simpson33

Shares of Warner Bros. Discovery (NASDAQ:WBD) got slammed on Friday after the company submitted its earnings card for Q2’22. Warner Brothers said that it is restructuring its businesses to narrow its streaming losses, which includes the consolidation of its streaming platforms. Warner Brothers is trying to open up new consumer segments and the company’s strategic platform shift towards ad-supported formats rivals the one announced by Netflix (NFLX) which is also preparing to launch a lower-price ad-supported tier. Because of the market’s sharp reaction to the company’s earnings report and admitted need for a restructuring, investors must be prepared for a continual mass exodus in the short term!

Massive Q2’22 revenue miss spooks investors

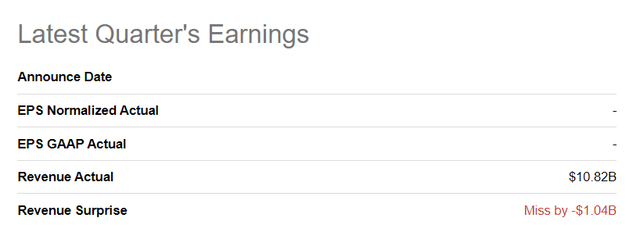

Expectations were for Warner Bros. Discovery to have revenues of $11.91B, which the company fell short of with actual revenues of $9.82B. It was the first earnings report for WBD after recent corporate transactions.

Seeking Alpha: WBD Q2’22 Results

Streaming wars are heating up

The recently completed merger of AT&T (T)’s former content business, known as WarnerMedia, with media company Discovery has led to the creation of a new streaming powerhouse that is set for robust growth in the future. However, before Warner Bros. Discovery can fully unleash its potential as a global streaming brand, the company will have to go through a painful restructuring that is aimed at improving profitability, especially in the streaming segment.

The entire industry is facing an uncertain outlook. Netflix has seen its first major subscriber losses this year as the streaming industry faces a new post-pandemic reality of slowing revenue and subscriber growth. Faced with weaker growth prospects and customer acquisition, pressure is building on streaming companies to differentiate their products and grow profitability.

Warner Bros. Discovery, whose streaming brands include HBO Max and Discovery+, has said that it plans to bring both streaming brands under one roof by mid-2023 in a bid to simplify its streaming service and improve profitability. WBD also said it plans to grow the total subscriber count of its streaming offers to 130M by FY 2025… which is an ambitious goal considering that the firm’s streaming services combined – this includes HBO Max, HBO and Discovery+ – served 92.1M subscribers at the end of the second quarter.

