bjdlzx

(Note: This article appeared in the newsletter on August 7, 2022 and has been updated as needed.)

Ranger Oil (NASDAQ:ROCC) is more than nimble enough to keep adding to a decent sized Eagle Ford position. The company is agilely picking up small positions at a discount because they are worth far more when connected to the company’s decent sized presence in the Eagle Ford. The strategy of purchasing from what are known as unnatural or suboptimal ownership leases is usually profitable throughout the cycle because sales from such owners are normally at a large discount to the “going price”.

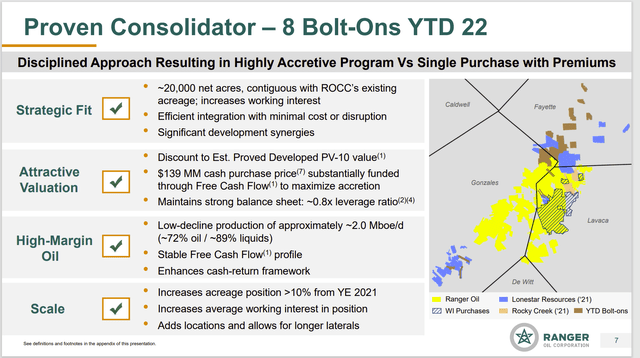

Ranger Oil Map Of Recent Acquisitions. (Ranger Oil Second Quarter 2022, Earnings Conference Call Slides)

Back when management did the Juniper acquisition, so many wondered why a company like this one would need the cash. Admittedly some of that cash did go to repayment of some debt that later allowed the company to float a bond issue successfully. But at the time, there was still a lot of cash left.

The reason is shown above. Management states that $149 million was paid to gain 20,000 acres (and more actually). Just the acreage cost (if that was all management really got for the money) is roughly $7,000 an acre. That is a fantastic price for decent Eagle Ford acreage at just about any time of the market cycle. As shown in the slide above, management gained some working interests as well, so the deal for the acreage overall works out to be even better. To be clear, management picked up more than just acreage depending upon the deal.

This points up a major problem that small leaseholders have. The sales market is largely limited to larger neighbors that want a bolt-on acquisition that improves their already large holdings. So, the market for small positions is not very liquid and really not competitive.

Long Term Debt

The Juniper acquisition, which also involved a cash injection has largely allowed management to purchase a fair amount of acreage and working interests while keeping debt at a conservative level. Of course, robust commodity prices help as well.

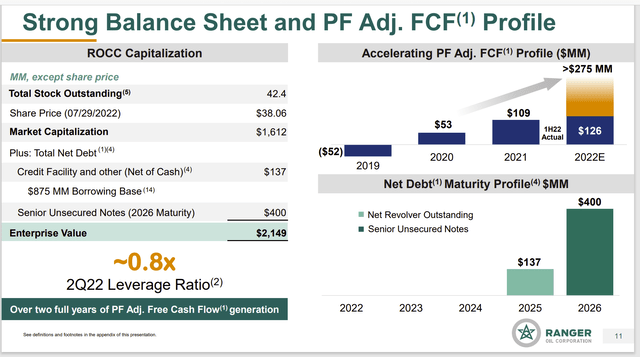

Ranger Oil Enterprise Value Calculation And Free Cash Flow Guidance (Ranger Oil Corporation Second Quarter 2022, Earnings Conference Call Slides)

Management has deftly kept the balance on the revolver low while retaining the option to make accretive acquisitions using the revolver. The result of this is a stock repurchase program combined with a continuing acquisition program that can be funded within cash flow (though not exactly each quarter). The overall debt ratio remains low enough so that adequate access to debt markets remains assured.

Management has also been managing the bank line to increase that committed amount steadily as the borrowing base has increased. Conservative management would normally direct a choice of a commitment that can be maintained when the borrowing base is lower due to low commodity prices.

The Eagle Ford has a lot of smaller operators than one would normally assume for a major producing basin. This allows for continuing consolidation opportunities. Small acquisitions like the ones the company continues to make tend to be very low risk and easy to assimilate. This also happens to be a low-risk way to grow production as well.

