JHVEPhoto

Company overview

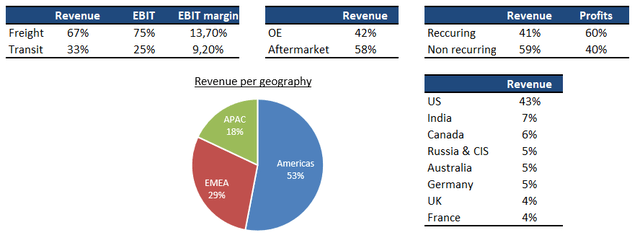

Wabtec (NYSE:WAB) is a leading supplier of equipment and services for the freight rail and passenger transit industries. It offers a wide range of products and services that are mainly found on locomotives, freight and passenger transit cars. It includes locomotives, engines, PTC safety systems (Positive Train Control) and components such as brakes, HVAC (heating, ventilation and air-conditioning), air compressors, entrance systems as well as the overhaul, modernizations and refurbishment of locomotives and railcars. Its customers are railroads (Canadian National Railway, Union Pacific, Canadian Pacific Railway, CSX…), railcar and locomotive manufacturers (Caterpillar, Alstom, Siemens, CRRC, Trinity industries, Greenbrier…), leasing companies GATX (GATX) and local transit authorities/governments (MTA, SNCF, etc.).

(Source: Company reports)

Wabtec has been able to build a large installed base over time. It has >23K locomotives (≈20% global market share) and provides parts to ≈ 20% of global freight cars and to >90% of passenger trains.

Competitive landscape

The supplier market is highly fragmented and competitive while the customer base is highly consolidated. As a result, rail suppliers do not enjoy pricing power. However, price competition remains limited because 1) suppliers compete on pricing but also on quality, performance, reliability, delivery and 2) they tend to remain in their local markets in which they have a strong position. For instance, Wabtec holds ≈15% market share globally for braking systems while it enjoys ≈50% market share in its core North America market.

Barriers to entry

The combination of a long homologation period, R&D spending, reputation, significant installed base and limited market opportunity prevent new competitors from entering the market. Firstly, new products must be at least as efficient as existing products, which require significant R&D investments. Besides, new products generally must undergo testing and approval processes that may be lengthy. A potential competitor could eventually deal with such barriers to entry. However, it will most likely not be able to be profitable because of clients’ loyalty and limited market opportunities.

Customers want to work with suppliers that enjoy a strong reputation for product quality and reliability as well as an excellent operational track-record as they do not wish to risk their reputation because of potential suppliers’ issues. Given the cost of many components account for only a small portion of total equipment cost, customers are not really inclined to switch suppliers for financial reasons. For instance, Wabtec estimates that components amount to around $6K per freight car while the selling price of a freight car is around $140K. The aftermarket business further strengthens switching costs because customers often look to purchase replacement parts from the original supplier in order to maintain similar safety/performance and compatibility between the old and new parts. As a result, customers tend to keep working with existing suppliers as long as they continue to propose the latest innovations and to meet required standards.

The market opportunity for each component tends to be limited because they are niche markets. Suppliers need to capture significant market share in order to recover R&D expenses and be profitable, which seems unlikely for a new player due to the stickiness of customers. Moreover, a new player will lack an installed base, which will further exacerbate the profitability issue given that aftermarket is a high-margin business and accounts for a vast portion of profits.

Poor recent financial results

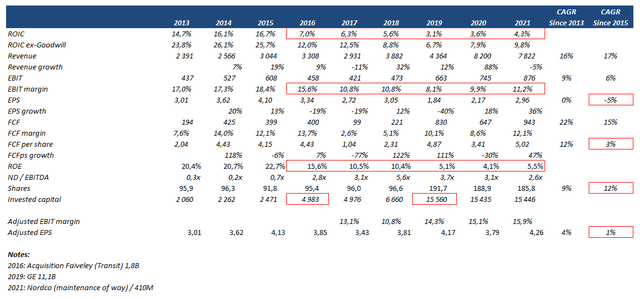

Financial performances have deteriorated since the end of 2015 as market conditions became unfavorable.

