ronstik

With a market capitalization of $9.65 billion as of this writing, Watsco (NYSE:WSO) is a sizable player in the air conditioning, heating, and refrigeration equipment business. In recent years, financial performance achieved by the company has been rather impressive. So far for 2022, management has demonstrated continued strength. Having said that, it’s also important to note that management expects current market conditions to begin to weigh on the company’s top and bottom lines. In fact, although we are still only halfway through the company’s 2022 fiscal year from a reporting perspective, management has already said that recent changes in monetary policy aimed at curbing inflation, as well as the consequential slowdown in the economy, should lead, when combined with other catalysts, toward financial results the more or less match historical levels. What exactly this means from a dollar perspective is anybody’s guess. But it’s safe to assume that the near-term outlook for the company will be less appealing than the recent past has been. Despite this, shares are still priced at levels that are not necessarily unreasonable. Assuming the company can achieve the level of profitability experienced during the 2021 fiscal year, the stock probably does not look any worse off than being fairly valued. Having said that, investors would be wise to keep a close eye on the enterprise and what comes out from it. Because if the financial condition worsens beyond that point, investors could be in store for some pain moving forward.

Checking in on Watsco

Back in late April of this year, I wrote an article that took a rather neutral stance on Watsco. Even though I acknowledged that the company had done incredibly well in recent years from a fundamental perspective, and that the long-term outlook for the company was favorable, I also said that shares were priced at levels that did not make it a great opportunity at that time. Balancing out the company’s fundamental performance and growth with the pricing of the stock, I ended up rating the company a ‘hold’, reflecting my belief that it would likely generate returns for investors that more or less matched the broader market for the foreseeable future. Since then, the company has delivered along these lines. While the S&P 500 is down by 12.2% since the publication of that article, shares of Watsco have generated a loss for investors of 10.1%.

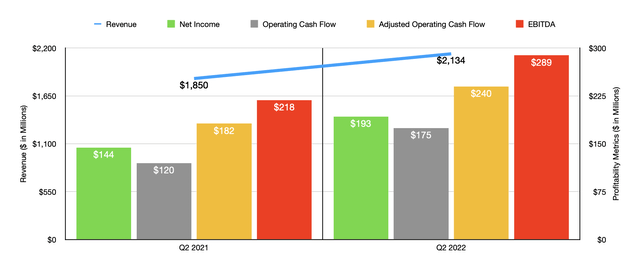

For investors looking only at the numbers, any sort of downside during this window of time may seem peculiar. To see what I mean, we should check in and look at the fundamental performance of the company for the second quarter of its 2022 fiscal year. This is the only quarter for which data is now available that was not available when I last wrote about it. Sales for that quarter came in strong at $2.13 billion. That’s 15.4% higher than the $1.85 billion generated one year earlier. On a same-store basis, the company saw revenue grow by 14% year over year with sales associated with its HVAC offerings rising largely because of higher prices and a higher mix of high-efficiency air conditioning and heating systems. Combined, these factors pushed sales prices up by roughly 16%, while the company was hit to the tune of just 1% from lower volume. In absolute dollar terms, the company benefited to the tune of $11.2 million from sales associated with new locations acquired and to the tune of 14.3% from other locations opened over the prior 12 months, some of which was offset by $5.2 million from locations that ended up being closed.

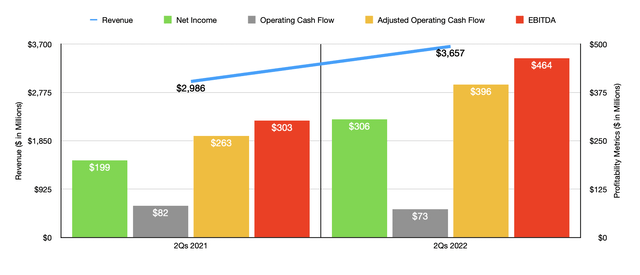

With this increase in revenue, particularly driven by higher pricing and product mix, the company also experienced an improvement in profitability. Net income in the second quarter came in at $192.6 million. This translates to a year-over-year increase of 33.7% compared to the $144.1 million reported in the second quarter of 2021. Operating cash flow rose from $119.6 million to $174.7 million. If we adjust for changes in working capital, it would have still risen, climbing from $181.7 million to $239.9 million. We also saw an improvement when it came to EBITDA, with the metric climbing from $218.4 million to $288.6 million. As the chart above illustrates, this strength on both the top and bottom lines proved instrumental in improving most of the company’s metrics for the first half of the 2022 fiscal year as a whole relative to the same time of its 2021 fiscal year.

Understanding what the future holds for Watsco is rather difficult because of current market conditions. As I mentioned already, management has already said that financial performance should moderate in 2023. At the same time, they also did say that the push to higher efficiency offerings should also help the company’s top and bottom lines because of the higher selling prices and margins that those offerings tend to bring. As a value-oriented investor, when I see ambiguity like this, I prefer to be cautious and assume that strong performance does not continue. So instead of projecting out what financial performance might be for the rest of 2022 and pricing the company based on that, I decided to instead price the company based on data from 2021.

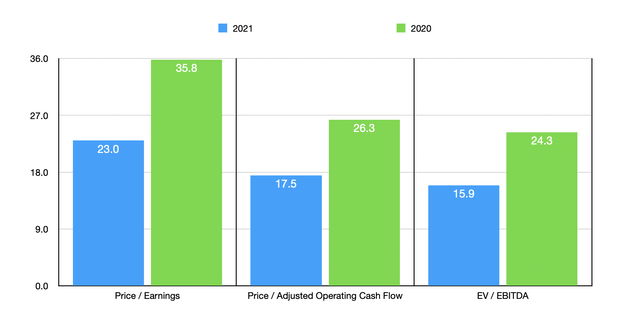

Following this approach, we can see that the firm is trading at a price-to-earnings multiple of 23. The price to adjusted operating cash flow multiple is lower at 17.5, while the EV to EBITDA multiple should be 15.9. These numbers compare favorably to the 35.8, the 26.3, and the 24.3, respectively, that we get using data from 2020. Assuming financial performance reverts back to levels experienced last year, I would say that shares are more or less fairly valued. But they could become overvalued if conditions worsen beyond my own expectations. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 6.5 to a high of 33.9. Using the EV to EBITDA approach, the range is between 9.6 and 19.7. In both cases, two of the five companies were cheaper than Watsco. Meanwhile, using the price to operating cash flow approach, the range is between 15.9 and 31.3, with only one of the five companies being cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Watsco | 23.0 | 17.5 | 15.9 |

| Comfort Systems USA (FIX) | 25.2 | 20.0 | 14.8 |

| SPX Technologies (SPXC) | 6.5 | 15.9 | 19.0 |

| EMCOR Group (EME) | 18.0 | 21.7 | 9.6 |

| CSW Industrials (CSWI) | 33.9 | 23.4 | 18.1 |

| Carlisle Companies (CSL) | 31.3 | 31.3 | 19.7 |

Takeaway

The data that we have today suggests to me that while Watsco is doing quite well for itself, it’s unclear whether this trend will continue. It could very well continue through the rest of 2022, but beyond that, the picture looks less certain. Instead of hoping for the best, it’s a wise idea to assume that financial performance will moderate as management expects. In some cases, I could see the company being more or less fairly valued and that is the direction I think it’s likely headed. Because of this, I do still feel as though a ‘hold’ rating on the company is appropriate at this time.

Be the first to comment