Between the share repurchases and the acquisition program, production and earnings should grow at a faster rate than is the case for competitors that grow solely by organic (drilling) growth. As the purchase price and acreage noted in the slide above demonstrate, it appears to be a lot cheaper than what operations can produce at the current time.

Earnings

Back when the Juniper deal was done, many investors at the time wondered if that meant the previous peak earnings would be halved this time around from all the shares outstanding. But management was never going to just “sit on the money” and do nothing. Of course, it helps that commodity prices are far stronger than anyone foresaw at the time of the deal. Then again, earnings edged past $3 per share in the current quarter.

Management has added a fair amount to the company from the acquisitions and as drilled to increase production as well. Management noted that the acquired production has been inching up the guidance as well as some well outperformance. It does not take a lot of “inching” to substantially increase long-term performance. As long as the debt ratio remains conservative, then let us see management keep going with the current strategy because it sure looks good so far.

What this points to is that the resources gained from the Juniper deal were not only accretive. But now the benefits are compounding as long as management continues to make good accretive deals. Given the small size of each individual transaction, I like the chances for still more benefits in the future from future deals.

The risk with a strategy like this is a tendency to sooner or later do a big deal. Bigger deals are riskier. So of course, they have a lower rate of success. The larger problem from a shareholder view is that a bigger deal that does not work could take a few years to recover from. But a smaller deal that does not turn out can often be overcome in a quarter or less.

The Future

Management implies (strongly) that the stock is undervalued. The difference here is some highly profitable Eagle Ford acreage combined with a combination of organic growth and low risk acquisitions.

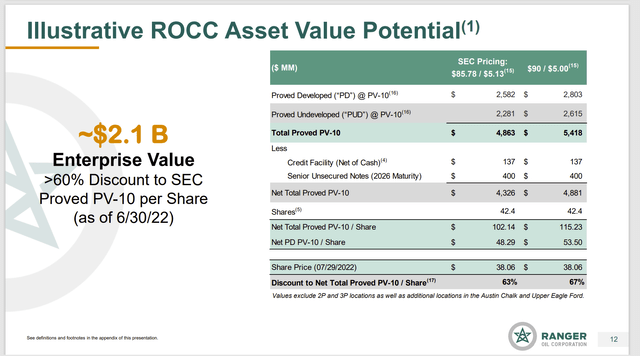

Ranger Oil Corporation Comparison Of Reserve Valuation To Enterprise Value (Ranger Oil Corporation Second Quarter 2022, Earnings Conference Call Slides)

There are a lot of reasons that companies never trade anywhere close to their reserve value. The most important of these is the cash flow compared to the reserve value.

One reason is shown by the latest decline in commodity prices. Investors are very unsure of robust future commodity prices. Still, the Eagle Ford is one of the lower-cost basins. So, the message in the slide above should still in general apply (even if one plugs in the current stock price).

But this is where that small bolt-on acquisition strategy will play a big part. As noted above, management paid about $7,000 an acre using the bolt-on strategy. That means a location cost for one well on 100-acre spacing (for example of $700,000).

Meanwhile a lot of managements are paying (for example) $50,000 an acre or more for good acreage in a basin like the Eagle Ford or the Permian. A management paying $50,000 an acre has a location cost of $5 million per well with 100-acre spacing.

Clearly this management is going to show a whole lot more cash flow for each dollar spent. That makes a goal of eventually trading for the reserves realistic. This management will not spend nearly as much per well as someone who insists on purchasing a marketable sized acquisition. Assuming that both companies pick geology with equal possibilities, the one doing small bolt-on acquisitions will be far more profitable and will likely trade at a premium because it is more profitable.

It does take extra work to “put together” a bunch of small acquisitions into one very profitable holding. But it is very much worth it to shareholders. This management is clearly going that “extra mile”. Sooner or later the market will notice as long as management stays with the current strategy and stays disciplined. The value of the shares calculated by management is likely to prove a very reasonable goal within the current 5-year period. All management needs is some time. They have clearly had more than enough practice.

Be the first to comment