19, we see current demand at the current prices as close to the peak.

Supply Growth

At the same time, it’s worth noting, that while it might not be the top story talked about, supply is growing.

While OPEC+ has struggled to match promised production, it is slowly increasing production. The organize has forecast additional growth. Non-OPEC+ growth is expected to be in the millions of barrels per day. That means overall crude oil production can be comfortably expected to grow by millions of barrels / day.

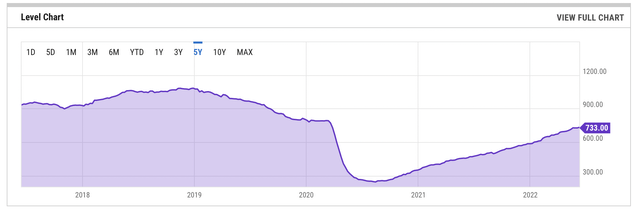

U.S. rig count has been growing very steadily since the mid-2020 lows at less than 300 rigs. They’ve more than doubled and we expect that number to continue expanding significantly over the coming months. The U.S. rig count has been increasing by 20-30 / month meaning it could finish the year at more than 900 rigs.

As WTI prices remain at more than $100 / barrel, combined with the rapid turnaround of shale drilling, we expect companies to maximize taking advantage. U.S. crude supply is expected to grow by 1 million barrels / day from 2022 to 2023, and eventually as demand moderates we expect supply to come up.

Our View

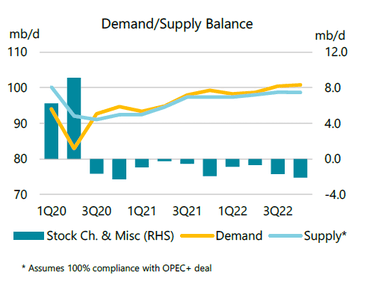

The oil demand / supply balance is expected to remain favoring demand, but we expect that to remain moderate.

Demand / Supply Balance – Oil and Gas Journal

The excess crude oil demand is expected to be roughly 1-2 million barrels / day going into the end of the year. Million of barrels of expected supply over the upcoming years will help balance this out, however, in the meantime, stocks will be drawn. However, it’s also worth noting we see less demand destruction in the forecasts than we expect.

We expect prices to average at more than $100 / barrel for the remainder of the year, however, we don’t expect prices to be near the $135-140 / barrel average others are forecasting. We expect demand destruction to help keep prices low. Going into next week we expect prices to stay at $70-80 long-term which seems to be a strong steady long-term for the markets.

Thesis Risk

The largest risk to the thesis is the amount of volatile factors in the economy. Sanctions against Russia are increasing as long as the conflict continues. Companies are reluctant to invest in long-term supply. People are looking forward to travel as the market reopens. The amount of volatility in the markets could support a substantial short-term increase in prices if tough black swan factors line up (i.e., a strong Gulf hurricane season)

Conclusion

Forecasts are now calling for $140+ / barrel oil prices. After being wrong the first time, no one wants to risk being wrong the second time. However, despite these predictions, we don’t expect prices to hit these levels without a confluence of negative factors. We instead expect prices to stay above $100 / barrel, but more near current factors.

This could have substantial effects on investing. Several companies are already overvalued in the industry and we could see that number increase. Investors should be extra cautious about the energy stocks they choose to invest in, versus the fire sales of previous months. Let us know your thoughts in the comments below.

Be the first to comment