Makiko Tanigawa/DigitalVision via Getty Images

Investment Thesis

Waste Connections, Inc. (NYSE:WCN) is the third-largest player in the ‘Waste Management’ or Garbage industry by market capitalization, according to Finviz. Most of the largest landfills in the US are owned by 2 of the largest players in the industry, Waste Management, Inc. (WM) and Republic Services, Inc. (RSG), effectively establishing a duopoly status in the market. WCN is not one of these 2 duopolies.

In response to the competition from larger players with massive ownership of landfills, WCN adopted a strategy of serving clients in the rural market with exclusive arrangements to control the whole waste stream end-to-end. Since the arrangements are exclusive, it shields WCN from external competition.

Overall financial comparison with peers suggests WCN does not have a clear competitive advantage over its peers.

Company Overview

WCN provides waste management services in the US and Canada regions. According to the latest annual report, these are the services it provides:

- “non-hazardous waste collection, transfer and disposal services”

- “resource recovery primarily through recycling and renewable fuels generation”

- “E&P waste treatment, recovery and disposal services” – This means the company provides management of wastes generated from exploration and production (E&P) of natural gas and oil

- “intermodal services for the movement of cargo and solid waste containers in the Pacific Northwest” – This means the company provides ‘Intermodal freight transport‘ services.

These services are similar to what other competitors in the Waste Management Industry are providing.

The latest Q1 2022 financial figures saw the company reporting mostly positive results on the top and bottom lines, based on a year-on-year comparison between 2021 and 2022:

- Revenues increased from $1,396M to $1,646M

- Net cash provided by operating activities increased from 400M to 441M

- Adjusted free cash flow increased from 290M to 320M

Competing Against the Duopoly of the Garbage Industry

According to CNBC, “Two private companies, Waste Management and Republic Services, lead the solid waste management sector”. This statement describes the duopolistic status created by the dominance of these 2 companies in the market. WCN is up against the competition from these 2 dominant companies in the duopoly.

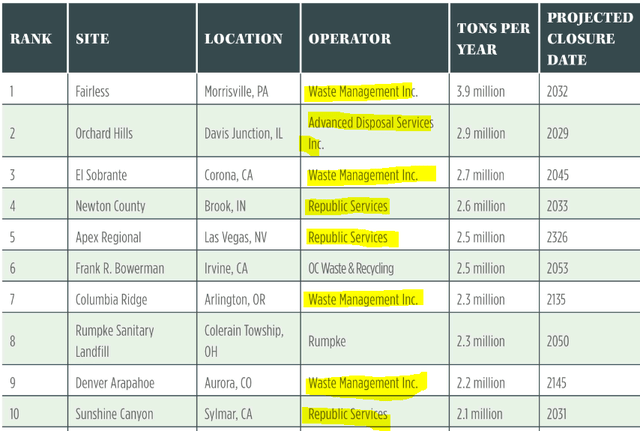

According to this article, which “ranks the largest 30 landfills in the U.S”:

- “U.S. Houston-based Waste Management Inc. leads with seven sites”

- “followed closely by Phoenix-based Republic Services with six”

- “Canada-based Waste Connections with four”

If we just observe the largest 10 landfills and their ownership, they are overwhelmingly dominated by WM and RSG. Note that Advanced Disposal was acquired by WM in October 2020, so landfills previously owned by Advanced Disposal are now owned by WM.

Largest Landfills List (Waste Today Magazine)

In WCN’s latest annual report, it was stated that:

we believe that controlling the waste stream by providing collection services under exclusive arrangements is often more important to our growth and profitability than owning or operating landfills.

This strategy allows the company to achieve cost savings by not having to own a large portfolio of landfills. At the same time, it does not have the benefit of the collection of massive tipping fees that owning large landfills can provide.

Inferring from the same CNBC article mentioned above, “Since its inception, landfills have made a majority of their revenue via tipping fees”. With such a revenue stream greatly discounted by not owning the largest landfills in the region that WCN operated in, it is unclear whether WCN is able to rise above its much larger competitors in terms of gaining market shares.

Controlling the Waste Stream in the Rural Market

Instead of incurring high costs to own and manage a large capacity of landfills, which is what WM and RSG are doing, WCN adopted a strategy of making exclusive arrangements with clients mostly in the rural market to control the overall waste stream. This provides clients with greater value in terms of a provision of an end-to-end waste management service. With such greater value provided, clients are less likely to leave. Hence, this provided WCN with a unique competitive advantage with respect to its larger peers. In my opinion, this advantage is ‘unique’ but not necessarily greater than WM and RSG.

Financial Comparison with Competitors

We will compare the financials with some of WCN’s peers:

- Republic Services, Inc.

- Waste Management, Inc.

- GFL Environmental, Inc. (GFL)

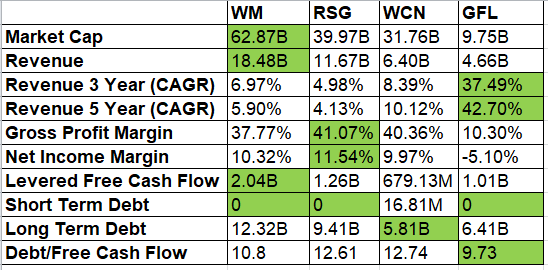

Key Financial Ratios (Seeking Alpha)

- We can observe that WM and RSG are the largest players in the comparison list in terms of market capitalization. This is not surprising as they hold the current duopoly in landfill ownership as described earlier. WCN is the 3rd largest player.

