Wasan Tita/iStock via Getty Images

W. R. Berkley Corporation (NYSE:NYSE:WRB) provides insurance, reinsurance, and monoline excess policies. It focuses on commercial lines, although it also offers specialized personal lines solutions. It covers commercial automobiles, property, workers’ compensation, admitted lines, and specialty personal lines. Over the years, it has grown to become one of the largest commercial lines writers in the US. It continues to adapt to the trend and extend its operations to other regions.

Today, it proves its durability and prudence amidst inflationary pressures. It takes advantage of interest-rate hikes and increased demand for property to fuel its performance. Its revenue growth is steady, allowing it to cover the rising expenses. Likewise, the stock price is in an upward pattern, but the valuation remains acceptable.

Company Performance

W. R. Berkley Corporation remains unperturbed amidst pandemic disruptions and inflationary pressures. In the last two years, it has capitalized on lower interest rates. Now, inflation remains elevated, and so do interest and mortgage rates. These affect the performance of the financial sector, including the insurance industry. But, its fundamental stability is one of its cornerstones to cope with the economic changes.

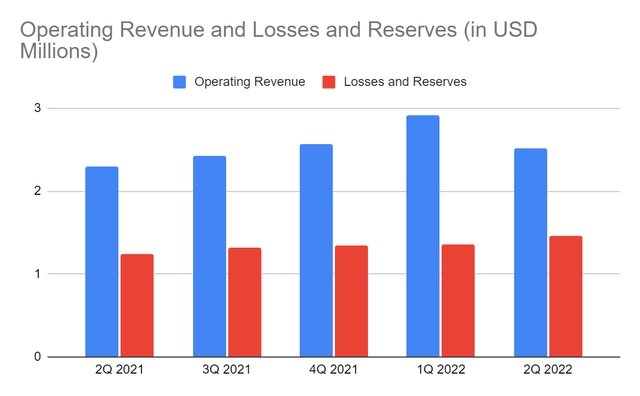

The company continues to show mixed results but maintains an exceptional performance. Its strategies lead to solid risk-adjusted returns. In this quarter, its operating revenue of $2.51 billion is a 9% year-over-year growth. Thanks to the solid growth in its written premiums as the market conditions improve. It is also consistent with the expansion of most of its business segments. It is most evident in its excess and surplus and specialty business lines.

Operating Revenue (MarketWatch)

Another excellent attribute is its prudent management and choice of its investment portfolio. Its investment funds are growing, which is favorable in a high-inflation environment. Its prudent investment choice is in line with the market trends. For instance, its investment funds in infrastructure grew from $12 million to over $100 million. Except in the energy sector, all its investment funds have higher yields. These lead to a 30% investment income.

But of course, some of its earning assets do not drive revenue growth. For instance, its fixed maturity securities have higher losses. Government and corporate bonds and mortgage-backed securities have lower valuations. Note that these asset-backed securities have an inverse relationship with interest rates. So, it is no surprise that their value decreases as interest rates increase further. To understand it better, you may refer to the investor bulletin discussion by the SEC. Since they are part of the core assets of WRB, they have a partial offsetting impact on the revenue.

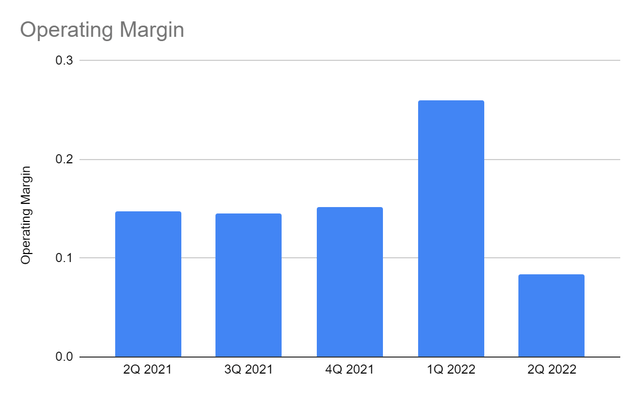

Costs and expenses are also affected by inflation. The company expands most of its business lines. So, the operating and non-insurance costs and expenses are higher. Their combined value has a 17% year-over-year growth. It is no surprise that the operating margin is only 8.4% vs 14% in 2Q 2021. The good thing is that the company is ready for the massive market changes. We can see how it continues to capitalize on the real estate market changes to write more P&C premiums. It also diversifies the risks through its investments across different sectors to offset the impact.