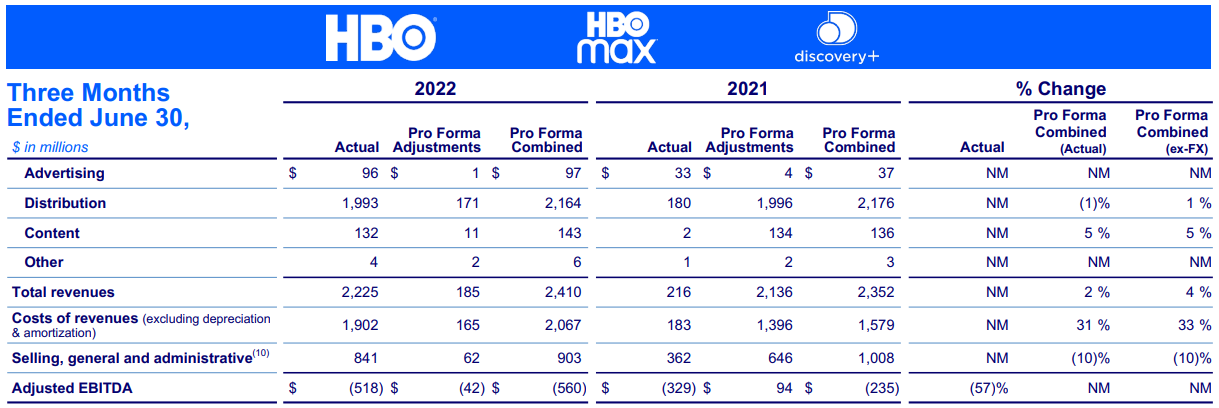

The streaming brands, which are included in WBD’s direct-to-consumer segment, had revenues of $2.23B, before adjustments, on which the company generated a large $518M EBITDA loss. Reducing losses in its streaming business is a key challenge for Warner Bros. Discovery and without a turnaround in the direct-to-consumer business shares of WBD are unlikely to rebound. Warner Bros. Discovery could grow its profitability by combining its streaming services to cut costs but also through the expansion of ad-supported/ad-lite tiers that offer an alternative monetization pathway for the company.

Warner Brothers: Q2’22 Direct-to-Consumer Segment

Focus on restructuring and reducing streaming losses

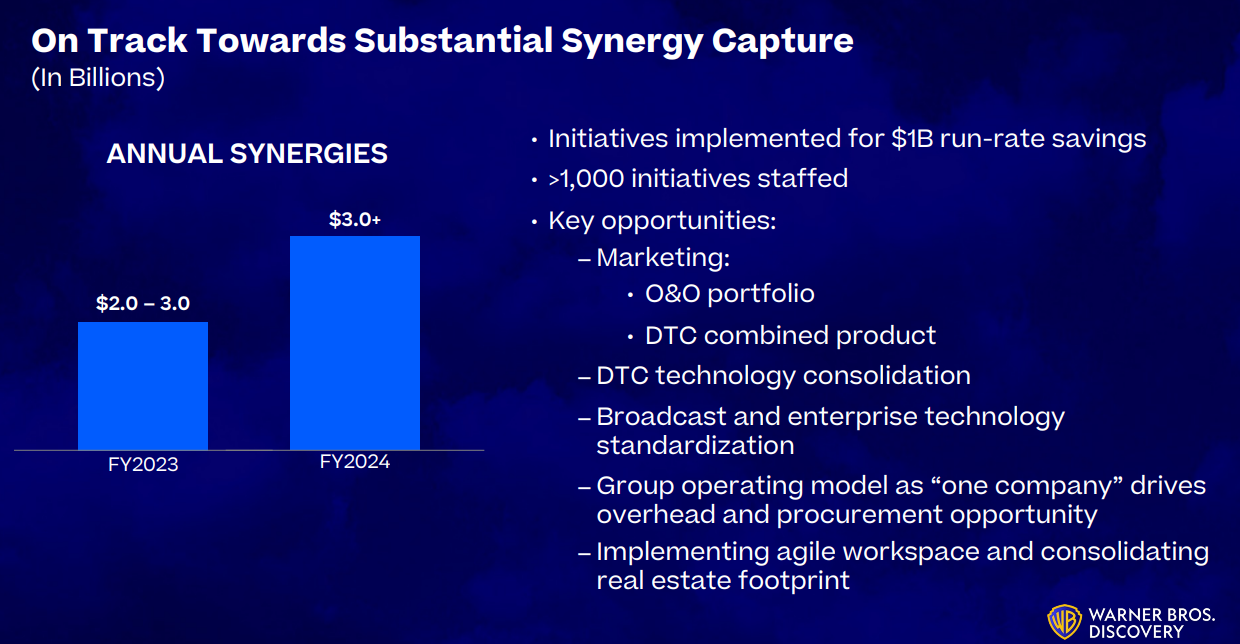

With gains in the streaming market harder to achieve post-COVID, Warner Bros. Discovery is turning to synergies to pull critical levers to drive earnings momentum. After the merger between AT&T’s media business and Discovery, the company plans an overhaul of its cost structure that it anticipated to generate $3.0B in annual cost synergies by FY 2024.