(Source: Company reports)

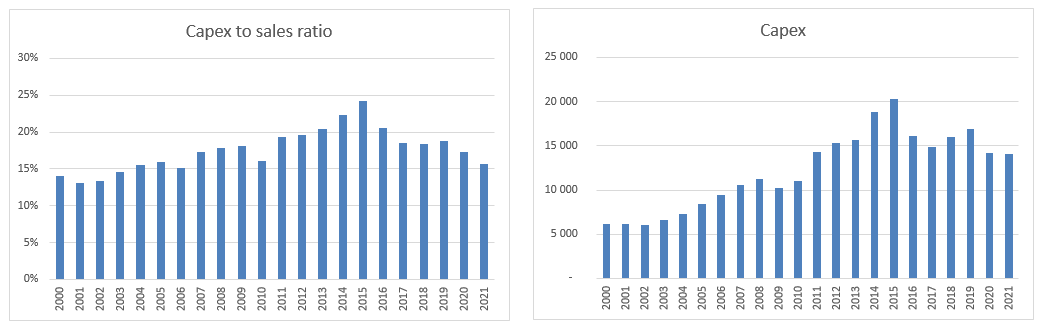

Following a massive boom in railroad spending (mainly related to crude-by-rail boom), capex started to decline from 2015 as highlighted by the fall in the capex-to-sales ratio from ≈25% to ≈15% over the period 2015/2021 (equivalent to a 6% CAGR capex decline). Furthermore, the industry faced an excess supply of locomotives and freight cars because of the adoption of PSR (Precision Scheduled Railroading).

Bloomberg

(Source: Statista and Railinc)

What to expect going forward?

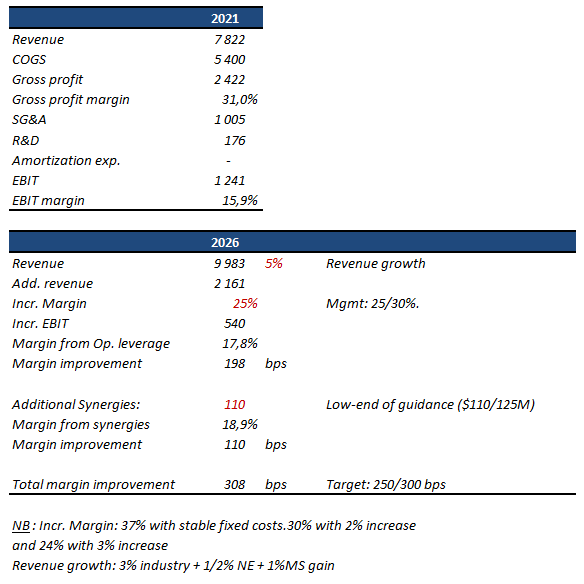

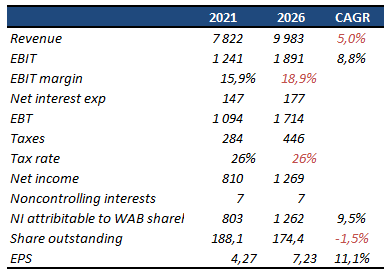

Revenue should grow organically by ≈5% CAGR over the coming years and M&A could further strengthen the growth profile. EBIT margin should improve by at least 250/300 bps by 2026, which should lead to >10% EPS growth.

