You want shares of AMT? Go get your own.

ajr_images/iStock via Getty Images

When Seeking Alpha reached a deal with Getty Images for the images at the start of articles, it probably seemed like I wouldn’t be able to find any cat memes. Wrong. Not quite as wrong as investors who doubt tower REITs, but still wrong.

There are a few REITs we think investors should be overweight in their portfolio. That small batch of REITs include all 3 tower REITs:

At recent valuations, AMT and CCI lead the way. These two tower REITs are trading in line with historical average valuations. That may not sound like much, but several REIT subsectors are trading at an absurd premium to their historical averages.

Keep It Simple

We’ve done plenty of articles where we dig deep into the fundamentals for each type of REIT. We’ve done it so often that I think it is time to provide an article focusing on the big picture view.

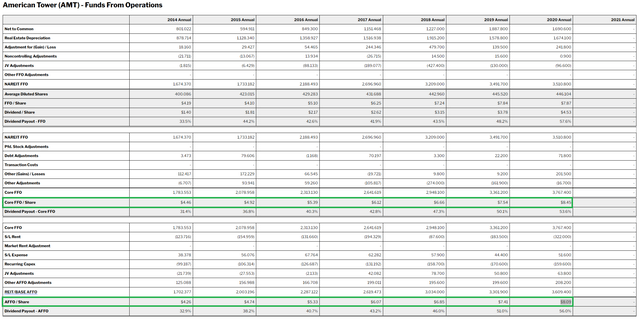

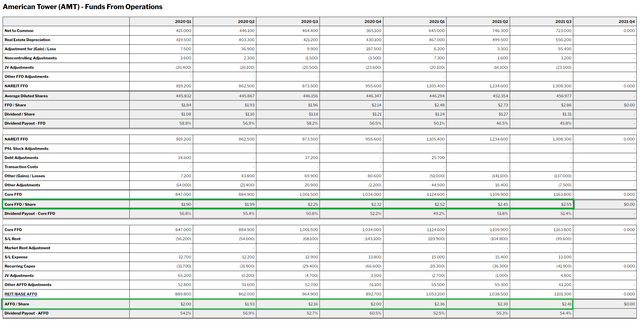

If you’re new to our analysis on tower REITs, the following chart may help:

You’ll notice that over a decade there has hardly been a dip in projected AFFO per share for AMT. There has hardly been a period where it went flat. It is a simple slope going up and to the right. That’s how AMT’s business model works.

One argument I heard against AMT recently is that the growth of 5G will be a “domestic phenomenon” and therefore investors should avoid AMT since AMT has the highest level of exposure to international revenue. It’s true that right now 5G will primarily be a domestic phenomenon. Do you know why? Because the carriers in many other countries are still rapidly building out their 4G networks.

What happens when they build those networks? They lease space from tower operators like AMT.

The domestic carriers are still rapidly spending on deploying their 5G networks as well. Remember that the domestic carriers have already sold customers on the 5G networks, but they don’t actually have it. The current level of real 5G coverage in the United States remains dramatically below the level being advertised.

What separates real 5G from fake 5G? Speed. It’s possible to have a network classified as 5G without running at the speeds enabled by 5G. Why would the carriers do that? Because it lets them cover more area in less time, with a weaker service. That way they can technically have a 5G network in place while they build the real network.

Revenue Benefits Shareholders

Where does AMT’s revenue go? Part of it goes to paying out the dividend, but there is also a significant chunk of AFFO per share that is retained for additional development, acquisitions, debt reduction, or share buybacks.

Since there are multiple definitions for “AFFO”, we’re going to be using REIT/BASE AFFO:

Notice that most Core FFO per share ends up in REIT/BASE AFFO per share. That’s great. The cash AMT is able to collect from tenants is not devoured by other expenses. It isn’t going into a huge budget for recurring capex. It isn’t disappearing when we adjust for straight-lining rents. While those factors do reduce the number, they only create a very small drag on the results.

Further, you’re able to see that the numbers go up and to the right again. If there was some doubt about whether the consensus analyst estimates for forward AFFO per share were accurate, the values from REIT/BASE confirm that the REIT has continued to generate increasing cash flows year after year.

Some investors might think the issue is AMT’s growth rate falling off in 2021, but it was another monster year:

Think 2022 is going to be dreadful? That’s doubtful given management has been very optimistic on the sector. There’s a bit of a headwind with the situation from T-Mobile (NASDAQ:TMUS) and Sprint merging a while back. Some of those contracts are still running off the books. Sounds bad, right? Yet management is still indicating that we’re in an excellent environment. DISH Network (NASDAQ:DISH) still needs to build its network. Verizon (NYSE:VZ) and AT&T (NYSE:T) are spending tens of billions on building their network.

Do investors understand that “building their network” means “leasing more tower space and installing equipment”?

Think your new Apple (NASDAQ:AAPL) phone is great? Probably not so great without internet access. The tower REITs are the critical step between a consumer’s phone and the internet. It’s a good place to be. Because they can lease space on the same tower to multiple carriers, it is in the carrier’s best interest to use the tower REIT rather than to own their own towers.

The 15 Year Cycle

When Rod Smith, CFO of American Tower (AMT), presented at the UBS Global TMT Virtual Conference, they were exceptionally bullish on the long-term fundamentals for the tower business. I want to highlight some comments from the transcript:

And then the final point that you made relative to the audience question around the carriers, not aggressively deploying 5G. Yes, the one thing to really note it — to note is that the 5G deployments is not something that happens quickly and over the short-term. It is a long-term investment cycle for the carriers. That’s the way we view it. That’s what we’ve seen with every other technology upgrade across time and across our networks of towers. We started in 3G and 4G, the 4G investment cycle was north of 15 years or so where the carriers are investing in that network and bringing it up.

