Justin Sullivan/Getty Images News

Introduction

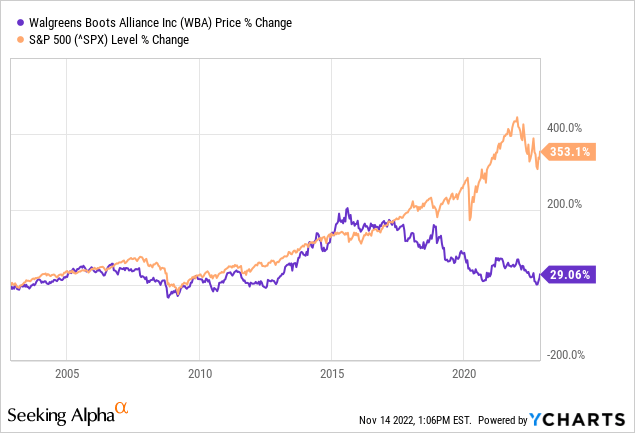

Walgreens Boots Alliance (NASDAQ:WBA) is one of the largest pharmacy, healthcare and retail companies in the United States. The stock experienced strong growth over the past 20 years until 2016, after which sales growth stalled and the stock’s valuation turned favorable.

Currently, the PE ratio is 9.2, a big discount compared to the S&P500’s PE ratio of 20.8. The strong earnings per share outlook, high dividend yield, and low valuation make the stock a buy.

Strong Earnings Outlook Is Expected

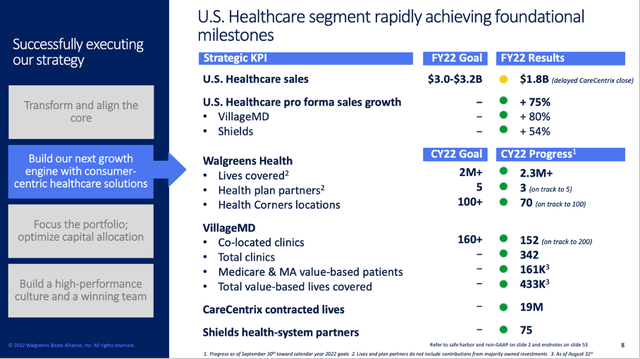

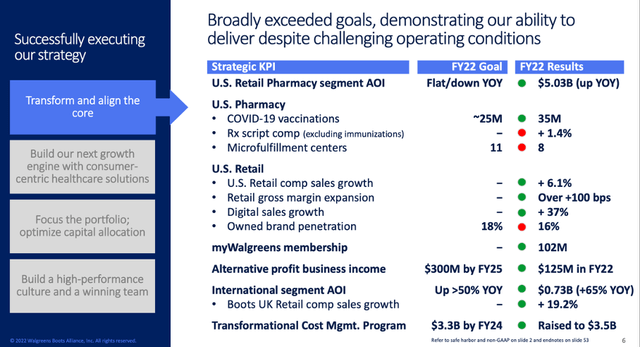

During the fourth quarter of fiscal 2022, WBA saw strong growth in U.S. retail sales and digital sales. Retail gross margin increased more than 100 basis points. The fourth quarter of fiscal 2022 recorded a 5.3% decline in sales compared to the same period last year. U.S. healthcare sales came in lower than expected due to a delayed CareCentrix close.

Fourth quarter FY22 earnings presentation (WBA Investor Relations)

Adjusted earnings per share of $4.45 to $4.65 are expected for fiscal year 2023.

Fourth quarter FY22 earnings presentation (WBA investor presentation)

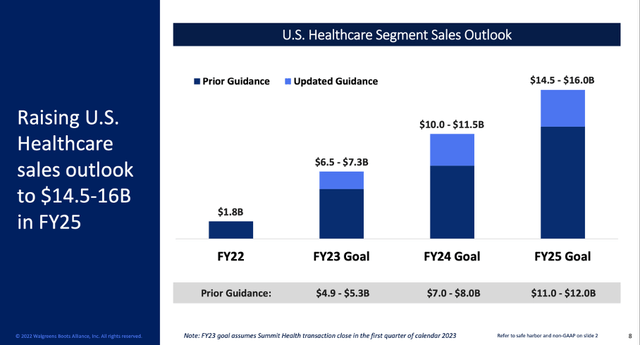

Summit Health-CityMD acquisition for $8.9B contributes positively to U.S. Healthcare outlook. WBA raises U.S. Healthcare segment revenue forecast for fiscal year 2025 from $11.5B to $15.25B. Previous expectations for adjusted EBITDA for the same period were $600M and have been raised to $1.1B. These are strong growth expectations for the coming years.

U.S. Healthcare Segment Sales Outlook (Walgreens Boots Alliance at the Credit Suisse 31st Annual Healthcare Conference)

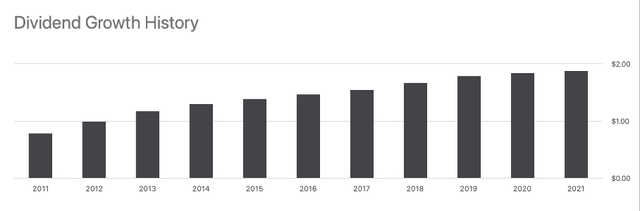

47 Years Of Dividend Growth

Walgreens Boots Alliance has been raising its dividend annually for 47 years. The dividend is currently listed at $1.92 and represents a dividend yield of 4.7%.

