Sundry Photography

Four months ago, Walmart (NYSE:WMT) came out with a surprise mid-quarter warning. Management lowered guidance in part due to excess inventories. It’s not unusual for companies to guide down mid-quarter, but when a company the size of Walmart makes the announcement it certainly creates a cause for concern.

While the stock price took a tumble on the news, the company has since reported two more quarters and there’s now more hope than dread where Walmart is concerned. We look at the prospects for Walmart, heading into 2023:

Key Metrics

Walmart hardly needs an introduction, but there are a few metrics that we should look at to understand where the company is headed.

Revenue & Sales Mix

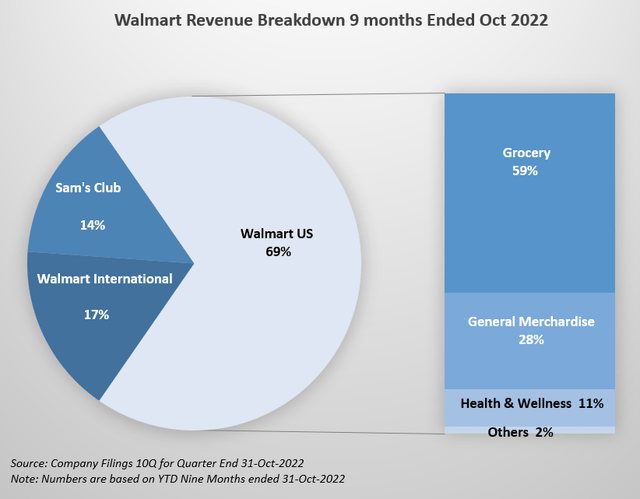

The largest proportion of Walmart’s overall revenue comes from Walmart US. While Sam’s Club comes in third in terms of overall revenue, the trend looks healthy going into 2023, as inflation and higher rates persist.

Sales Mix for Walmart (Company Filings 10Q for Qtr End 10/31/2022)

In terms of revenue for Walmart US, Grocery takes the largest share of the sales mix by far. This has set up the company to take advantage of the current macro environment.

Walmart US reported solid revenue acceleration with an increase in Same-store Sales (SSS) during Q3. Quarterly revenue for Walmart US was up 8.45% YoY with SSS up 8.2%.

Sam’s Club posted a similar acceleration with quarterly revenue up 12.8% YoY and SSS up 10.2%.

Margins

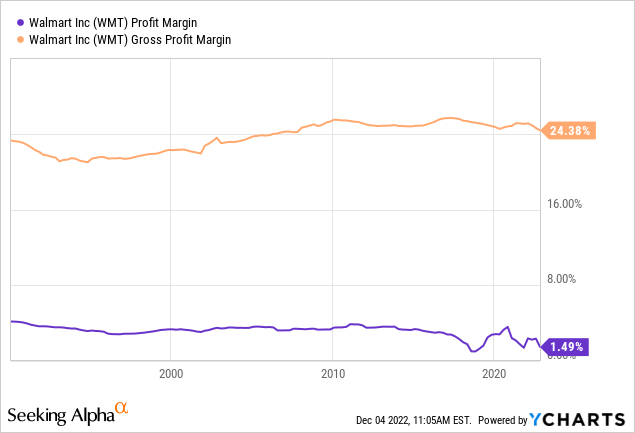

Walmart’s gross margins have been incredibly stable over the years at an average of about 24%. Net margins and EBITDA margins have fluctuated with time. In fact, both EBITDA and net margins are the lowest they have been in the last 32 years.

We believe, however, that there remains upside to these margins in the coming months through better inventory management and cost controls.

Inventory

The inventory situation was a major cause for concern earlier this year and it’s quite possible that this is still holding back the stock price. The inventory situation that caught Walmart off-guard isn’t unique. The Fed aims to reduce inflation through demand destruction with their monetary tightening. This leads to build up of inventory as the economy slows.

For Walmart, the inventory situation was slightly different in the sense that they saw a shift in spending patterns. With inflation raging through the economy, consumers had to spend more on groceries and staples, paying more for fewer items. Consequently, spending on discretionary items such as general merchandise declined far more than expected.

Another factor was the supply chain crisis faced earlier on. To circumvent the crisis, Walmart did everything possible to get inventory in on time, and they over-estimated what demand levels would be.

Having said that however, management has turned the situation around quite well:

- Globally, inventory was up 12.7% in Q3. This was a meaningful deceleration from the increase of 25.5% from the prior quarter. About 70% of this growth was the result of inflation while the balance was improving in-stocks. Around $1B was excess inventory during the quarter, compared to the previous Q2 excess inventory of about $3B.

- Management has made changes to their supplier situation. They are matching demand item-by-item, category-by-category. The Company has been cutting down on orders of “General Merchandise” where they can and negotiating steeper discounts. And because they are Walmart, they have the bargaining power to do that.

Management

With the right management, a company can weather almost any storm and the current macro environment needs solid management. Walmart was quick to provide guidance when their inventory situation came to light and has been even quicker to take action.