- WCN is making significantly less in top-line revenue but it is growing at a faster rate. However, while the growth is significantly faster than the leading players of WM and RSG, it is still relatively ‘modest’ at a high single to the low-teens range. This growth looks rather insignificant considering that the smallest player on the list, GFL is growing 4 times faster at around 40%.

- WCN generated a Gross and Net margin of around 40% and 10%, respectively. This is on par with the market leaders of WM and RSG.

- While we observe that WCN has the lowest amount of Free Cash Flow (“FCF”), this is compensated by the fact that it also has one of the lowest amounts of ‘total’ debt (short-term + Long-term debt). Overall, if we compare the debt with respect to its FCF for each of the peers in the comparison list, there are no significant differences. All the peers on the list have a debt/FCF in the range of 9 to 13.

Overall, WCN does not have a significant advantage over its other peers on the list in terms of financial performance. In my opinion, the only silver lining is that WCN operates with a low ‘absolute’ debt profile. Some investors who are apprehensive against highly leveraged companies may find this factor appealing.

Valuation

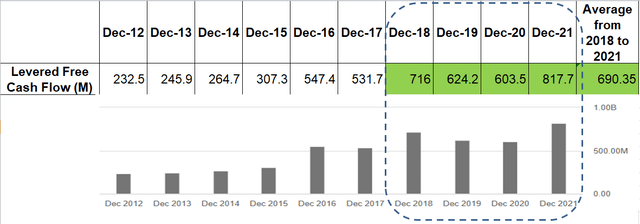

From Seeking Alpha’s cash flow data, WCN has an FCF that is generally increasing in the long run since 2012. From 2018 to 2021, there was a temporary decline followed by a recovery. We will use the average FCF from 2018 to 2021 (690.35M) in our calculation of intrinsic value. This will smoothen out the fluctuations in FCF from recent years.

Levered Free Cash Flow (Seeking Alpha)

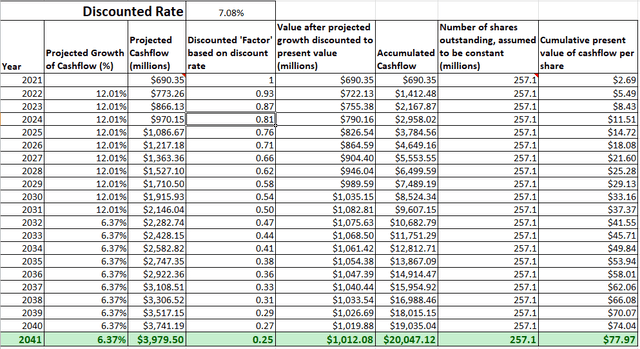

We will make the following additional assumptions when evaluating the intrinsic value of the company:

- From Seeking Alpha’s observation of ‘Compound Annual Growth Rates (“TTM”)’, the growth rate for Levered Free Cash Flow for the last 10 years is 12.01%. We will assume WCN will grow its free cash flow at this rate for the next 10 years.

- WM matures in growth from year 11 to year 20, growing at 6.37%, which is the ‘mean value’ of the US GDP growth rate.

- The discount rate is estimated to be 7.08%, taken from the WACC value.

- I assume WCN may not exist beyond 20 years. As such, Terminal Value will not be included in the calculation of intrinsic value.

Intrinsic Value (Author’s Calculation)

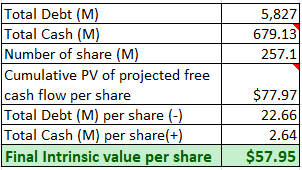

Based on the above inputs, the present value (“PV”) of projected free cash flow per share for WCN is $77.97.

Intrinsic Value (Author’s Calculation)

Taking into account the total debt and cash that the company is holding, the final intrinsic value is $57.95.

The current price of around $123 implied the stock is currently overvalued.

Investment Risk

Generally, most waste management companies in our comparison list discussed earlier incur a significant level of debt. In the current environment where interest rates are increasing, companies with high levels of debt will hurt more due to the need to incur higher interest expenses. Right now, WCN is having 161.7M in interest expense and 1738.7M in operating cash flow. That means the interest expense is 9.3% of its operating cash flow, which, in my opinion, is considered low. Investors should monitor and ensure that this percentage does not go up to more than 30%.

Conclusions and Key Takeaway for Investors

As discussed above, the waste management industry is dominated by WM and RSG in terms of ownership of landfills. WCN’s strategy is to target the rural markets as opposed to competing directly with WM and RSG in the urban market. Instead of benefitting from the tipping fees collected from owning massive landfills, WCN made exclusive arrangements with clients to own and operate the whole waste stream, providing an end-to-end service.

On one hand, this means WCN is missing out on a major revenue stream of tipping fees enjoyed by WM and RSG; on the other hand, WCN is able to control exclusive waste streams that shield it from external competition.

Financial comparison with peers also shows that overall, WCN does not have a clear advantage over its peers.

The price is currently overvalued and investors who believe in WCN’s unique strategy of targeting the specific secondary and rural markets should hold and wait for the price to retrace to at least the fair value of around $57.95 before taking an investment position.

Be the first to comment