Salameh dibaei

By The Valuentum Team

The garbage business is full of gems including Waste Management Inc (NYSE:WM), which is a rock-solid income generation idea. Waste Management’s business model comes with ample pricing power (helps offset inflationary pressures), an incredibly stable cash flow profile (given the essential nature of its pickup and disposal services), and there are significant barriers to entry given how hard it is to develop new waste disposal sites in the US (due to local, regulatory, and political opposition). Shares of WM yield a nice ~1.5% as of this writing.

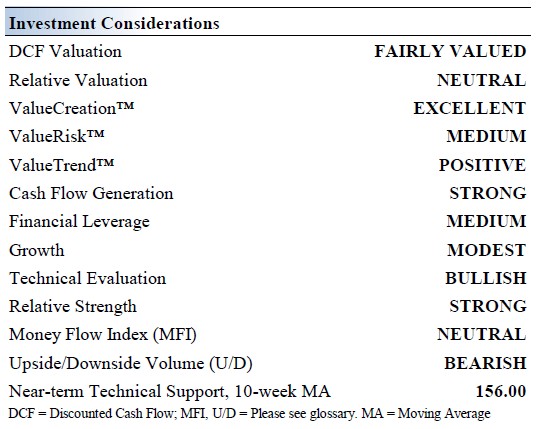

Waste Management’s Key Investment Considerations

Image Source: Valuentum

Waste Management is the largest environmental solutions provider in North America. It serves ~20 million customers in the US and Canada through a network of recycling facilities (~100), transfer stations (~340), solid and hazardous waste landfills (~260), and landfill gas energy facilities (~145). It was founded in 1987 and is headquartered in Houston, Texas.

The company’s pricing strength at its recycling, collection, and disposal businesses supports its long-term outlook. Its landfill operations boast significant barriers to entry due to regulatory requirements and stiff NIMBY opposition. The collection side of its residential business is generally stable and recession-resistant, though volatile commodity prices can cause large swings in its recycling-related revenues.

Waste Management plans to meaningfully improve its cost structure going forward through a combination of technology investments and economies of scale, a strategy supported by its impressive pricing strength. Waste Management completed its acquisition of Advanced Disposal in October 2020, which had a total enterprise value of ~$4.6 billion when including assumed net debt. The US Department of Justice forced Waste Management to divest certain assets as part of this deal.

In September 2022, Waste Management announced it was acquiring a controlling interest in Avangard Innovative’s US business, a recycling company that aims to produce 400 million pounds per year of post-consumer resin within five years. Terms of the deal were not disclosed, though the transaction is expected to close by the end of this year.

Earnings And Guidance Update

On July 27, Waste Management reported second quarter 2022 earnings that beat both consensus top- and bottom-line estimates. Its GAAP revenues were up 12% year-over-year to reach $5.0 billion last quarter. The firm noted that its total company volumes were up 1.6% year-over-year in the second quarter, with collection and disposal volumes up 2.3%. Waste Management also benefited from its ample pricing power. According to its earnings press release, Waste Management defines its core price as such:

Core price is a performance metric used by management to evaluate the effectiveness of our pricing strategies; it is not derived from our financial statements and may not be comparable to measures presented by other companies. Core price is based on certain historical assumptions, which may differ from actual results, to allow for comparability between reporting periods and to reveal trends in results over time.

Last quarter, its core price stood at 7.5%, which along with volume growth enabled Waste Management to post robust revenue growth. Its GAAP operating income rose by 13% year-over-year last quarter to hit $0.9 billion, with cost management initiatives and pricing increases offsetting headwinds arising from elevated fuel prices. Waste Management’s GAAP diluted EPS rose by 70% year-over-year in the second quarter of 2022, aided by its financial performance in the same period last year being held down by special items (namely a $0.2 billion charge relating to early debt extinguishment).

Waste Management exited June 2022 with $0.9 billion in cash and cash equivalents on hand versus $0.2 billion in short-term debt and $14.0 billion in long-term debt on the books. The single biggest risk to its dividend is its large net debt load, though given the stability of its cash flow profile and ability to tap capital markets, we view that burden as manageable.

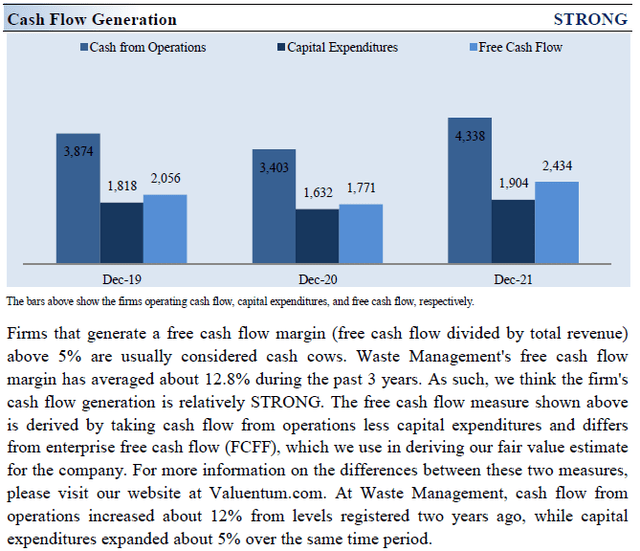

During the first half of 2022, Waste Management generated $1.3 billion in free cash flow (defined as net operating cash flow less capital expenditures). It spent $0.5 billion covering its dividend obligations and $0.5 billion buying back its stock during this period. Historically, Waste Management’s dividend has been well-covered by its traditional free cash flows.

