BreakingTheWalls

‘Tis the season to revisit themes from 2020, apparently.

On September 29, I published, “It’s Time for ‘Cash Is King’ to Make a Comeback.” And now today’s agenda has me returning to the scene of the “cute” crime.

That was another topic I talked about two years ago.

By “cute,” I mean thinking you can outsmart the markets by buying into really high, unsustainable yields and other too-good-to-be-true “opportunities.” While I’m sure people manage to make money off such things here and there, the odds are not in your favor.

You’re much – much – more likely to lose out intensely in the end when you speculate on stocks.

The reason I mentioned this repeatedly during the 2020 shutdowns is because there were LOTs of high-yielding opportunities out there to begin with. With stock prices diving the way they did as investors everywhere panicked…

It was easy for the intrepid to think they could get away with absolute steals.

To a degree, they were right. There were absolute steals to be made. That’s how the Cash Is King Portfolio came to be. But…

It came to be based off that through anything but speculation.

(Brad Thomas on Seeking Alpha – December 5, 2019)

Never Forget That Cash Is King

I quoted my March 19, 2020, article on September 29, 2022. And I’m going to quote it again here. Because the idea that inspired the Cash Is King Portfolio remains just as relevant in this current selloff as it was during that one.

So…

“I know you’ve heard that the No. 1 rule in real estate is ‘location, location, location.’ And perhaps it deserves that placement.

“But a very close second, at least when it comes to REITs, is ‘cash is king.’ In fact, you could even say that rule No. 1 doesn’t work long-term if it doesn’t automatically align itself with rule No. 2.

“That’s because REITs pay out so much cash every year. It’s the main reason why investors buy into them in the first place. The dividends they’re designed to faithfully offer.

“In order to stay faithful though, they have to have enough cash on hand to cover those shareholder perks.

“They also need enough cash to cover everyday business expenses, such as salaries, utilities, taxes (although REITs do pay less in that regard by doling out more money to shareholders), and so many other expected or unexpected costs.”

That should be the focus: sustainability. Not fast profits.

Because fast profits rarely last.

Just look at how much the markets rallied on Wednesday, September 28. As MSN explained:

“U.S. stocks surged Wednesday afternoon as Treasury yields retreated from a sharp ascent and investors cheered on a surprise policy pivot by the Bank of England.

“The S&P 500 bounced roughly 2%, while the Dow Jones Industrial Average gained nearly 550 points, or 1.9% after both major averages hit fresh 2022 lows this week. The Nasdaq Composite rallied about 2.1%.”

As a result, people said the bear market bottom had been beat.

But then Thursday, September 29 happened.

(Brad Thomas on Seeking Alpha – March 9, 2020)

And Never Forget That “Cute” Alone Doesn’t Cut It

Here’s the numeral form of looking at Wednesday’s gains:

- S&P 500 – 67.1 points

- Dow – 484.82 points

- Nasdaq – 234.12 points.

As for Thursday’s losses…

- S&P 500 – 78.44 points (2.11%)

- Dow – 458.06 points (1.54%)

- Nasdaq – 314.13 points (2.84%).

It could have been worse, as evidenced by the day’s lows. But it very, very, very clearly could have been better.

Now, who knows. Maybe we’ve officially reached the bottom here. Or we’ll hit the bottom today. (Since I publish these articles the evening before, I couldn’t come close to speculating one way or the other even if I wanted to.)

I know that, right now, everyone is trying to call the bottom regardless. Because there’s an untold fortune to be made by doing so.

But it’s a fool’s errand. The only way you – or anyone else in the world, including experts who have made billions off their market skills – can call the bottom is by sheer luck. Which means it’s speculating.

Which means it’s being too cute. Something that, as I’ve already established, I don’t believe in doing.

Why bother when I’ve spent the last decade+ proving how well careful analysis and patience pays off? If you want to see stocks that fit into that slow-but-steady category… the kind that can more than merely muddle through this dreary market…

You’ll have to read my latest “Cash Is King” article that I referenced above. The point of this piece is actually to warn you away from speculative companies that can’t go the distance.

Trust me on this one.

No matter how “cute” the opportunity and how nicely it bats its eyelashes or flexes its biceps.

Just say no.

This is not my first or last harbinger

Let’s face it folks, we’re in a new cycle, and one in which investors need to be exceptionally cautious right now.

I know many of you own some high yield stocks, and I do too…

But I purposely limit my exposure to these higher risk names, recognizing that the dividends are not as stable or predictable.