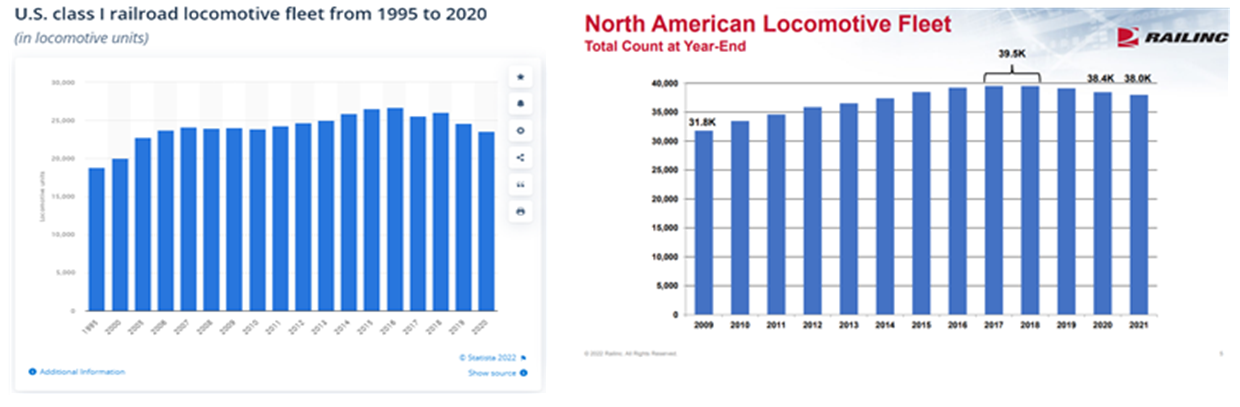

An ageing locomotive fleet, decarbonization, new infrastructure builds, market share gains and a cyclical recovery will support revenue growth. The global locomotive fleet is 20 years old on average, thus upgrades are required to enhance the performances and reduce CO2 emissions, which bodes well for the demand of new equipment (especially for locomotives with alternative powertrains such as electric, biofuel, hydrogen), modernization works and services. The modernization market is comprised of 15k locomotives and is less than 10% penetrated. Governments invest heavily in rail infrastructures: emerging countries invest heavily to meet rising demand while developed economies invest to meet their environmental goals. More and better rail infrastructure should favor increasing traffic (passengers, freight, intermodal, etc.), enables market share gains over trucking and supports the demand for equipment and services over time. Wabtec also has the opportunity to gain market share. For instance, Wabtec has 9% locomotive market share in APAC despite being the global leader. The company can also convince its customers who currently perform maintenance and overhaul functions in-house to outsource.

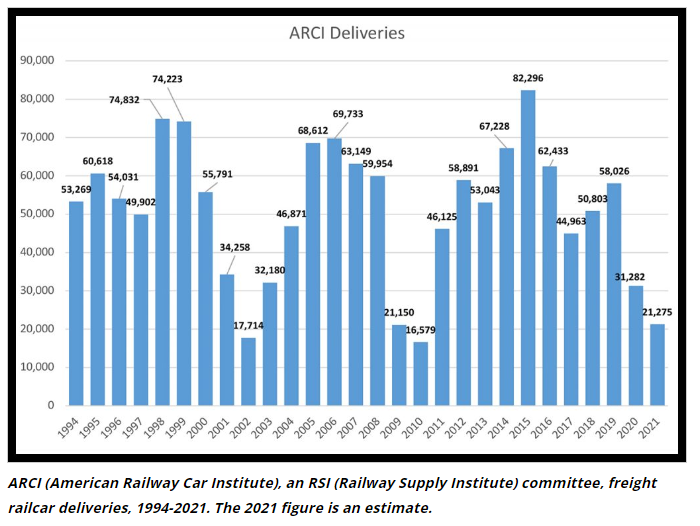

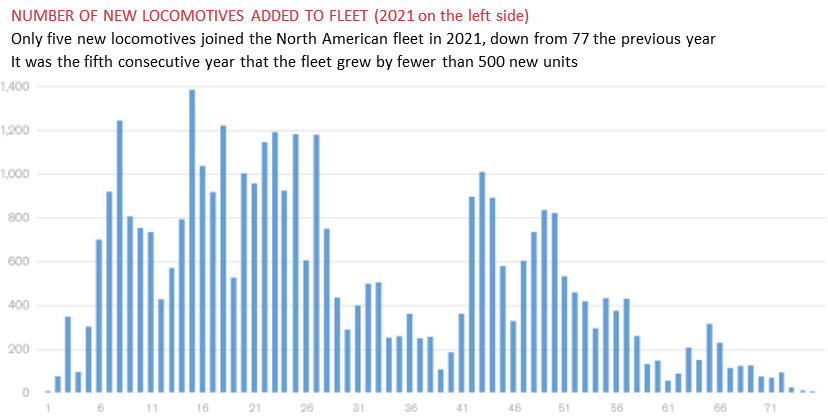

In addition to benefiting from structural growth drivers, the company should benefit from a cyclical recovery. Indeed, railcars and locomotives are coming out of storage following the pandemic and network fluidity issues. As this equipment is back to work, they will require additional maintenance. Railroads’ capex are now expected to increase by 6% CAGR over the next five years. Finally, the demand for new equipment in North America could revert to a more normalized level as recent years have been quite challenging. Freight railcar deliveries were ≈40% below their historical average of >50K units. For 2022, industry outlook is for 40/50k units. The locomotive fleet grew by 185 new units on average for the last five years, relative to its ≈800 historical annual average.