When Waste Management reported its latest earnings update, the firm raised its guidance for 2022. Now the company expects to grow its revenues by 10% (up 400 basis points at the midpoint from its previous guidance), post $5.5-$5.6 billion in non-GAAP adjusted EBITDA (up $175 million at the midpoint from its previous guidance), and generate $2.05-$2.15 billion in free cash flow (flat versus its previous guidance) this year. When excluding certain growth investments, Waste Management now expects to exceed the upper end of its adjusted free cash flow range of $2.6-$2.7 billion this year. The company is firing on all-cylinders and we appreciate management’s confidence in Waste Management’s near term performance.

Dividend Analysis

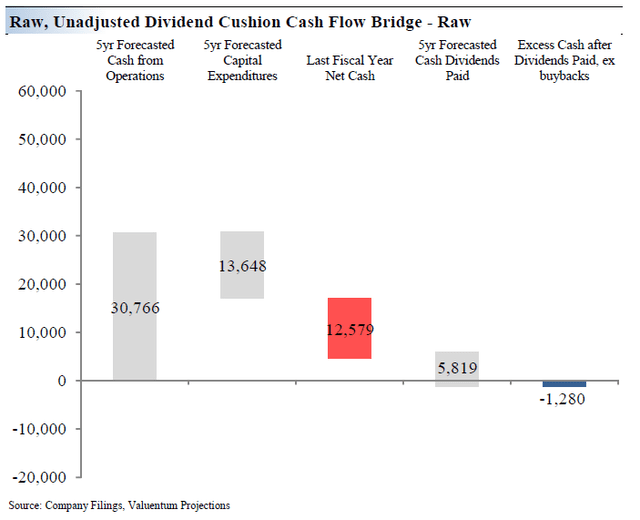

Waste Management’s net debt load weighs negatively against its Dividend Cushion ratio. (Valuentum)

The Dividend Cushion Ratio Deconstruction, shown in the image up above, reveals the numerator and denominator of the Dividend Cushion ratio. At the core, the larger the numerator, or the healthier a company’s balance sheet and future free cash flow generation, relative to the denominator, or a company’s cash dividend obligations, the more durable the dividend.

The Dividend Cushion Ratio Deconstruction image puts sources of free cash in the context of financial obligations next to expected cash dividend payments over the next 5 years on a side-by-side comparison. Because the Dividend Cushion ratio and many of its components are forward-looking, our dividend evaluation may change upon subsequent updates as future forecasts are altered to reflect new information.

In the context of the Dividend Cushion ratio, Waste Management’s numerator is smaller than its denominator due to its large net debt load. However, when factoring in its ability to tap capital markets to refinance its debt load and given the incredibly stable nature of its cash flow profile, Waste Management’s forward-looking dividend strength improves materially.

Waste Management’s Economic Profit Analysis

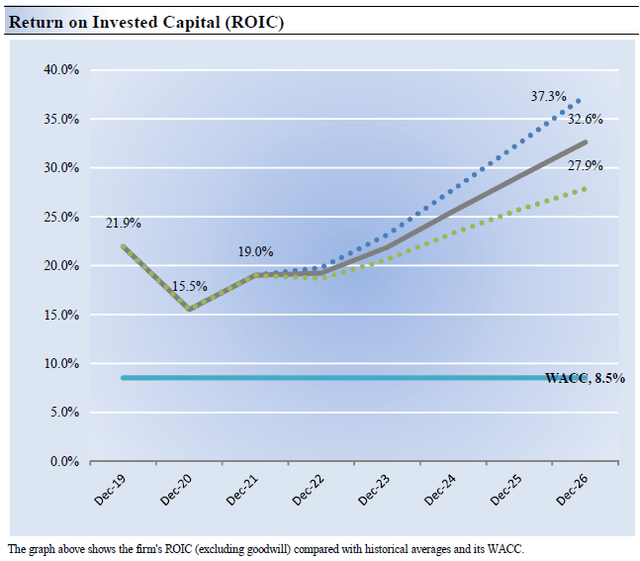

The best measure of a firm’s ability to create value for shareholders is expressed by comparing its return on invested capital [‘ROIC’] with its weighted average cost of capital [‘WACC’]. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. Waste Management’s 3-year historical return on invested capital (without goodwill) is 18.8%, which is above the estimate of its cost of capital of 8.5%.

In the chart down below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. Waste Management has consistently generated shareholder value and we forecast that will keep being the case going forward.