The CEO of the company since 2014, Douglas McMillon has spent his career at Walmart. McMillon was CEO of Sam’s Club during the 2008 Great Financial Crisis, while The CFO joined in June 2022. He was ex-PayPal and ex-United Airlines. Both are solid executives and seem to be handling the macro situation well.

Catalysts for Watch For

After a 13-year run of easy money and low interest rates, we are faced with an economy that is changing rapidly. When you add inflation to that equation, it creates a landscape that most of us have no memory of experiencing.

We do not make predictions about what the Fed will do, but the aggressive tightening rate environment and balance sheet run-off is a recipe for tighter financial and economic conditions. While inflation may very well have peaked, it will still remain at a significant level throughout 2023, according to the Fed’s own forecasts.

The macro landscape is set up for defensive companies, with lower beta and higher visibility in terms of earnings. Not only does Walmart tick all three boxes but, it also has several other drivers that could support profitability. These are:

Growing Market Share due to Change in Spending Patterns

Seventy-five percent of Walmart’s market share gains have come from trade-down behavior of people over earning over $100,000 a year. The more affluent consumer is also shopping at Walmart and this will be a major driver into 2023, as economic conditions tighten.

Growth of the Club Stores

With the change in spending patterns due to inflation, there has been an obvious shift to wholesale club stores and that’s where Sam’s Club comes in. Sam’s Club is about 14% of net sales. The segment is continually making shopping cheaper for the customer with massive savings, and remains an underappreciated gem during these trying times. Grocery revenue accounts for about 64%, followed by Fuel & Tobacco at about 19%.

Sam’s Club posted Same-Store Sales (SSS) of over 10% during Q3, 2023 translating to a +35% increase on a 3-year stack. Operating income saw an increase of 18% with fuel and 8% without fuel. Membership income increased 8% during Q3.

Pivoting to Digital

Thirteen percent of US sales for the year came from the Company’s digital platform in Q3; 20% for Walmart International. The Company continues to invest in Walmart+, which is the alternative to Amazon Prime. The membership offers free shipping, and discounts on fuel and it costs $12.95/ month or $98/year which is lower than Amazon Prime and customers also get Paramount’s Essential streaming package.

Analysts’ Outlook

The Street has EPS estimates at $6.07 for this year with a Revenue forecast of $601.4 billion for FYE Jan 2023, according to SeekingAlpha. At the current level of share count of 2,711 billion, this works out to Net Income of $16.45 billion and net margin of 2.74%

FYE Jan 2024 has an EPS estimate of $6.59 and Revenue Estimate of $619.2 billion, with an estimated forward PE of 23.26. The Average Price Target is $159.8 with a high target of $175 and low of $133.

Analysts are mostly bullish with an overall buy of 4.17.

What Is the Long-Term Forecast For 2023?

We agree with the analysts and remain bullish on Walmart. The Company is guiding net sales growth of about 5.5% (6.5% including divestitures) which give us Net Sales of $598.99 billion.

For FY 2024 (Calendar Year Feb 2023-Jan 2024), we’re starting with Walmart’s guidance on Net Sales. Our forecasts are based on the following assumptions:

- Sales growth between 3.5% and 4.5%. This is because we see the company continue to benefit from increased market share because of customers trading down and continued acceleration in Sam’s Club.

- Improvement in profitability leading to net margins of 3% to 3.25%. This is due to higher online penetration, better inventory management and cost controls. As a comparison, Walmart’s average net profit margin since 1990 has been 3.28%.

On the lower end of the spectrum, this gives us an EPS of $6.83 while, on the higher end we get $7.50. Walmart’s average PE ratio since 1990 has been 25.3x. We’re using 23x.

Our forecasted price target is a range between $158 and $172 for FY2024 (Calendar Year 2023).

Key Risks

The valuation and price target are not without risk:

- FX headwinds: As we’ve seen, 17% of revenues are derived from Walmart International – India, Mexico, China. Given the strong US Dollar, almost every company with overseas revenues are facing severe headwinds and taking a hit to their revenues. The company estimates $4.1 Billion in FX headwinds for the current year.

- Change in the macro landscape: As inflation starts to decelerate, we may see some level of change in spending patterns. Although, we believe this will be a very small proportion, given that the consumer has already endured substantial hardship because of previous high levels of inflation and now, higher rates. Nevertheless, prices coming down may mean lower levels of revenue.

- Global Economic Slowdown: The IMF is projecting a global slowdown in GDP levels. Not only do we have a strong US Dollar but, as well as rate hikes across the globe. Rate hikes in the US are also likely to lead to an economic slowdown. Finally, China’s lockdown policies are also a factor causing a slowdown in international revenue. While the Company remains a defensive play and likely to still do well during an economic downturn, a recessionary environment is bound to hurt sales to a certain extent.

Is WMT Stock A Buy, Sell, or Hold?

Given the current macro environment and what could be a difficult backdrop entering 2023, Walmart’s business looks poised to benefit from the situation. There still seems to be upside potential in the price of the company’s stock and could be a good defensive buy for portfolios, noting that there are risks to the forecast.

Be the first to comment