MURAT GOCMEN/iStock via Getty Images

Wallbox N.V. (NYSE:WBX) offers electric vehicle charging solutions and energy management systems for residential, commercial, and public-use settings. With the mass adoption of EVs ongoing, Wallbox is well-positioned to capture the strong demand for the necessary charging infrastructure that represents a major worldwide opportunity. Indeed, the company became publicly traded last year following a SPAC merger and has reported impressive growth trends with a positive outlook.

We are bullish on WBX which looks attractive following the recent selloff considering several catalysts for the year ahead. The launch of a new manufacturing facility is set to boost sales while a roadmap to profitability highlights the upside potential.

WBX Financials Recap

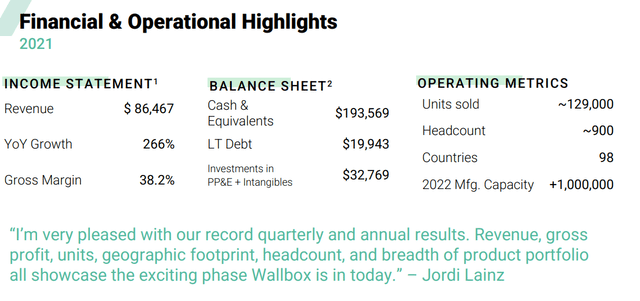

The company reported its Q4 and full-year 2021 results on March 16th highlighted by revenue of $33 million, up 165% year over year. The company remains unprofitable considering ongoing investments towards growth resulting in a negative adjusted EBITDA of -$22 million in the quarter. With proceeds from the IPO, Wallbox ended the year with $194 million in cash and equivalents against just $20 million in long-term debt. Management believes its business plan is fully funded for the foreseeable future which we see as a strong point in the company’s investment profile.

The story here has been the operating momentum with the company selling 129k units in 2021, compared to just 35k in 2020. The company now counts on an installed base of charging units globally near 200k in over 83 countries. To get a sense of the scale, the company expects to have a manufacturing capacity of over 1.1 million units per year by the end of 2022 including a new facility in Arlington, Texas that is expected to open by Q4. A separate facility in Barcelona, Spain opened in 2021 and is now ramping up output.

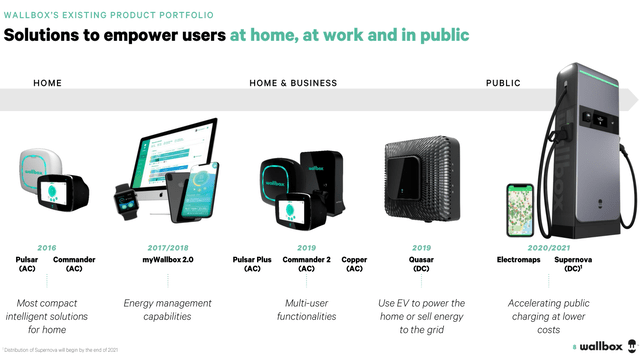

The core products here include level 2 alternating current (AC) chargers for home and business applications, along with a direct current (DC) “fast charger” product for public applications. One innovation in the market is Wallbox’s “Quasar” home charger recognized as the “world’s first bi-directional DC charger” which allows users to both charge their electric vehicle and use the energy from the car’s battery to power their home or, or send stored energy back to the electrical grid.

All this is integrated into a proprietary software platform for energy management allowing drivers to locate and transact with all public charging stations. Operators are able to manage their public charging stations at scale.

WBX Growth Outlook

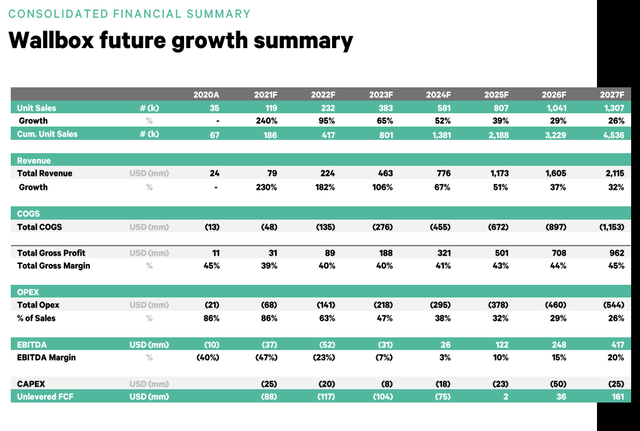

In conjunction with the IPO materials last year, the company released a growth outlook and financial forecast targeting positive adjusted EBITDA by 2024 and free cash flow as soon as 2025. The driver here is a declining level of Capex as a percentage of revenue that is expected to generate scale and efficiency benefits.

Based on the latest results, the company ended up surpassing its 2021 growth estimate by delivering $87 million in revenue, up 266% y/y compared to the prior estimates of $79 million. The outlook is to approach $1 billion in annual revenue by 2026 representing a compound annual growth rate near 100% from the 2020 level.