American Railway Car Institute

Railinc

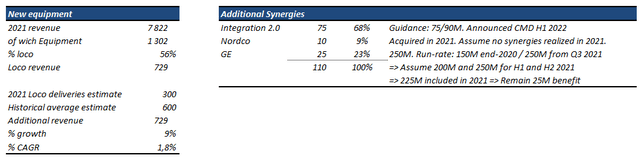

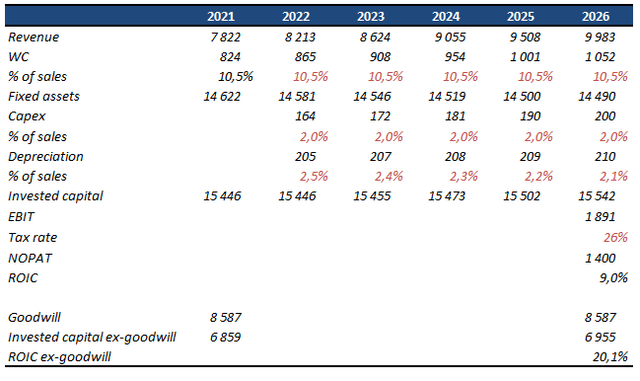

Positive operating leverage (cost basis is 30% fixed and 70% variable) will be the main contributor to margin improvements. Synergies ($110-$125M) from recent acquisitions will also help, especially considering that >70% of them come from a second plan related to the GE acquisition, after that the first one has been successfully delivered 15-months ahead of schedule. As a result, EPS growth should outgrow revenue growth and reach >10% CAGR, especially if the company reduces share count. Finally, ROIC (ex-goodwill) should improve from the current low level and move towards 20%, as EBIT grows and asset intensity declines.

Recent Q2 results showed positive momentum: the company narrowed its full-year guidance despite the shutdown of the Russian business and very unfavorable FX (suggesting a strong underlying business performance), delivered margin improvement and positive comments about future prospects. At the same time, it seems that PSR will act less as a headwind going forward because further capacity reductions (equipment, headcount. etc.) is unlikely. Indeed, operating ratios have significantly improved while questions on safety and service quality have been raised.

Financial modelling

We believe that revenue can grow around 5% CAGR over the next five years, driven by 3% industry long-term growth, 1%-2% recovery in new equipment and 1% market share gain. Incremental operating margin of 25% considers that variable and fixed costs will increase annually by 5% and 3%, respectively. We estimate that synergies will account for $110M despite being quite confident in the company’s ability to deliver the high-end of its guidance (which is $125M).

(Source: Author)

As a result, we believe that two-thirds of margin improvement will come from positive operating leverage and one-third from synergies.

(Source: Author)

Finally, we think that the company will be able to reduce its share count by at least 1.5% per year. As a result, we derive an EPS of around $7.23 in 2026.

(Source: Author)

If are assumptions are correct, ROIC (ex-goodwill) should improve towards 20% by 2026.

(Source: Author)

Valuation

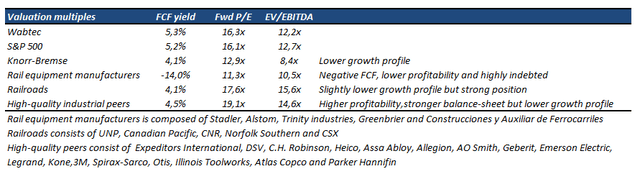

From a relative valuation perspective, company valuation does not seem excessive compared to the S&P 500, peer groups or its historical average. The following table summarizes valuations:

(Source: Author & Bloomberg)

The PE should remain at least stable (eventually expand) as it does not look expensive versus its peers, it’s slightly lower than its long-term historical average of 18x and is backed by improving fundamentals (increasing ROIC, growth acceleration, etc.). Assuming a stable PE, the TSR should be around 12%, in line with the expected 11% EPS growth and the <1% dividend yield.

Risks

Economic cycle: The recovery in new equipment could be postponed as well as some government spending.

Brand damage: Equipment failures or delays in deliveries could lead to market share loss

Client concentration: Some clients account for a significant portion of revenue

M&A: Wabtec has historically pursued external growth opportunities. Overpaying or failing to integrate properly new targets could negatively affect the company.

FX: Wabtec generates a significant portion of its revenue abroad. An appreciation of the US dollar is negative for the company.

Be the first to comment