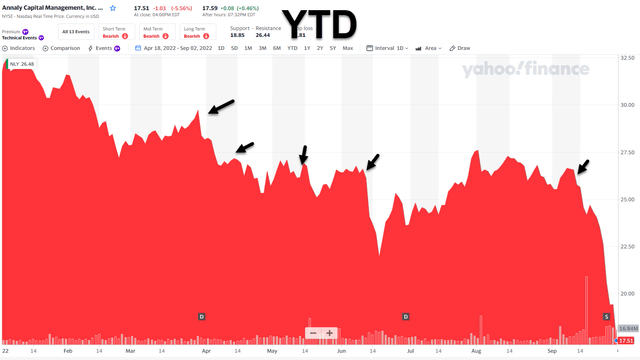

Annaly Capital Management, Inc. (NLY)

You can’t say that I didn’t warn you.

All the arrows (in the chart below) represent our warnings to avoid NLY.

Had you listened, you would not be as frustrated with the 43% YTD share price erosion.

As I pointed out earlier this year,

“…mortgage REITs are extremely sensitive to interest rate fluctuations and rarely perform well in rising-rate environments. That’s because most of the mortgages already on their books are fixed-rate assets. So they don’t benefit from any such changes.

Plus, they then have to pay higher interest rates to borrow money to fund their current operations. The result is shrinking profit margins, which in turn can easily impact the stock price, not to mention the dividend.”

I’m not sure I could have provided a better harbinger as I called NLY “a textbook ‘ugly duckling’ pick.”

Believe me, I’m not kidding when I say things like “don’t be too cute”…

My goal is to steer you away from dangerous sucker yields like NLY.

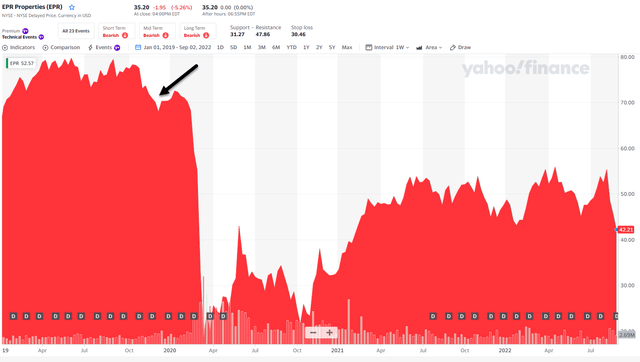

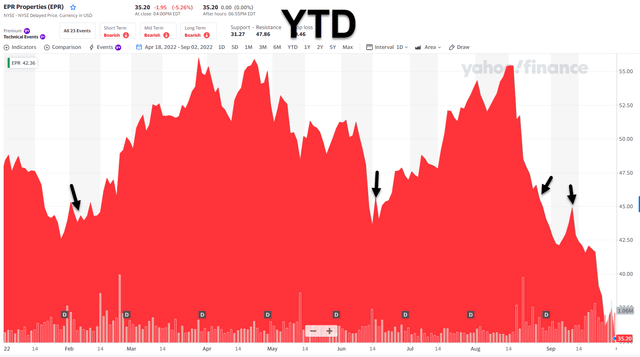

EPR Properties (EPR)

Here’s another one…

Don’t say I didn’t warn you…

In 2019 we wrote, “we don’t see the logic behind taking higher risks to generate mediocre returns. EPR’s payout ratio is getting higher, and this puts the dividend at a higher risk of being cut.”

Then in 2022 we provided a few other harbinger articles (arrows illustrate articles):

I know many of you are looking at EPR right now thinking to yourself,

“what is Thomas smoking? EPR is yielding 8.60% and the dividend is well-covered with a payout ratio of 67% as of Q2-22 (based on AFFO per share).”

I’m not tempted whatsoever…

I’ve seen this chapter before, when I was a developer for Blockbuster Video. I used to build stores and lease them back at cap rates of 10% or higher, but at some point, when it appears too good to be true…it usually is.

Just like Blockbuster, I see a massive deceleration in demand (thanks to streaming) and acceleration in theater bankruptcies.

Seeking Alpha Seeking Alpha

If you recall, I said the same thing in 2019 as department stores were dying.

“Odds are Macerich is going to own at least a few of the unfortunate malls that house those doomed spaces. Which means its shares are going to come under even more pressure. Which means it’s really not going to be able to sustain its dividend.”

Thus, similar to Blockbuster video and department stores, I believe theaters are in for a lot more pain, and as a developer for over two decades, I know firsthand that the cost to redevelop buildings – especially theaters – is quite extensive.

There’s tremendous risk here, and I would hate to see your hard-earned capital going down the toilet. We all know what that flushing sound means…

Now’s Not The Time To Gamble

I may be one of the most experienced REIT analysts on Seeking Alpha, which means I’ve seen how recessions play out. Likely we are entering one right now and I caution you to avoid chasing yield.

I know the pain of losing millions of dollars…

It’s not fun…

I know the agony of starting all over again…

It’s not fun…

I also know that we are entering a phase in which REIT investors can get rich…

Please follow my advice!

Do NOT Chase Yield…

Instead, focus on high quality real estate managed by respected executives…

“An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.” Benjamin Graham

Be the first to comment