Warner Brothers: Expected Annual Synergies

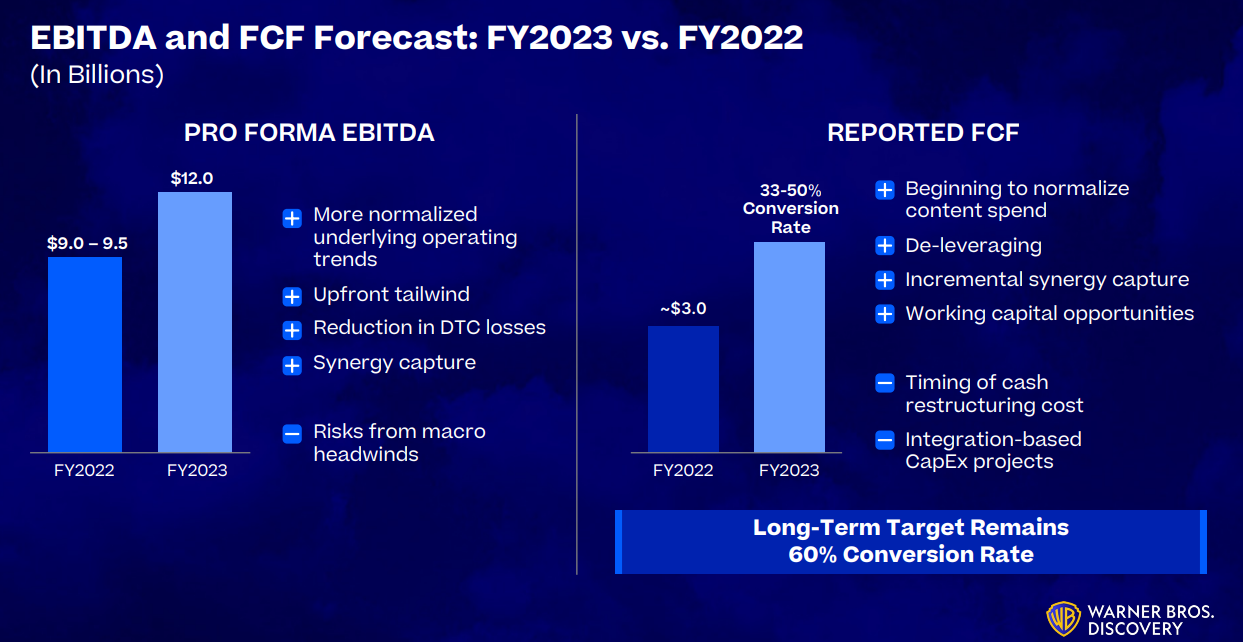

Key to Warner Bros. Discovery’s restructuring is the reduction of losses in the segment for premium pay TV and digital content services. While Warner Brothers’ studio and network businesses are soundly profitable, it is streaming that has emerged as a drag on the company’s margins and profit growth. By consolidating its streaming platforms, targeting cost cuts and shifting away from straight-to-streaming big-budget movie releases, Warner Bros. Discovery is looking to stop the bleeding and grow to $12.0B in pro forma EBITDA by FY 2023, indicating 26-33% EBITDA upside on restructuring measures alone.