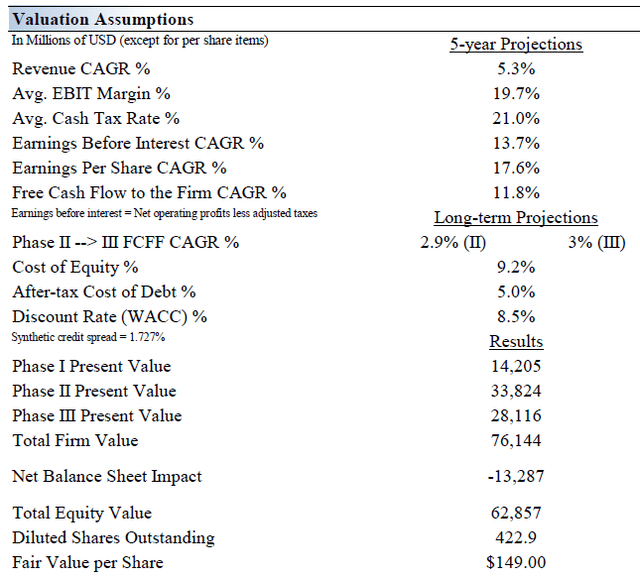

Waste Management’s Cash Flow Valuation Analysis

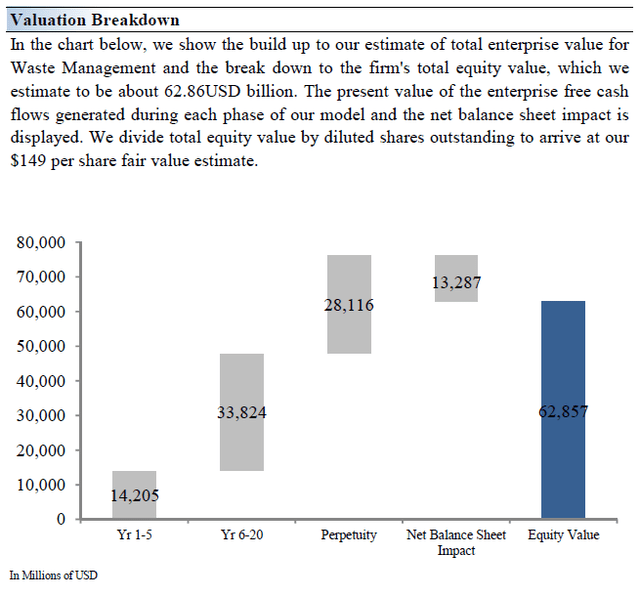

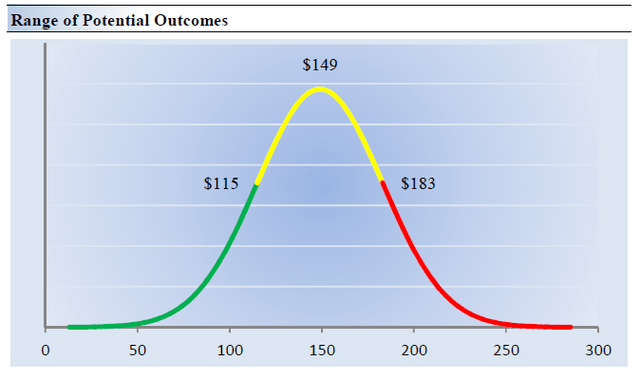

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows, net of its balance sheet considerations. We think Waste Management is worth $149 per share, with a fair value range of $115-$183. Shares of WM are trading in the upper bound of our fair value estimate range as of this writing.

The near term operating forecasts used in our enterprise cash flow models, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 5.3% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 6.3%.

Our model reflects a 5-year projected average operating margin of 19.7%, which is above Waste Management’s trailing 3-year average. Beyond Year 5, we assume free cash flow will grow at an annual rate of 2.9% for the next 15 years and 3% in perpetuity. For Waste Management, we use an 8.5% weighted average cost of capital to discount future free cash flows.

Image Source: Valuentum Image Source: Valuentum

Waste Management’s Margin Of Safety Analysis

Although we estimate Waste Management’s fair value at about $149 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

In the graphic up above, we show this probable range of fair values for Waste Management. We think the firm is attractive below $115 per share (the green line), but quite expensive above $183 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

Concluding Thoughts

Waste Management boasts the waste industry’s largest and most diverse asset base, as well as a broad and diverse customer base. Long-standing customer relationships with a significant amount of contracted business help fuel its recession-resistant business model, which produces returns on invested capital at the upper end of its peer group. Pricing power allows Waste Management to offset cost inflation and grow its margins over time. Ongoing consolidation in the US waste management industry, material pricing strength, cost control measures and its moaty business model all underpin Waste Management’s promising long-term outlook.

The largest drawback to Waste Management’s dividend growth potential is its large net debt load. Additionally, the pace of its stock buyback program and future M&A activity needs to be monitored, as those activities will compete for capital against its dividend program. Waste Management has a nearly irreplaceable asset base and remains quite shareholder friendly. The company is a stellar income generation idea with ample room to grow its per share payout over the coming years.

Be the first to comment