Operating Margin (MarketWatch)

If we weigh the impact, it is more of a challenge for the company. It drives more yields and demand, but the costs and expenses offset the increase in revenues. Fortunately, WRB is still well-positioned to cushion uncertainties in the market. It maintains its profitability and sustain its operating capacity. The high-flying prices of houses and cars still have spillovers on its insurance segment. Also, the higher risks associated with inflation continue to highlight the vital role of monoline excess. The market volatility adds value to the company although it affects the performance of its securities.

Current Challenges

The high-inflation environment is both a challenge and an opportunity for the company. We saw in the first half how the company capitalized on it to expand and write more premiums. Yet, the impact on its fixed securities and costs and expenses offsets the added value. Even so, WRB can cushion its scourge while expanding most of its business lines.

Inflation has been elevated since the start of the year. It accelerated in 2Q 2021 and peaked at 9.1% last June. In July, it seemed to go into a summer lull as it decreased to 8.5%. Even better, the most recent release shows that the inflation rate is 8.3%. It appears that it starts to stabilize, but one must still be careful amidst market volatility. The pent-up demand, port congestion, and geopolitical tension in Europe may affect the global economy. In turn, interest and mortgage rates may remain elevated in the next 12 months to stabilize inflation. The recession must also be taken into account since interest and mortgage rate hikes affect the cost of borrowing. The increased interest rates may encourage savings, which may affect investment security yields. Yields are lower in June and July. But once the economy becomes stable, growth prospects may become more enticing.

Opportunities And Drivers

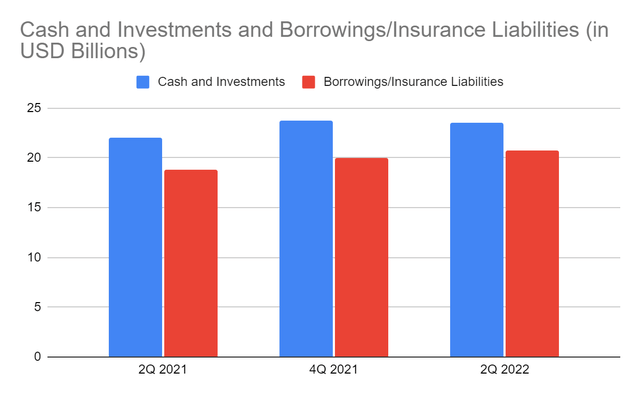

WRB maintains solid and intact fundamentals despite market pressures. Its stellar Balance Sheet proves its capacity to withstand inflation. It is already proven by its maintained viability despite the increase in costs and expenses. Although cash levels are lower, they are still stable. Investments comprise 76% of its assets, making the company liquid. WRB has prudent management of its investment portfolio. The components are allocated in a way that they still yield adequate returns in a high-inflation environment. Indeed, it knows how to handle investments and what sector to invest in. Also, they can cover borrowings and insurance liabilities should WRB make a single payment.

Cash and Investments and Borrowings/Insurance Liabilities (MarketWatch)

Now, W. R. Berkley Corporation sees more demand for its commercial and personal lines solutions. One of the factors that drive it is the higher value of houses and automobiles. P&C insurance remains a staple for many homes and car owners. They protect their houses and cars, and the valuable items within the property. So, having P&C insurance is a staple for many. Although home sales are in a downtrend, the value is still high at over $500,000. The good thing is that house inventory increased by 4.8%. Also, homeownership remains a dream for many Americans. In a survey, 30% say that now is not a good time to buy houses. But, 74% want to buy a house. It is possible once prices decrease and become more stable. Either way, there is an opportunity for P&C insurance to expand further. It is also at the forefront of climate finance as natural disasters become more frequent. Analysts estimate that the P&C insurance industry will increase by 3.7% in 2022 and 3.3% in 2023.