Over the past 5 years, the dividend per share has increased an average of 5.2% per year.

Dividend Growth History (WBA Seeking Alpha Ticker Page)

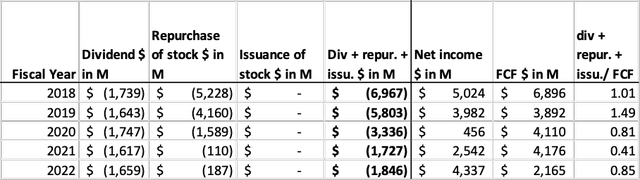

In terms of dividend sustainability, it can be said that free cash flow covers dividend payments well.

The dividend per share increased annually, partly due to share repurchases. As of 2021, share repurchases are significantly lower due to lower free cash flows.

Dividends including share buybacks are less than free cash flow. This is a good indication because, however, net cash position is very high compared to free cash flow (net cash position concerns -$10.3B, fiscal 2022 FCF is only $2.2B). Higher interest rates may create difficulties in refinancing debt. Walgreens Boots Alliance has been too fanatical about distributing cash to shareholders in recent years.

WBA Cash Flow Highlights (SEC and Authors’ own calculation)

Forward PE Ratio Looks Attractive

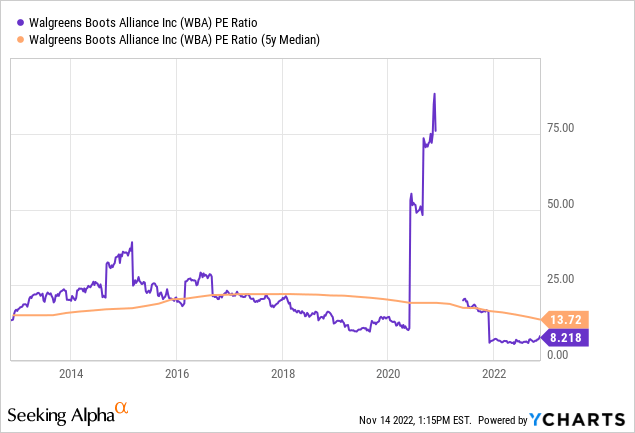

To chart the stock valuation for Walgreens Boots Alliance, the PE ratio is an appropriate choice. Analysts on the Seeking Alpha WBA ticker page expect earnings per share to grow in the coming years.

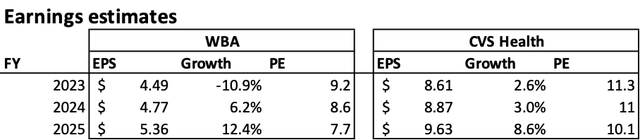

The stock is trading at a PE ratio of 8.2, very cheap overall and also compared to the 5-year median. A 10.9% decline in earnings per share is expected for fiscal year 2023. Nevertheless, the outlook beyond fiscal year 2023 is very favorable.

Walgreens Boots Alliance’s competitors include CVS Health (CVS) and Rite Aid (RAD). Rite Aid is a minor competitor because its sales are only $24 billion, a pittance compared to CVS Health’s sales of $291 billion. Rite Aid has been making losses for years and its prospects are bleak. Walgreens Boots Alliance’s main competitor is CVS Health, a serious competitor because its sales are almost equal to WBA’s, CVS Health’s sales are $292B.

Looking at WBA and CVS’s expectations for earnings per share, WBA expects a decline for fiscal 2023. CVS Health, on the other hand, expects growth of 2.6%. However, WBA’s valuation is more favorable than CVS’s; it is listed at a 24% discount for fiscal 2024.

WBA’s sales have barely increased over the past 5 years (averaging 2.3% per year). In contrast, CVS Health’s sales have increased very strongly by 9.6%. The strong growth is partly due to the acquisition of Aetna in 2018, but if we look at the overall picture of sales over the past 10 years, we see a steady increase in sales in recent years.

WBA and CVS earnings estimates (Seeking Alpha and Authors Own Calculation)

Walgreens Boots Alliance’s 5-year average PE ratio is 13.7. If we multiply this PE ratio by 2025 expected earnings per share, we arrive at a share price of $73.4. With the current share price of $41, this equates to a yearly share price return of 21%. This presents a too rosy picture, especially as the average PE ratio has fallen in recent years. Stock valuations are lower as of today in a high interest rates environment as they are at the moment.

The valuation of WBA’s shares is cheap, both in the present and in the future. The outlook in both revenue and earnings per share looks good for WBA. WBA is valued 24% cheaper than CVS Health. If earnings per share expectations materialize, WBA will rise sharply in price. CVS Health’s steadily growing revenues make it interesting to take a closer look at CVS Health as well.

Conclusion

Walgreens Boots Alliance saw strong growth in comparable U.S. retail and digital sales. Retail gross margin also grew strongly. WBA expects strong growth from the Summit Health-CityMD acquisition and is raising sales and earnings expectations for the next few years. WBA has been raising its dividend for 47 years, growing 5.2% a year for the past 5 years. With the recent share price decline, the dividend yield is very high at 5.2%. To supplement the dividend, WBA repurchases its own shares. Even though WBA is returning a lot of cash to shareholders, the stock’s valuation is very favorable. The outlook is strong, and WBA is trading at a 24% discount to competitor CVS Health. The strong expected growth in earnings per share, high dividend yield, and favorable valuation make this stock a buy.

Be the first to comment