For 2022, Wallbox management is currently guiding for revenue of around $230 million, up ~180% y/y which is also above the previous forecast closer to $224 million. There is a case to be made that the recent results have been stronger than expected with the company on track to meet its long-term financial objectives.

WBX Stock Price Forecast

The growth of electric vehicles is exceptional and expected to continue. In our view, the high gas prices amid the Russia-Ukraine geopolitical conflict add to the attraction of clean energy alternatives. For Wallbox, the company enters 2022 in a strong operating environment.

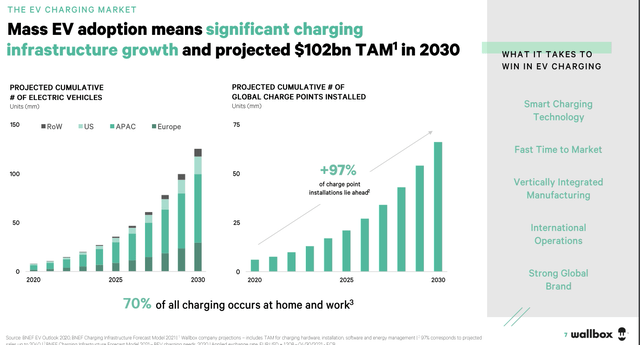

Compared to approximately 6.5 million EVs sold worldwide in 2021, industry forecasts are for the cumulative number of EVs on the road to climb towards 170 million by 2030 including models from several “legacy” auto manufacturers that are just beginning to enter the market. For Wallbox, management notes that the installed base of EV charge points globally will need to accelerate over the coming years to meet the demand which sets up a positive backdrop for the company.

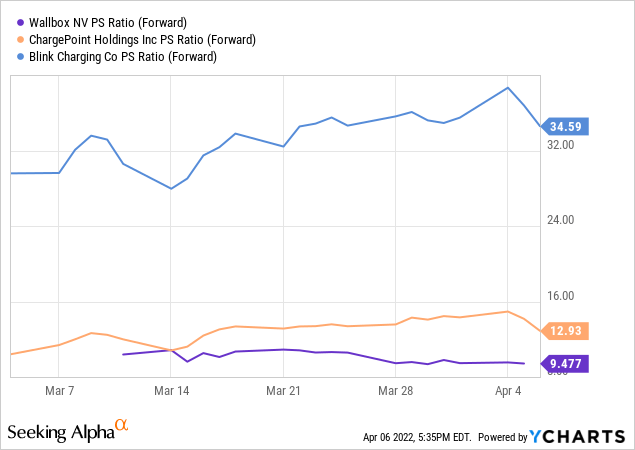

The business strategy is to partner with both major commercial players like auto manufacturers and dealerships for distribution. The company even offers the home version on retail e-commerce sites like Amazon.com (AMZN). To be clear, Wallbox is not the only player in the segment considering companies like ChargePoint Holdings, Inc. (CHPT), Blink Charging Co. (BLNK), and Volta Inc. (VLTA) have alternative solutions. That said, we believe the market is big enough for everyone while Wallbox has the advantage of having an established presence in Europe with a significant near-term production capacity increase expected this year which should allow it to capture market share.

We note that WBX trades at a discount compared in terms of its forward sales multiple at 9.5x compared to CHPT and BLNK at 13.0x and 34.6x each respectively. On this point, we note that WBX’s consensus revenue growth for 2022 at 165% y/y is above CHPT which is expected to generate a 91% increase in sales while BLNK is lower at 54% for 2022.

Taking a look at the stock price chart, from the early momentum based speculative rally that ran shares of WBX to as high as $27.50 in Q4 2021, the stock has sold off in recent months amid the broader market volatility. We note that the $12.00 level appears to represent a strong area of technical support which WBX continues to hold. With a bullish view on the stock, we believe the next leg is higher.

Final Thoughts

The case for EV charging systems is the strong demand with more electric vehicles on the road. This is a case where we see Wallbox selling the units as fast as they can make them. In this regard, 2022 is set to be a transformative year for the company as it begins to scale with significant production growth.

We rate WBX as a buy with an initial price target of $17.50 which was the high of the year for the stock back in early January. Our price target also implies a 13.5x forward price to sales multiple which places WBX more in line with ChargePoint Holdings in terms of its current growth premium.

Recognizing the company is not expected to be profitable for the next several years, WBX remains high risk and we expect shares to stay volatile. The outlook is exposed to global macro conditions with a deterioration of consumer spending or weaker than expected trends in EVs likely forcing a reassessment of the company’s earnings outlook. Management execution on its business plan will be important. Monitoring points for the year ahead include the unit sales levels while the gross margin is also a key metric.

Be the first to comment