So when they initially turn on 5G, they can do that using a lot of lower band spectrum and get nationwide coverage. But as and when they need lower latency on their handsets, and the subscribers demand a truer 5G service, that’s going to require the mid band spectrum to be pulled into the networks. When that happens, the mid-band spectrum propagates less far, less well compared to the lower-band spectrum. So then there’s a whole cycle of [filling in] and densifying network, that’ll be a multiyear investment cycle to get that done. And that is more and more applications become available in the capacity of data, the data consumption and the capacity requirements go through the roof continue to grow, 30% a year over time, they’re going to need to continue to invest in those networks.

What Are People Buying?

The REIT sector is getting exciting again as investors have been supporting the valuations of dramatically weaker REITs. What’s a weak REIT? How about one with a poor balance sheet and poor growth in AFFO per share? I don’t want to distract from this article by slamming a bunch of them, but I’ll put it in the notes for another time.

Prior Mention

We discussed our interest in increasing our position last week in an article on AMT.

Trade Alert

We decided to increase our position since the market is offering such a nice deal on the tower REITs. This article actually comes from the real-time trade alert on The REIT Forum.

Execution

Schwab

Note: The weighted average is $246.2099, which I rounded up to $246.21.

AMT saw continued weakness and is down over 5% from our last purchase. Great time to boost our allocation again. As has often been the case, we are increasing positions when our top choices get cheaper.

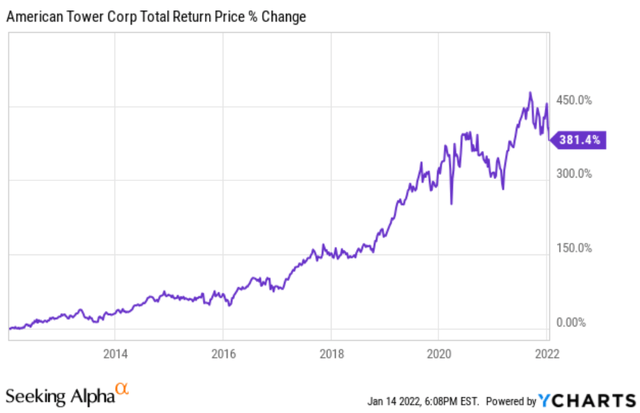

Some investors may be concerned because AMT is plunging:

YCHARTS

Shares are down and we believe they are a bargain, but they’ve still generated a substantial return for shareholders:

YCHARTS

This isn’t the end of AMT, it’s just a nice opportunity to get a better entry price.

Account

These trades were placed in our taxable account.

We expect to hold these shares of AMT indefinitely and the shares carry a low dividend yield. That combination is favorable for placing them in our taxable account.

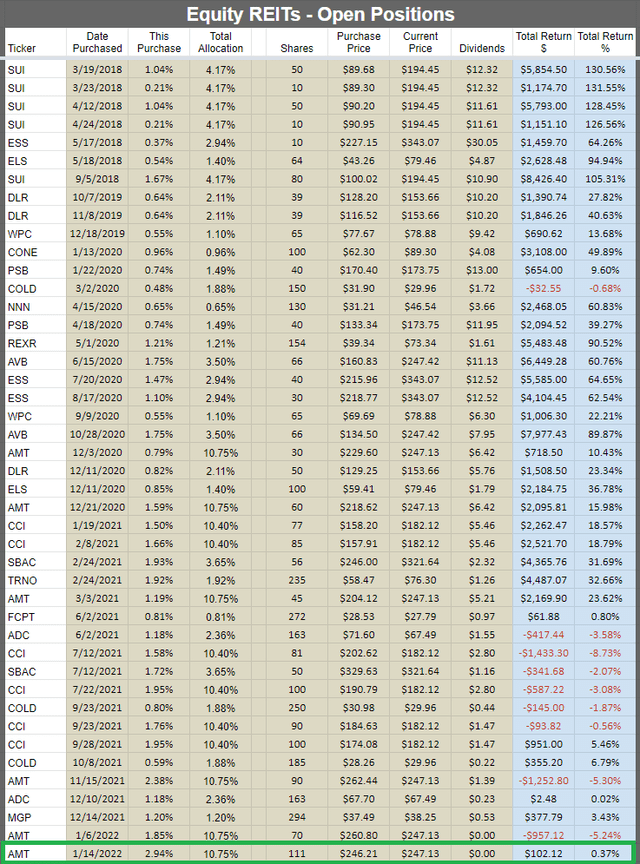

Returns for Open Positions

The returns on our open equity REIT positions are shown below:

The REIT Forum

In the disclosure, I’ll tag the article indicating that I’m long AMT, CCI, and SBAC because we own shares in each of those REITs and explicitly mentioned them in the article. However, we also own shares in the other REITs included in the image. They don’t go in the disclosure area because they haven’t been tagged in the article. Sometimes that can be confusing for a new reader.

You may also notice that we bought shares of AMT on 1/6/2022 at $260.80. I’m confident that those shares will turn out well also. To be fair, we’ve purchased shares a few times. All of the transactions are in the chart. With the lower price, we simply wanted to buy even more.

Conclusion

AMT’s fundamentals remain strong. This looks like another market overreaction to concerns that growth might temporarily slow from outstanding to very good. We’ve seen this before, but the unique wrinkle this time is that it happens while most of the rest of the market remains very expensive. That’s wonderful for finding an opportunity when fewer remain.

As exciting as the current weakness in the price can be, in a few years, I expect this will be no more than a memory of a time when investors were able to get better entry prices.

Ratings:

Be the first to comment