Warner Brothers: EBITDA FY 2022 And FY 2023 Forecast

Sales valuation factor

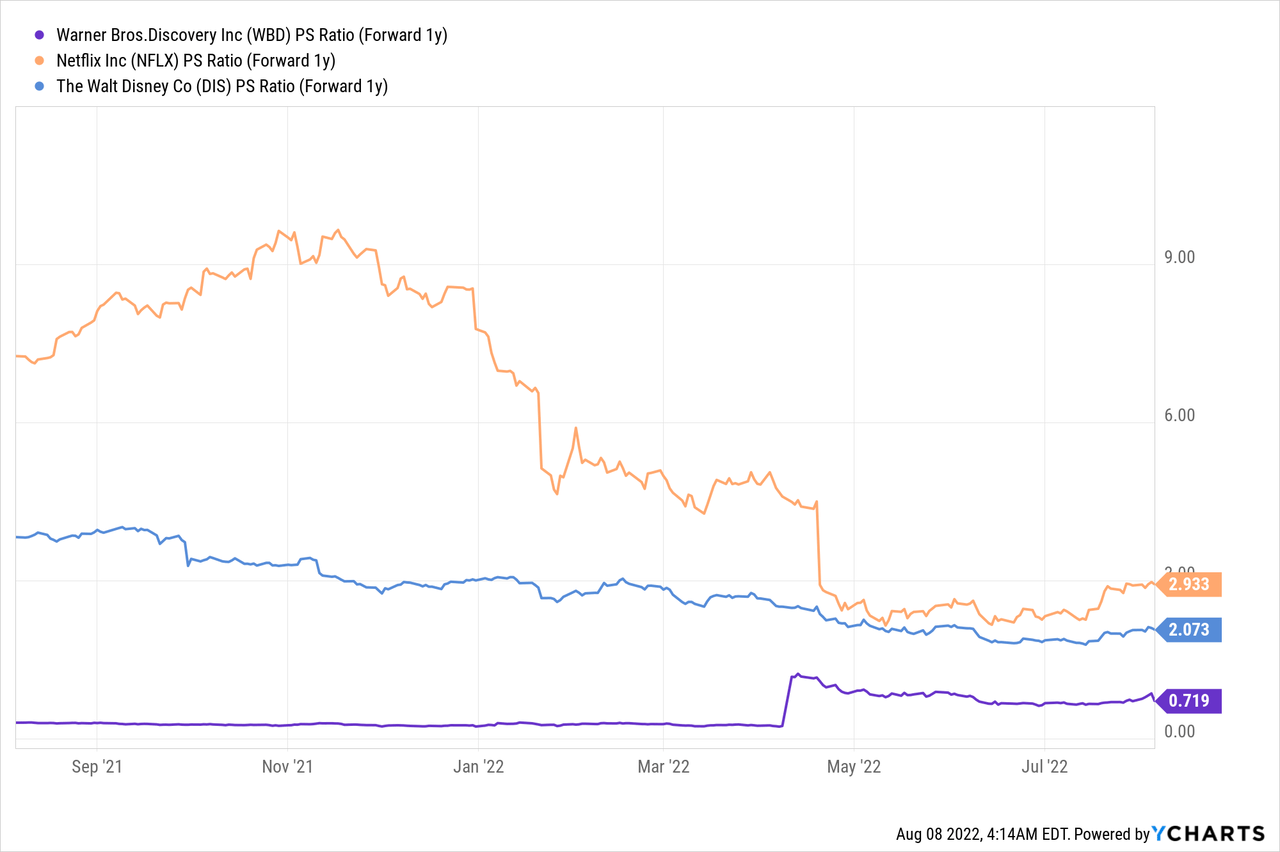

The expectation is for Warner Bros. Discovery to grow revenues to $45.2B in FY 2022 and to $49.3B in FY 2023, implying top line growth rates of 271% and 9%. The surge in revenues this year is due to the recent merger. Based off of next year’s top line estimates, shares of Warner Bros. Discovery have a price-to-revenue ratio of 0.72 X which makes it the cheapest mega-cap streaming business. Netflix, which has revalued lower by 62% in FY 2022 due, in part, to significant subscriber losses, and Disney (DIS) both have higher revenue-based valuation factors.

Risks with Warner Bros. Discovery

The biggest risk for WBD right now is uncertainty that has been created by the second-quarter earnings report. While streaming companies are likely going to see moderate growth in the foreseeable future, Warner Bros. Discovery’s persistent streaming losses and restructuring create near-term headwinds for WBD, which may result in a lower valuation factor. Additionally, there is a risk that Warner Bros. Discovery will cannibalize its revenue base by getting subscribers to adopt cheaper, ad-supported tiers.

Final thoughts

Because of the articulated need for a restructuring in the streaming business, I expect a continual mass exodus out of WBD shares. However, if the media company can convince investors that its restructuring in the streaming segment can yield real improvements regarding subscriber growth and monetization, then shares of Warner Bros. Discovery could become interesting again. Since the firm just completed its merger and is just at the beginning of its restructuring, which already has created negative sentiment overhang for WBD, I believe it is too early for an engagement here!

Be the first to comment