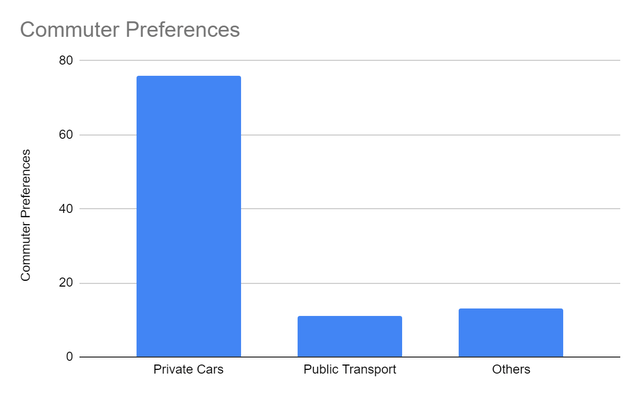

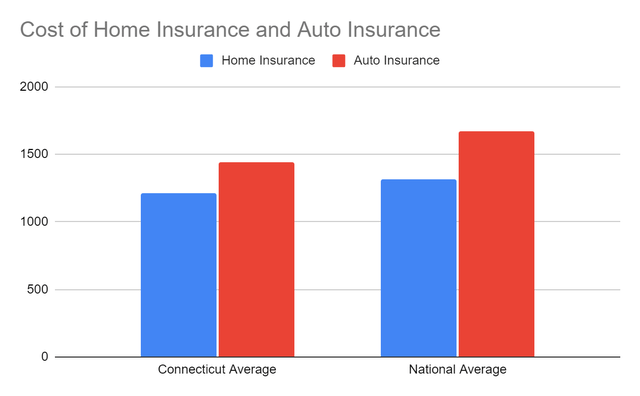

Likewise, cars are a staple for many commuters. Although car sales are in a downtrend, the preference for cars remains high. A recent survey also shows that 76% of Americans prefer cars when going to work and other establishments. It shows that there may be more demand for cars once the price stabilizes. It is an opportunity for WRB since many homes and car owners do not have insurance. Statistics show that over 30 million car owners have insufficient and no insurance at all. It also operates in the UK wherein almost 4 million cars are uninsured. So, it has more chances to capture more policyholders. Meanwhile, the price of its insurance is still lower than the state and national average. It has more flexibility to adjust its prices to cope with the market changes and competition.

Preferences Of Commuters (Statista)

Cost of Home And Auto Insurance (Bankrate)

Stock Price

The stock price of W. R. Berkley Corporation remains in an uptrend after rebounding from its recent pullback. It has been moving sideways in the last month. At $67.11, it is already 24% higher than the starting price. It still appears reasonable as shown by the PE Ratio of 14.12, Price/Cash Flow Ratio of 7.2. But, the EV/EBITDA of 10.91 and the PTBV Ratio of 2.72 show a slight overvaluation.

The company is also a dividend-paying stock, which has been consistent despite the economic downturn. Payments are continuous despite the unsustained increase. Yet, its dividend yield is only 0.64%, which is way lower than the S&P 500 at 1.69%. To assess the stock price better, we will use the Dividend Discount Model.

Average Dividend Growth 0.01091087094

Estimated Dividends Per Share $1

Cost of Capital Equity 0.02568037713

Stock Price $67.11

Derived Value $67.76135568 or $67.76

Bottomline

W. R. Berkley Corporation is faced with external pressures amidst the still high demand in the industry. It remains robust with its sound fundamentals and strategies in a high inflation environment. It has adequate financial capacity to cover its expansion, borrowings, and dividends. Likewise, the stock price is reasonable, but investors must wait for a better entry point. The recommendation, for now, is that W. R. Berkley corporation is a hold.

Be the first to comment